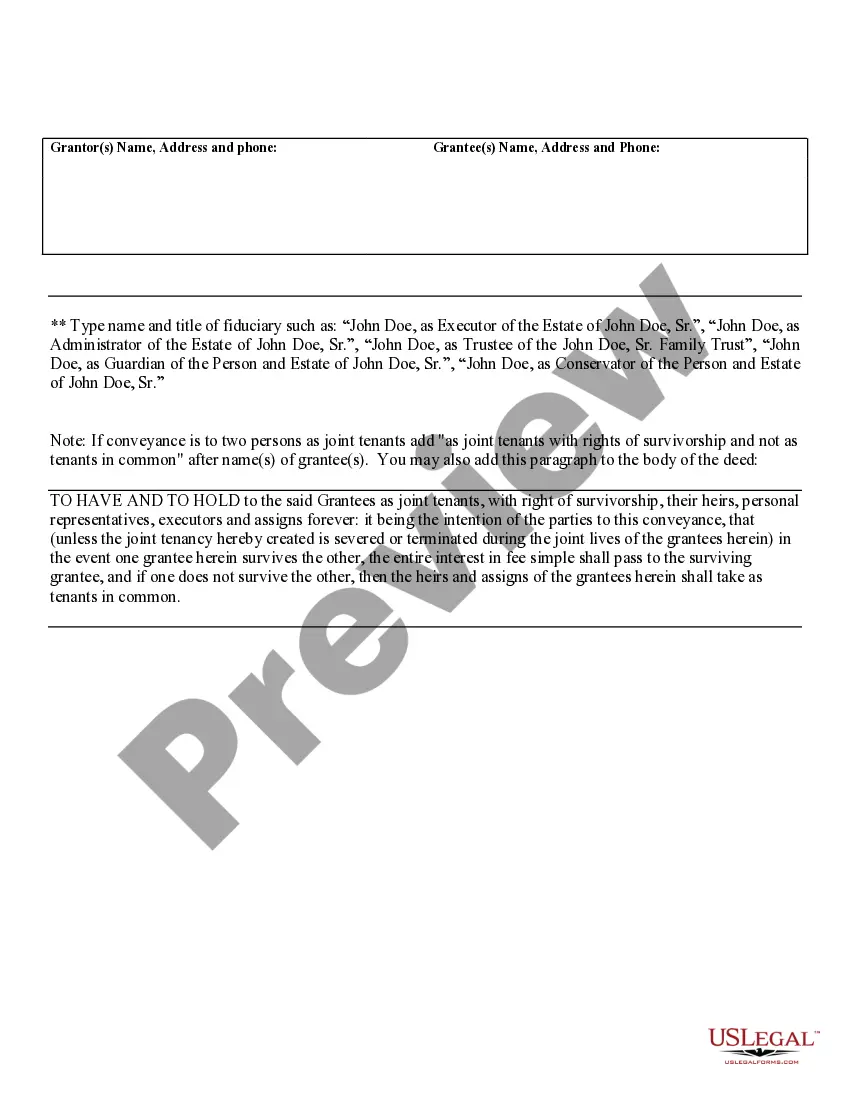

Oklahoma Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description Adding Someone To A Deed

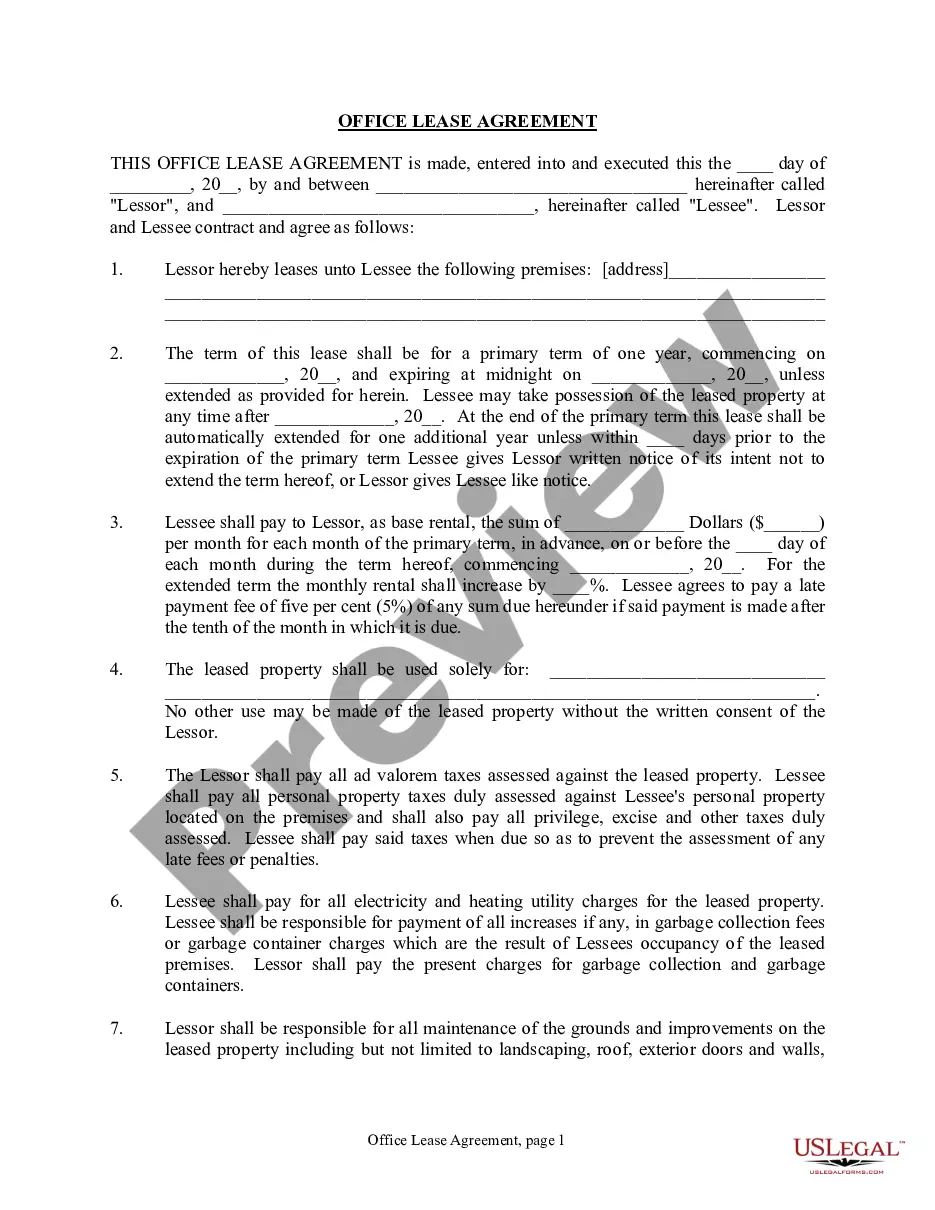

How to fill out Oklahoma Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among numerous paid and free examples that you can find on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they are skilled enough to deal with what you need them to. Always keep relaxed and use US Legal Forms! Find Oklahoma Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries templates created by professional lawyers and prevent the high-priced and time-consuming process of looking for an lawyer and then having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are looking for. You'll also be able to access your previously saved documents in the My Forms menu.

If you’re utilizing our website the very first time, follow the guidelines listed below to get your Oklahoma Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries with ease:

- Ensure that the document you discover applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you have signed up and bought your subscription, you can use your Oklahoma Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as often as you need or for as long as it remains valid where you live. Change it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Executor's Deed Form popularity

Administrator's Deed Other Form Names

FAQ

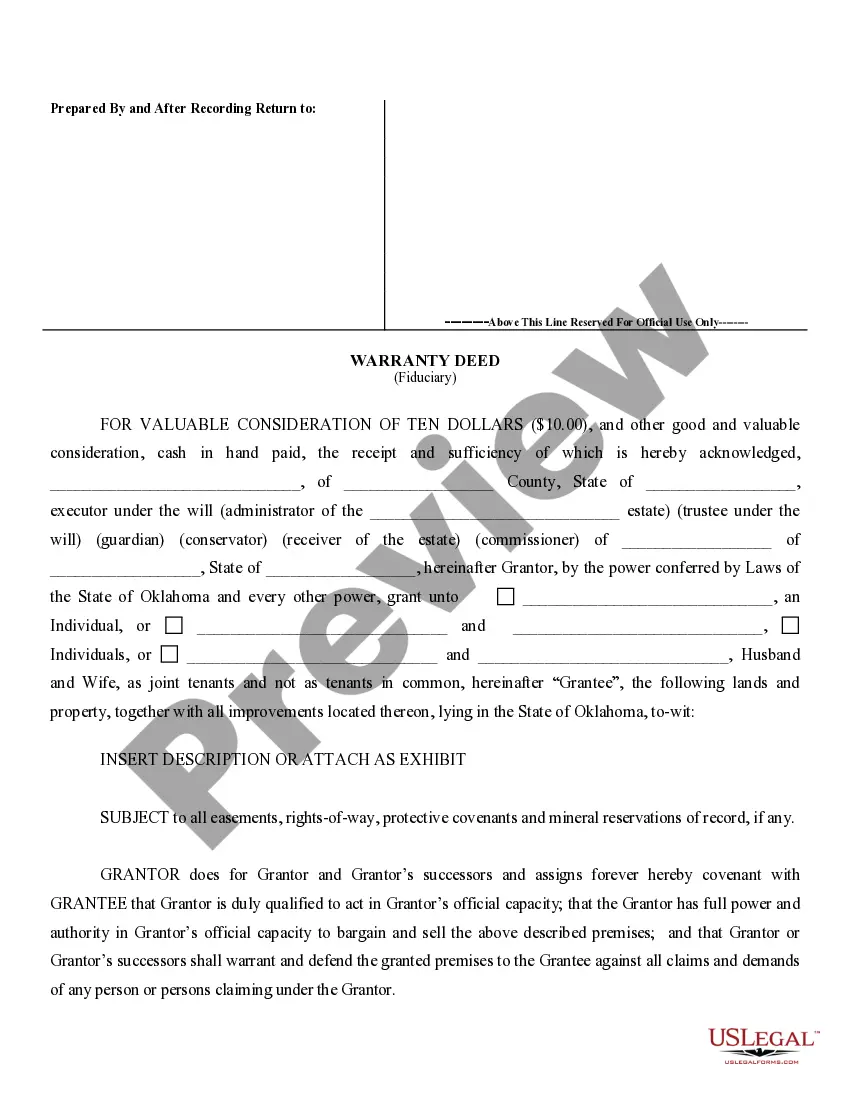

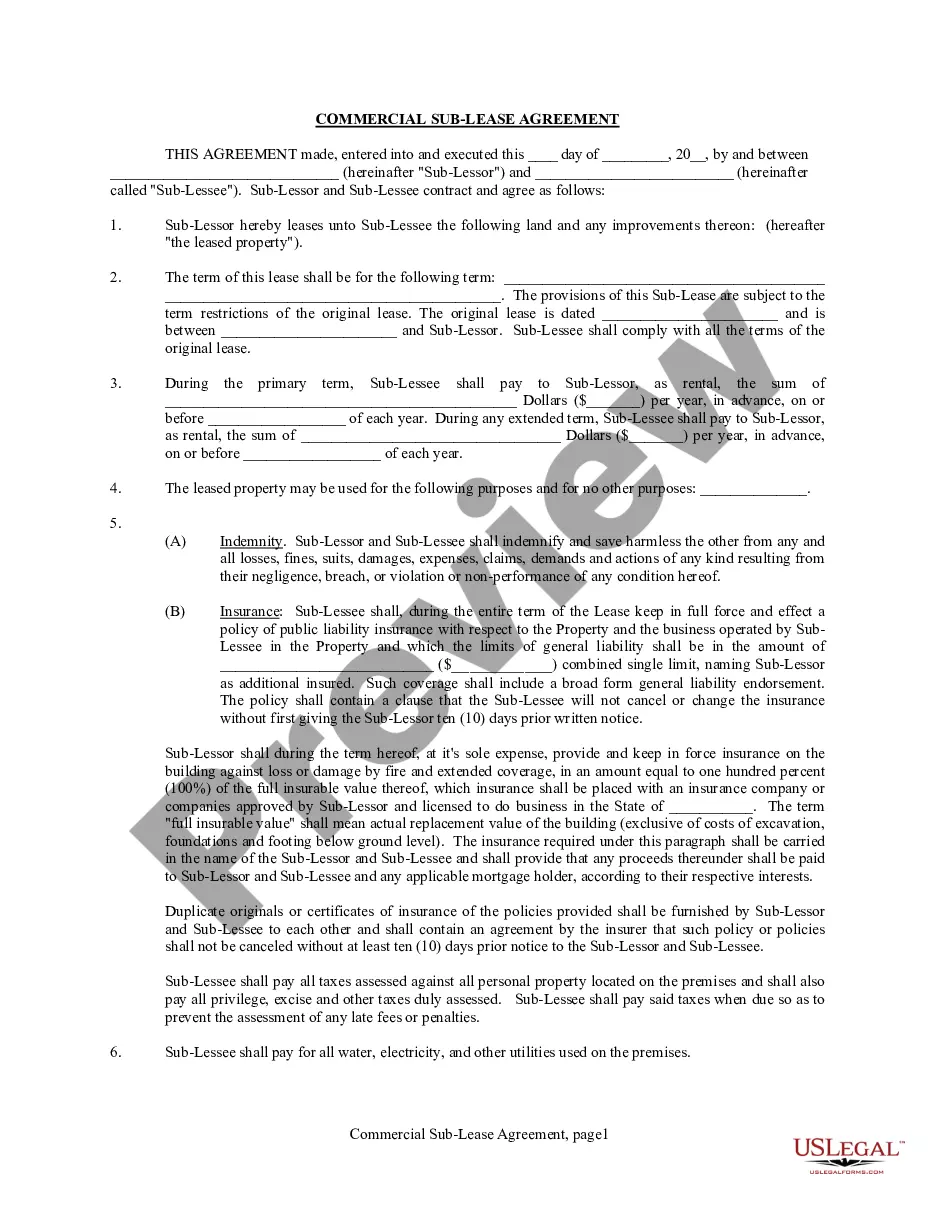

An Oklahoma (OK) quitclaim deed is the type of deed used when people who trust one another need to transfer ownership or interest in real estate property from one person to the next.If the buyer (grantee) wants a warranty on the title and ownership, the proper form to use is a warranty deed.

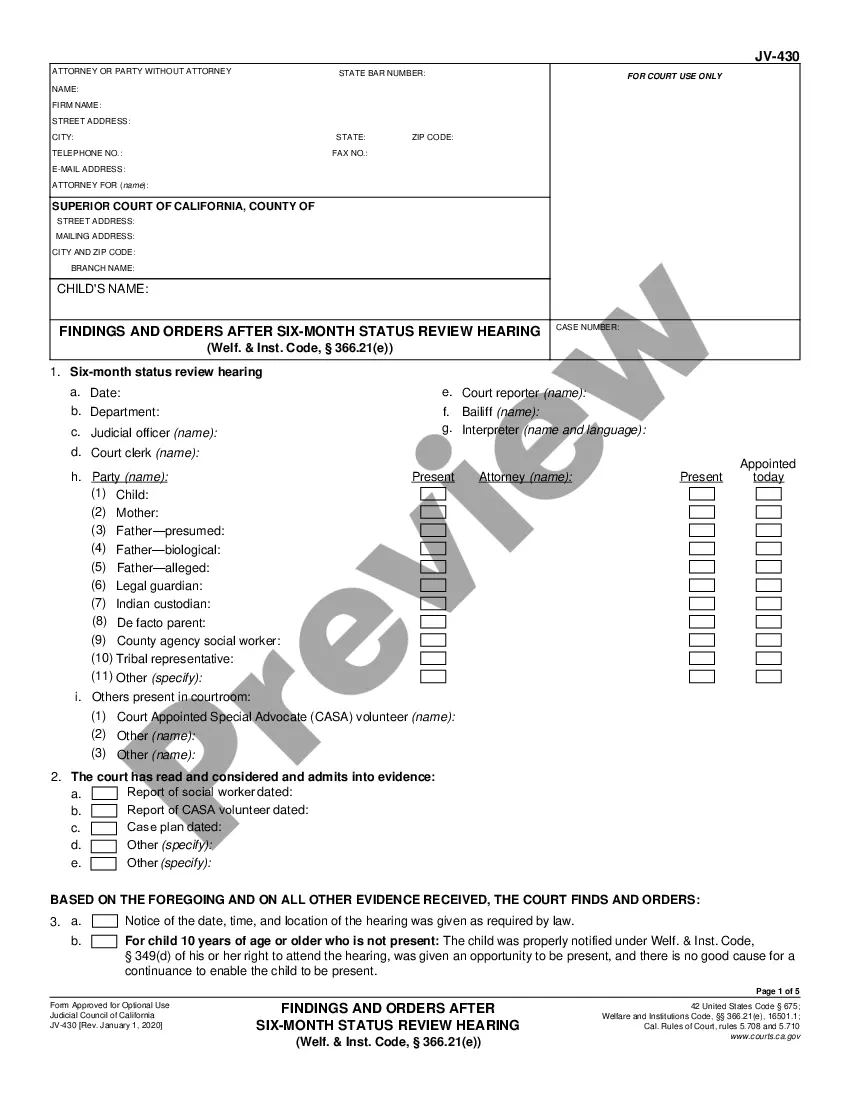

In Oklahoma, if the will does not specify the executor fee (or you have renounced your claim to that fee), default executor fees are calculated as a percentage of the net value of the estate: 5.0% on the first $1K. 4.0% on the next $5K. 2.5% on anything more.

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

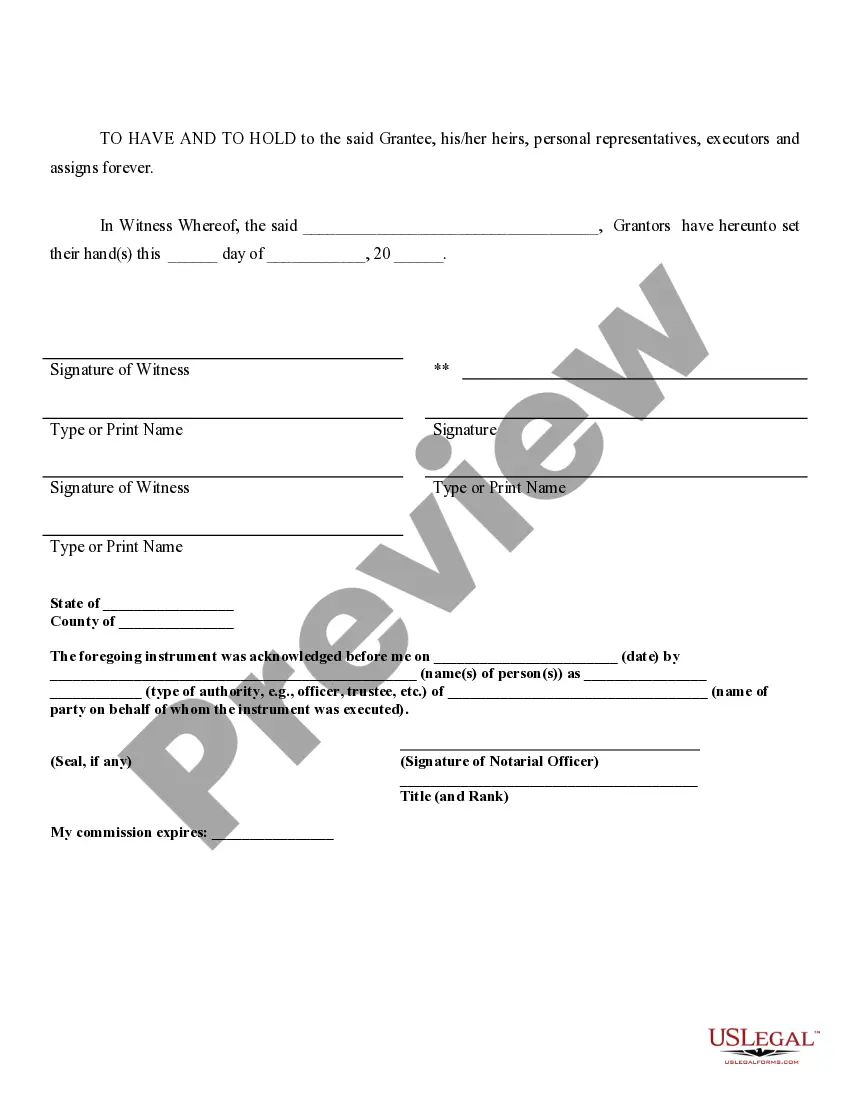

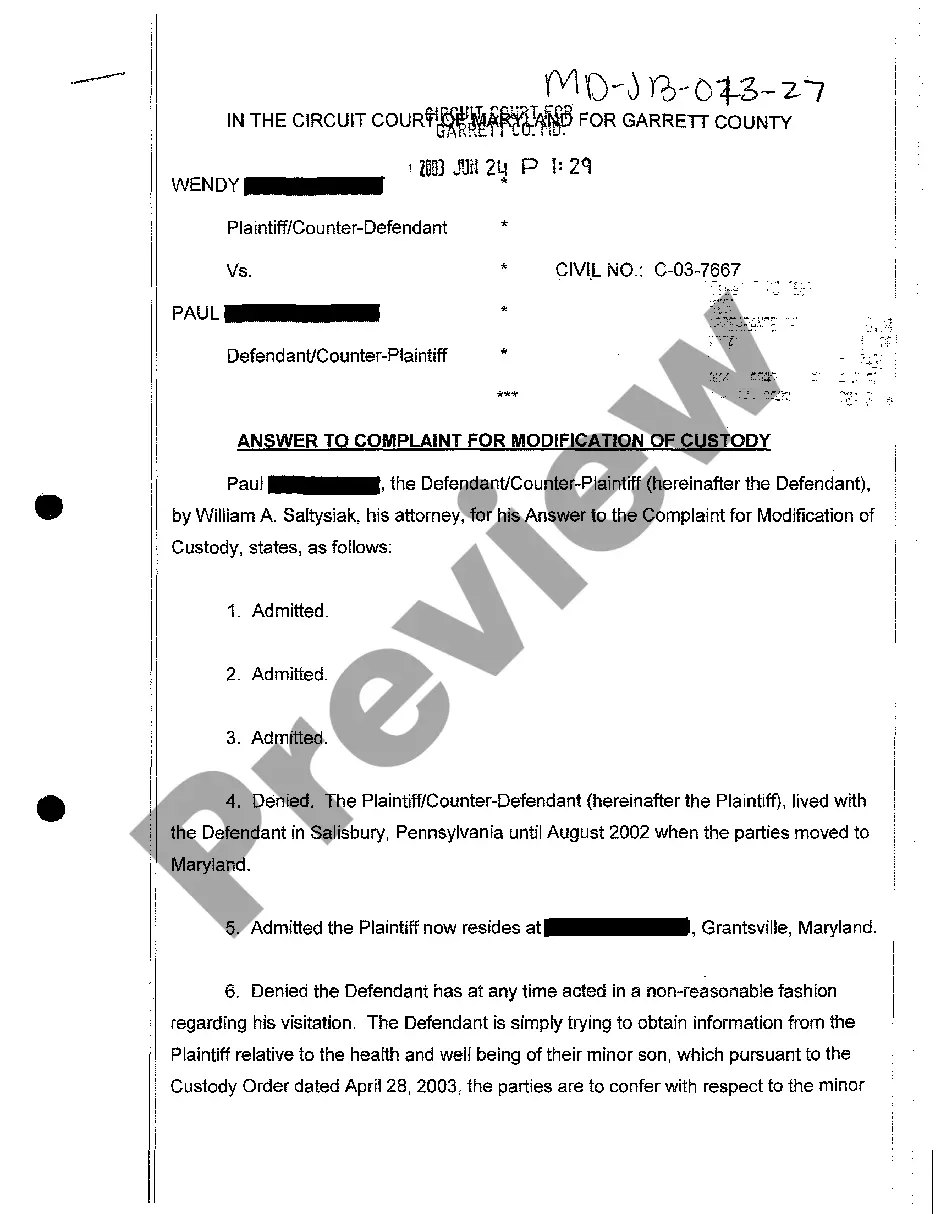

The Will must be filed in the District Court in the county where the decedent lived. A Petition for Probate must be filed as well. This requests the appointment of an executor. If there is no Will, the Court will appoint someone to serve as the Personal Representative of the estate.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who's familiar with local probate procedure .

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.