This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Certificate of Merger or Consolidation - Foreign Corporation into Oklahoma Corporation

Description

How to fill out Certificate Of Merger Or Consolidation - Foreign Corporation Into Oklahoma Corporation?

When it comes to completing Certificate of Merger or Consolidation - Foreign Corporation into Oklahoma Corporation, you probably imagine an extensive procedure that requires finding a ideal sample among hundreds of similar ones and after that being forced to pay out an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific form within just clicks.

In case you have a subscription, just log in and click on Download button to find the Certificate of Merger or Consolidation - Foreign Corporation into Oklahoma Corporation form.

If you don’t have an account yet but want one, keep to the point-by-point guide listed below:

- Make sure the file you’re getting applies in your state (or the state it’s needed in).

- Do so by looking at the form’s description and by visiting the Preview function (if available) to see the form’s information.

- Click on Buy Now button.

- Select the proper plan for your budget.

- Sign up to an account and select how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled lawyers draw up our samples so that after saving, you don't need to bother about editing and enhancing content material outside of your personal info or your business’s info. Be a part of US Legal Forms and receive your Certificate of Merger or Consolidation - Foreign Corporation into Oklahoma Corporation document now.

Form popularity

FAQ

Step 1: Name Your LLC. Choosing a company name is the first and most important step in starting your LLC in Oklahoma. Step 2: Choose Your Oklahoma Registered Agent. Step 3: File the Oklahoma LLC Articles of Organization. Step 4: Create an LLC Operating Agreement. Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

Form 2553 S Corporation Election. Form 1120S S Corporation Tax Return. Schedule B Other Return Information. Schedule K Summary of Shareholder Information. Schedule K-1 Individual Shareholder Information.

If you want your LLC to be taxed as an S corporation, you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corporation. You may use online tax filing, or can file by fax or mail.

Individuals may operate a business as a sole proprietor or they may take steps to form an incorporated business entity, such as an S corporation.While single-member S corporations are legal, a sole proprietor cannot file as an S corporation unless he takes the proper steps to create the corporate entity.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

Under Domestic Organizations, select Domestic Profit Corporation. Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

To form a corporation in Oklahoma, you must file a certificate of incorporation with the Secretary of State and pay a filing fee. The corporation's existence begins when you file the certificate. The minimum information that must be included in the certificate of incorporation is as follows: Name of the corporation.

How do you change your registered agent in Oklahoma? File the Notice of Change of Registered Office/ Registered Agent form with the Oklahoma Secretary of State by mail, in person or online. The filing fee is $35 for all LLCs and domestic corporations. Pay $50 to change the agent of a foreign corporation.

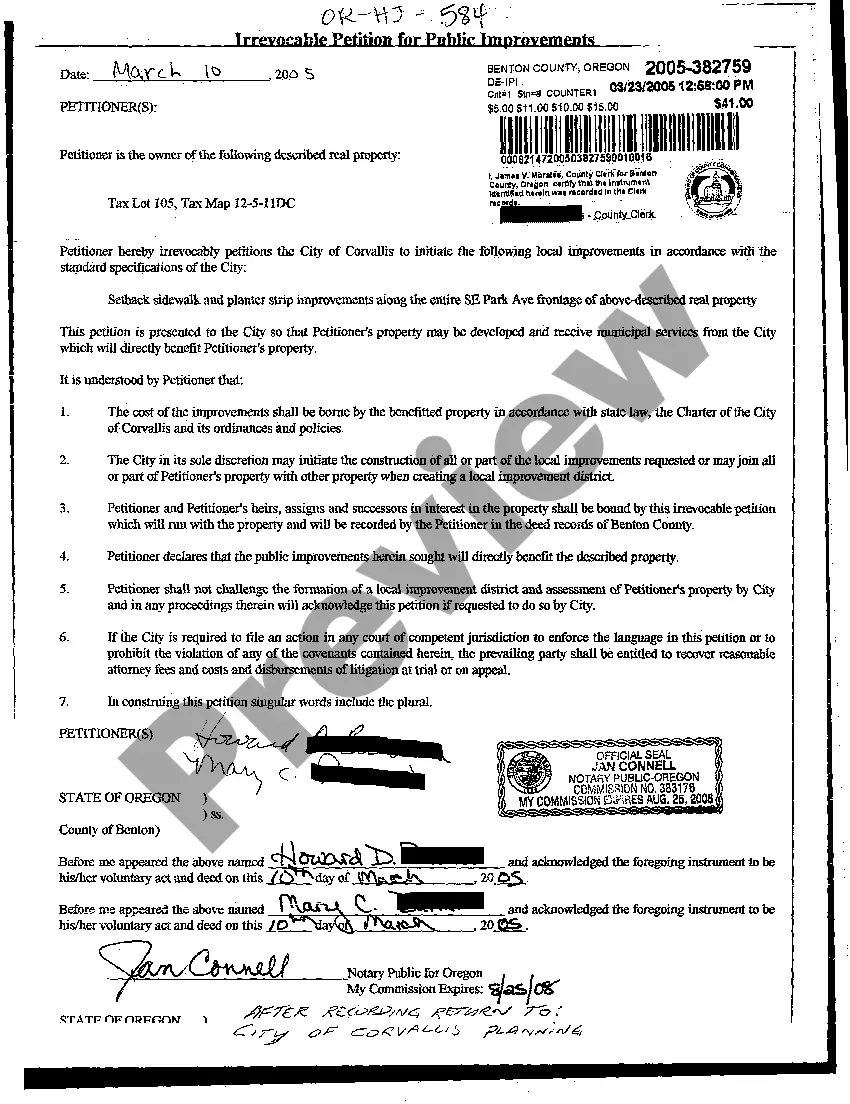

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.