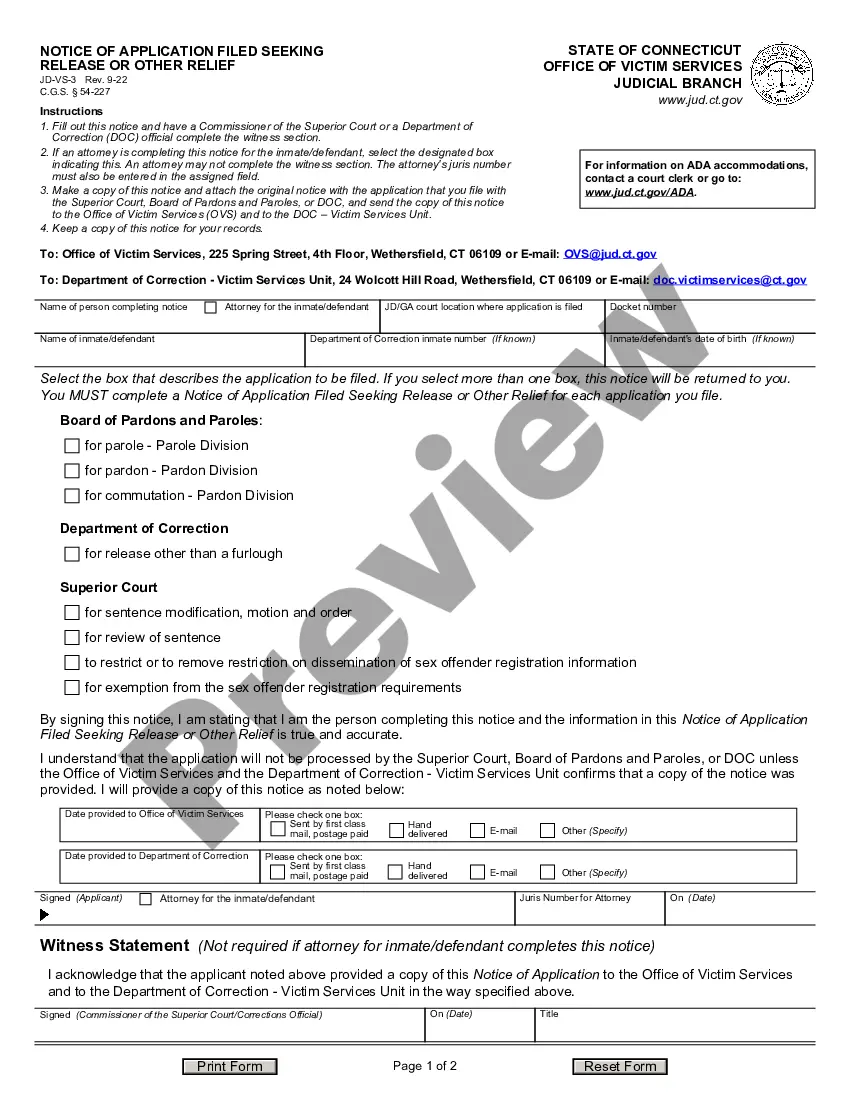

An Oklahoma Amended Certificate of Incorporation is a document that is filed with the Oklahoma Secretary of State's office to update or amend the formation of a domestic corporation. It is used to make changes to information regarding the company's name, purpose, number of shares authorized, and corporate structure. There are two types of Oklahoma Amended Certificate of Incorporation: one before receipt of stock (profit) and one after. The amended certificate of incorporation before receipt of stock (profit) is used to make changes to the company's information before any stock is issued or profits are generated. The document must include the name of the corporation, the date of the amendment, the original date of incorporation, the purpose of the corporation, the number of shares authorized, and the names and addresses of the directors. Any changes or amendments to the company's information must be approved by the shareholders or directors prior to filing.

Oklahoma Amended Certificate of Incorporation, before receipt of stock (profit)

Description

How to fill out Oklahoma Amended Certificate Of Incorporation, Before Receipt Of Stock (profit)?

Handling official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Oklahoma Amended Certificate of Incorporation, before receipt of stock (profit) template from our library, you can be certain it complies with federal and state regulations.

Working with our service is straightforward and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Oklahoma Amended Certificate of Incorporation, before receipt of stock (profit) within minutes:

- Make sure to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Oklahoma Amended Certificate of Incorporation, before receipt of stock (profit) in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Oklahoma Amended Certificate of Incorporation, before receipt of stock (profit) you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

An articles of organization form is the document that one must complete and submit to the state to establish the creation of an LLC within Oklahoma. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

You amend the articles of your Oklahoma Corporation by submitting the Amended Certificate of Incorporation form by mail, in person or by fax, along with the filing fee to the Oklahoma Secretary of State.

Oklahoma LLCs that want to process amendments have to file an Amended Articles of Organization of an Oklahoma Limited Liability Company form. You can submit it to the Secretary of State by fax, mail, or in person. Oklahoma also allows online filing through the website of the Secretary of State.

Business name changes in Oklahoma usually require filing an Amended Certificate of Incorporation (for corporations) or Amended Articles of Organization (for LLCs). Our Amendment Filing Service gives you a quick and easy option for filing amendments.

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

You can file the form in person, by mail, by fax, or online at the Secretary of State's filing website. For a business with up to $50,000 in authorized shares, the filing fee is $50. If you need same-day service for your articles of incorporation, you must file in person and pay an additional $25 expediting fee.

Depending on the state in which the business is incorporated, unanimous agreement from all the shareholders may be required to change the articles of incorporation. Most states have changed this older, common law rule, and now only require a majority of shareholders to agree to change the articles of incorporation.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by mail, in person, or online, but we recommend online. Online processing costs $10 plus $1 per page and takes about an hour.