Oklahoma Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

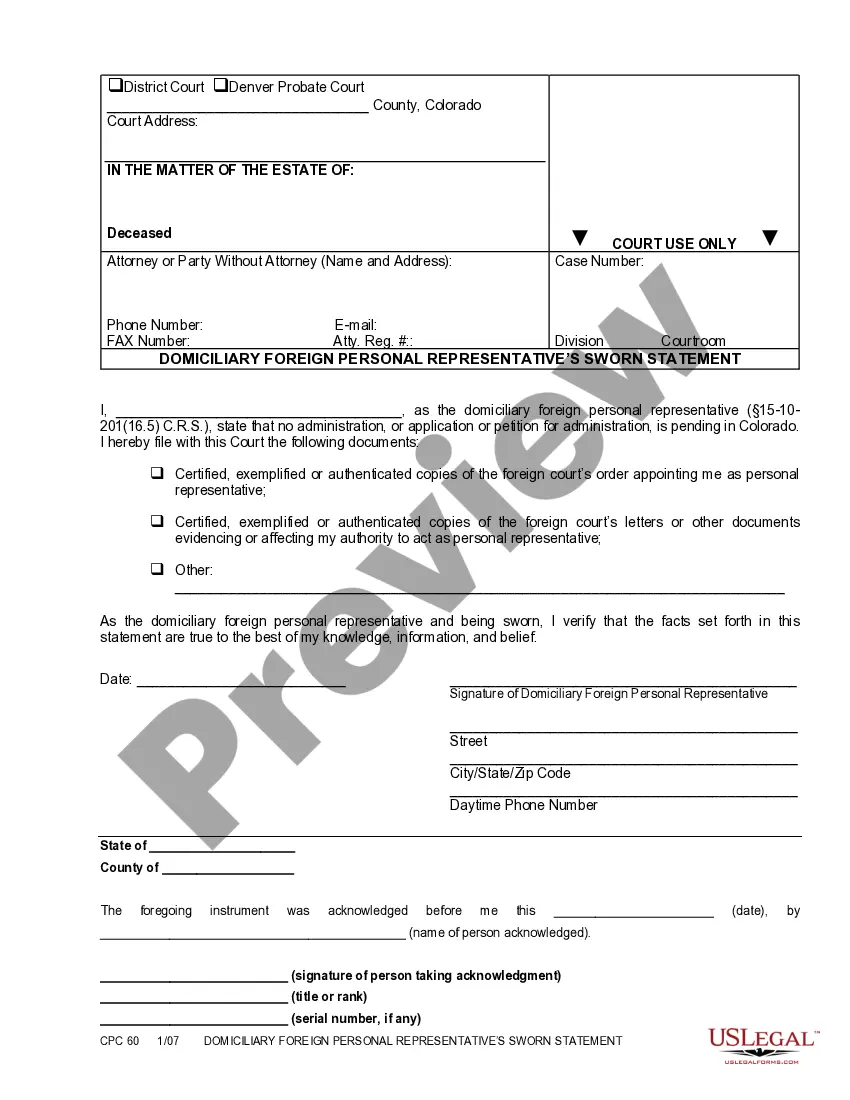

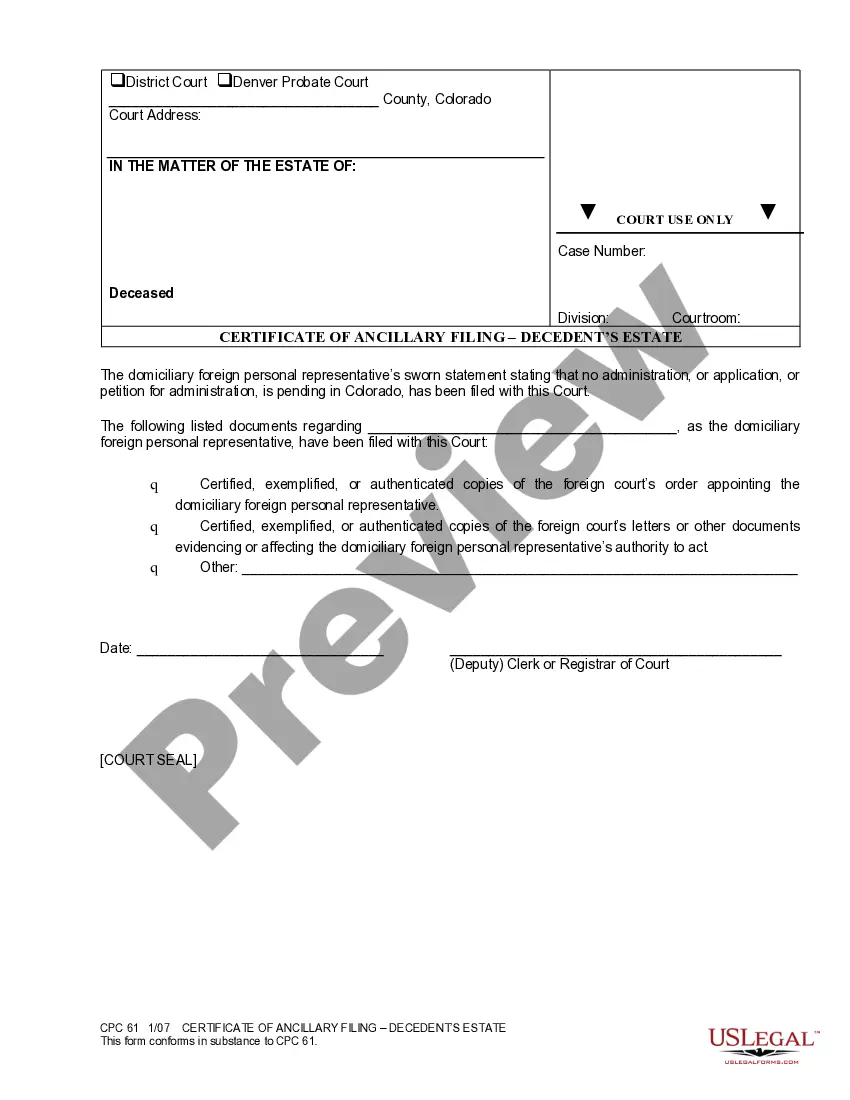

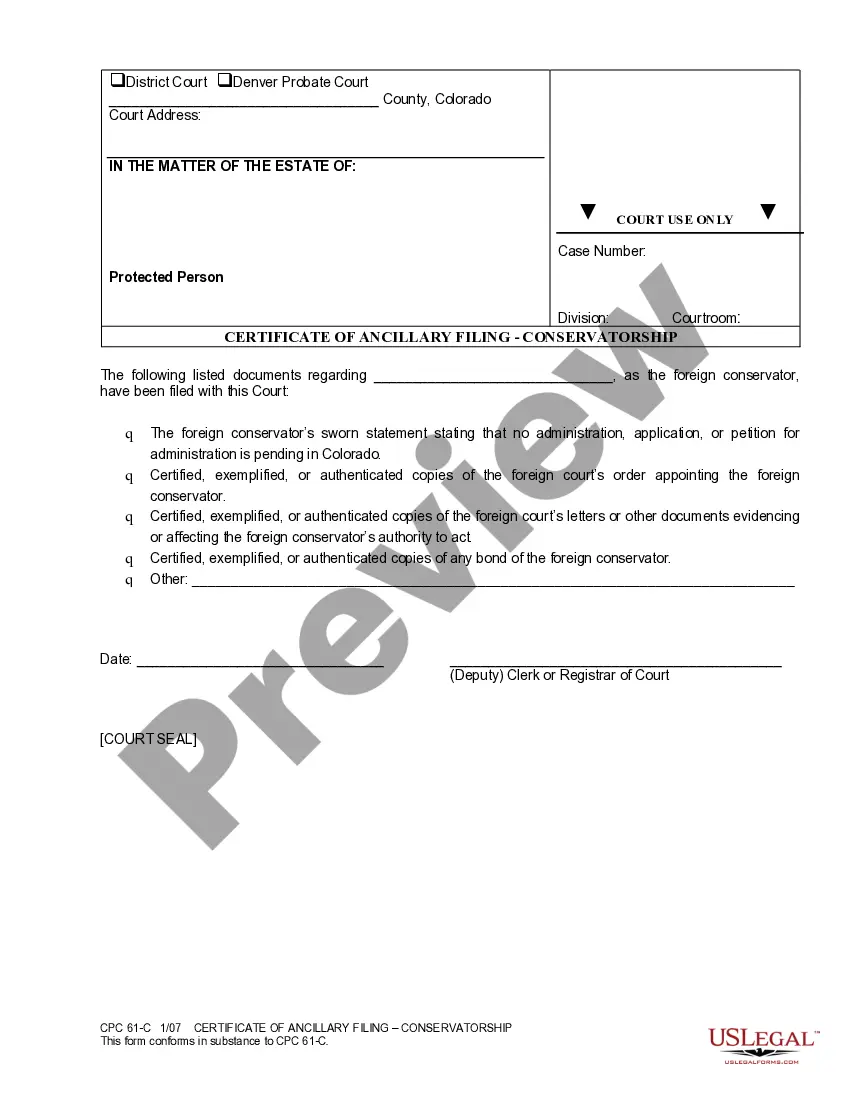

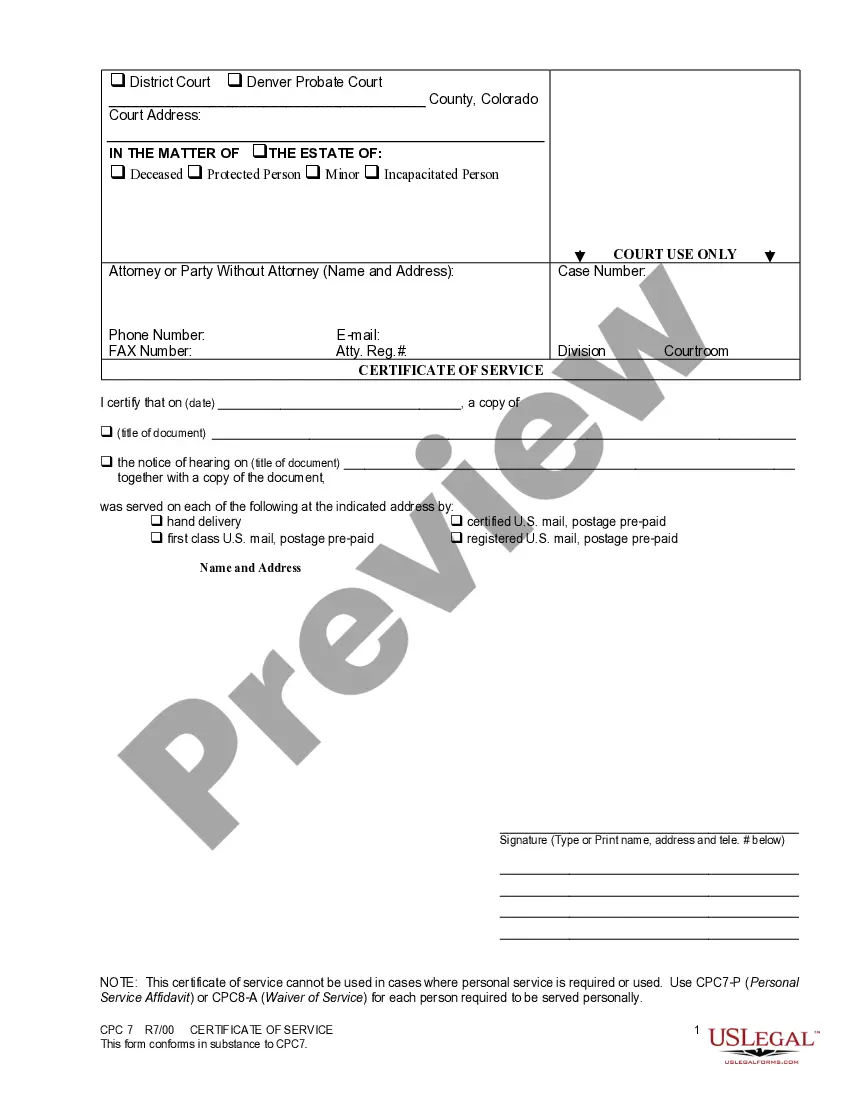

How to fill out Oklahoma Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

When it comes to filling out Oklahoma Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you most likely visualize a long procedure that involves choosing a ideal sample among numerous very similar ones and then being forced to pay out legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific form in a matter of clicks.

For those who have a subscription, just log in and click on Download button to get the Oklahoma Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template.

In the event you don’t have an account yet but want one, follow the point-by-point manual below:

- Be sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and through clicking on the Preview option (if offered) to view the form’s content.

- Click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled lawyers work on drawing up our samples so that after saving, you don't need to worry about enhancing content material outside of your personal details or your business’s information. Sign up for US Legal Forms and receive your Oklahoma Installments Fixed Rate Promissory Note Secured by Commercial Real Estate sample now.

Form popularity

FAQ

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Commercial Promissory note A commercial promissory note is used when borrowing money from a commercial lender such as a bank or loan agency. In the event the borrower is unable to make required payments, the lender may demand full payment of the loan including interest.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.