Oklahoma Warranty Deed from Trustees to Husband and Wife

Description

How to fill out Oklahoma Warranty Deed From Trustees To Husband And Wife?

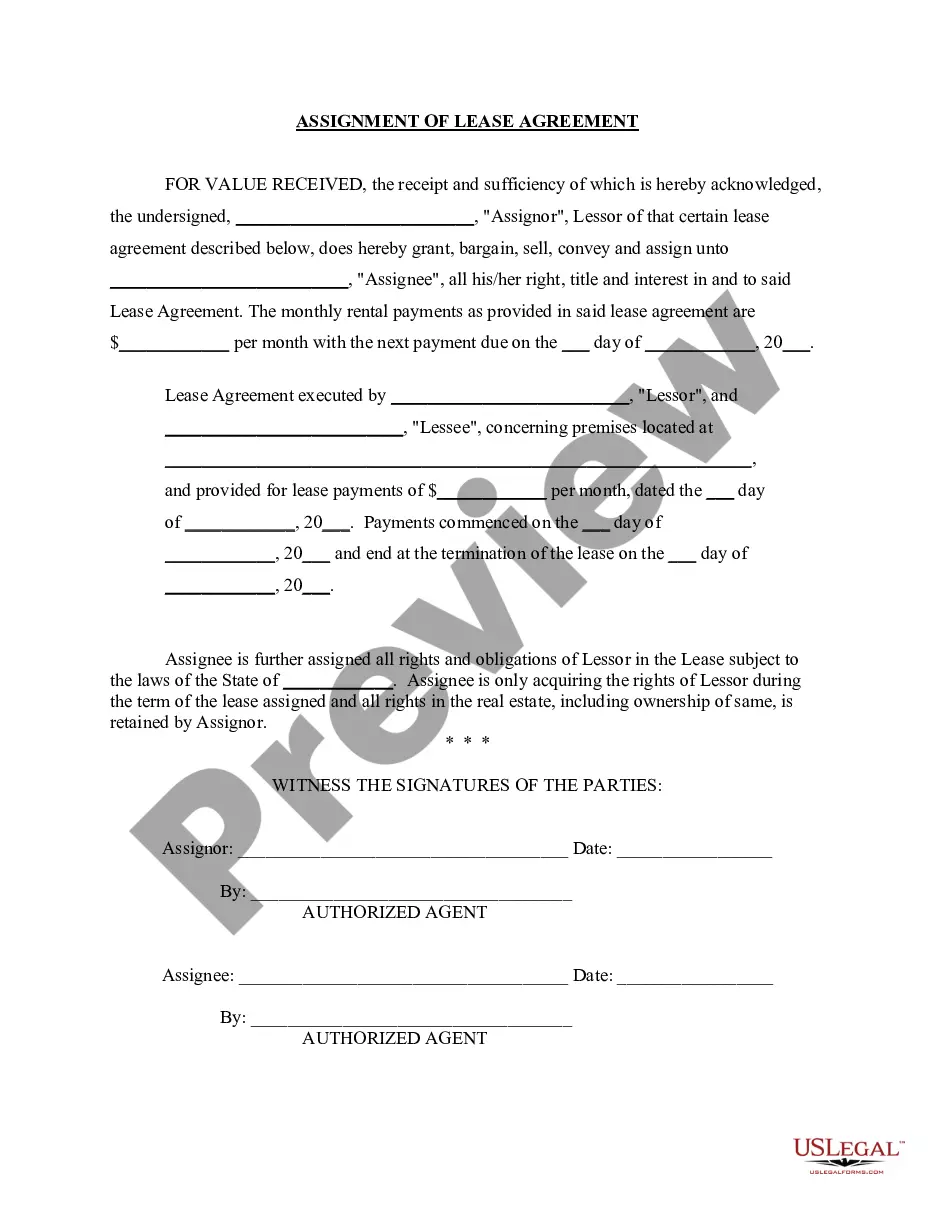

Among lots of free and paid examples which you find on the internet, you can't be certain about their reliability. For example, who created them or if they’re skilled enough to take care of the thing you need them to. Keep calm and utilize US Legal Forms! Discover Oklahoma Warranty Deed from Trustees to Husband and Wife templates created by professional legal representatives and avoid the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access all your earlier downloaded examples in the My Forms menu.

If you’re using our service for the first time, follow the tips listed below to get your Oklahoma Warranty Deed from Trustees to Husband and Wife fast:

- Ensure that the document you find applies where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you can use your Oklahoma Warranty Deed from Trustees to Husband and Wife as often as you need or for as long as it continues to be active in your state. Revise it in your preferred editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

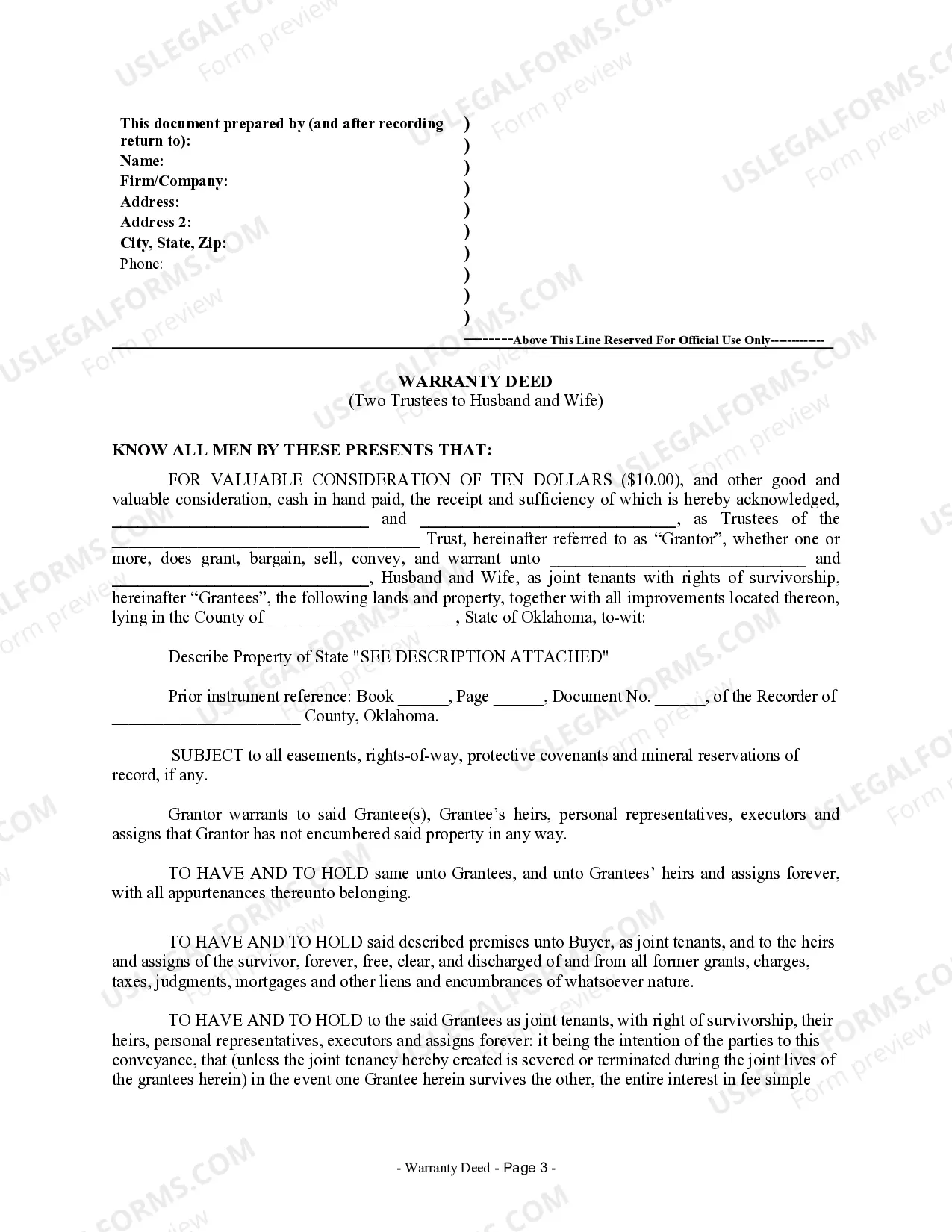

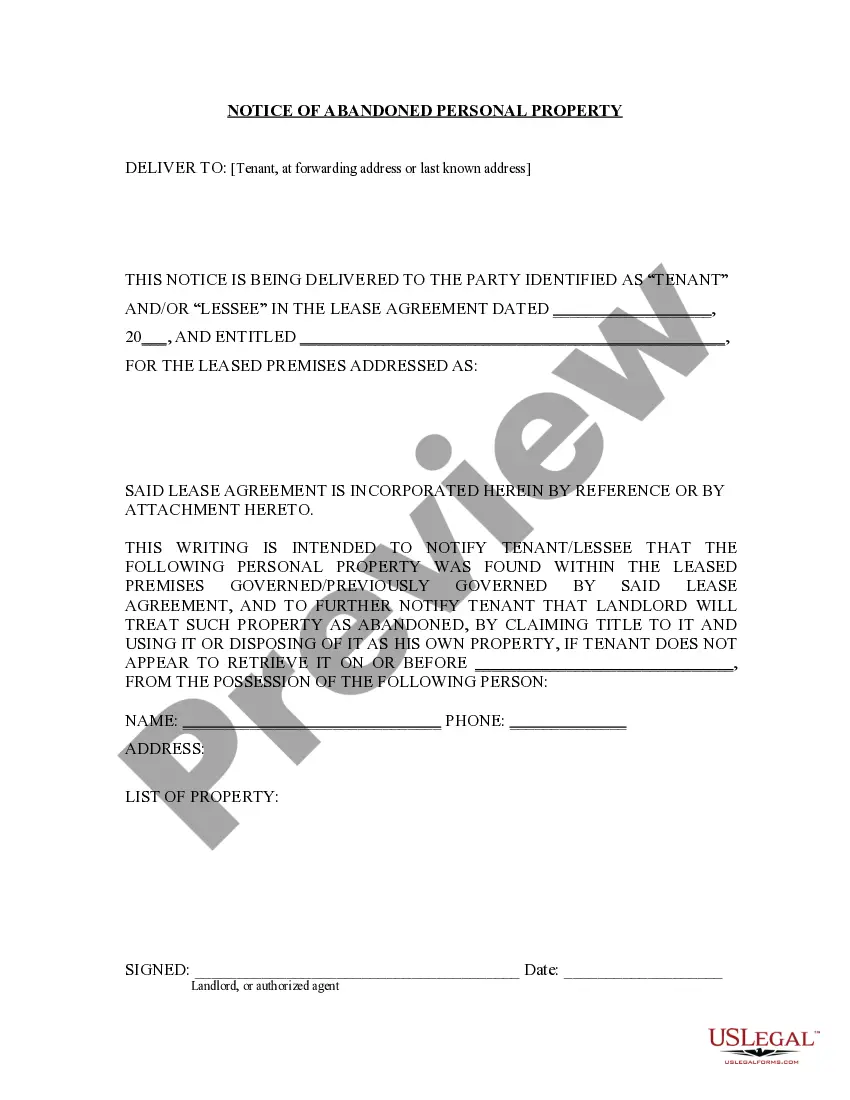

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A trustee deed offers no such warranties about the title.

Like all deeds, these two legal documents are both used to transfer titles from one owner to another. A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

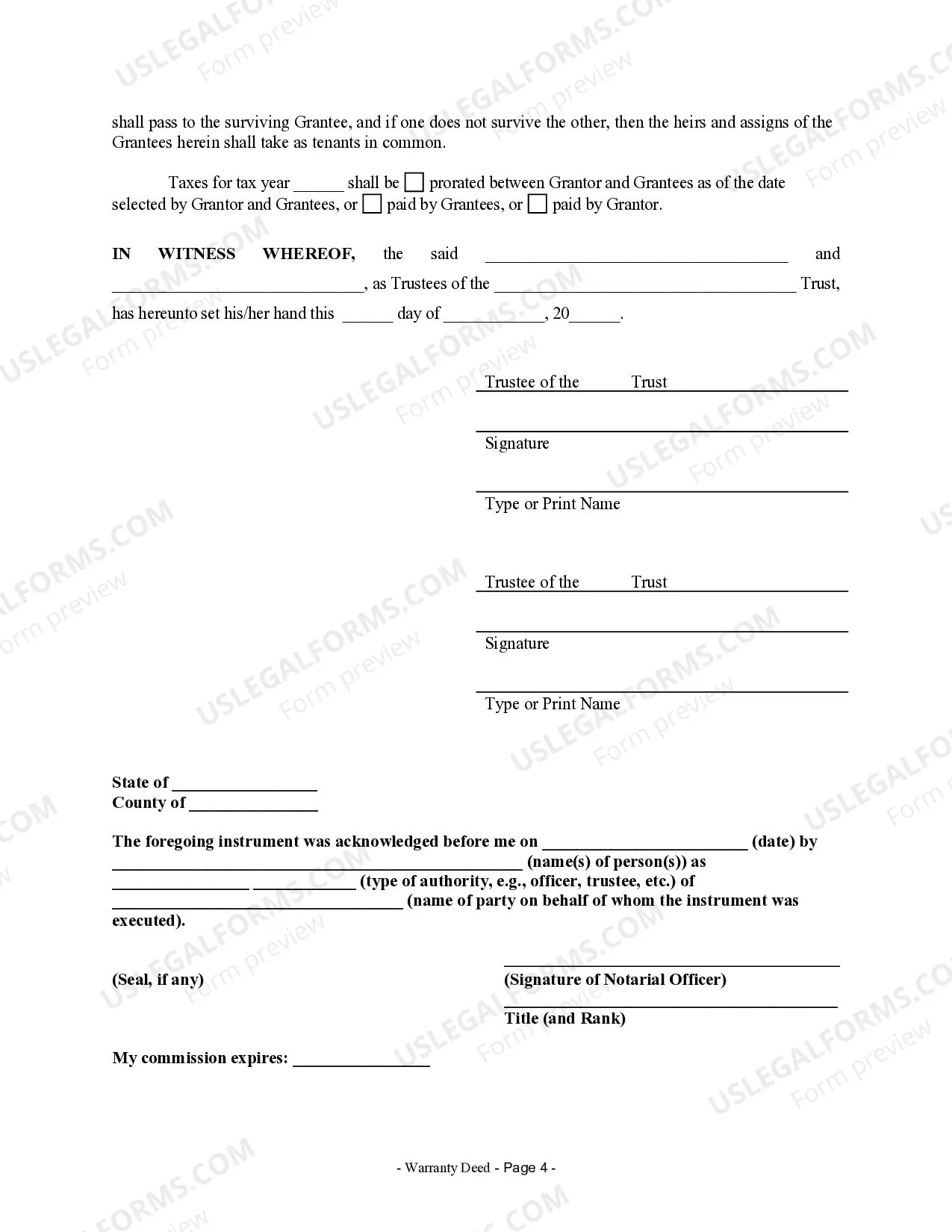

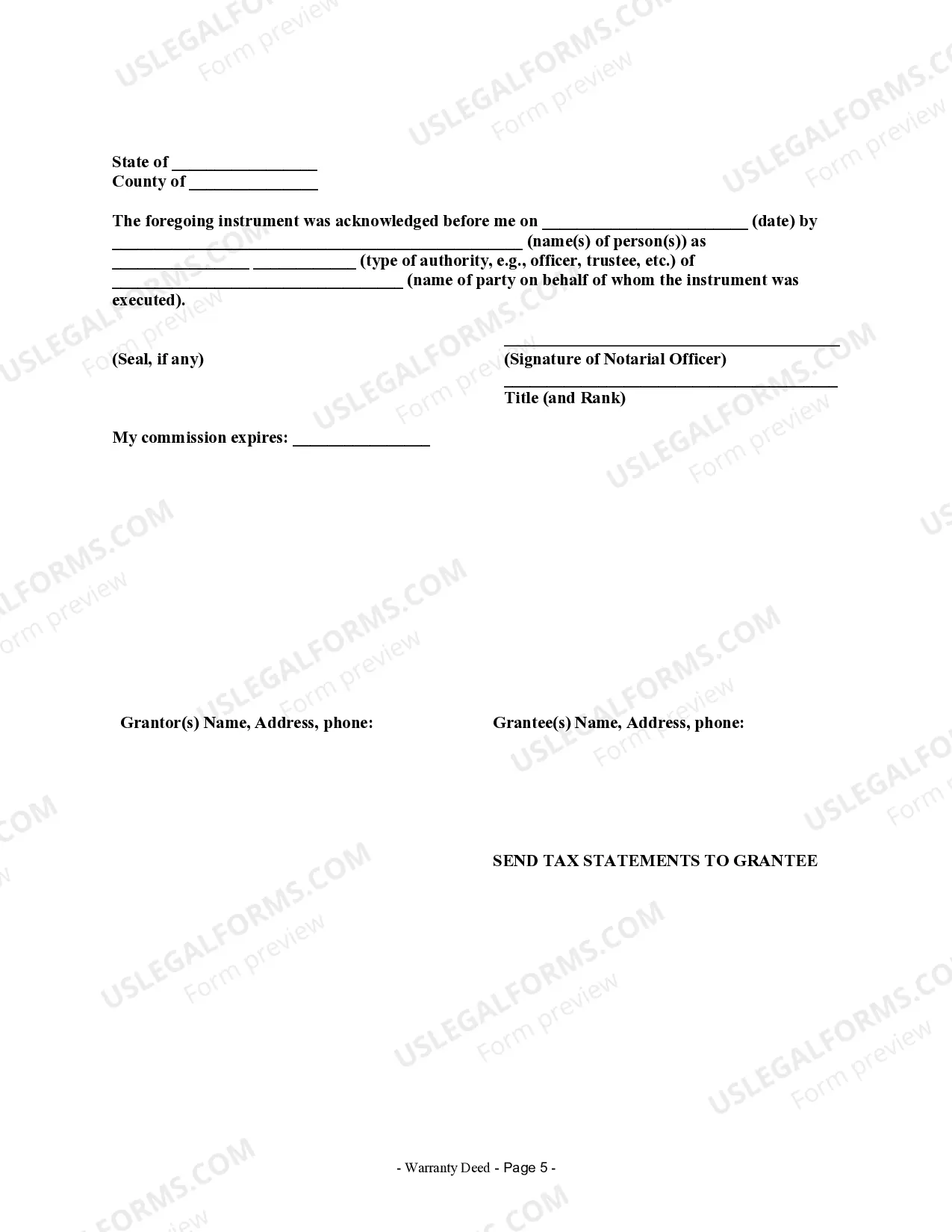

Laws § 16-40. Recording (A§ 16-16) Must be filed with the Register of Deeds in the County where the property is located. Signing (A§ 16-26) The Grantor(s) are required to sign this form in the presence of a Notary Public. Step 1 Write in the date of the deed. Step 2 Fill in the name of the person selling.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.