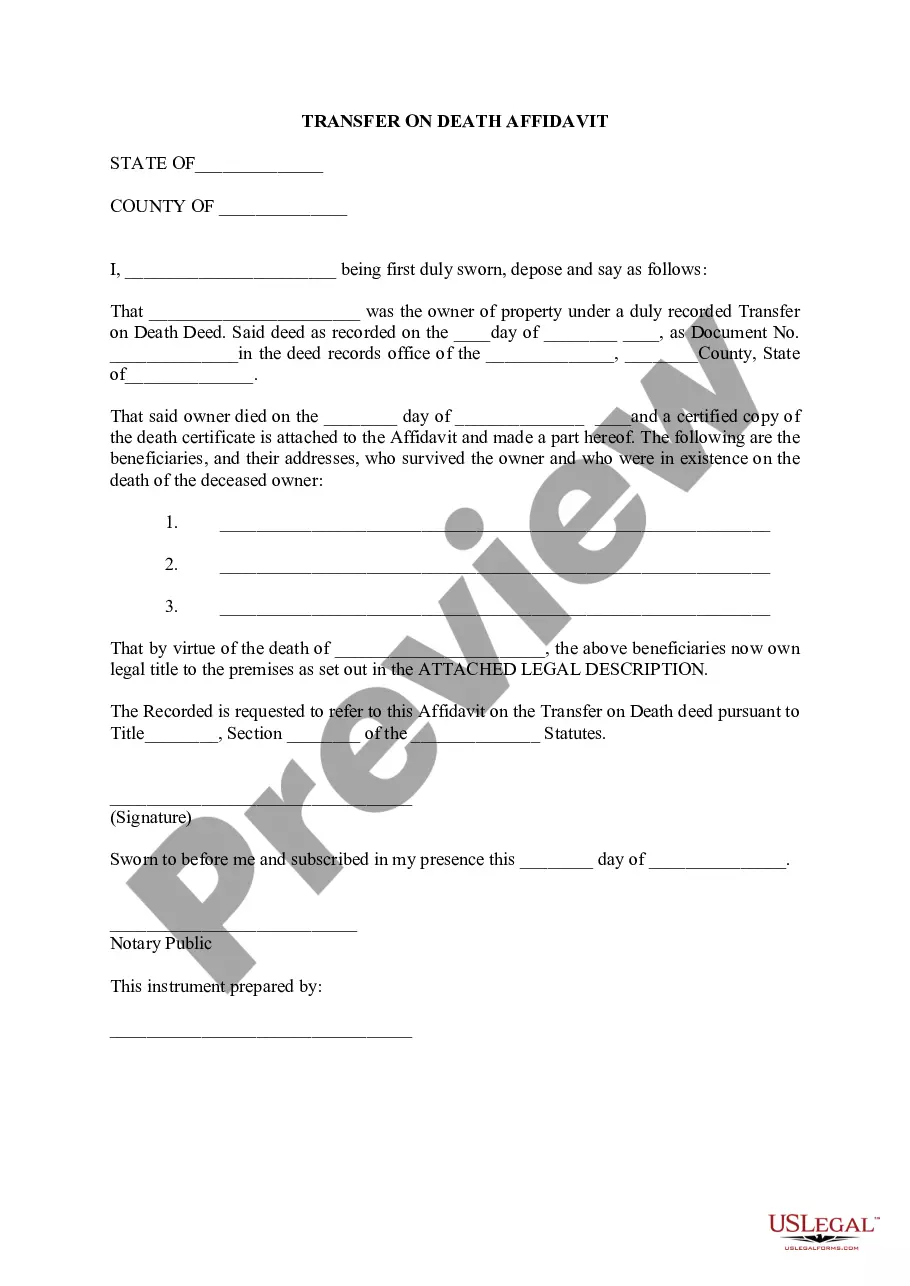

Oklahoma Transfer on Death Affidavit

Description

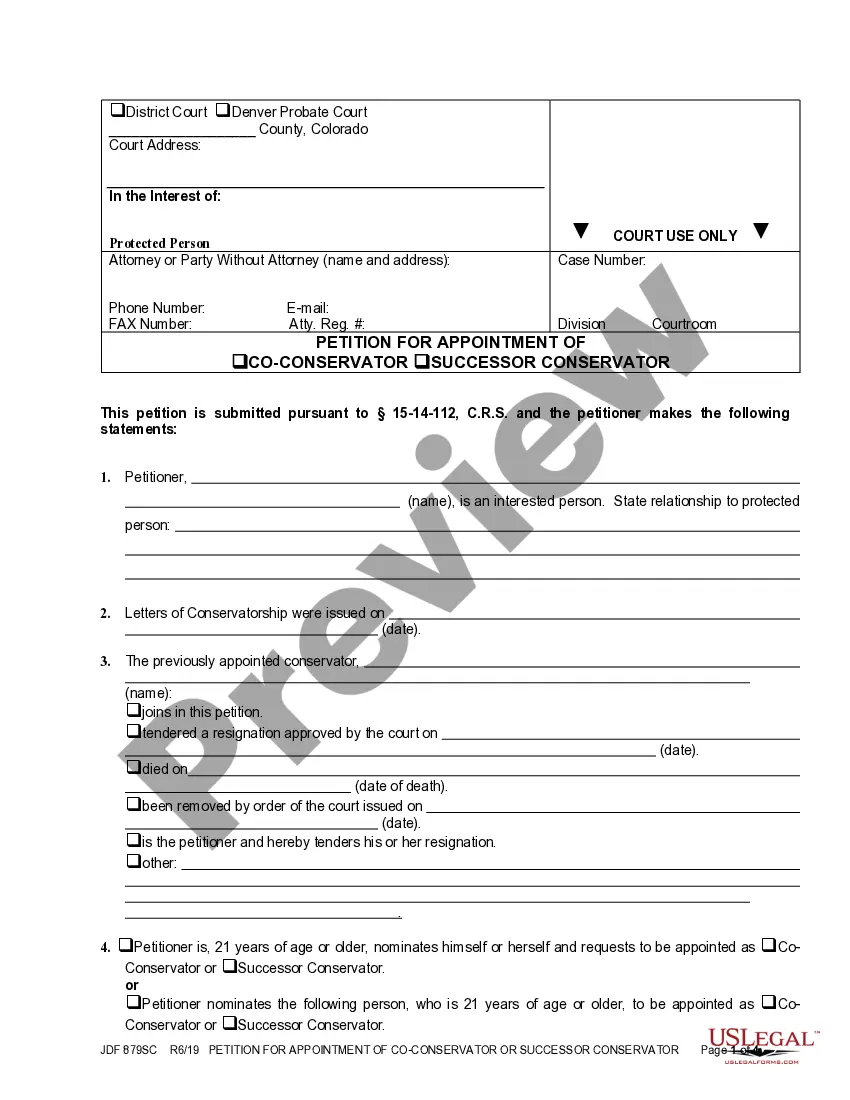

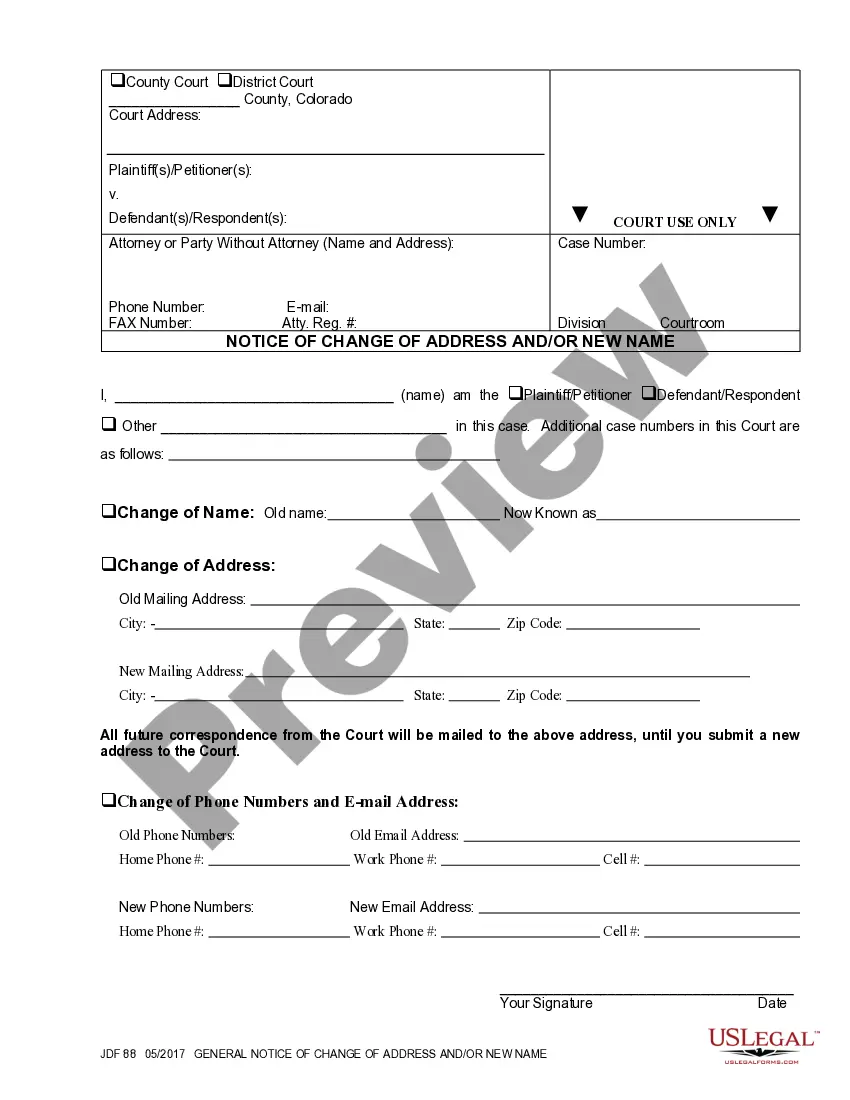

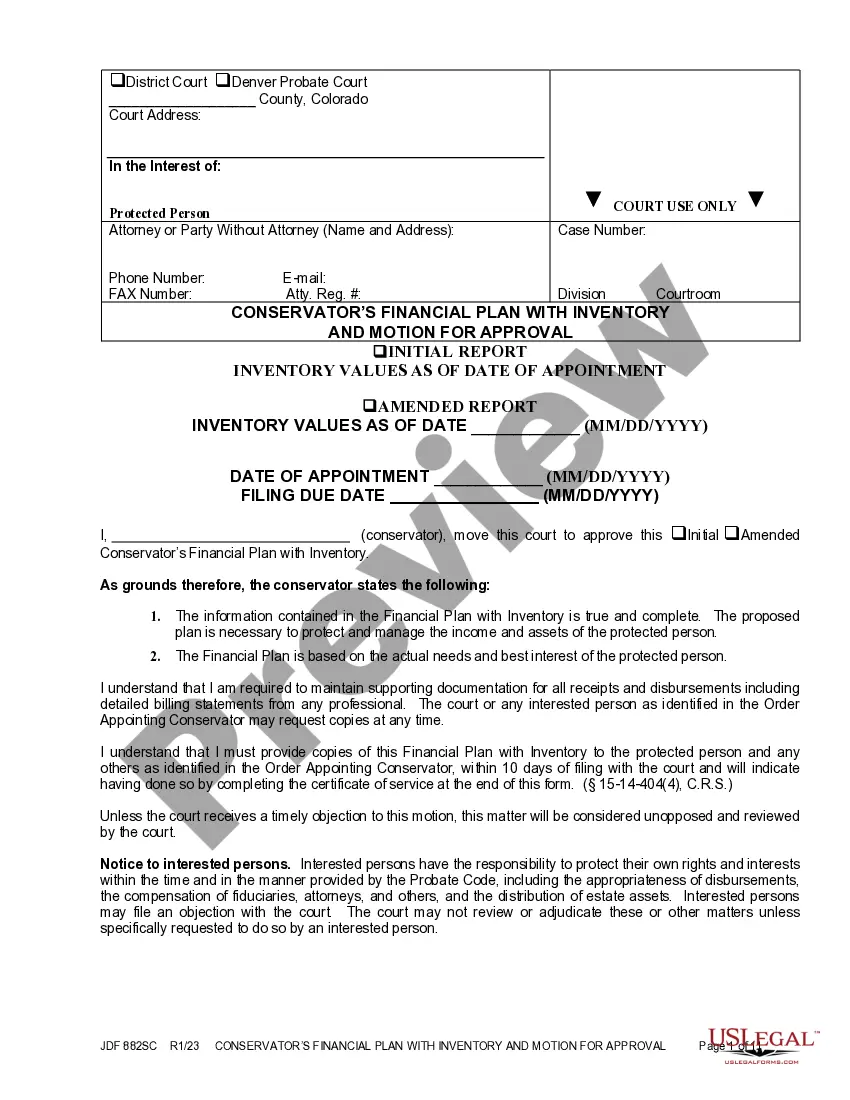

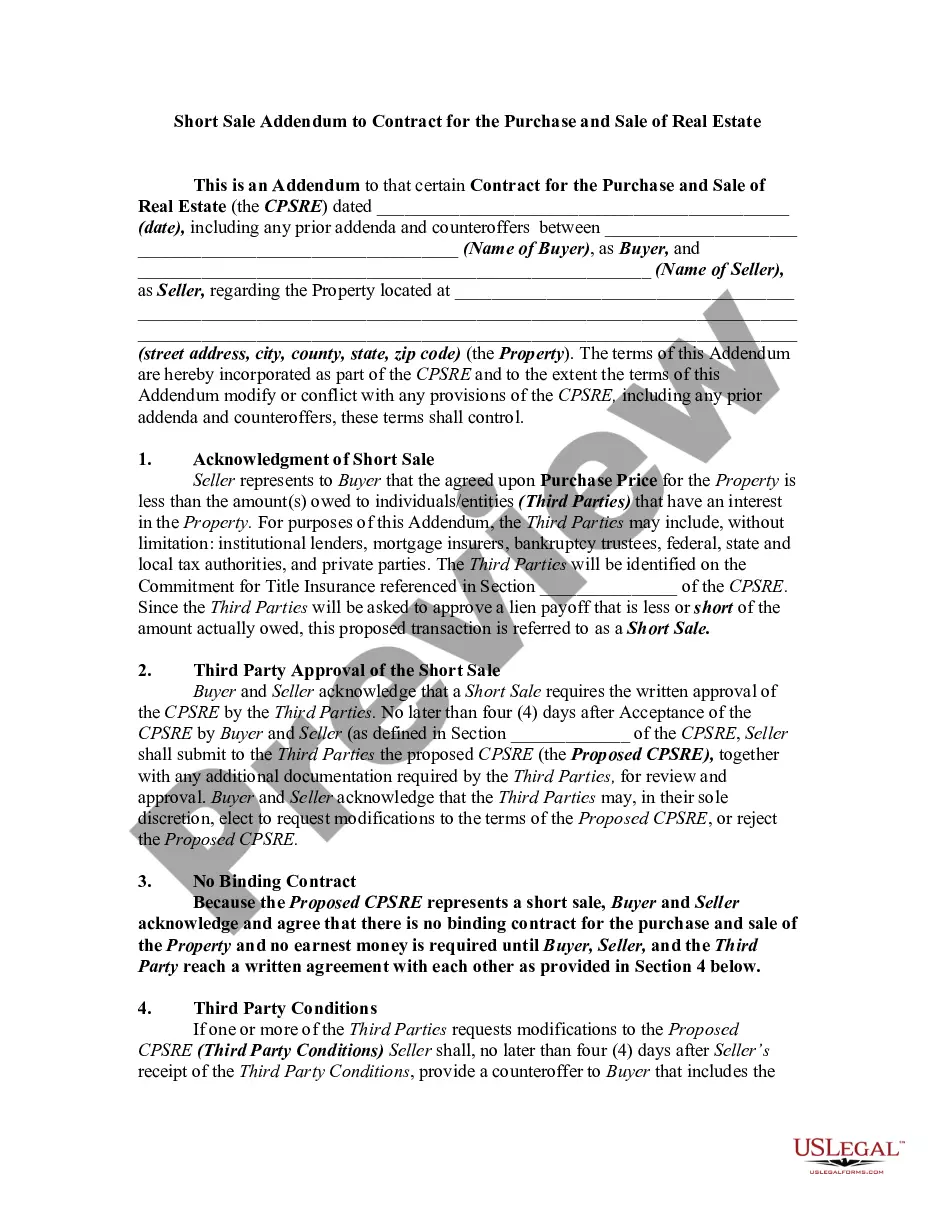

How to fill out Oklahoma Transfer On Death Affidavit?

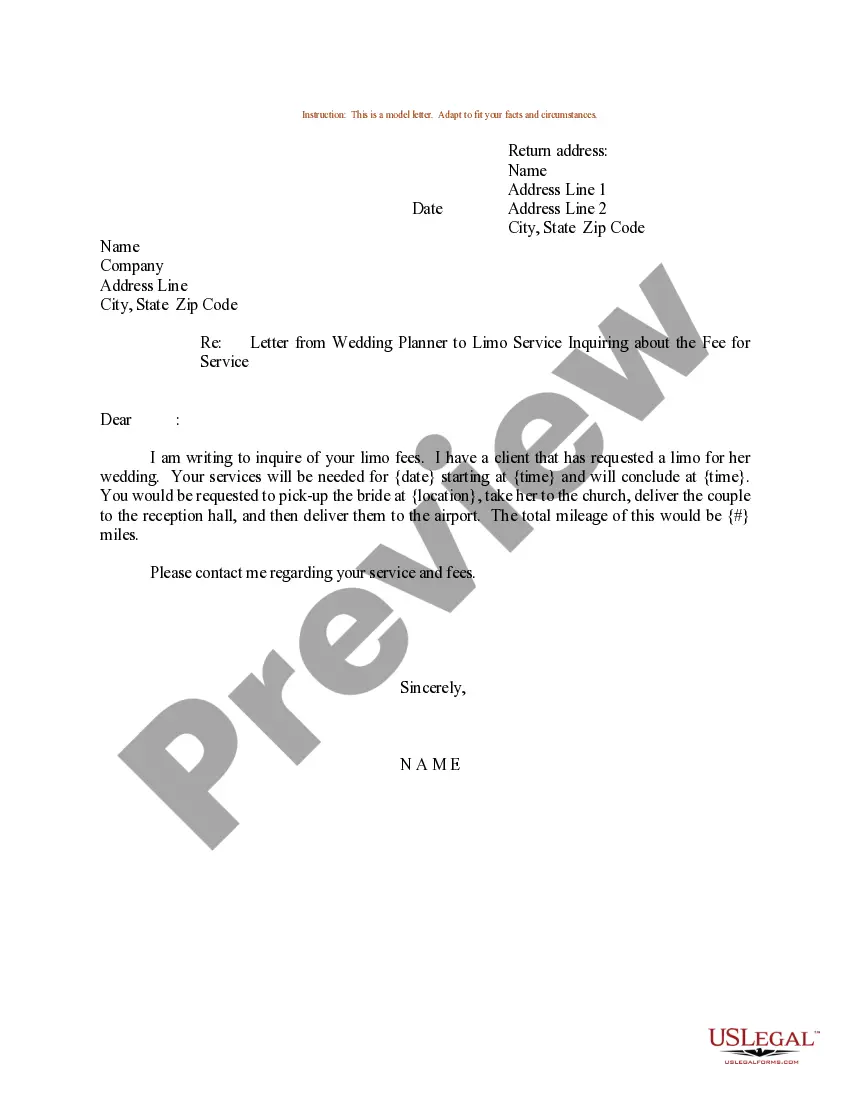

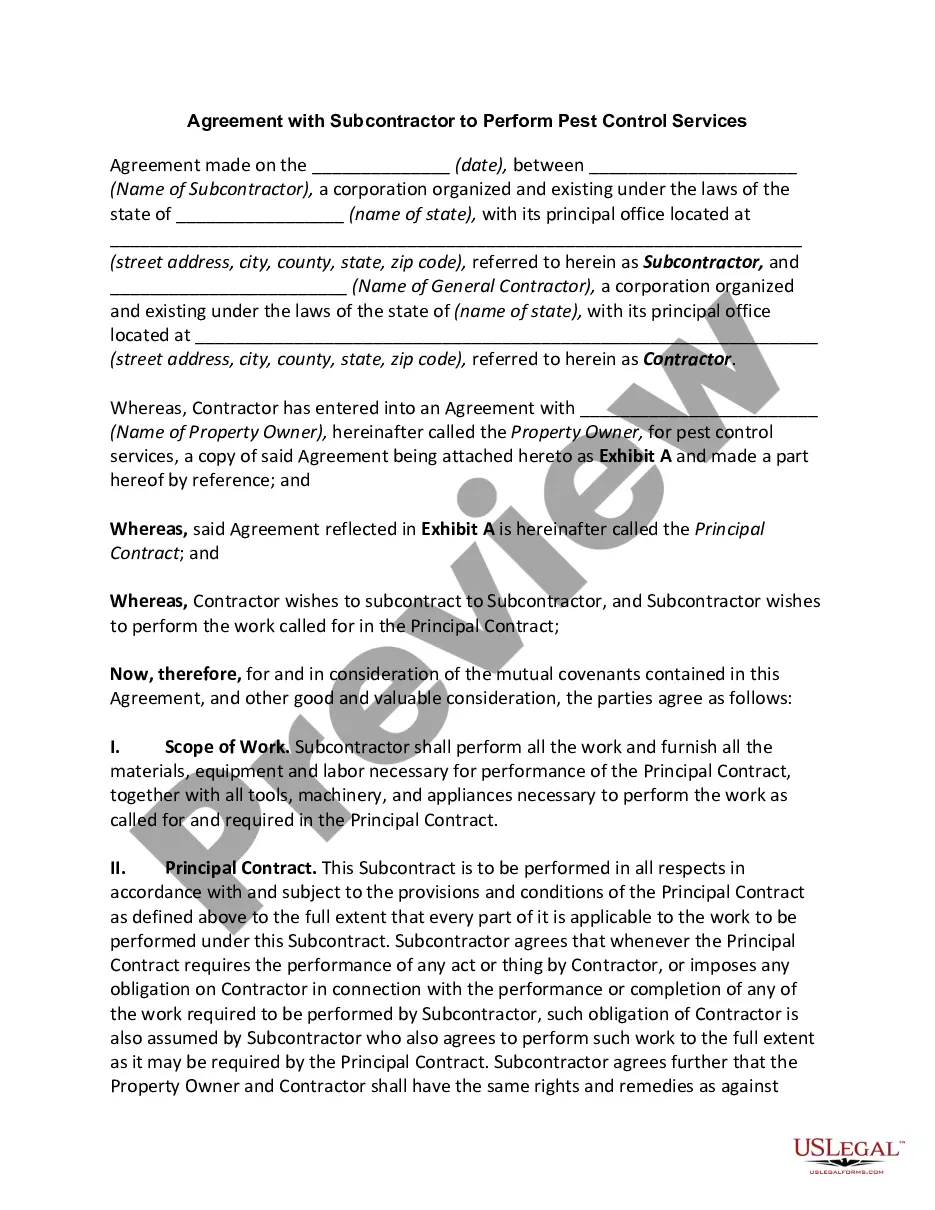

When it comes to filling out Oklahoma Transfer on Death Affidavit, you almost certainly visualize an extensive procedure that involves choosing a suitable sample among numerous very similar ones then having to pay out an attorney to fill it out for you. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific template in just clicks.

If you have a subscription, just log in and click on Download button to find the Oklahoma Transfer on Death Affidavit form.

If you don’t have an account yet but need one, keep to the step-by-step manual listed below:

- Make sure the document you’re saving applies in your state (or the state it’s required in).

- Do so by reading through the form’s description and also by visiting the Preview function (if accessible) to view the form’s content.

- Simply click Buy Now.

- Find the appropriate plan for your budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure after downloading, you don't have to bother about editing content outside of your individual info or your business’s information. Sign up for US Legal Forms and get your Oklahoma Transfer on Death Affidavit document now.

Form popularity

FAQ

What is a Transfer-On-Death Deed? On November 1, 2008, Oklahoma's "Nontestamentary Transfer of Property Act" (Title 58 O.S. ? 1251-1258) went into effect. This law allows a "record owner" to use a "Transfer-On-Death Deed" to name another person to receive his real estate without going through probate.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.