Oklahoma Form U-4 is a tax filing form used by the Oklahoma Tax Commission for collecting income tax withholding on wages paid to employees. It is also used to report certain types of payments to non-residents of Oklahoma. The Form U-4 has two different versions: Form U-4A for employers of household employees, and Form U-4B for employers of non-household employees. This form is used to report wage and salary payments, as well as payments for services provided by independent contractors. The form also includes information such as employee name, Social Security number, Oklahoma withholding amount, and other pertinent information. Employers must complete and submit the Oklahoma Form U-4 to the Oklahoma Tax Commission in order to comply with state tax laws and to ensure that the correct amount of income tax is withheld from employees’ wages.

Oklahoma Form U-4

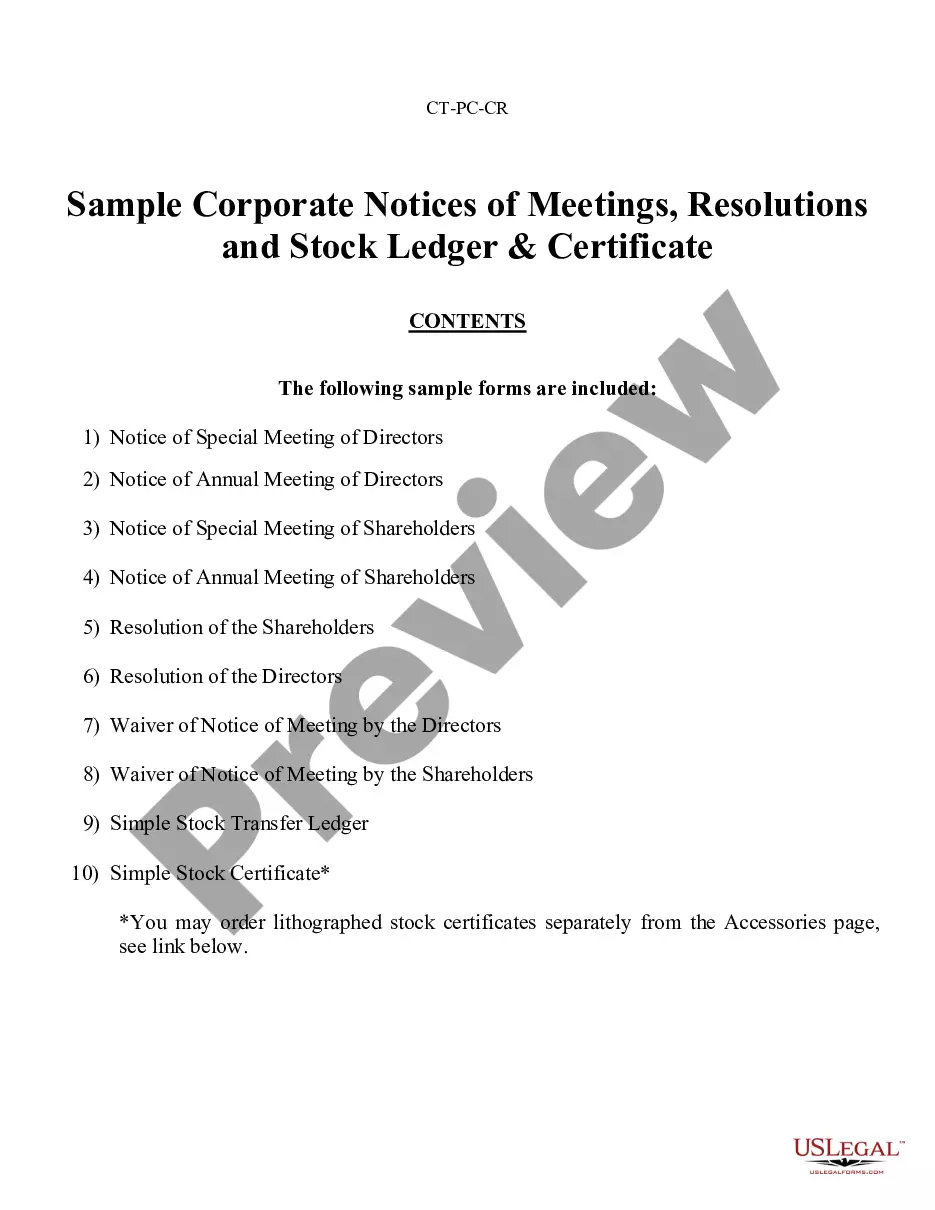

Description

How to fill out Oklahoma Form U-4?

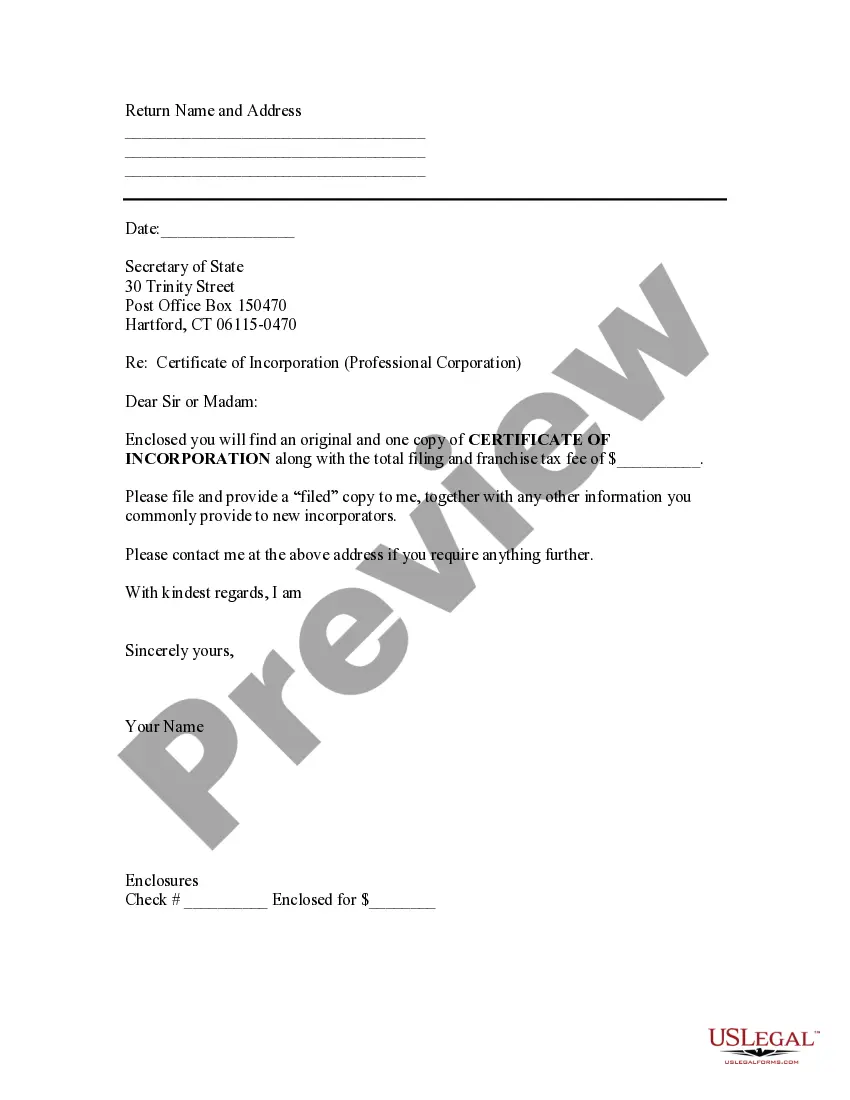

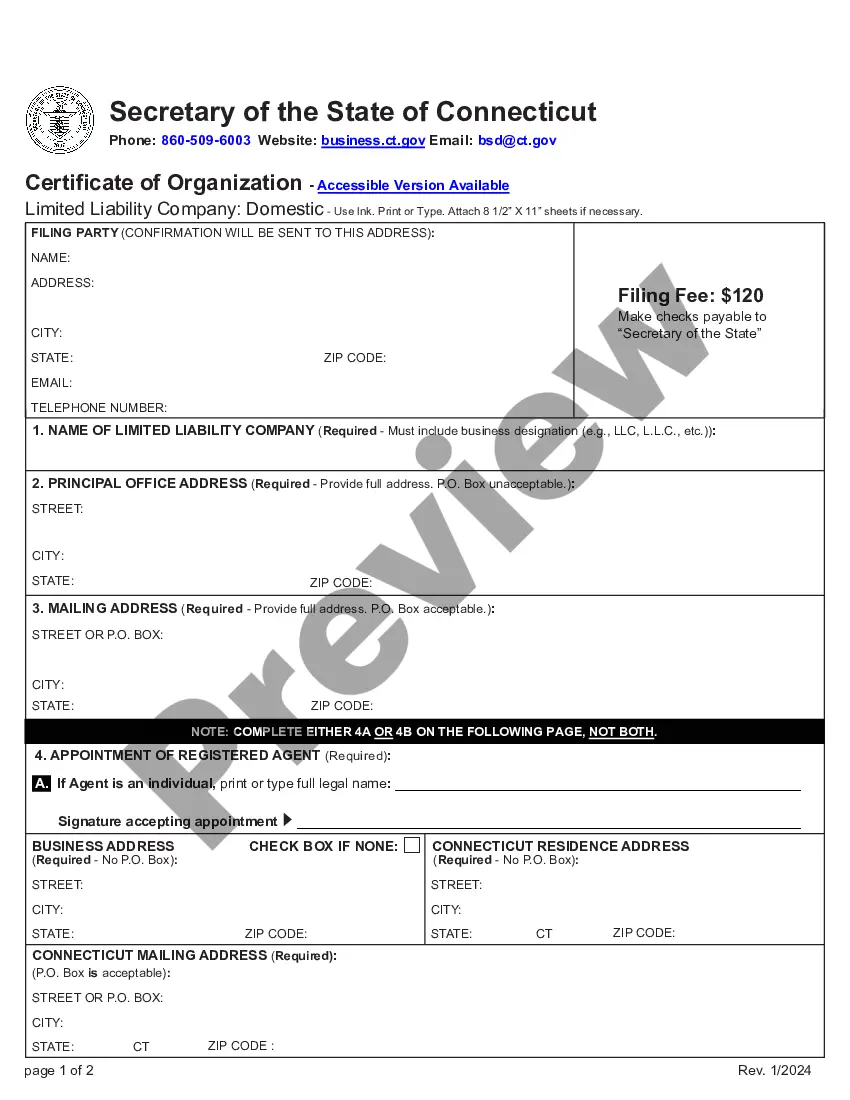

US Legal Forms is the most straightforward and cost-effective way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by legal professionals. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Oklahoma Form U-4.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Oklahoma Form U-4 if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your needs, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Oklahoma Form U-4 and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

After clicking the Open Filing link, the draft Form U4 will open in Data Entry View within a new tab or window. You will only have access to view and update the form ing to the access granted by the firm.

The Form U4 is the Uniform Application for Securities Industry Registration or Transfer. Representatives of broker-dealers, investment advisers, or issuers of securities must use this form to become registered in the appropriate jurisdictions and/or SROs.

This Bylaws section grants folks up to 30 days to amend their Form U4 after learning of the facts giving cause to make an amendment, but if the amendment involves a statutory disqualification, then it must be filed within 10 days, as opposed to 30 days.

The term "registered representative" means an employee engaged in the solicitation or handling of accounts or orders for the purchase or sale of securities, or other similar instruments for the accounts of customers of his employer or in the solicitation or handling of business in connection with investment advisory or

Retrieving & Reviewing Form U4 Once your firm has sent a Form U4 filing to you for e-signature, a yellow banner will display in FinPro's Reminders section with a link to the filing. After clicking the Open Filing link, the filing will open read-only in another browser tab.

The Form U4 (Uniform Application for Securities Industry Registration or Transfer) is used to establish that registration. FINRA, other self-regulatory organizations (SROs) and jurisdictions use the Form U4 to elicit employment history, disciplinary and other information about individuals to register them.

Who Files a Form U5? Entitled system users at broker-dealer and investment adviser firms are required to file Forms U5 on behalf of registered representatives and investment adviser representatives. The form must disclose why an individual left the firm and other certain events.

GENERAL INSTRUCTIONS The Form U4 is the Uniform Application for Securities Industry Registration or Transfer. Representatives of broker-dealers, investment advisers, or issuers of securities must use this form to become registered in the appropriate jurisdictions and/or SROs.