The Oklahoma Direct Deposit Form for IRS is a document provided by the state of Oklahoma for individuals and businesses to electronically submit their tax refunds and payments directly to their bank accounts. Direct deposit is a convenient and secure method of receiving funds, eliminating the need for paper checks and reducing the risk of lost or stolen payments. This form is required for taxpayers who wish to have their state tax refunds or payments directly deposited into their bank accounts. By providing the necessary information, taxpayers can ensure a faster and more efficient process, as well as the peace of mind that their funds will be directly credited to their chosen financial institution. The Oklahoma Direct Deposit Form for IRS requires certain key details to be filled out accurately and completely. These include the taxpayer's name, Social Security number, mailing address, bank account number, bank routing number, and type of account (checking or savings). Additionally, the form may also ask for the taxpayer's phone number and email address for communication purposes. There are no specific variations or types of Oklahoma Direct Deposit Forms for IRS pertaining to different situations or entities. Regardless of whether you are an individual taxpayer or a business entity, the same form is used to set up direct deposit for state tax refunds or payments. Using the Oklahoma Direct Deposit Form for IRS is highly recommended as it ensures a swift and seamless deposit process, eliminating the need for taxpayers to wait for a physical check to arrive via mail. By opting for direct deposit, individuals and businesses can receive their funds faster, allowing for easier budgeting and financial planning. In summary, the Oklahoma Direct Deposit Form for IRS is a necessary document to request direct deposit of state tax refunds or payments into a bank account. It streamlines the refund process, reduces the chance of payment mishaps, and provides individuals and businesses with a hassle-free and time-saving alternative to receiving funds via traditional paper checks.

Oklahoma Direct Deposit Form for IRS

Description

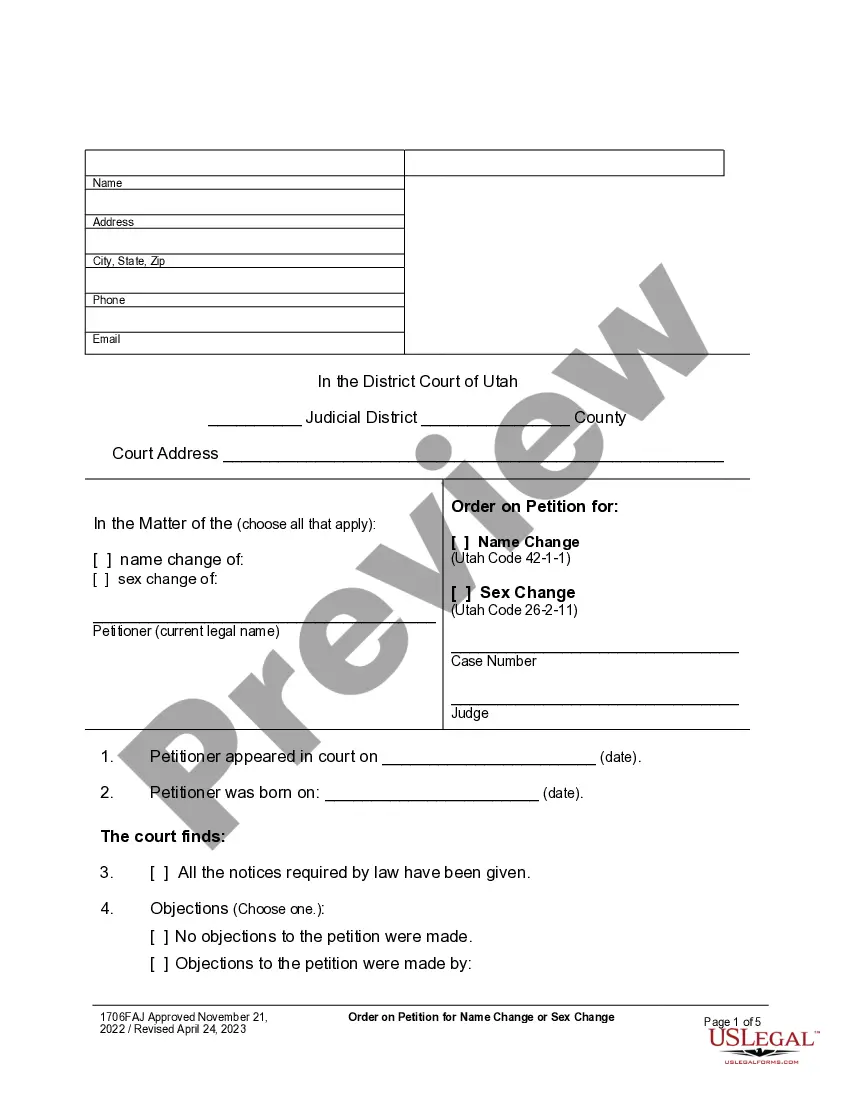

How to fill out Oklahoma Direct Deposit Form For IRS?

Choosing the right legitimate record web template might be a struggle. Needless to say, there are a lot of templates available on the Internet, but how can you get the legitimate kind you need? Use the US Legal Forms site. The assistance provides a large number of templates, including the Oklahoma Direct Deposit Form for IRS, which can be used for organization and private requires. Every one of the forms are inspected by pros and satisfy federal and state requirements.

When you are currently authorized, log in to the profile and click the Download option to find the Oklahoma Direct Deposit Form for IRS. Make use of your profile to check throughout the legitimate forms you possess purchased previously. Visit the My Forms tab of your own profile and get yet another backup from the record you need.

When you are a whole new user of US Legal Forms, listed here are easy directions for you to adhere to:

- First, ensure you have selected the right kind for your personal town/state. You are able to look over the shape utilizing the Preview option and read the shape explanation to ensure this is basically the right one for you.

- In the event the kind is not going to satisfy your expectations, take advantage of the Seach field to obtain the appropriate kind.

- Once you are certain the shape would work, select the Purchase now option to find the kind.

- Opt for the prices prepare you would like and enter in the required information. Build your profile and pay for the transaction with your PayPal profile or credit card.

- Select the data file format and obtain the legitimate record web template to the device.

- Complete, modify and printing and signal the acquired Oklahoma Direct Deposit Form for IRS.

US Legal Forms is definitely the greatest collection of legitimate forms in which you will find numerous record templates. Use the service to obtain skillfully-created paperwork that adhere to express requirements.

Form popularity

FAQ

Or, use IRS' Form 8888, Allocation of RefundPDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. If you want the IRS to deposit your refund into just one account, use the direct deposit line on your tax form.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

Oklahoma taxes and fees may be paid by bank draft, check, cashier's check, money order, cash, or by a nationally recognized credit or debit card. For payment by credit or debit card, the Tax Commission may add a 2.5% convenience fee.

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

IRS has an on-line tool, "Where's My Tax Refund", at .irs.gov that will provide the status of a tax refund using the taxpayer's SSN, filing status, and refund amount.

A resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the Oklahoma return (Form 511). If another state taxes this income, the resident may qualify for this credit.

If there are any delays in the processing of your return by the IRS, your entire refund will be deposited in the first account listed on Form 8888. Make sure the first account you list on Form 8888 is an account you would want the entire refund deposited in if this happens.

Your direct deposit information will be at the bottom of your Form 1040. To view your 1040 after filing, Sign into TurboTax > Taxes > Tax Timeline > Some other things you can do > Download/print (. pdf).