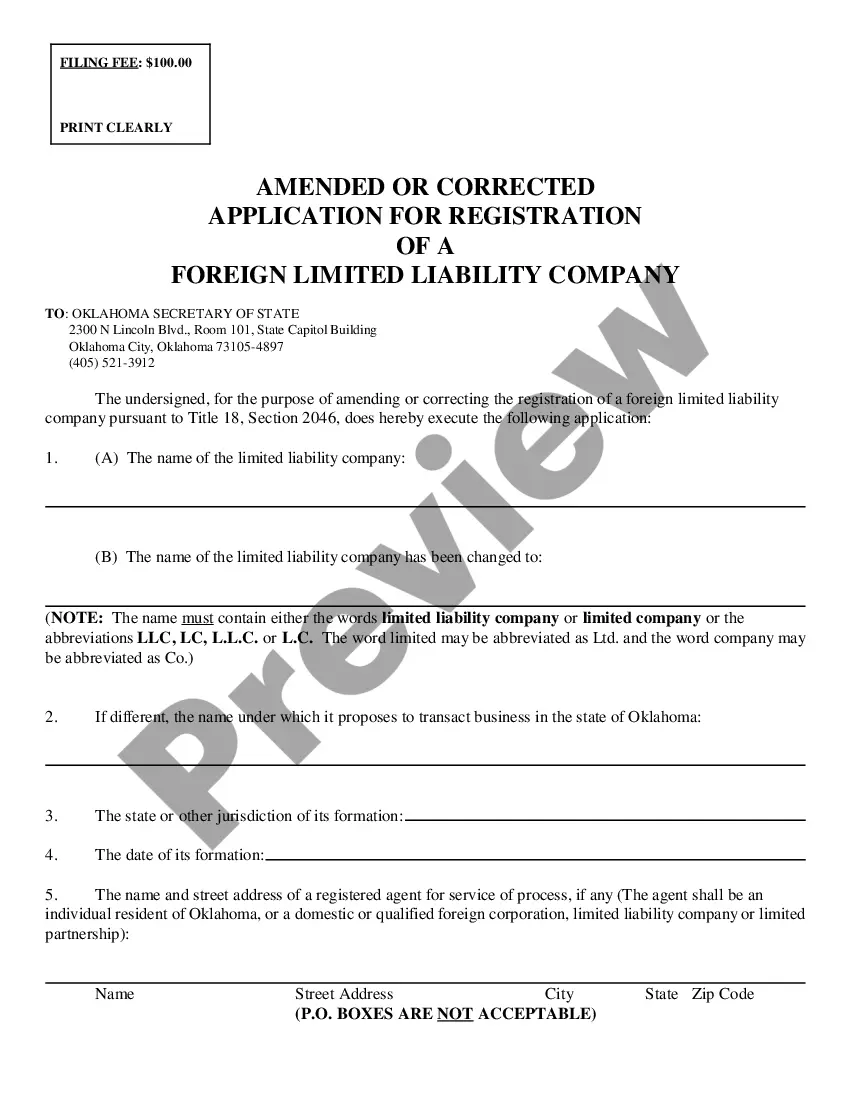

Oklahoma Amended or Corrected Application for Registration is a form provided by the Oklahoma Tax Commission for businesses to make corrections or changes to their existing registration or application for registration. This form must be completed and submitted to the Oklahoma Tax Commission in order to make changes to a business’ registration or application for registration. The form includes sections to provide information about the business, such as the business’ name, address, contact information, and a description of the business activities. Additionally, the form includes sections to note any corrections or changes that need to be made to the existing registration or application. There are two types of Oklahoma Amended or Corrected Application for Registration, one for entities and one for non-entities. The entity form is used by corporations, LCS, general partnerships, limited partnerships, and nonprofit organizations. The non-entity form is used by sole proprietors, independent contractors, and other individuals.

Oklahoma Amended or Corrected Application for Registration

Description

How to fill out Oklahoma Amended Or Corrected Application For Registration?

If you’re searching for a way to appropriately complete the Oklahoma Amended or Corrected Application for Registration without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of documentation you find on our web service is created in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Oklahoma Amended or Corrected Application for Registration:

- Ensure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Oklahoma Amended or Corrected Application for Registration and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

To make amendments to the organization of your limited liability company in Oklahoma, you file the Amended Articles of Organization of an Oklahoma Limited Liability Company form with the Secretary of State by mail, in person or by fax and with the filing fee.

An articles of organization form is the document that one must complete and submit to the state to establish the creation of an LLC within Oklahoma. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

Oklahoma LLCs that want to process amendments have to file an Amended Articles of Organization of an Oklahoma Limited Liability Company form. You can submit it to the Secretary of State by fax, mail, or in person. Oklahoma also allows online filing through the website of the Secretary of State.

Business name changes in Oklahoma usually require filing an Amended Certificate of Incorporation (for corporations) or Amended Articles of Organization (for LLCs). Our Amendment Filing Service gives you a quick and easy option for filing amendments.

You can file the form in person, by mail, by fax, or online at the Secretary of State's filing website. For a business with up to $50,000 in authorized shares, the filing fee is $50. If you need same-day service for your articles of incorporation, you must file in person and pay an additional $25 expediting fee.

You can find information on any corporation or business entity in Oklahoma or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

Business name changes in Oklahoma usually require filing an Amended Certificate of Incorporation (for corporations) or Amended Articles of Organization (for LLCs). Our Amendment Filing Service gives you a quick and easy option for filing amendments.

To make amendments to the organization of your limited liability company in Oklahoma, you file the Amended Articles of Organization of an Oklahoma Limited Liability Company form with the Secretary of State by mail, in person or by fax and with the filing fee.