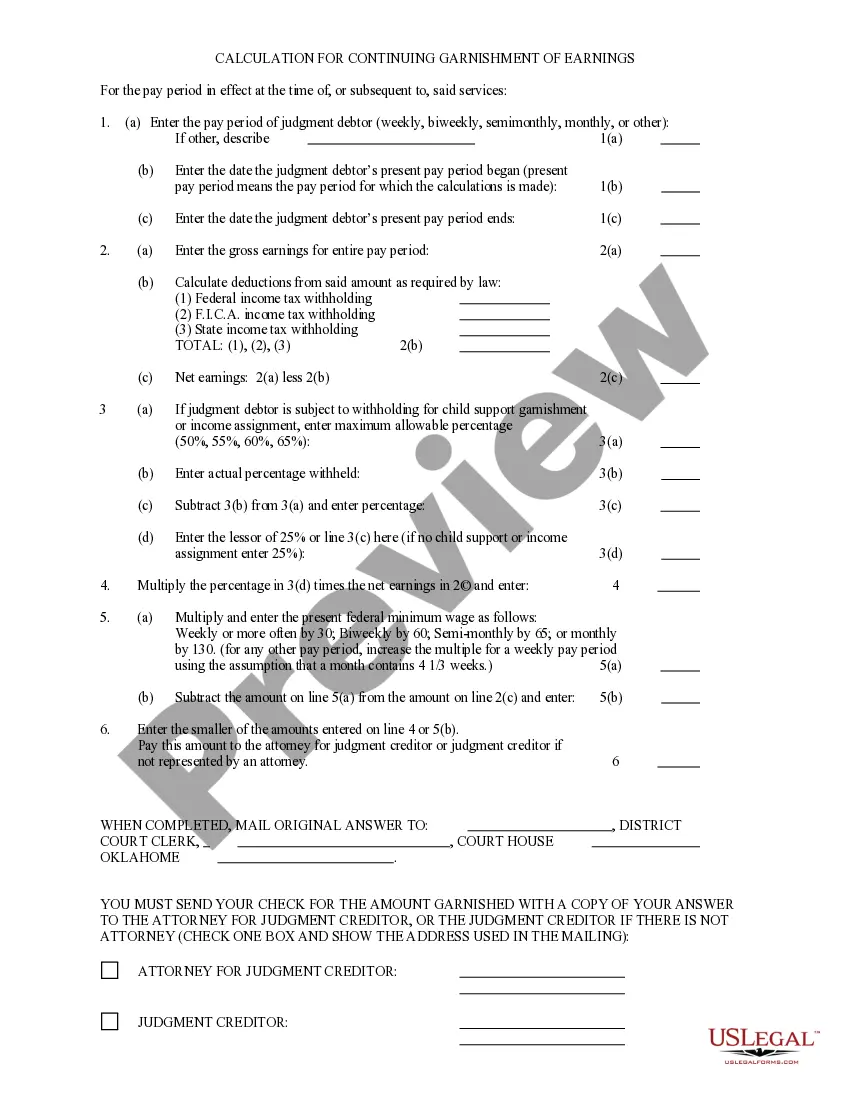

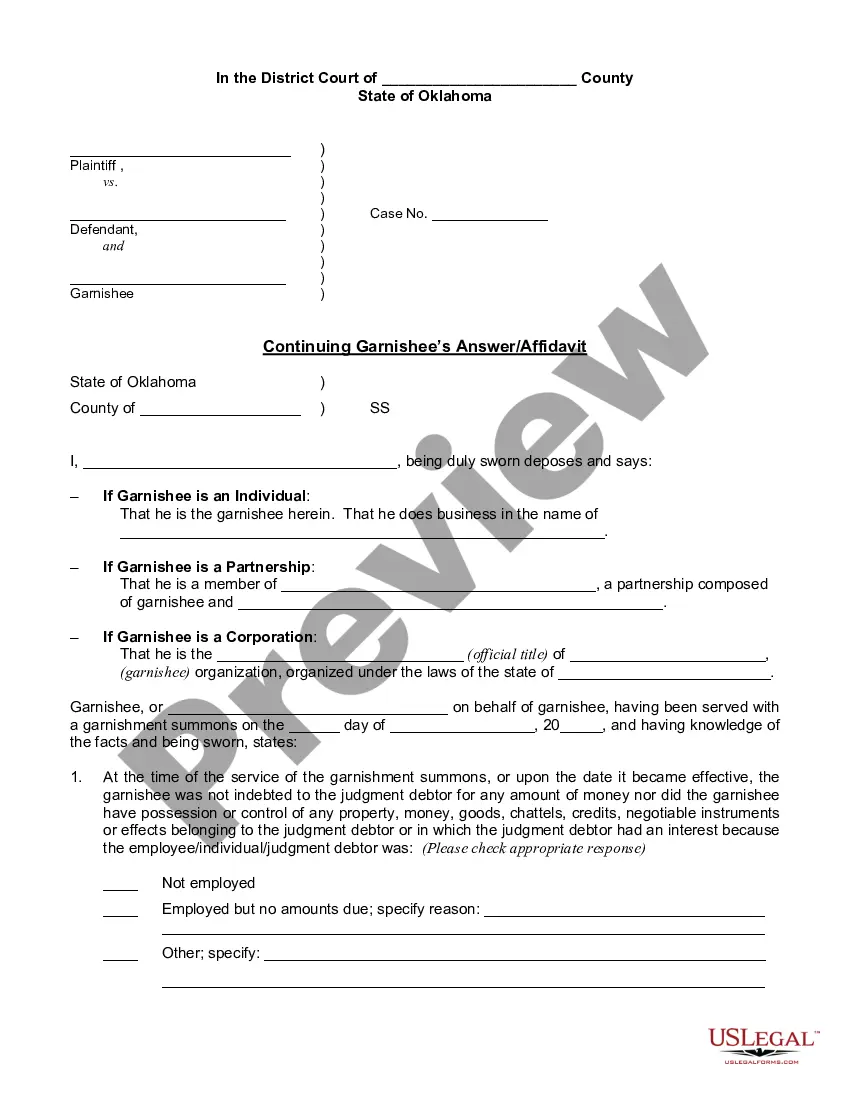

Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings is a form that is used in the state of Oklahoma when a creditor is attempting to collect wages from a debtor due to a court order. This form provides the garnishee (the employer) with information about the amount of wages that must be withheld from the debtor's paycheck, as well as instructions for remitting the withheld wages to the creditor. This form also requires the garnishee to provide an affidavit that states the amount of wages that are subject to garnishment, the amount of wages that have been withheld, and the amount of wages that have been paid to the creditor. The garnishee must also calculate the total amount of wages that should be withheld from the debtor's paycheck in order to satisfy the court order. The different types of Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings is: Prejudgmentnt Garnishment: This form is used when a creditor is attempting to collect wages from a debtor prior to a court judgment. — Post-Judgment Garnishment: This form is used when a creditor is attempting to collect wages from a debtor after a court judgment. — Non-Wage Garnishment: This form is used when a creditor is attempting to collect non-wage assets from a debtor, such as bank accounts, stocks, bonds, and other assets.

Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings

Description

How to fill out Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation For Continuing Garnishment Of Earnings?

US Legal Forms is the most straightforward and affordable way to locate suitable legal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by attorneys. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one meeting your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Oklahoma Continuing Garnishee's Answer/Affidavit; Calculation for Continuing Garnishment of Earnings and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

Affidavit for continuing garnishment is a sworn statement by a plaintiff or his/her attorney or agent requesting the issuance of a summons of continuing garnishment as the defendant is indebted to the plaintiff on a judgment from a particular court and the plaintiff believes that the garnishee is or may be an employer

Non-continuing garnishment This is essentially a bank levy, which allows the creditor to take non-exempt money directly from your account. This may also result in a bank account freeze while they take funds from the balance of your account to pay the judgment.

You can only be paying on one garnishment at a time. This kind of exemption is claimed as an "undue hardship." Undue Hardship. You can apply for an "undue hardship" exemption" if you have a family to support.

25% of your disposable earnings for that week, or. the amount by which your disposable earnings for the week exceed 30 times the federal minimum hourly wage.

For example, if you make $500 per week in disposable income, only $125 of that amount can be subject to garnishment. This is because 25% of $500 is equal to $125, which is less than the amount your wages surpass 30 times the federal minimum wage ($217.50).

Wage garnishments can be stopped through two options: 1) Pay the debt in full with interest and attorney fees. 2) File bankruptcy. You may file for Chapter 7 or Chapter 13 bankruptcy.

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.

Under federal law and Oklahoma state law, whichever is lesser of the following can be garnished: 25% of your weekly disposable earnings, OR. The amount your weekly earnings exceeds 30 times the federal minimum wage of $7.25.