Oklahoma Letter of Credit- Sample Form

Description

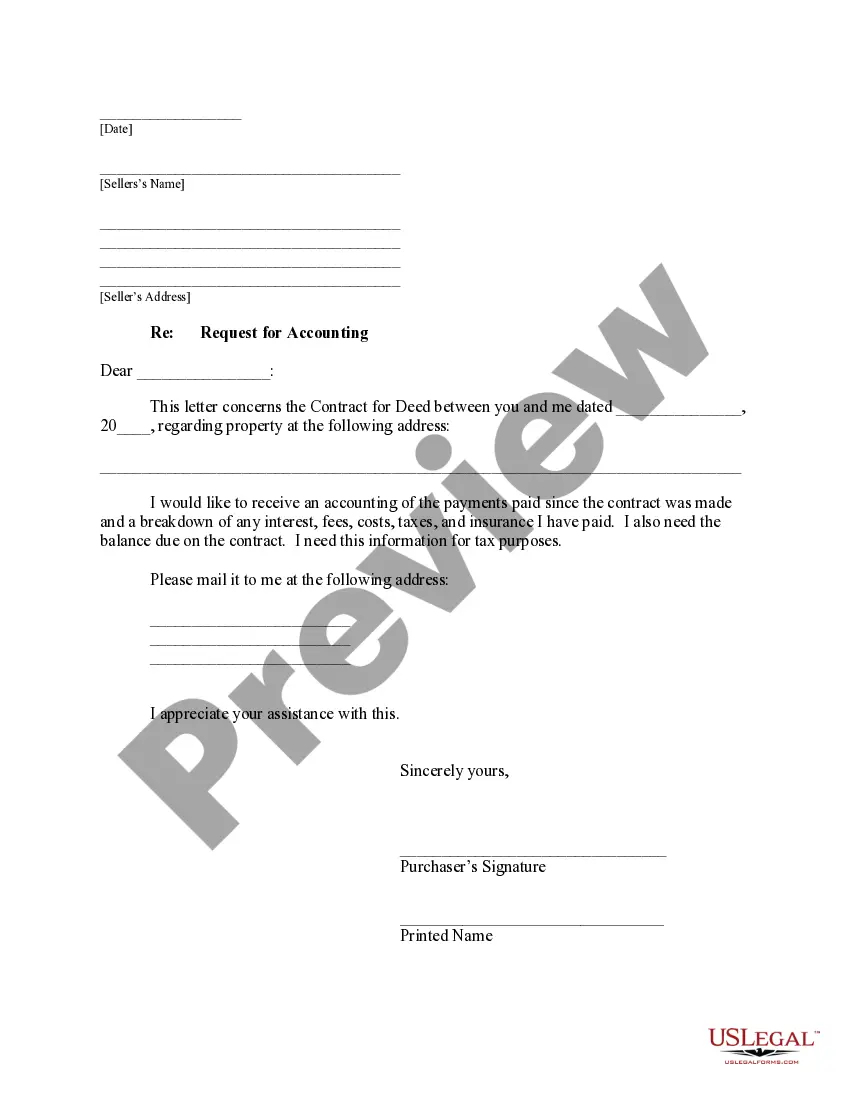

How to fill out Oklahoma Letter Of Credit- Sample Form?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to fill out Oklahoma Letter of Credit- Sample Form, our service is the best place to download it.

Getting your Oklahoma Letter of Credit- Sample Form from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it satisfies your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Oklahoma Letter of Credit- Sample Form and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

Main types of LC Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller).Revocable LC.Stand-by LC.Confirmed LC.Unconfirmed LC.Transferable LC.Back-to-Back LC.Payment at Sight LC.

NOTATIONS: This is notation Letter of Credit. Each draft must be accompanied by Letter of Credit for endorsement by (Bank Name) , for the amount and date of each draft and the balance remaining. This Letter of Credit must be surrendered to (Bank Name) when exhausted.

The process of getting an LC consists of four primary steps, which are enlisted here: Step 1 - Issuance of LC.Step 2 - Shipping of goods.Step 3 - Providing Documents to the confirming bank.Step 4 - Settlement of payment from importer and possession of goods.

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

What's a letter of credit? A letter of credit, also known as a credit letter, is a document from a bank or other financial institution guaranteeing that a specific payment will be made in a business transaction. Importantly, the process involves an impartial third party in the transaction.

A letter of credit involves five or more parties, such as the buyer, seller, providing bank, consulting bank, negotiating bank, and validating bank. A bank guarantee involves only three parties: buyers, sellers, and lenders.