Oklahoma Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Are you in a circumstance where you require files for potential business or personal reasons nearly every working day.

There are numerous legal document templates available online, but finding versions you can trust isn't straightforward.

US Legal Forms provides thousands of template options, including the Oklahoma Buy Sell Agreement Between Shareholders and a Corporation, which can be tailored to meet federal and state requirements.

Once you find the suitable template, click Get now.

Choose the pricing plan you want, complete the required details to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oklahoma Buy Sell Agreement Between Shareholders and a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and confirm it is for your correct city/area.

- Use the Review button to examine the form.

- Check the details to ensure you have selected the appropriate template.

- If the template isn't what you are looking for, use the Look for box to find the template that meets your needs.

Form popularity

FAQ

A shareholder agreement is closely related to an Oklahoma Buy Sell Agreement Between Shareholders and a Corporation, but they are not exactly the same. The shareholder agreement encompasses a broader range of topics, such as management rights and duties, while the buy-sell agreement specifically addresses the sale of shares. Both documents work together to create a comprehensive governance framework.

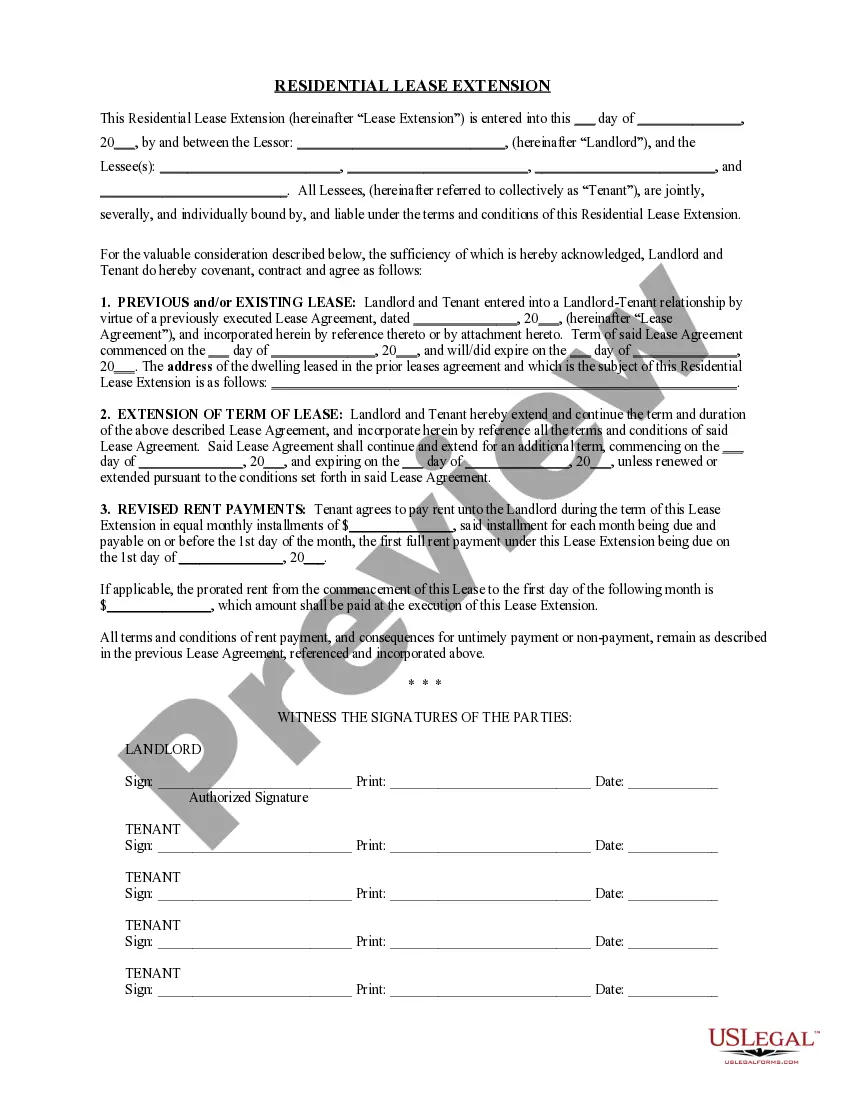

To fill out an Oklahoma Buy Sell Agreement Between Shareholders and a Corporation, start by identifying all parties involved, including shareholders and the corporation. Clearly outline the terms, including valuation methods for shares, triggering events for the buy-sell agreement, and the process for transactions. Ultimately, seeking guidance from a legal expert can ensure accuracy and compliance.

Another common term for an Oklahoma Buy Sell Agreement Between Shareholders and a Corporation is 'shareholder agreement'. This term emphasizes the collaborative nature of the document, outlining the relationships and obligations between shareholders and the corporation itself, ensuring clarity and order in business operations.

While an Oklahoma Buy Sell Agreement Between Shareholders and a Corporation serves to protect shareholder interests, it does have some disadvantages. One significant concern is that it can be costly to implement and may require legal assistance. Additionally, it may restrict a shareholder's ability to sell their shares freely, limiting their options in a changing market.

While an Oklahoma Buy Sell Agreement Between Shareholders and a Corporation is not strictly mandatory, it is highly recommended for any business with multiple shareholders. This agreement helps prevent misunderstandings and protects the interests of all parties involved. Without it, shareholders may face difficulties in managing their relationships and executing share transfers effectively.

When shareholders do not agree, it can create significant challenges for the corporation's operations and decision-making. The Oklahoma Buy Sell Agreement Between Shareholders and a Corporation typically outlines procedures for resolving disputes or addressing disagreements. These processes might include mediation, buyout provisions, or even dissolution, so it's essential to clarify these terms upfront to avoid future conflicts.

Not all shareholders need to agree on every aspect of the Oklahoma Buy Sell Agreement Between Shareholders and a Corporation for it to be effective. Often, a majority may be sufficient, depending on the terms defined in the agreement itself. However, building consensus reasonably reduces conflicts later and fosters a cooperative environment among shareholders.

An Oklahoma Buy Sell Agreement Between Shareholders and a Corporation becomes legally binding when it meets specific legal requirements, such as mutual consent, consideration, and lawful purpose. Additionally, when these agreements are drafted clearly and signed by all relevant parties, they gain enforceability in a court of law. Consulting legal professionals can ensure compliance with state laws and safeguard the interests of all stakeholders.

While it is highly beneficial for all shareholders to agree to the Oklahoma Buy Sell Agreement Between Shareholders and a Corporation, not all shareholders are legally required to consent. Typically, majority consent is sufficient to form a binding agreement. However, requiring unanimous agreement may strengthen the commitment among shareholders and provide greater stability for the corporation.

An Oklahoma Buy Sell Agreement Between Shareholders and a Corporation establishes clear guidelines for the relationship among shareholders and between shareholders and the corporation. This agreement typically outlines responsibilities, rights, and procedures for buying and selling shares. It ensures that all parties understand their obligations, which helps protect their investments and facilitates smooth transitions in ownership.