Oklahoma Request to Transfer — Lump Sum is a program that allows a state agency or local government to transfer lump sum payments from one budget line to another within the same fiscal year. This type of transfer is used for one-time expenses that may exceed the amount of money available in the current budget line. It is a method of moving funds from one budget line to another without having to reallocate the budget. There are two types of Oklahoma Request to Transfer — Lump Sum: transfer-in and transfer-out. A transfer-in is when funds are transferred from one budget line to another within the same fiscal year. A transfer-out is when funds are transferred from one budget line to another within the same fiscal year, but the funds are used for expenses outside the current fiscal year.

Oklahoma Request to Transfer - Lump Sum

Description

How to fill out Oklahoma Request To Transfer - Lump Sum?

If you’re looking for a way to appropriately prepare the Oklahoma Request to Transfer - Lump Sum without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of documentation you find on our online service is drafted in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to obtain the ready-to-use Oklahoma Request to Transfer - Lump Sum:

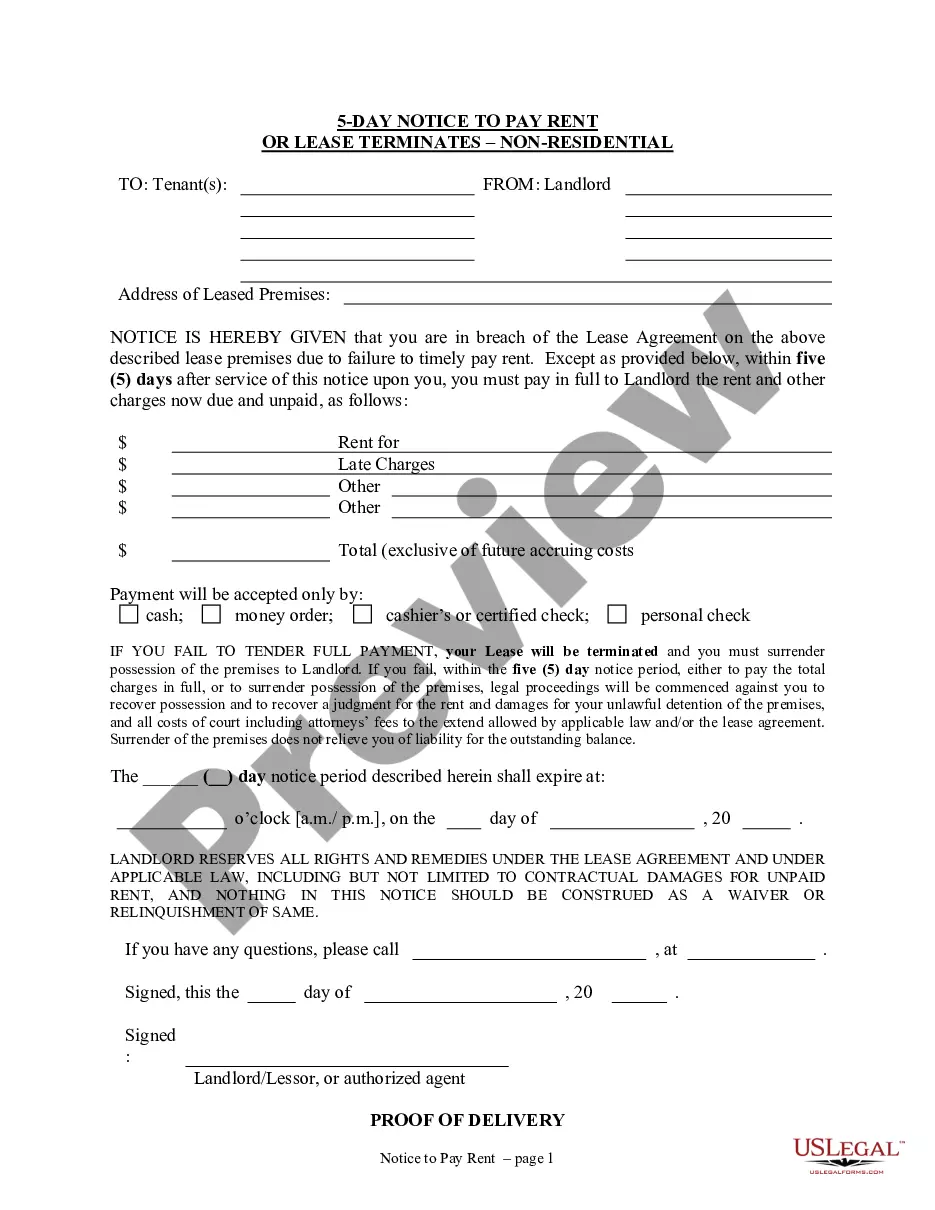

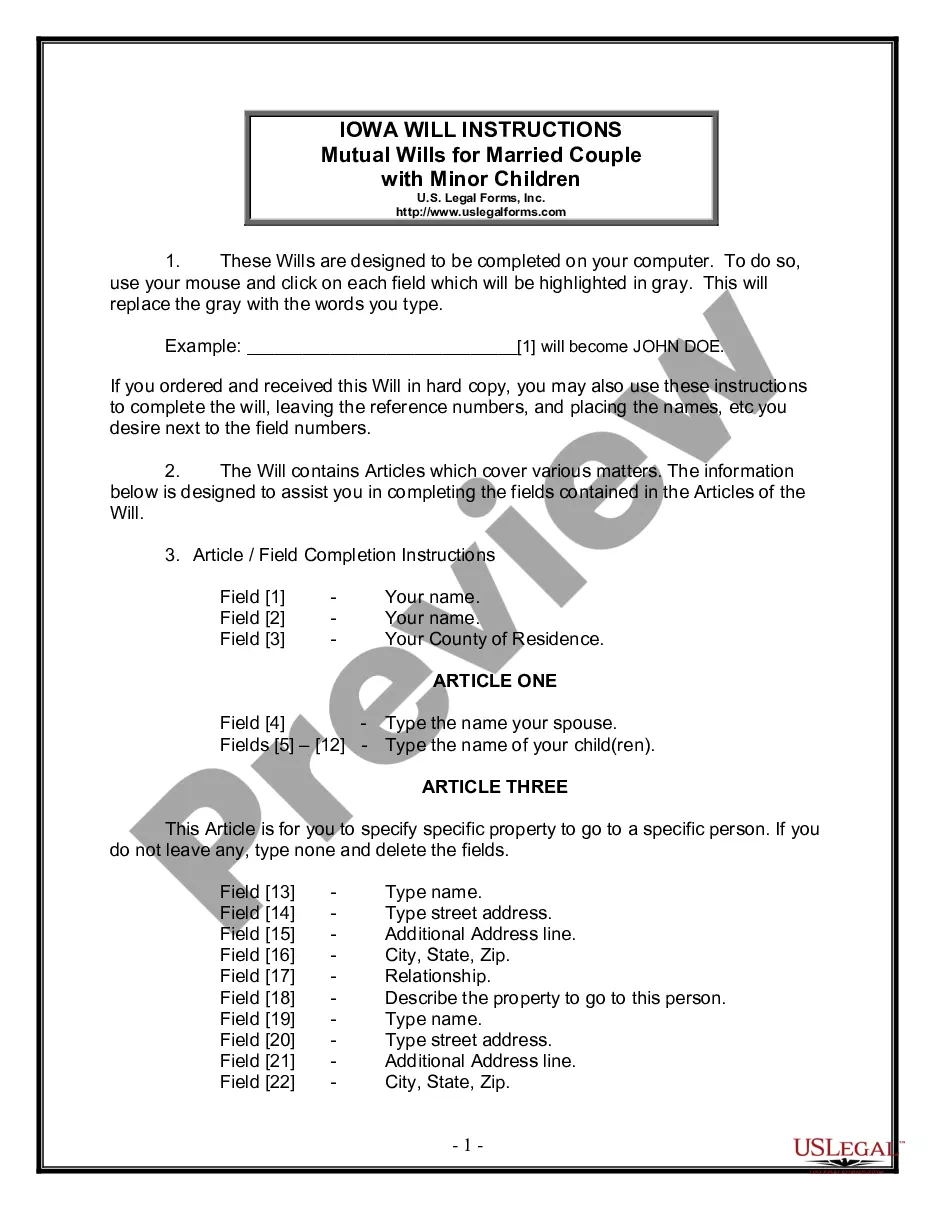

- Ensure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Oklahoma Request to Transfer - Lump Sum and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Social Security's Lump Sum Death Payment (LSDP) is federally funded and managed by the U.S. Social Security Administration (SSA). A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements.

A lump sum payment is a one-time payment for the total amount of an insurance policy benefit, legal settlements, inheritances, lottery winnings, or retirement plans. Lump sum payments offer the option to receive benefits in a single payout rather than in periodic payments.

Under the lump-sum election method, you refigure the taxable part of all your benefits for the earlier year (including the lump-sum payment) using that year's income. Then you subtract any taxable benefits for that year that you previously reported. The remainder is the taxable part of the lump-sum payment.

The lump sum could be sizable. In 2023, the average Social Security monthly benefit is $1,827. Someone who chose to receive the maximum of six months of retroactive benefits could theoretically expect a check for $10,962. However, claiming retroactive benefits in a lump sum comes with a cost.

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account (IRA) or other eligible retirement accounts.

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

In 2023, the average senior on Social Security collects $1,827 a month. But you may be eligible for a lot more money than that. In fact, some seniors this year are looking at a monthly benefit of $4,555, which is the maximum Social Security will pay. Here's how to score a benefit that high.

Lump sum reimbursements refer to a payment made to relocating employees to cover expenses accrued during relocation. Lump sum reimbursements are an aggregate fixed amount that the employer reports as wages. No accounting back to the employer is required, and employees may keep any unspent reimbursement money.