Title: Understanding the Oklahoma Option to Purchase Stock — Long Form: An In-Depth Insight Keywords: Oklahoma Option to Purchase Stock — Long Form, stock purchase agreement, shareholder agreement, buying company stock, terms and conditions, exercise of stock option Introduction: The Oklahoma Option to Purchase Stock — Long Form refers to a legally binding agreement between a purchaser and a seller for the acquisition of stock in a company. This document outlines the terms and conditions governing the purchase of company shares, ensuring transparency and clear expectations for both parties involved. Various types of Oklahoma Option to Purchase Stock — Long Form agreements exist, tailored to specific circumstances and situations. Types of Oklahoma Option to Purchase Stock — Long Form: 1. General Stock Purchase Agreement: The general Oklahoma Option to Purchase Stock — Long Form agreement outlines the basic terms and conditions for purchasing company stock. It covers provisions such as the number of shares, purchase price, payment terms, applicable restrictions or limitations, and the rights and obligations of both the purchaser and the seller. 2. Shareholder Agreement: The shareholder agreement variant of the Oklahoma Option to Purchase Stock — Long Form occurs when existing shareholders in a company have the option to sell their stock. This agreement includes provisions for rights preemption, restrictions on transfer, approval requirements, and other shareholder-specific terms and conditions. 3. Employee Stock Option Agreement: This type of Oklahoma Option to Purchase Stock — Long Form agreement is often used by companies to grant employees the opportunity to purchase company stock at a predetermined price, typically as part of their compensation package. This agreement typically includes vesting schedules, exercise periods, and provisions for early exercise or termination. Key Elements of an Oklahoma Option to Purchase Stock — Long Form Agreement: 1. Identification of Parties: The agreement begins by identifying the purchaser, seller, and details of the company in which the stock is being purchased. 2. Stock Purchase Terms: This section outlines the key terms, such as the number of shares being purchased, the purchase price, payment terms, and any conditions associated with the transaction. 3. Restrictions and Limitations: The Oklahoma Option to Purchase Stock — Long Form agreement may include any restrictions or limitations on the purchased stock, such as transfer restrictions, voting rights, or the treatment of dividends. 4. Exercising Stock Option: Details regarding the exercise of the stock option, including the timeline, notice requirements, and any associated fees or penalties, will be outlined in this section. 5. Representations and Warranties: Both parties generally provide assurances and warranties regarding their legal authority, ownership of shares, and compliance with applicable laws and regulations. 6. Governing Law and Dispute Resolution: This section sets forth the governing law under which the agreement will be interpreted and any dispute resolution mechanisms, such as mediation, arbitration, or litigation jurisdiction. Conclusion: The Oklahoma Option to Purchase Stock — Long Form is a comprehensive agreement that safeguards the interests of both buyers and sellers of company stock. Understanding the key elements and the various types of this agreement ensures parties can navigate the purchase process smoothly, ensuring legal compliance and minimizing disputes. Seek legal counsel to draft or review the agreement to ensure its adequacy and alignment with state and federal laws.

Oklahoma Option to Purchase Stock - Long Form

Description

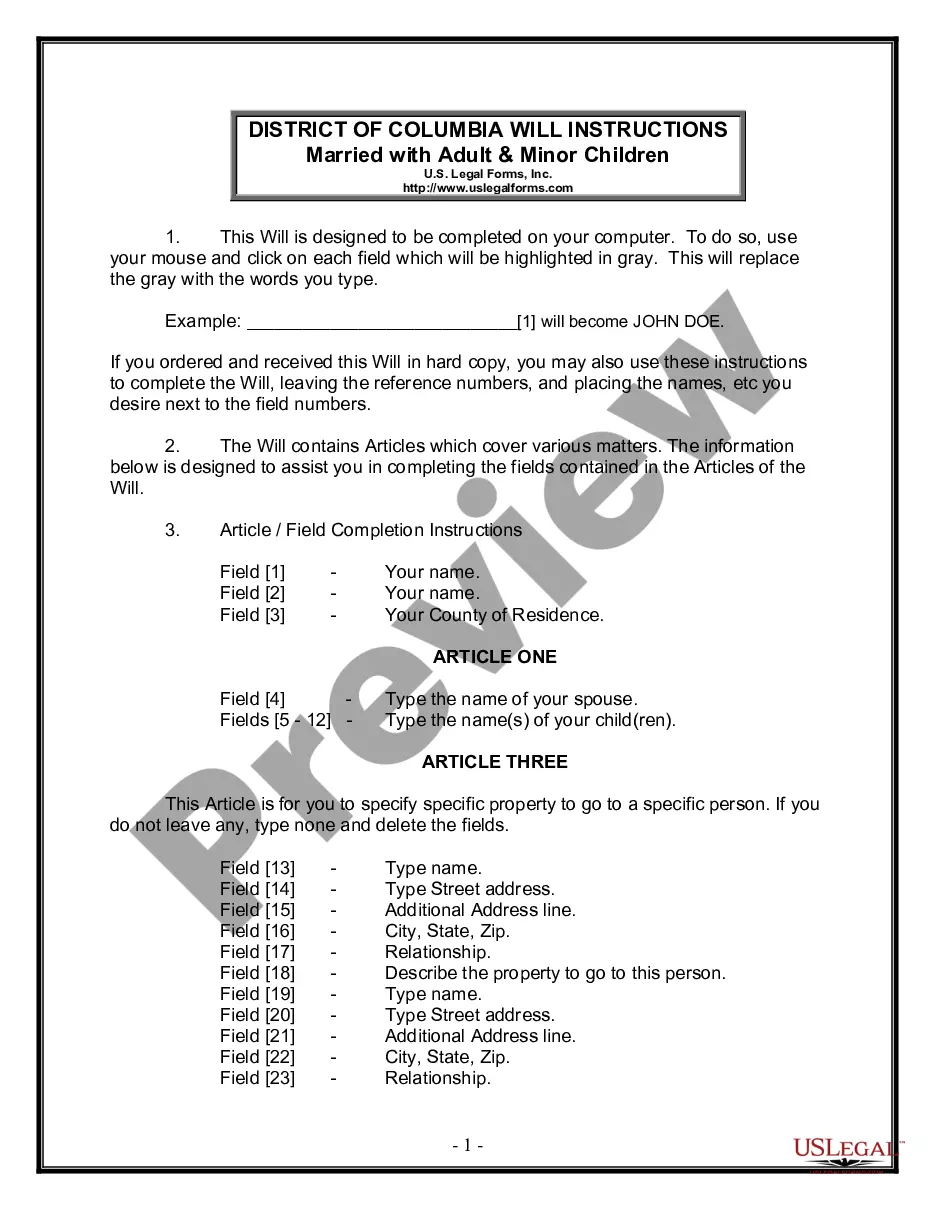

How to fill out Oklahoma Option To Purchase Stock - Long Form?

You can invest hours online looking for the legal document template that meets both state and federal requirements you will need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can easily obtain or print the Oklahoma Option to Acquire Stock - Long Form from our services.

First, ensure that you have selected the appropriate document template for the county/town of your choice. Review the document description to confirm you have chosen the correct document. If available, use the Preview button to browse through the document template as well. To find another version of your document, use the Search field to locate the template that suits your needs and specifications.

- If you already possess a US Legal Forms account, you may Log In and then click the Get button.

- After that, you may complete, modify, print, or sign the Oklahoma Option to Acquire Stock - Long Form.

- Every legal document template you obtain is yours to keep permanently.

- To obtain another copy of any purchased document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To mail an Oklahoma annual franchise tax return, you should send it to the Oklahoma Tax Commission. Ensure that you have completed the necessary forms accurately to avoid any issues. If you need assistance with documentation or have questions regarding the process, consider using US Legal Forms to access resources tailored to help you navigate the requirements efficiently.

Interesting Questions

More info

Login Why Choose us? We help you make smart decision. How do I use this site? Simply visit this site, sign up for a free account, start your free account and start trading. Is there any cost to use stock option trading website? Do you charge any additional fee? How much can I bet using this site? When can I play? Please visit our site for full details. Free Stock Option Trading site will always provide free stock option trade in any stock you request and no additional fee will be charged for free stock option. You can play on any day for free. What is Stock Market on Trading website Stock Market on Trading website provides a simple interface for trading stocks, options and other financial assets and services online. The service allows you to find out the best price in the market, the best time to order or receive delivery of a stock, the best available margin in your account if trading stocks or options or how to get the best results at your location.