An Oklahoma Certificate of Dissolution (not for profit) is a legal document that dissolves a nonprofit corporation in the state of Oklahoma. It is filed with the Oklahoma Secretary of State's office to officially end the life of a nonprofit corporation. The document must be signed by a majority of the corporation's board of directors, or by all the directors if there are fewer than three. It must include the name of the corporation, its date of incorporation, the reason for dissolution, and the name of the board member(s) signing the document. Depending on the type of nonprofit, there may be additional requirements for filing the certificate. The different types of Oklahoma Certificate of Dissolution (not for profit) are: Standard Dissolution, Judicial Dissolution, and Administrative Dissolution.

Oklahoma Certificate of Dissolution (not for profit)

Description

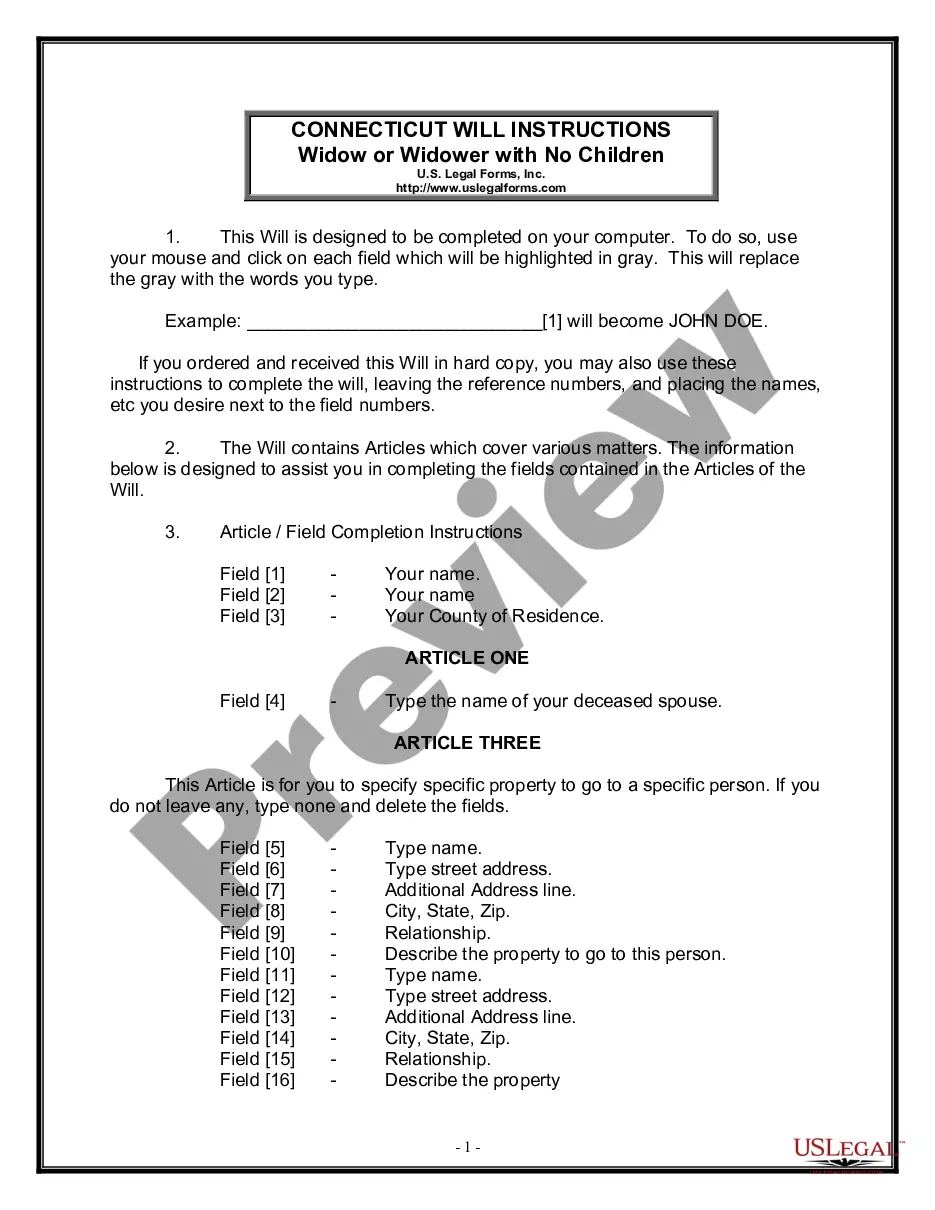

How to fill out Oklahoma Certificate Of Dissolution (not For Profit)?

How much time and resources do you often spend on drafting official documentation? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Oklahoma Certificate of Dissolution (not for profit).

To obtain and prepare an appropriate Oklahoma Certificate of Dissolution (not for profit) template, adhere to these simple instructions:

- Look through the form content to ensure it complies with your state requirements. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Oklahoma Certificate of Dissolution (not for profit). If not, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Oklahoma Certificate of Dissolution (not for profit) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us now!

Form popularity

FAQ

To dissolve/terminate your domestic LLC in Oklahoma, you must submit the completed Articles of Dissolution of an Oklahoma Limited Liability Company form to the Oklahoma Secretary of State by mail, in person or by fax along with the filing fee. If you file by fax, include a cover sheet with all credit card information.

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

You can file the form in person, by mail, by fax, or online at the Secretary of State's filing website. For a business with up to $50,000 in authorized shares, the filing fee is $50. If you need same-day service for your articles of incorporation, you must file in person and pay an additional $25 expediting fee.

Steps to dissolving a nonprofit File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Articles of dissolution are the reverse of organization or incorporation articles ? they end your business entity's existence.

The cost to dissolve an LLC in Oklahoma is $50 online. You can find the forms to do so on the Oklahoma Secretary of State's website. Your LLC will be officially dissolved once you've completed and submitted the forms.

If the leadership of the organization decides that winding down is the best option, the organization will need a ?plan of dissolution.? A plan of dissolution is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.

This is a formal process for closing and if followed, should provide some protection for the owners of the company. Written Resolution.Pay creditors.Distribute to Members.Complete Articles of Dissolution.File with Secretary of State.File with Oklahoma Tax Commission.File with IRS.Unemployment Authority.