This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Application for Withdrawal of a Foreign Limited Liability Company

Description

How to fill out Oklahoma Application For Withdrawal Of A Foreign Limited Liability Company?

In terms of filling out Oklahoma Application for Withdrawal of a Foreign Limited Liability Company, you almost certainly imagine an extensive procedure that involves choosing a perfect sample among countless similar ones and then being forced to pay an attorney to fill it out to suit your needs. In general, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document in just clicks.

For those who have a subscription, just log in and click Download to find the Oklahoma Application for Withdrawal of a Foreign Limited Liability Company form.

If you don’t have an account yet but need one, follow the step-by-step guideline listed below:

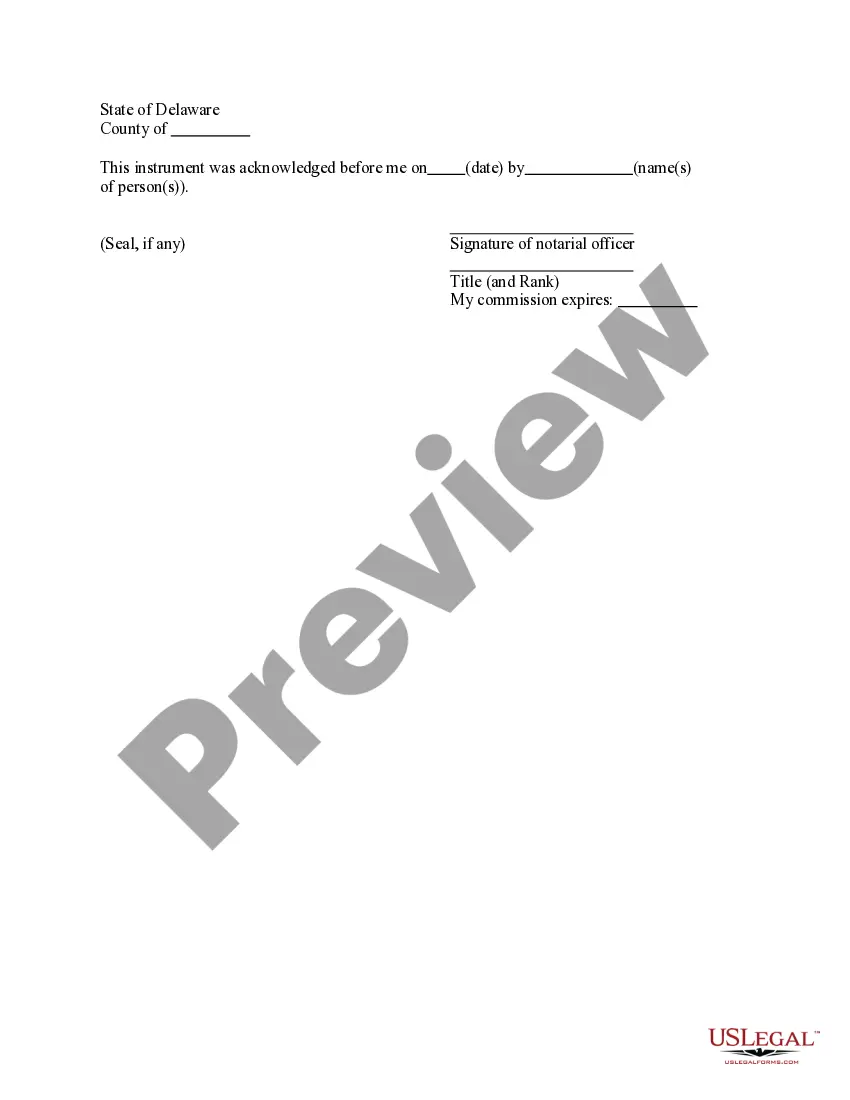

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and through clicking the Preview function (if available) to see the form’s information.

- Simply click Buy Now.

- Pick the proper plan for your financial budget.

- Sign up for an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys draw up our templates to ensure after saving, you don't have to worry about editing and enhancing content material outside of your personal information or your business’s information. Sign up for US Legal Forms and get your Oklahoma Application for Withdrawal of a Foreign Limited Liability Company document now.

Form popularity

FAQ

Oklahoma requires LLCs to file an annual certificate, which is due on the anniversary date of the LLC's incorporation. The filing fee is $25. Taxes. For complete details on state taxes for Oklahoma LLCs, visit Business Owner's Toolkit or the State of Oklahoma .

Oklahoma Statutes, § 18-2012.2, state that every Oklahoma LLC may adopt an operating agreement, but it isn't required by the Secretary of State. Despite it not being required, there are several reasons it is recommended to have one.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

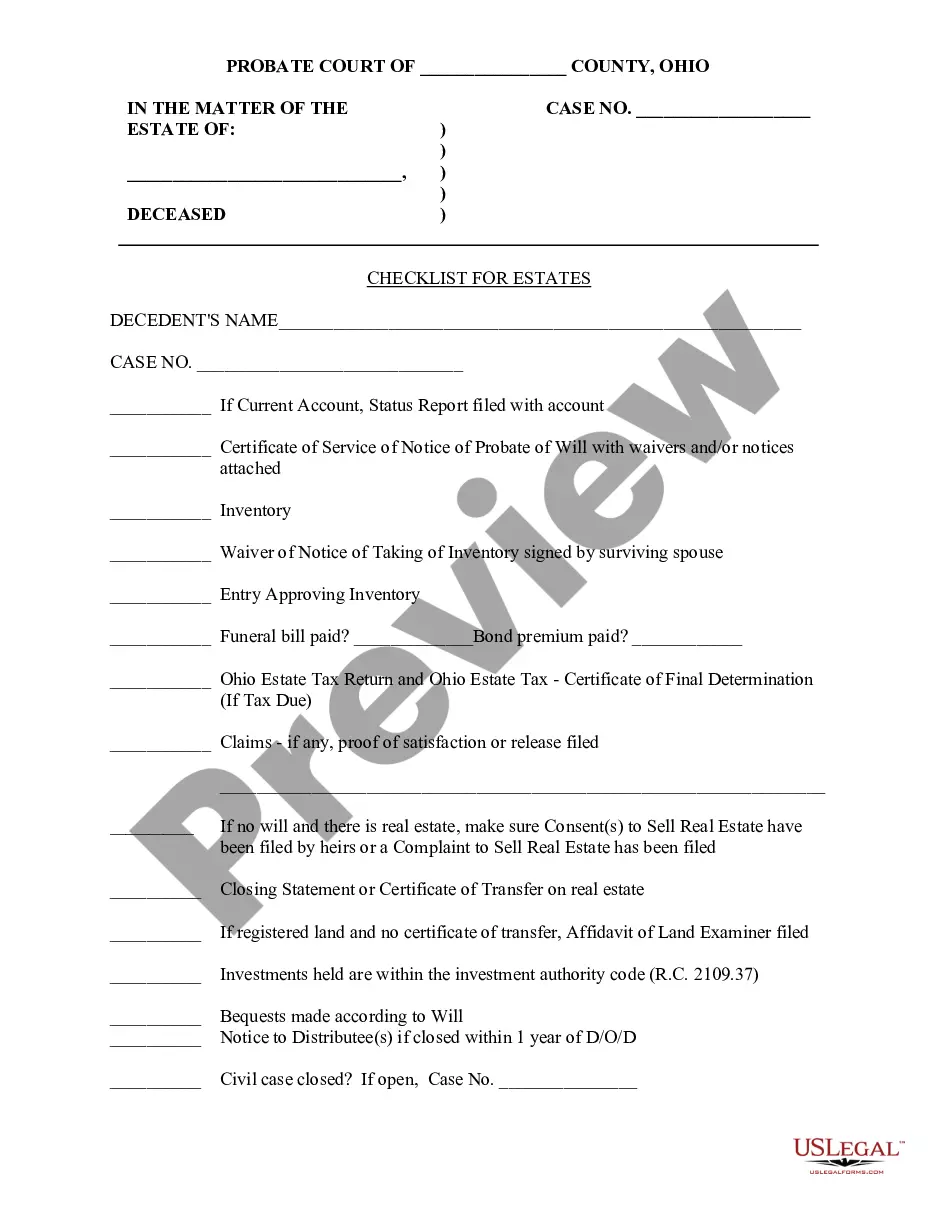

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Certificate of Dissolution with the Oklahoma Secretary of State. Fulfill all tax obligations with the state of Oklahoma, as well as with the IRS.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

The fees to the State of Oklahoma to start an LLC are $100 plus the credit card processing fee if you don't pay by another means. There's no way to spend less than the fees charged by the Secretary of State.

Written Resolution. Pay creditors. Distribute to Members. Complete Articles of Dissolution. File with Secretary of State. File with Oklahoma Tax Commission. File with IRS. Unemployment Authority.