Oklahoma Assumption Agreement of Loan Payments

Description

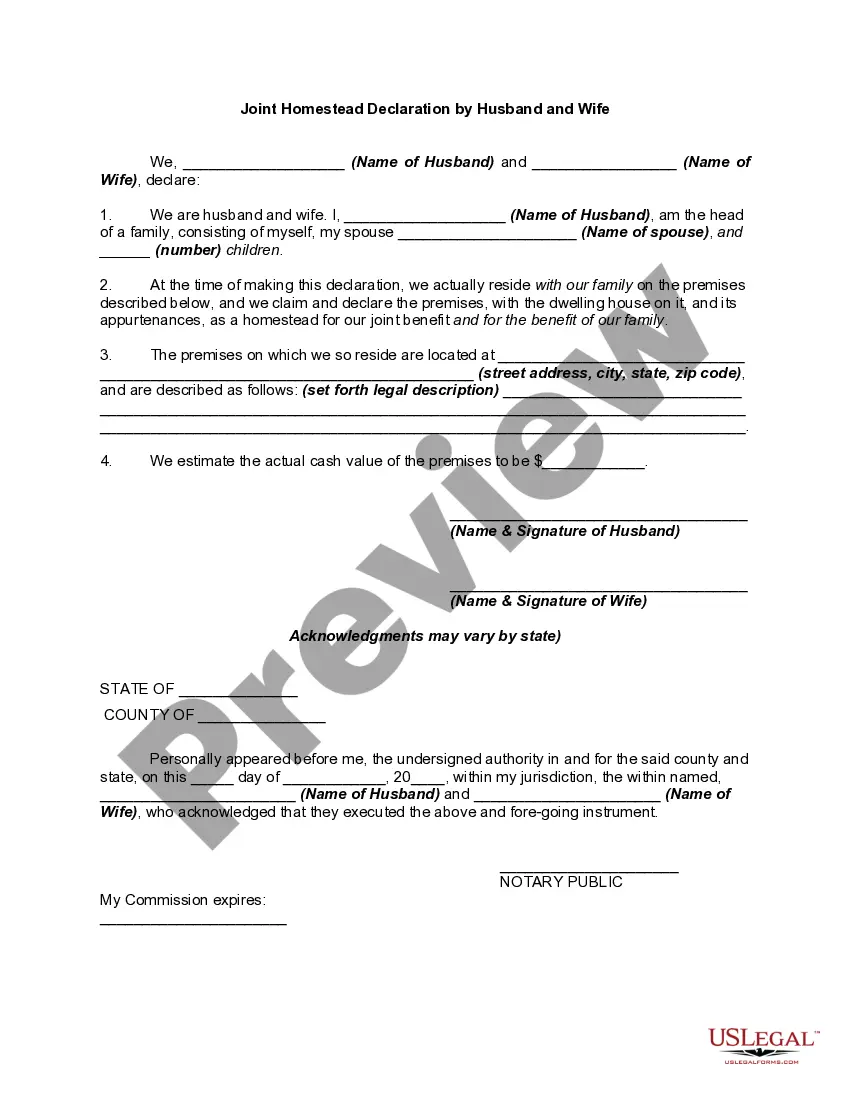

How to fill out Assumption Agreement Of Loan Payments?

If you have to complete, obtain, or print out authorized document layouts, use US Legal Forms, the biggest collection of authorized varieties, which can be found on-line. Make use of the site`s simple and handy search to get the documents you require. A variety of layouts for company and specific uses are sorted by classes and suggests, or keywords. Use US Legal Forms to get the Oklahoma Assumption Agreement of Loan Payments within a number of clicks.

In case you are presently a US Legal Forms customer, log in for your accounts and click on the Down load switch to have the Oklahoma Assumption Agreement of Loan Payments. You can also accessibility varieties you formerly delivered electronically from the My Forms tab of your accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the appropriate area/land.

- Step 2. Make use of the Review method to look over the form`s content. Never neglect to read the outline.

- Step 3. In case you are unhappy together with the develop, utilize the Lookup industry on top of the screen to get other versions from the authorized develop web template.

- Step 4. Once you have discovered the shape you require, click the Acquire now switch. Select the prices prepare you favor and put your references to sign up for the accounts.

- Step 5. Procedure the deal. You can use your charge card or PayPal accounts to perform the deal.

- Step 6. Select the format from the authorized develop and obtain it on your own device.

- Step 7. Complete, revise and print out or sign the Oklahoma Assumption Agreement of Loan Payments.

Every authorized document web template you buy is your own property forever. You possess acces to every single develop you delivered electronically within your acccount. Click on the My Forms portion and decide on a develop to print out or obtain once more.

Contend and obtain, and print out the Oklahoma Assumption Agreement of Loan Payments with US Legal Forms. There are many specialist and state-particular varieties you may use for your company or specific requirements.

Form popularity

FAQ

USDA, FHA, and VA loans are assumable when certain criteria are met. The buyer need not be a military member to assume a VA loan. Buyers must still qualify for the mortgage to assume it.

If the mortgage loan is assumable, a seller can sell their home to a qualified buyer, allowing the buyer to purchase the home by way of assuming responsibility for the seller's loan terms and remaining balance.

Most conventional mortgages are not assumable, but many government-backed loans (FHA, VA, USDA) are. The lender must approve you assuming the mortgage, and at the closing, you must compensate the old borrower for the amount they've paid off.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Assuming a mortgage may not be as common, but they are still a viable option for Canadian buyers and sellers. If you've done your research, asked all the important questions, and the benefits outweigh the risks, it could be the perfect fit for you!

The purchaser wishing to assume the TD Canada Trust mortgage must qualify for the mortgage under normal mortgage application criteria. To discuss your mortgage situation and the best option to meet your needs, please visit your local branch for assistance.

Assuming a mortgage By having your mortgage assumed, you (the seller) are simply transferring your current mortgage to your buyer. Assuming a mortgage makes sense if you are selling your home without buying another.