Oklahoma Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy

Description

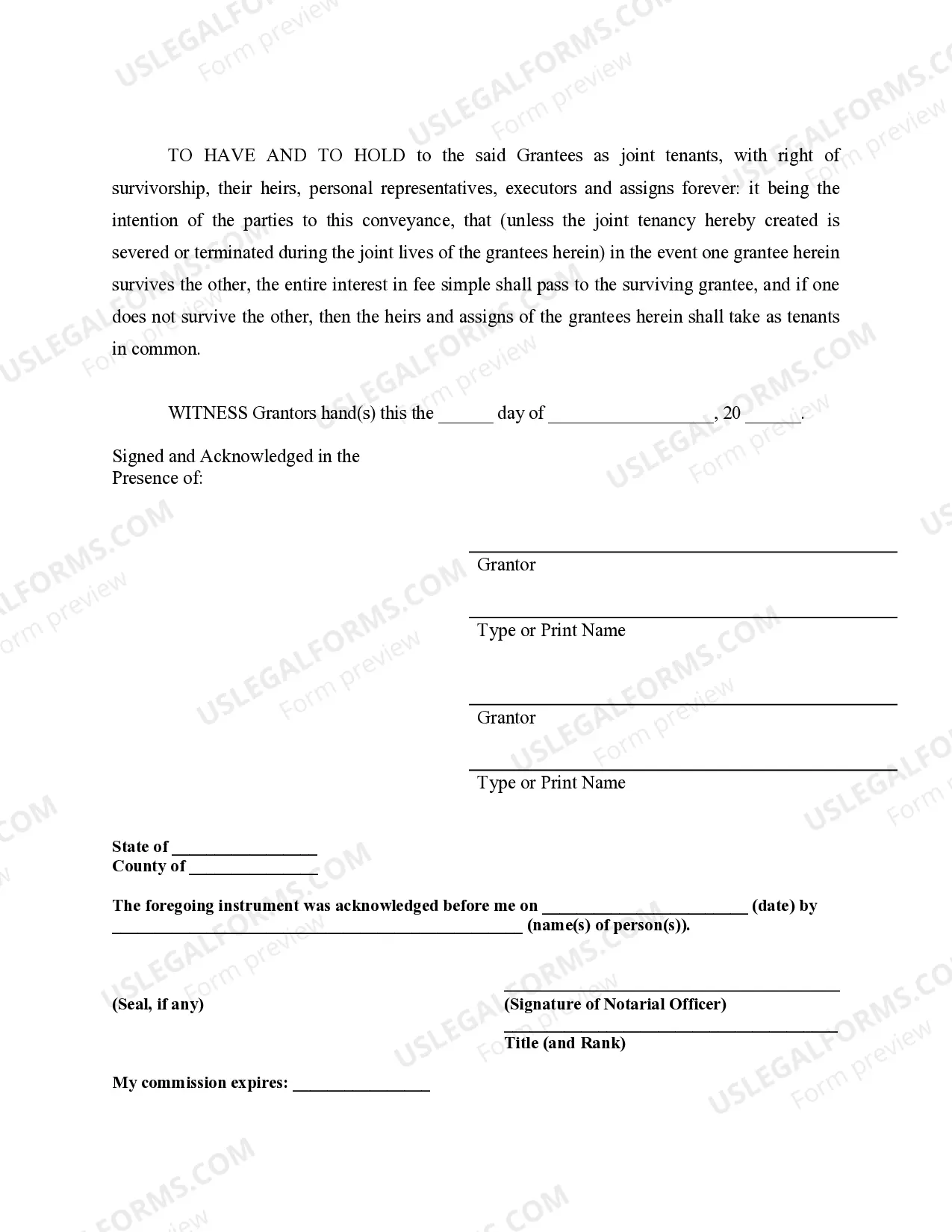

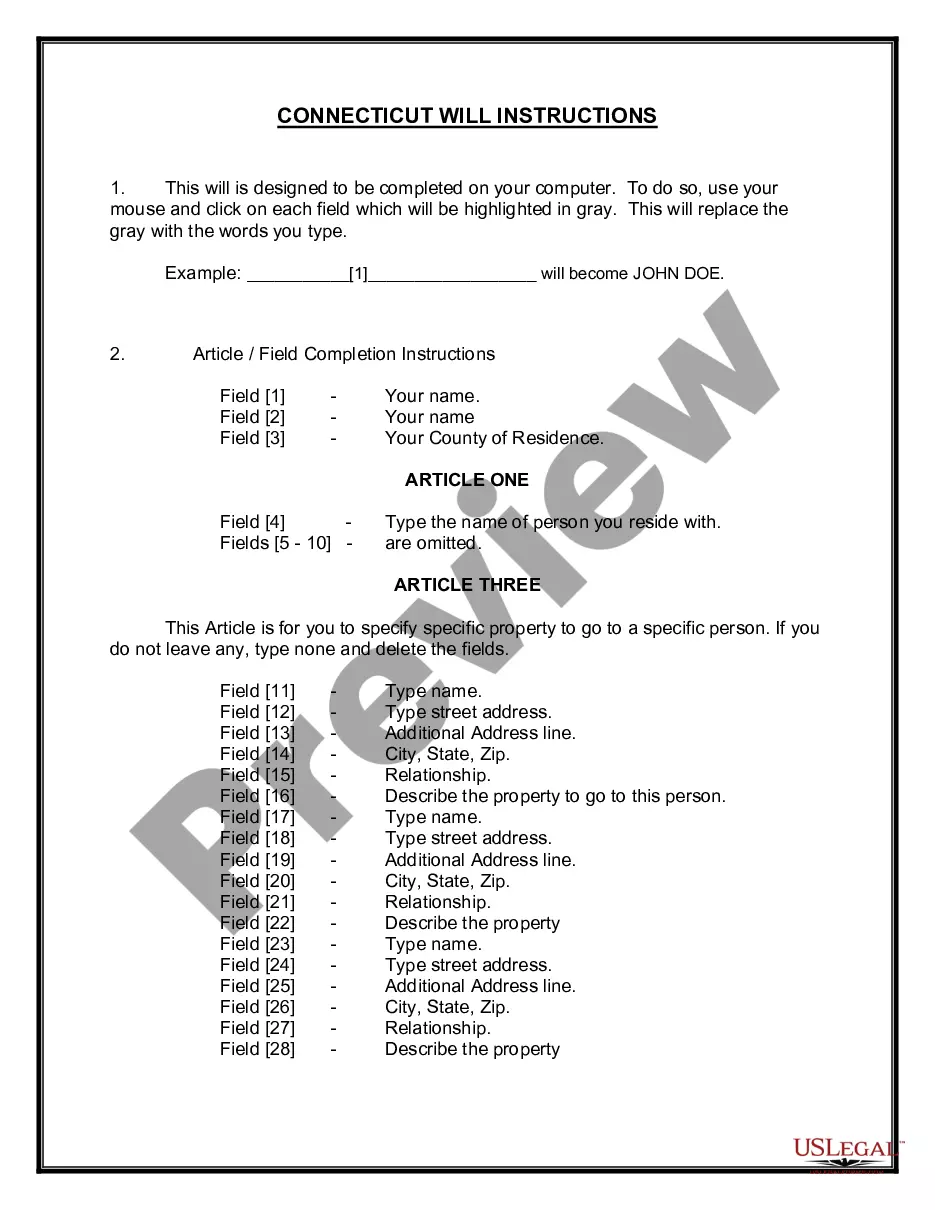

How to fill out Oklahoma Warranty Deed For Husband And Wife Converting Property From Tenants In Common To Joint Tenancy?

Among numerous paid and free samples that you can get online, you can't be sure about their accuracy and reliability. For example, who created them or if they are skilled enough to deal with the thing you need these to. Keep calm and use US Legal Forms! Discover Oklahoma Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy templates made by professional legal representatives and avoid the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access all your previously acquired files in the My Forms menu.

If you are making use of our website for the first time, follow the guidelines below to get your Oklahoma Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy quick:

- Make sure that the document you discover is valid in the state where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you can use your Oklahoma Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy as often as you need or for as long as it continues to be active in your state. Revise it with your favored editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Change from joint tenants to tenants in common This is called 'severance of joint tenancy'. You should apply for a 'Form A restriction'. You can make this change without the other owners' agreement. A solicitor, conveyancer or legal executive can also make the application for you.

Jointly-owned property.There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

When one co-owner dies, property that was held in joint tenancy with the right of survivorship automatically belongs to the surviving owner (or owners). The owners are called joint tenants.

Jointly owned propertyProperty owned as joint tenants does not form part of a deceased person's estate on death. But the value of the deceased person's share of jointly owned property is included when calculating the value of the estate for Inheritance Tax purposes.

Most jointly owned property is held as joint tenants but you should not assume this.As property held under a joint tenancy will automatically pass to the surviving joint owners it will not form part of the deceased's estate except for the purposes of calculating inheritance tax.

Regardless of how the property is owned (and how it will be treated for succession purposes), the deceased's share of jointly owned property will form part of the deceased's estate for inheritance tax (IHT) purposes (although an exemption will, of course, apply where the deceased's share passes to their spouse/civil

All the tenants in the joint tenancy needs to sign an application form to move from a joint to a sole tenancy. If you are a joint tenant, you will still be responsible for the rent and terms of the agreement until your name has been removed.

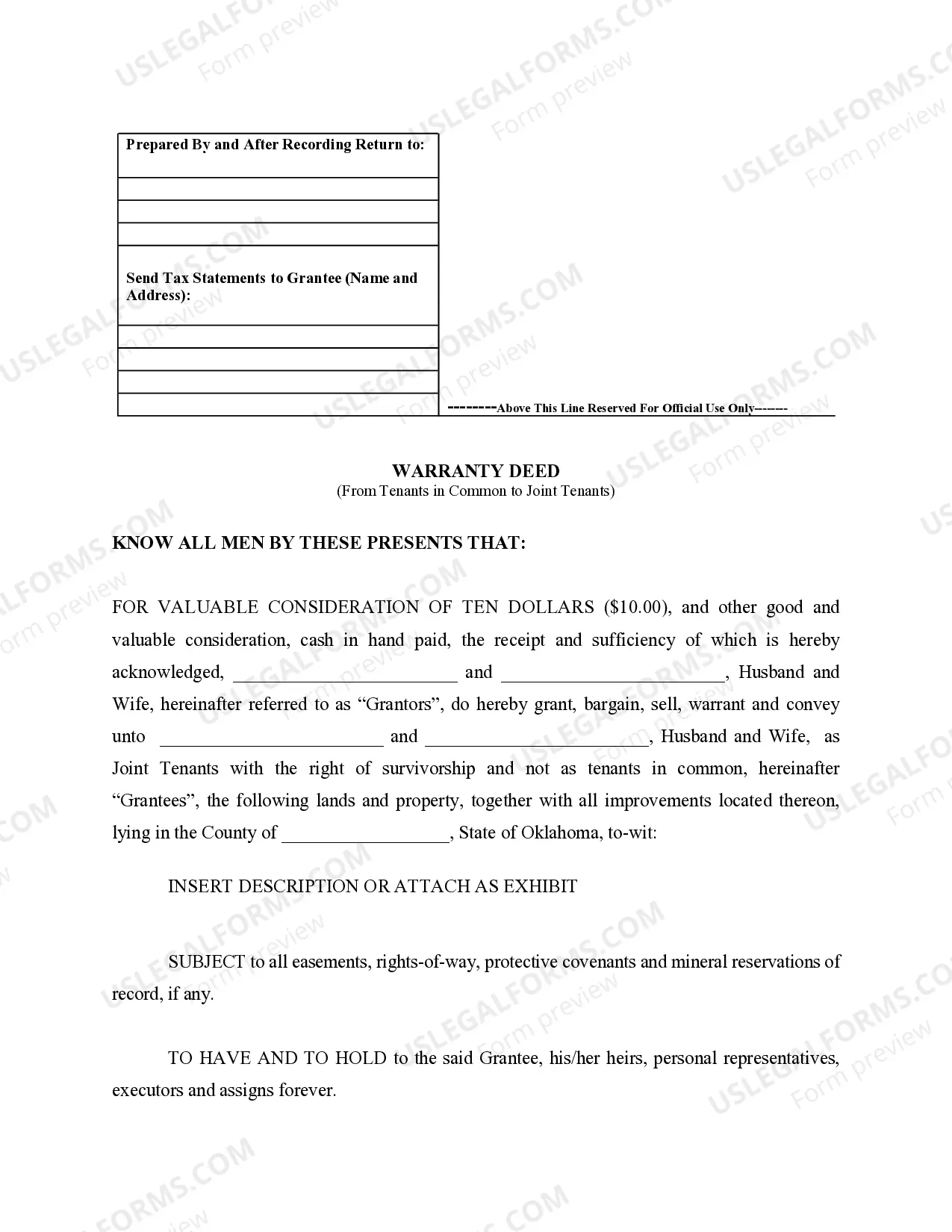

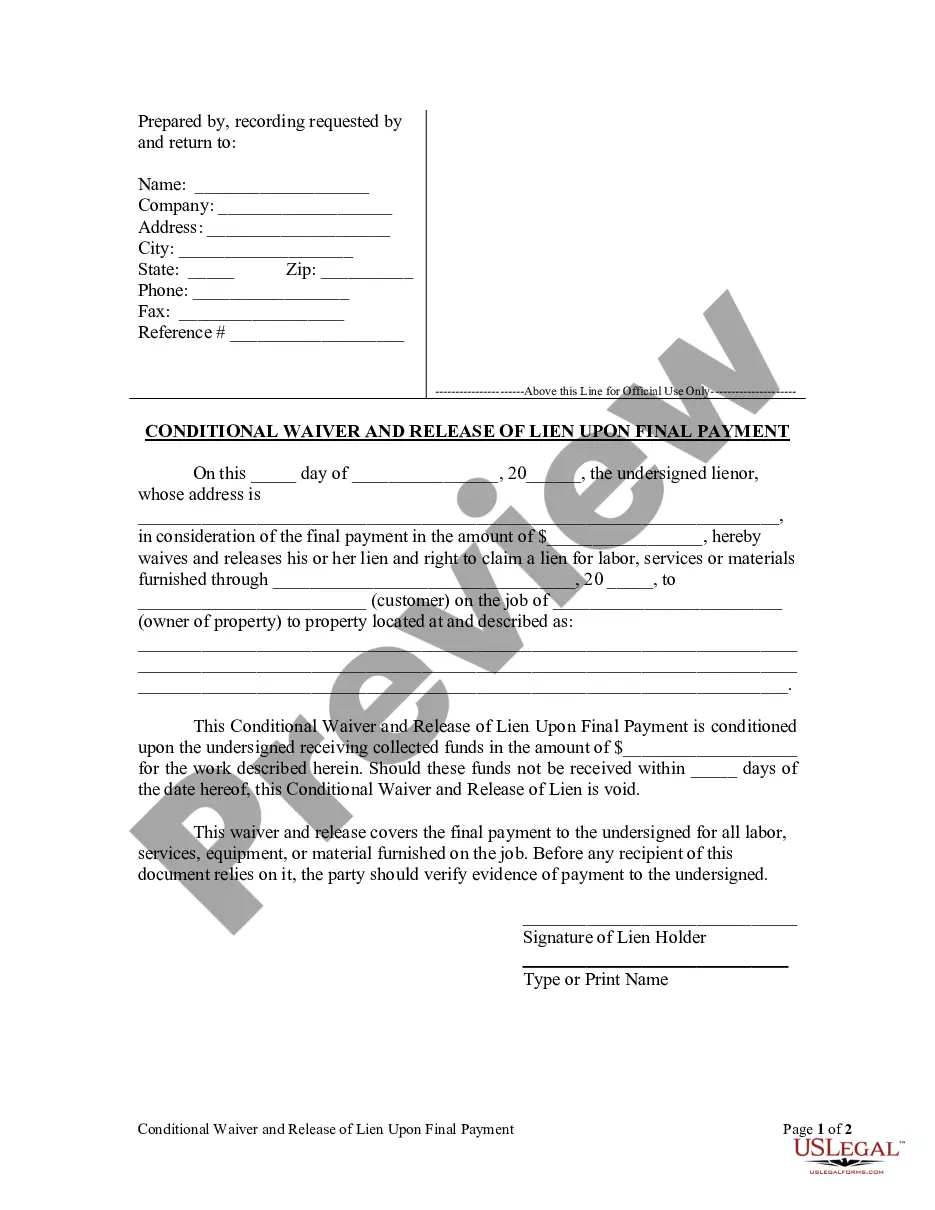

Although not required, hire a title company that will help with the deed modification process. Create a new document called a deed transfer. Each owner will sign the new deed in the presence of a notary, who will make the document official with a stamp.

Joint Tenancy Two or more people, including spouses, may hold title to their jointly owned real estate as joint tenants. There is a so-called right of survivorship, which means that when one dies, the property automatically transfers to the survivor without the necessity of probating the estate.