Oklahoma Transfer of Property under the Uniform Transfers to Minors Act

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

If you need to aggregate, acquire, or print sanctioned document templates, utilize US Legal Forms, the primary collection of legal forms, which can be accessed online.

Take advantage of the site's user-friendly and convenient search to obtain the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Oklahoma Transfer of Property under the Uniform Transfers to Minors Act in just a few clicks.

Every legal document template you obtain is yours forever. You have access to each form you acquired in your account. Browse the My documents section and select a form to print or download again.

Complete and obtain, and print the Oklahoma Transfer of Property under the Uniform Transfers to Minors Act with US Legal Forms. There are various professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms member, Log In to your account and then click the Download button to find the Oklahoma Transfer of Property under the Uniform Transfers to Minors Act.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

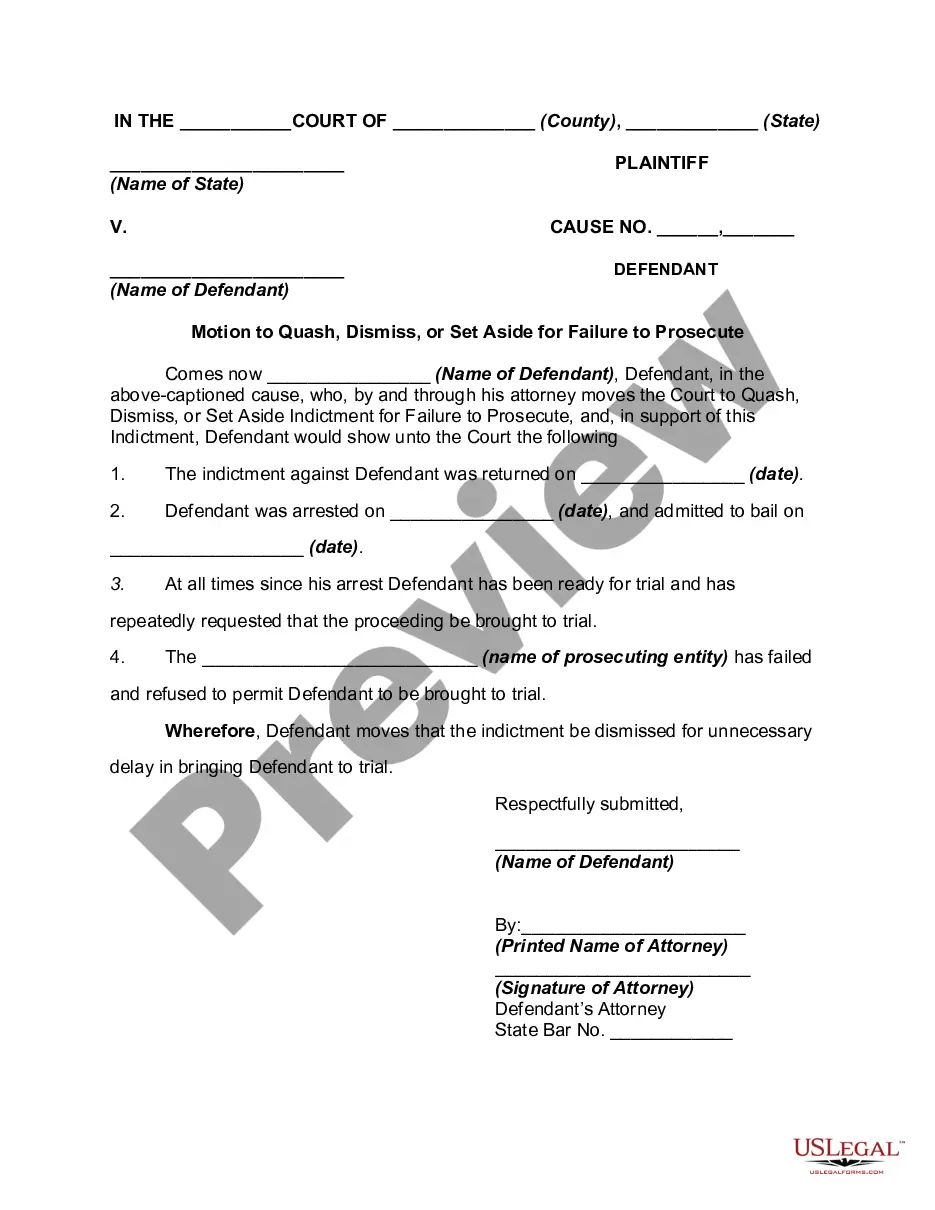

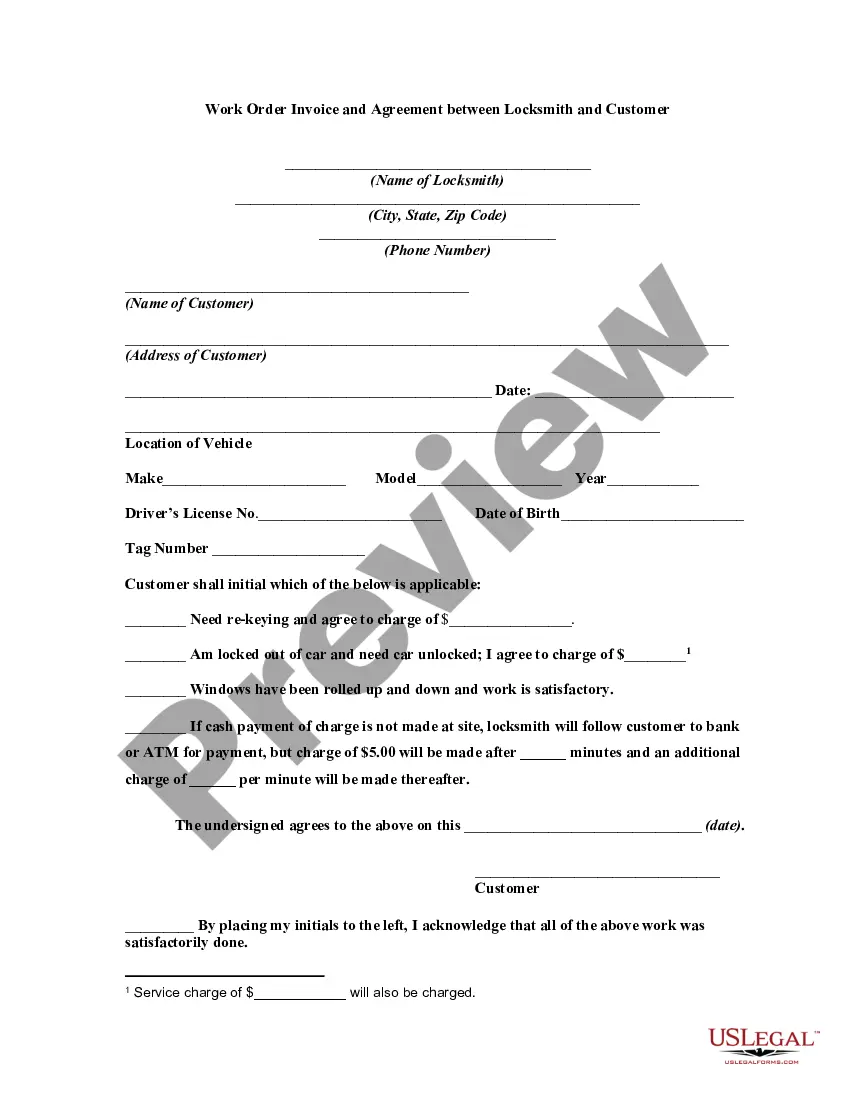

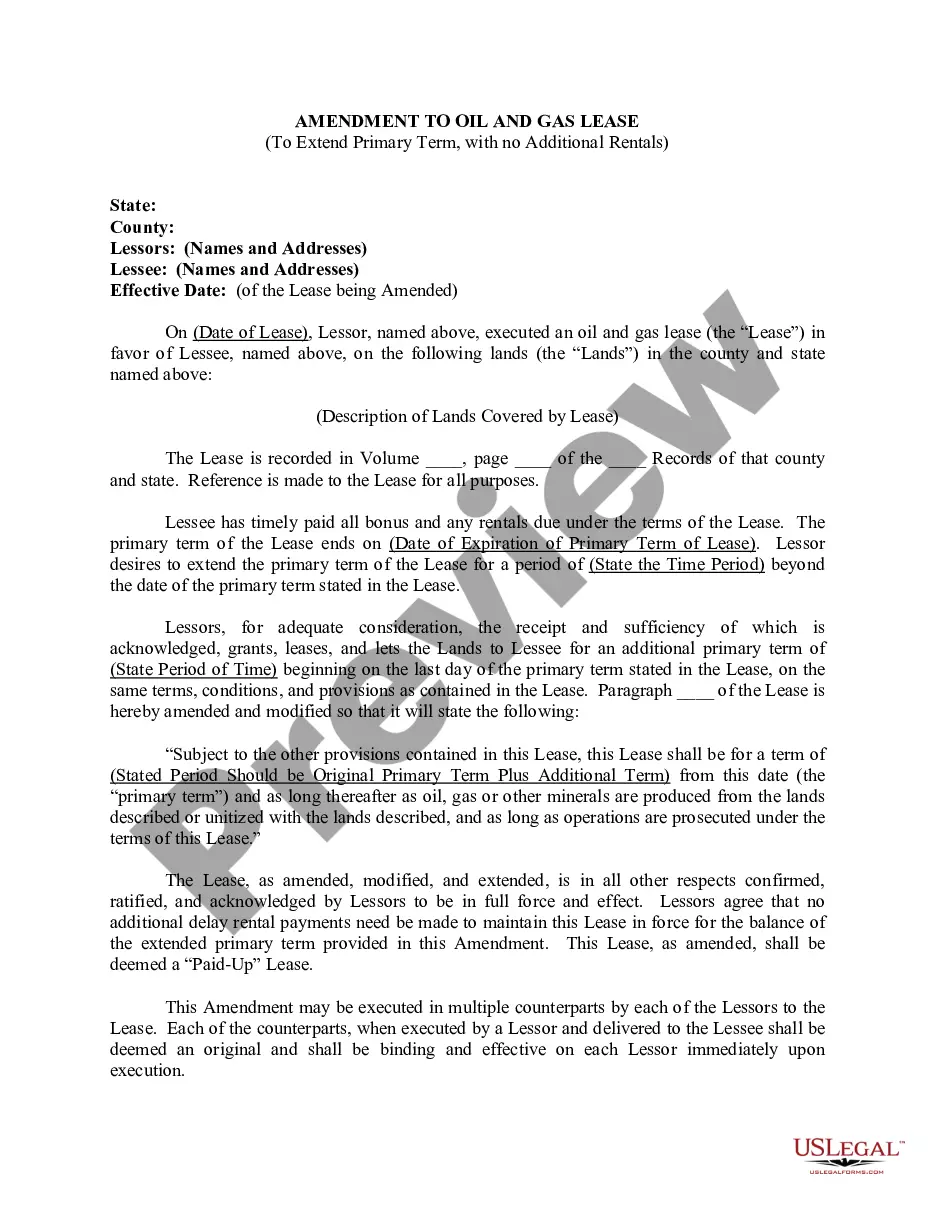

- Step 2. Use the Preview option to review the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form design.

- Step 4. Once you have identified the form you want, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oklahoma Transfer of Property under the Uniform Transfers to Minors Act.

Form popularity

FAQ

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

The UTMA allows the donor to name a custodian, who has the fiduciary duty to manage and invest the property on behalf of the minor until that minor becomes of legal age. The property belongs to the minor from the time the property is gifted.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

If you want to transfer cash, stocks, or bonds, a UGMA would fit the purpose. If you want to transfer real estate, or if you want more flexibility in how the assets are used, then a UTMA may be the better option.

Cons. Greater impact on financial aid. Because they're held in the name of the child, UTMA/UGMA accounts hurt financial aid eligibility more than comparable 529 plans. Money becomes the child's at majority.

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by all U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed ...

The Uniform Transfers to Minors Act was established in 1986, and it has been adopted in most states, including Oklahoma. These accounts mirror the UGMA accounts in every way except for the fact that any type of property can be transferred into a UTMA account. Another difference is the age of majority and termination.

Age of Majority and Trust Termination StateUGMAUTMANorth Carolina1821North Dakota1821Ohio1821Oklahoma211849 more rows