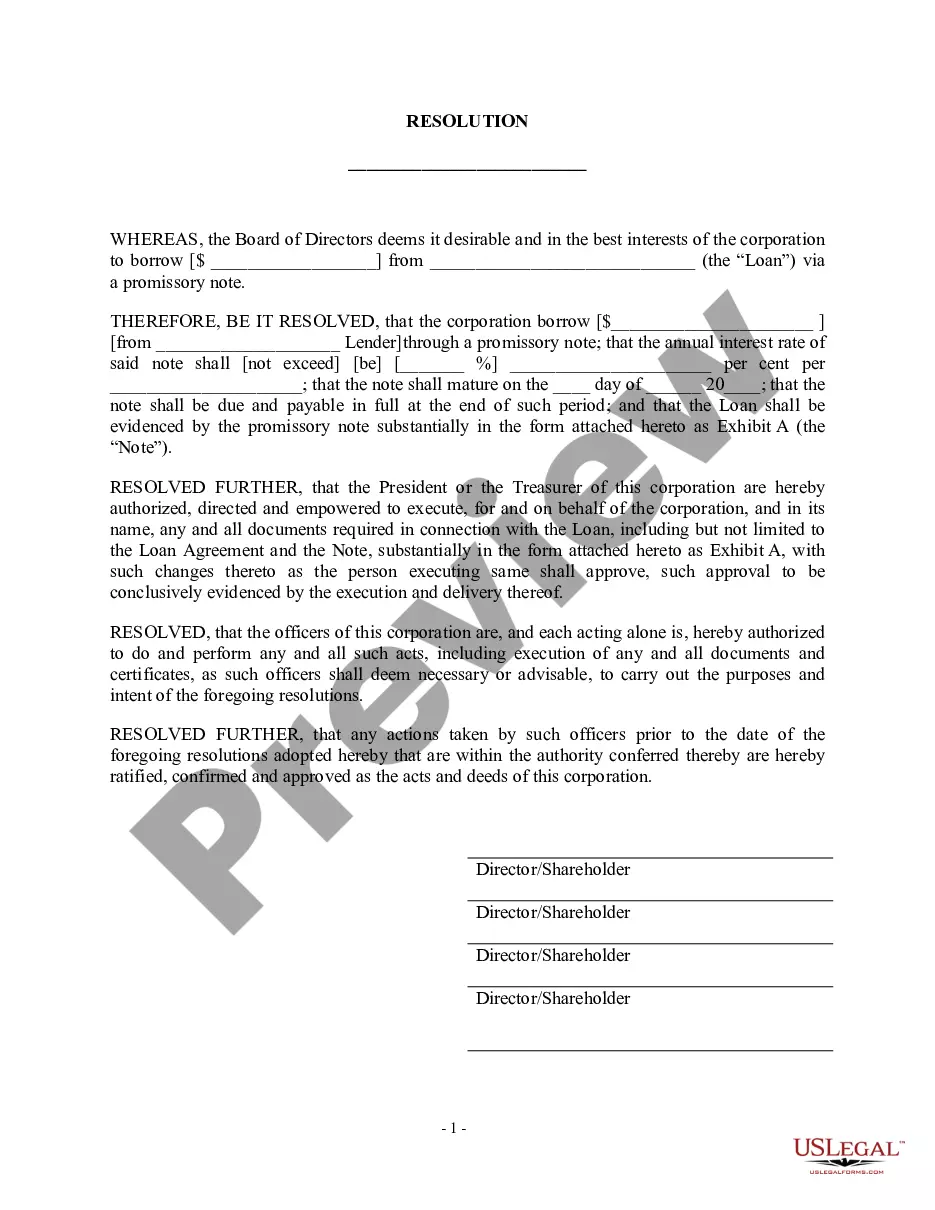

Oklahoma Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Have you ever found yourself in a scenario where you need documents for either business or particular tasks almost every day.

There are numerous legal document templates available online, but obtaining reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Oklahoma Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions, crafted to comply with federal and state regulations.

Once you have the correct form, click Get now.

Choose your preferred pricing plan, enter the required information to process your payment, and finalize your order using PayPal or a credit card. Select a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain another copy of the Oklahoma Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions anytime, if necessary. Just select the desired form to download or print the document template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you already know about the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Oklahoma Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction.

- Utilize the Preview button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your requirements.

Form popularity

FAQ

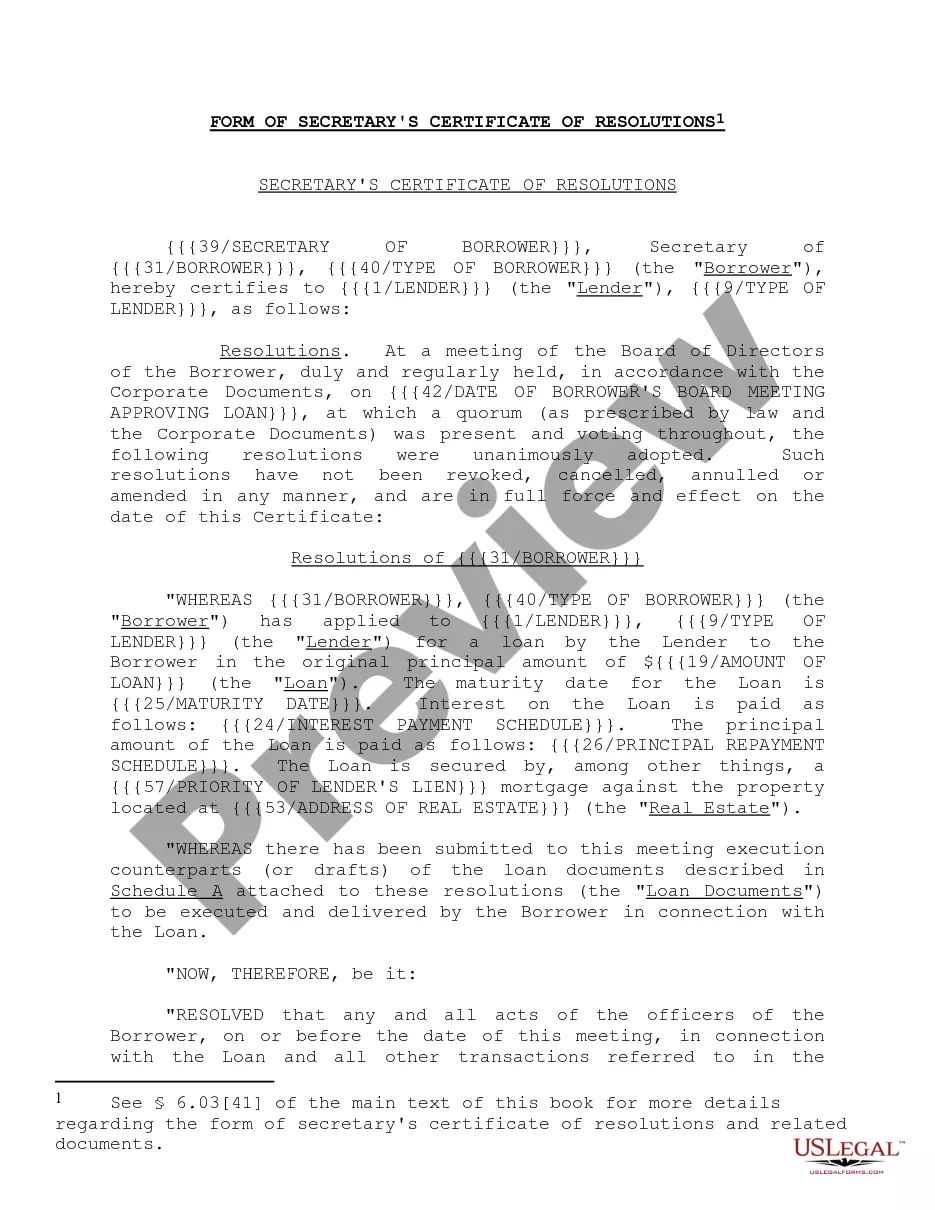

Such processes can be laid out in a corporate resolution form, usually known as the operating agreement. The agreement can also specify whether or not the decision-making is to be agreed upon by all members or a majority of members.

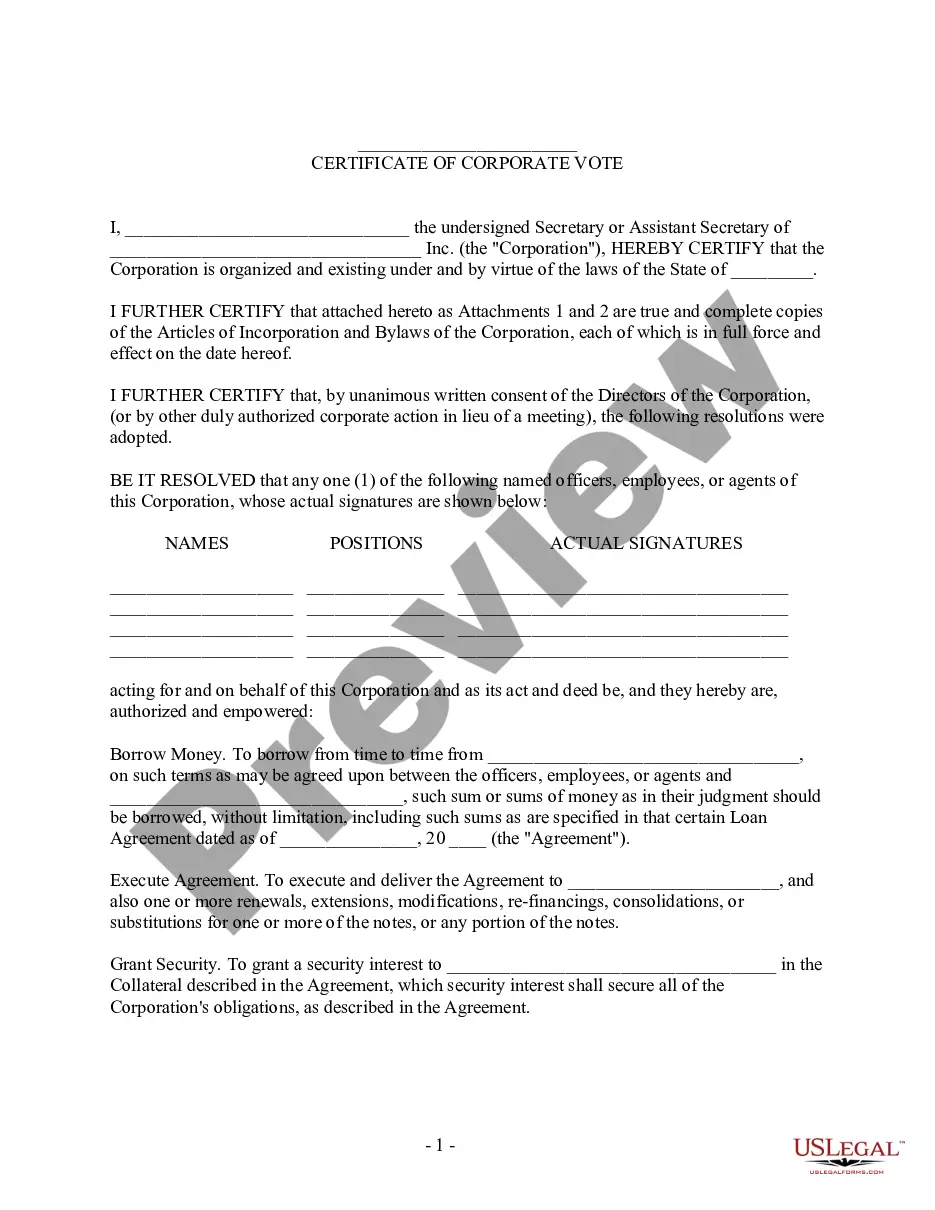

Name of the lender from whom they will borrow sums of money. Signature of authorized member/director that will execute and endorse all such documents required by said bank as well as agreement to perform all acts and sign all agreements and obligations required by said bank. The state where the business is formed.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

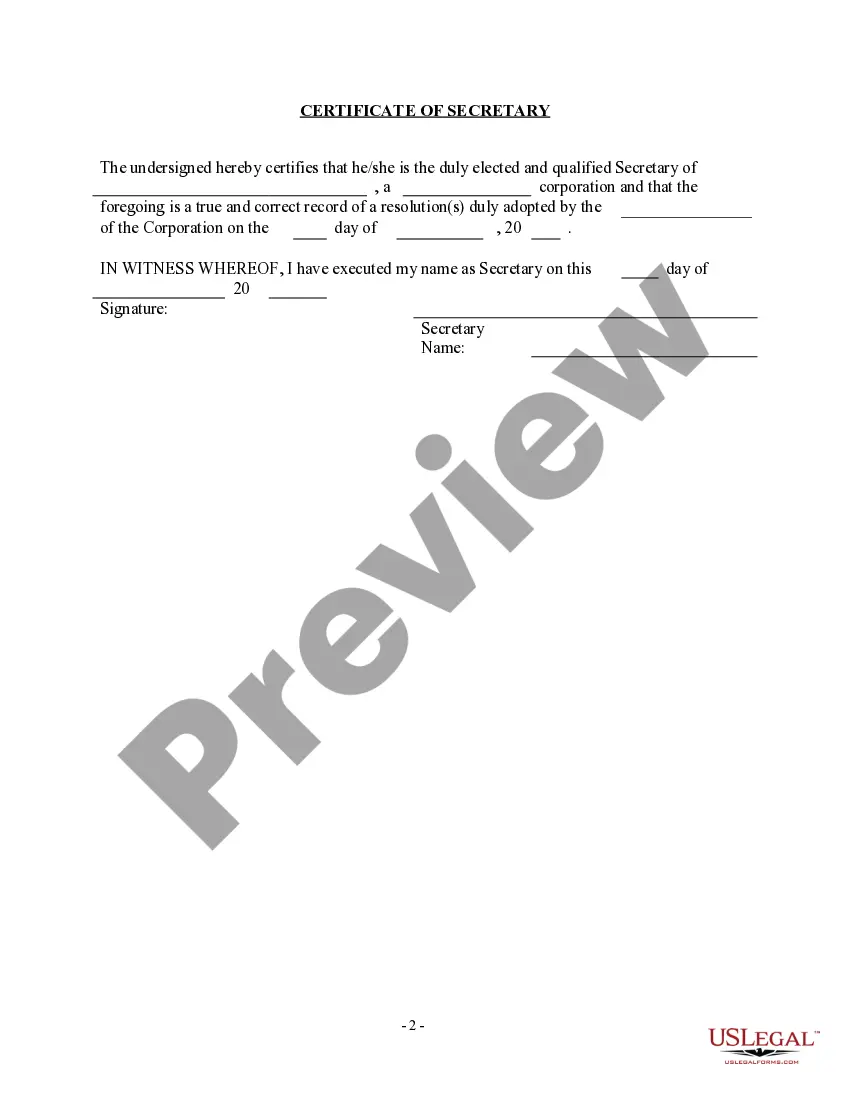

Board resolutions should be written on the organization's letterhead. The wording simply describes the action that the board agreed to take. It also shows the date of the action and it names the parties to the resolution.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.