The Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding document that outlines the terms and conditions of a business sale between a sole proprietorship and a buyer. This agreement is specifically tailored for use in the state of Oklahoma. It involves a contingent purchase price, meaning that the final price paid for the business is dependent on the outcome of an audit conducted by the buyer. Keywords: Oklahoma, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent, Audit Different types of Oklahoma Agreements for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit can include: 1. Standard Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: This is the basic and most common type of agreement, where the terms and conditions are outlined in a straightforward manner, specifying the contingent purchase price and the audit process. 2. Customizable Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: This type of agreement allows the parties involved to customize and add additional clauses based on their specific needs and requirements. It provides more flexibility in tailoring the agreement to the unique circumstances of the business sale. 3. Agreements for Sale of Business by Sole Proprietorship with Purchase Price Adjustment Contingent on Audit Results: This variation of the agreement outlines that the purchase price will be adjusted based on the findings of the audit. It provides a framework for determining the adjustments to be made to the sale price, taking into account any discrepancies or significant changes discovered during the audit process. 4. Confidentiality Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: This type of agreement includes additional clauses pertaining to the confidentiality of the audit results and any sensitive information shared during the process. It ensures that both parties maintain the utmost confidentiality to protect the interests of the business being sold. 5. Asset Purchase Agreement with Purchase Price Contingent on Audit: This variation of the agreement focuses specifically on the purchase of assets rather than the entire business entity. It outlines the contingent purchase price based on the audit results, specifically valuing and accounting for the assets being acquired. In conclusion, the Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a comprehensive legal document that provides a framework for the sale of a sole proprietorship business while incorporating a contingent purchase price dependent on the outcome of an audit. The mentioned variations of this agreement cater to specific needs and circumstances of the business sale.

Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

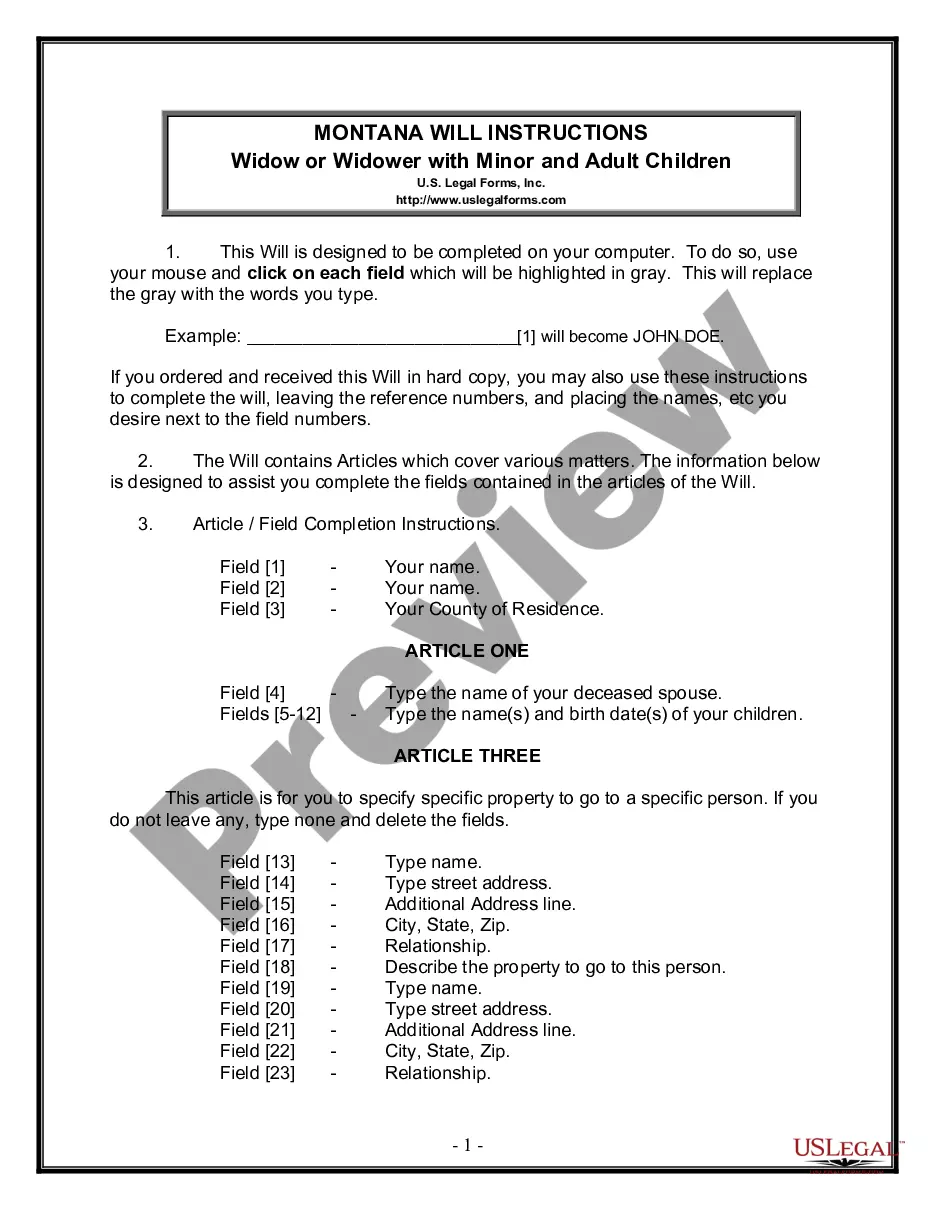

How to fill out Oklahoma Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

If you need to finalize, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search to locate the documents you require.

A variety of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan that suits you and enter your credentials to register for an account.

Step 5. Complete the purchase process. You can use your Мisa, credit card, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to obtain the Oklahoma Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions outlined below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the page to find other versions of the legal document template.

Form popularity

FAQ

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

What is Included in an Agreement of Purchase and Sale?Purchase price including taxes.Deposit amount.Terms and conditions of sale outlined by the buyer.Fixtures, appliances, and other accessories included in the sale.Deadlines for seller to accept offer.Deadline for buyer to make the deposit payment.More items...

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.