Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate

Description Oklahoma Warranty Deed Form

How to fill out Life Estate Deed Example?

Among numerous paid and free examples which you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they are competent enough to take care of the thing you need these to. Keep relaxed and make use of US Legal Forms! Locate Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate templates created by professional lawyers and prevent the expensive and time-consuming procedure of looking for an attorney and after that paying them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access your earlier downloaded files in the My Forms menu.

If you’re making use of our service the very first time, follow the tips below to get your Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate with ease:

- Make certain that the document you find is valid in the state where you live.

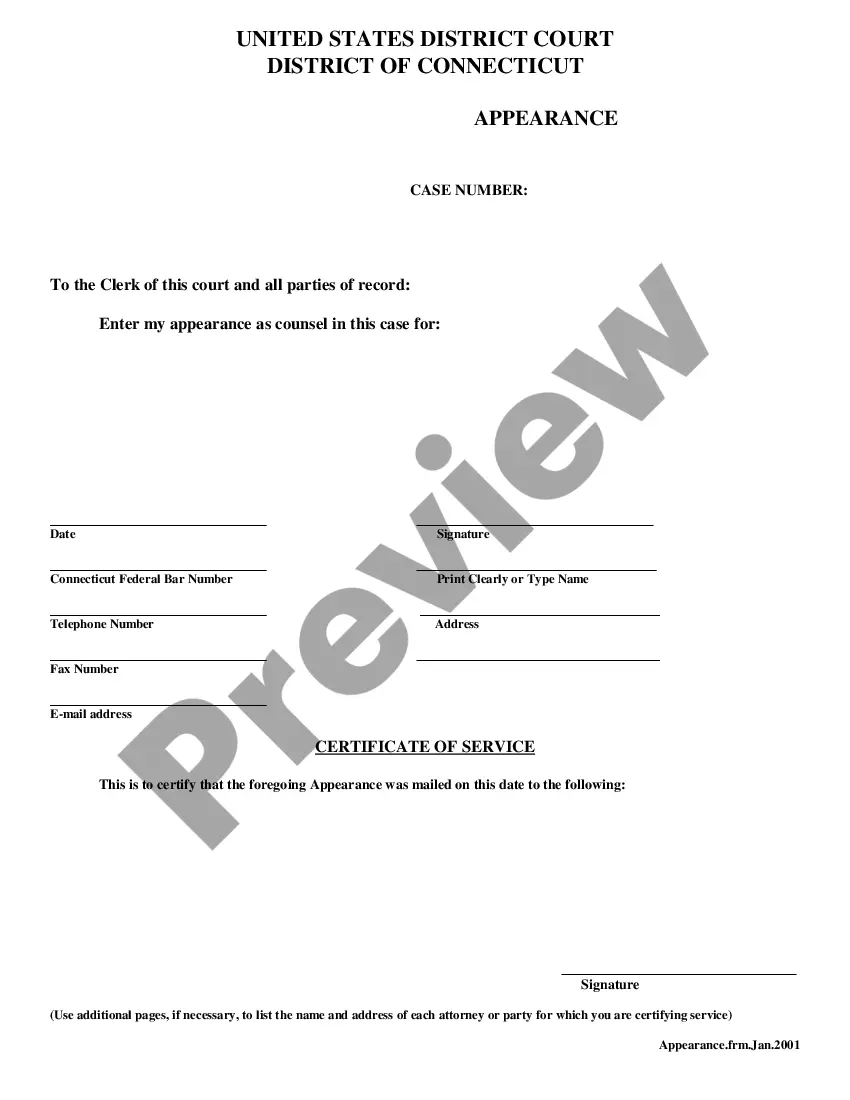

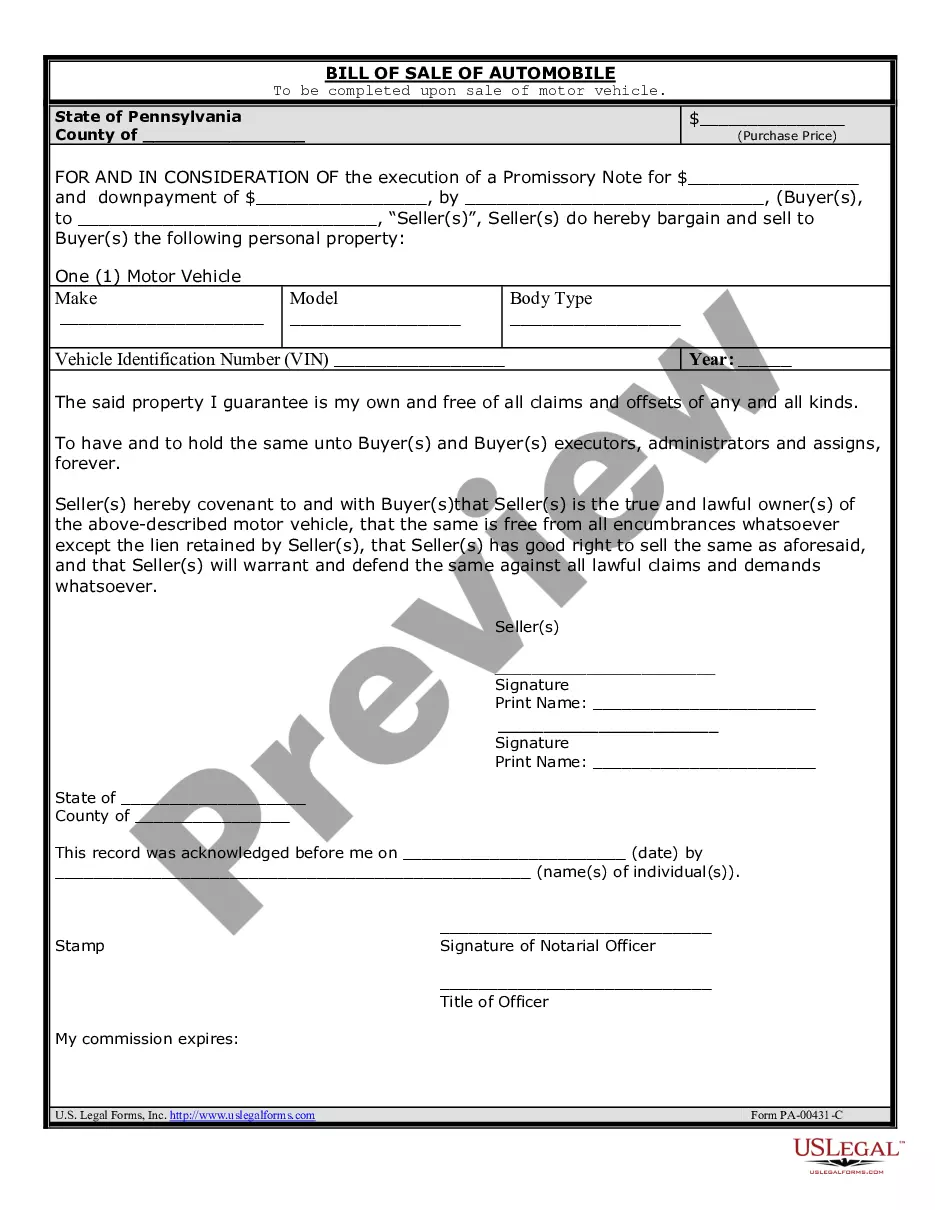

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another sample utilizing the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you have signed up and bought your subscription, you may use your Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate as often as you need or for as long as it stays active where you live. Revise it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Oklahoma Warranty Deed Form popularity

Life Estate Deed Oklahoma Other Form Names

What Is A Life Estate Deed FAQ

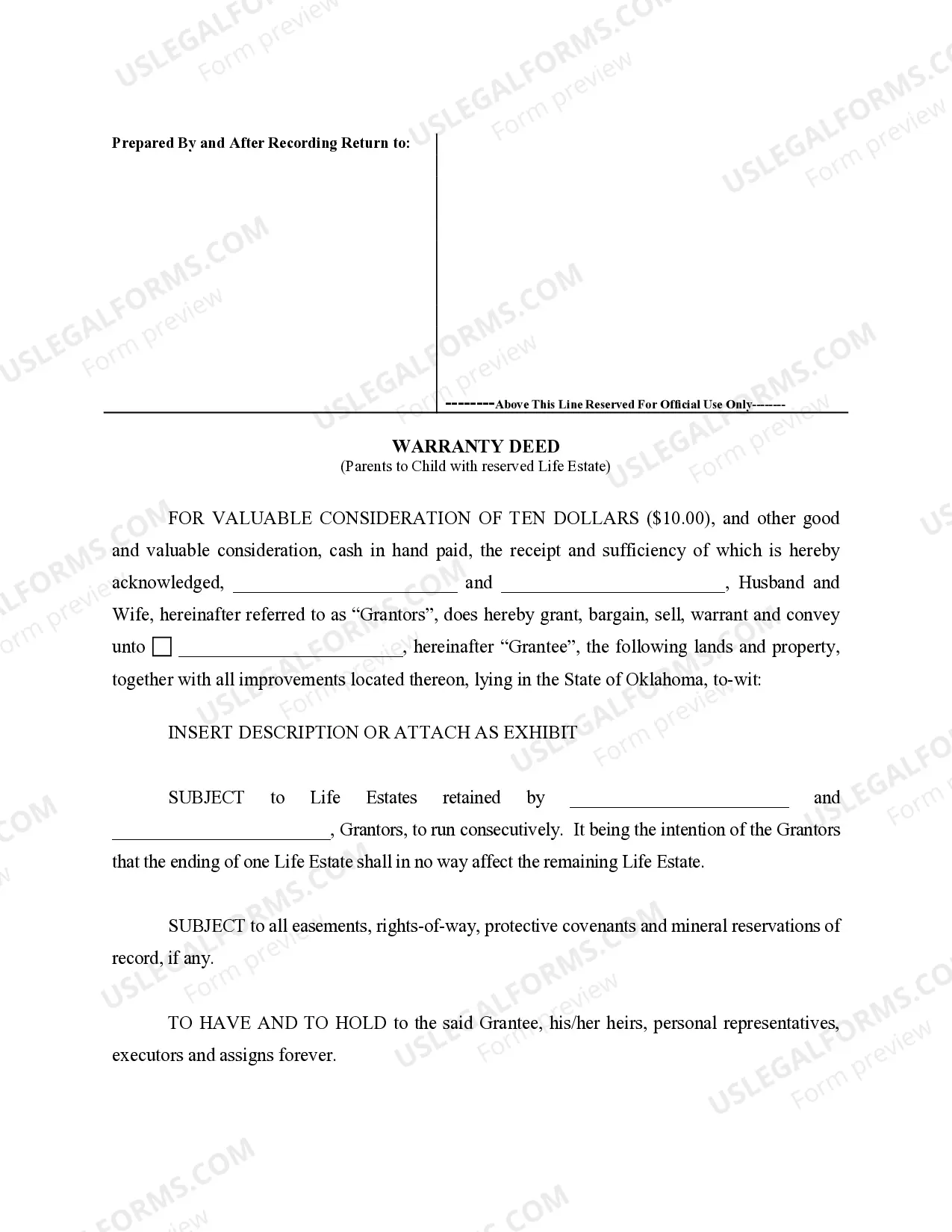

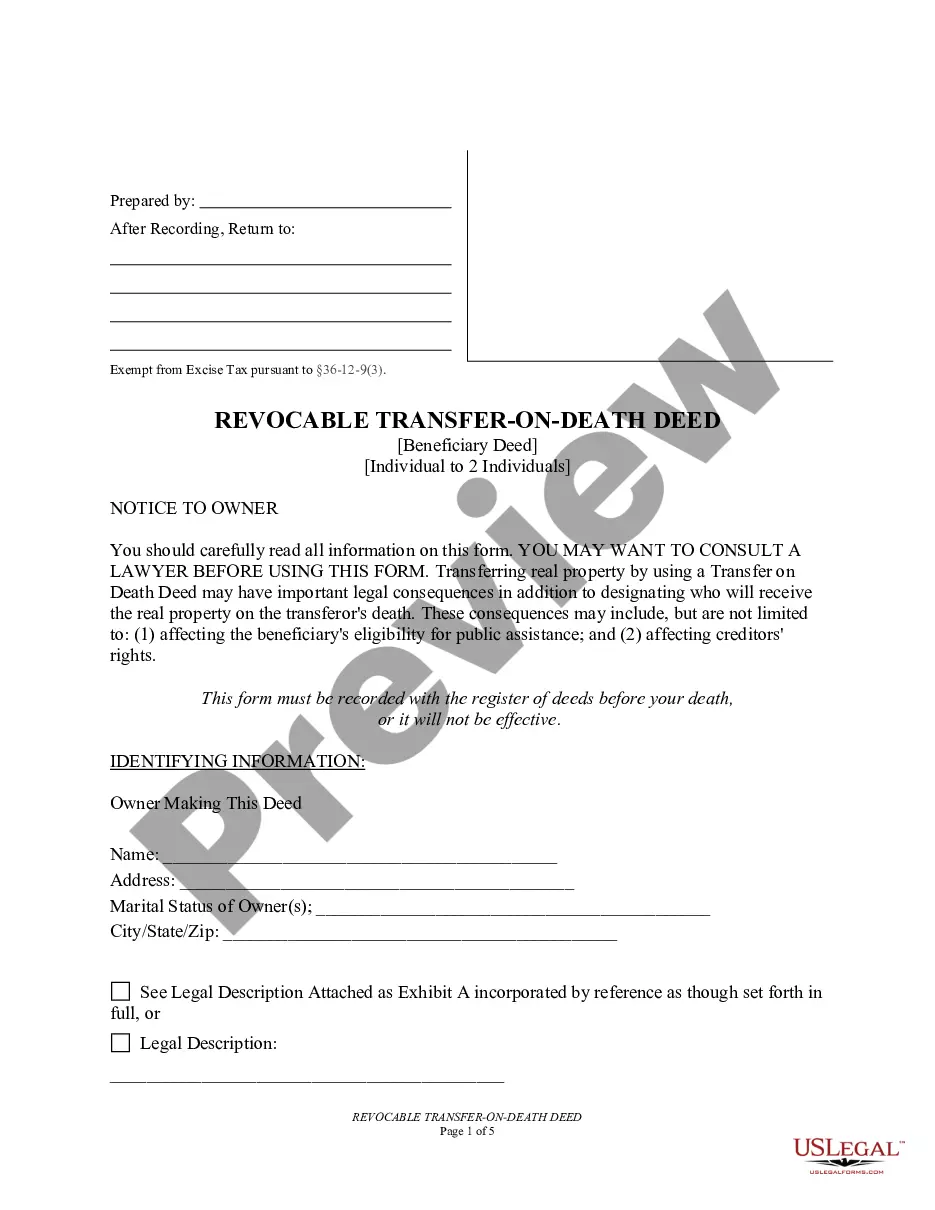

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

The person holding the life estate -- the life tenant -- possesses the property during his or her life. The other owner -- the remainderman -- has a current ownership interest but cannot take possession until the death of the life estate holder.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.