Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

Are you presently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous reliable document templates available online, but finding versions you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, designed to comply with federal and state regulations.

Once you identify the correct form, click Get now.

Select the payment plan you prefer, enter the required information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/area.

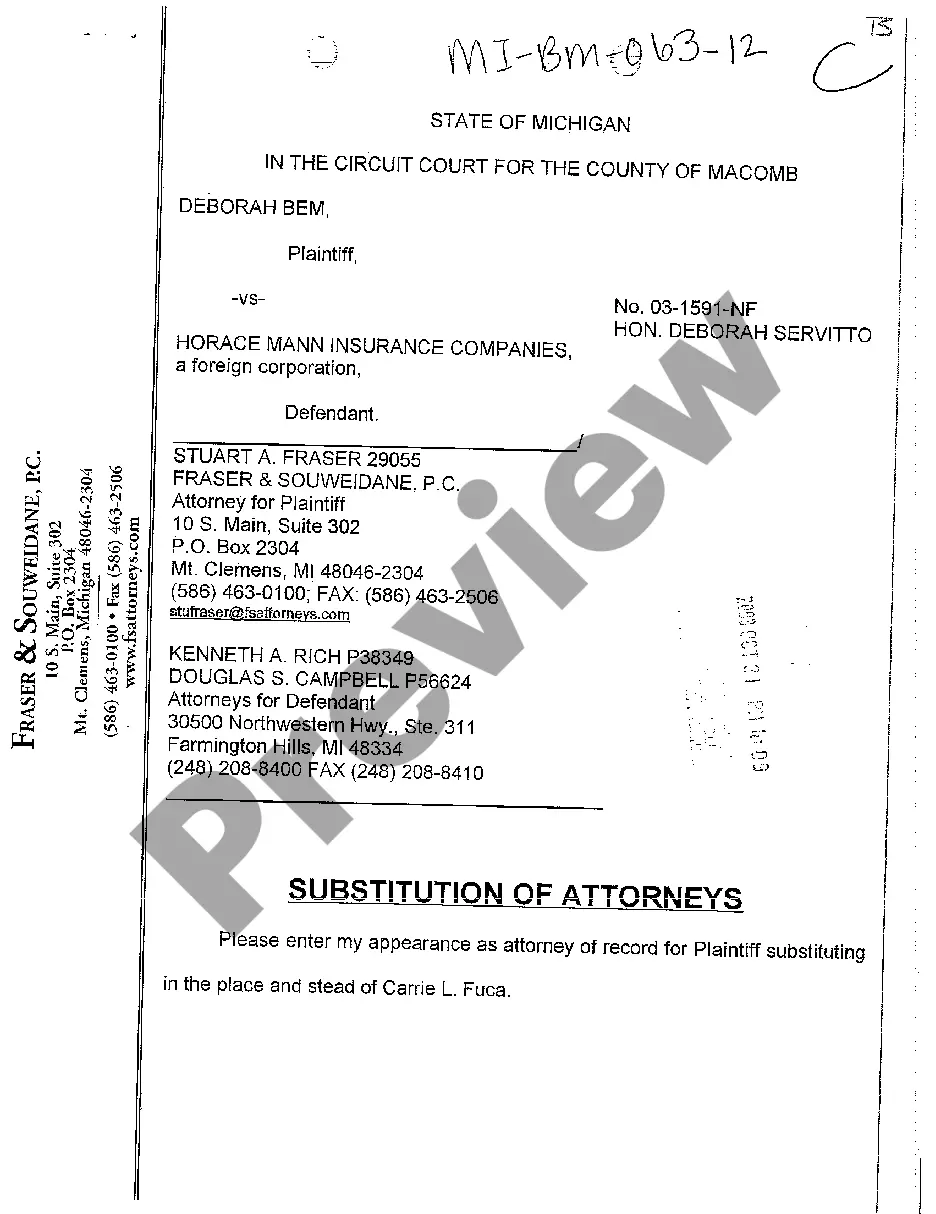

- Use the Preview option to examine the form.

- Inspect the details to confirm that you have selected the correct form.

- If the form does not match your requirements, use the Search section to find the form that suits your needs.

Form popularity

FAQ

Preparing an annual report is mandatory for many corporations and some LLCs. Failure to submit this report can result in penalties or loss of good standing. If you are focusing on how to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, knowing your reporting requirements is a critical part of managing your business effectively.

To find out the status of your LLC in Oklahoma, visit the Oklahoma Secretary of State’s website. There, you can perform a business entity search using your LLC's name or filing number. This is an important step, especially if you are interested in how to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, as you need to ensure your LLC is in good standing.

Yes, Oklahoma requires most corporations to file an annual report. This report is due by the anniversary date of the corporation's formation. Ensuring timely submission of your annual report is vital to maintain your good standing, especially when you're working on how to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms.

Corporations and certain limited liability companies (LLCs) typically must prepare an annual report. This requirement helps maintain transparency and allows the state to keep updated information about businesses. If you're exploring how to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, understanding your annual report obligations is essential for maintaining your corporate status.

A few states, including Delaware, Nevada, and Wyoming, do not require annual reports for corporations. This can provide a more streamlined process for business owners seeking to limit regulatory obligations. However, if you wish to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, be sure to comply with Oklahoma's specific reporting requirements for S Corporations.

To form an S Corp in Oklahoma, start by selecting an available name for your corporation and then file the Articles of Incorporation with the Secretary of State. Afterward, you need to obtain an Employer Identification Number (EIN) from the IRS. Finally, complete Form 2553 to elect S Corporation status. By following these steps, you can efficiently Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms.

Not all companies are required to file an annual report. However, most corporations in the U.S. must submit one to maintain their good standing. If you are considering how to Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms, understanding annual report requirements is crucial. Additionally, check your specific state's regulations to ensure compliance.

Filling out a W-9 form for an S Corporation is straightforward. You'll need to include your S Corp name as it appears on your tax return, your Employer Identification Number (EIN), and check the box for 'S Corporation' under the tax classification section. For additional support with the intricacies of completing tax forms like the W-9, turn to uslegalforms, which can assist with your Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms.

To elect S Corporation status, the primary form you need is IRS Form 2553, which allows you to submit your election request to the IRS. It is crucial to file this form within the correct timeframe to ensure timely approval of your S Corp election. By utilizing uslegalforms, you can access step-by-step guidance and forms necessary for your Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms.

To successfully file for an S Corporation, you will need essential forms like IRS Form 2553, along with your Articles of Incorporation, and potentially additional state-specific forms depending on your location. Keep in mind that you must also prepare annual tax returns using Form 1120S after receiving your S Corp status. If you seek assistance in gathering these forms, uslegalforms offers tailored solutions aimed at facilitating your Oklahoma Obtain S Corporation Status - Corporate Resolutions Forms.