The Oklahoma Leaseback Provision in a Sales Agreement is a crucial aspect of real estate transactions involving leasing and selling properties. This provision outlines the terms and conditions regarding the leaseback arrangement between the seller and buyer after the sale has been completed. When potential buyers show interest in purchasing a property with Oklahoma Leaseback Provision, it is essential for them to grasp the different types of leaseback provisions available in this state's sales agreements. One type of Oklahoma Leaseback Provision is a Seller Leaseback Agreement. In this arrangement, the seller becomes the tenant and leases the property back from the buyer for a specific period. This type of provision allows the seller to retain possession of the property even after the sale is finalized, providing them with financial flexibility and time to secure alternative accommodations. Another type of leaseback provision is called a Blanket Net Lease Agreement. This type of provision is often utilized in commercial real estate sales, wherein the seller, who is also the tenant, agrees to rent the property back from the buyer. Under this provision, the seller is responsible for paying not only the rent but also the property taxes, insurance, and maintenance costs, which are usually bundled together as a net lease. Additionally, the Oklahoma Leaseback Provision can be outlined as a Sale-Leaseback Agreement. This arrangement involves the simultaneous sale and leaseback of a property. The seller, now the tenant, sells the property to the buyer and then immediately leases it back for a predetermined period. The buyer, in turn, becomes the landlord, gaining ownership of the property while the seller remains as the tenant with certain lease obligations. It is important to note that the specific details and terms of the Oklahoma Leaseback Provision can vary depending on the negotiated agreement between the parties involved. These provisions typically include information about lease duration, rental payments, maintenance responsibilities, termination clauses, and any potential restrictions or contingencies. In conclusion, the Oklahoma Leaseback Provision in a Sales Agreement encompasses various arrangements, such as the Seller Leaseback Agreement, Blanket Net Lease Agreement, and Sale-Leaseback Agreement. Understanding the different types of leaseback provisions ensures that buyers and sellers can navigate and negotiate the terms of their real estate transaction effectively.

Oklahoma Leaseback Provision in Sales Agreement

Description

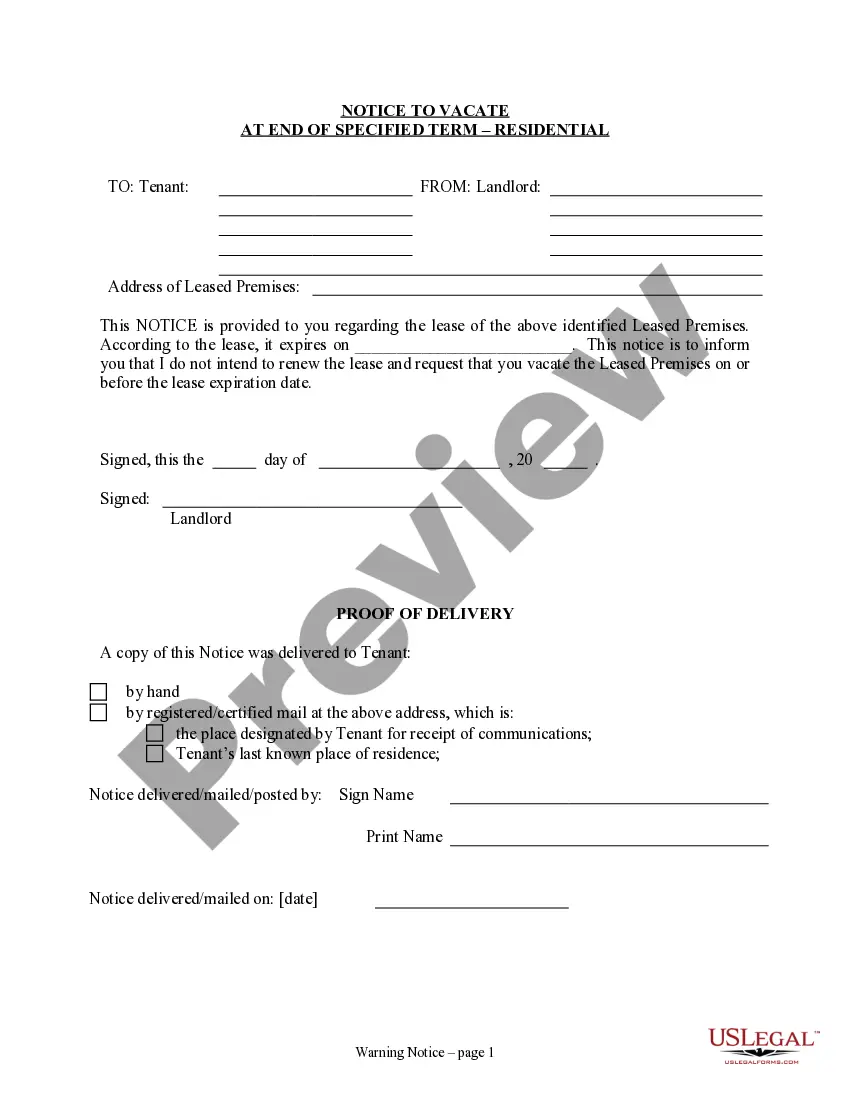

How to fill out Oklahoma Leaseback Provision In Sales Agreement?

You can spend hours online attempting to locate the legal document template that aligns with the state and federal regulations you require. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Oklahoma Leaseback Provision in Sales Agreement from my service.

If you possess a US Legal Forms account, you may Log In and click on the Obtain button. After that, you can complete, edit, print, or sign the Oklahoma Leaseback Provision in Sales Agreement.

Once you have found the template you want, click on Buy now to proceed. Select the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the purchase. You may use your credit card or PayPal account to buy the legal form. Choose the format of your document and download it to your device. Make changes to the document if necessary. You can complete, edit, and sign and print the Oklahoma Leaseback Provision in Sales Agreement. Obtain and print a multitude of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for your county/city of choice.

- Review the form description to confirm you have selected the appropriate form.

- If available, use the Review button to examine the document template as well.

- Should you wish to locate another version of your form, use the Search box to find the template that fits your needs and requirements.

Form popularity

FAQ

A common example of a sale and leaseback involves a company selling its office building to an investor and then leasing it back. This scenario allows the company to access capital while continuing to operate in the same location. In such a case, the terms of the Oklahoma Leaseback Provision in Sales Agreement come into play, outlining the lease duration and payment structure. This arrangement helps businesses remain flexible while securing vital resources.

An entity assesses whether the transfer of an asset qualifies as a sale by analyzing if all significant risks and rewards of ownership have passed to the buyer. This involves evaluating the transaction terms, including obligations and control post-transfer. Understanding these nuances is key, especially under the Oklahoma Leaseback Provision in Sales Agreement, to ensure accurate accounting treatment.

The primary difference between a lease and a sale lies in ownership. In a sale, ownership of the asset is transferred from the seller to the buyer. Conversely, in a lease, the lessee gains the right to use the asset without transferring ownership, making this distinction vital when navigating the Oklahoma Leaseback Provision in Sales Agreement.

To account for a transaction as a sale under the new revenue recognition standards, the seller must demonstrate it has transferred control of the asset. Proper documentation showing the rights and obligations post-sale is essential. Moreover, aligning your process with the Oklahoma Leaseback Provision in Sales Agreement can help clarify compliance, ensuring that both parties understand their roles.

In Oklahoma, notarization of a lease is not typically required; however, it is advisable for certain leases to be notarized for record-keeping purposes. Notarizing your lease can provide a layer of security for both parties in a sale and leaseback arrangement. While it may not be legally necessary, it enhances trust and clarity under the Oklahoma Leaseback Provision in Sales Agreement.

To determine if a sale and leaseback transaction qualifies as a sale, evaluate the transfer of risks and rewards associated with the asset. If the seller relinquishes control and the buyer assumes the associated rights, it is likely treated as a sale. Legal and accounting standards, including those relevant to the Oklahoma Leaseback Provision in Sales Agreement, must be carefully followed to ensure compliance.

The structure of a sale and leaseback transaction typically begins with a sale followed by a lease agreement that outlines rental terms and conditions. Each party should understand their rights and responsibilities clearly. The Oklahoma Leaseback Provision in Sales Agreement provides a framework to ensure that this structure operates smoothly for both the seller and buyer.

Despite the advantages, a sale and leaseback can have disadvantages, such as losing control over your property and potential fluctuations in lease payments. It may limit your ability to capitalize on the property's appreciation. When considering the Oklahoma Leaseback Provision in Sales Agreement, understanding these drawbacks helps in making informed decisions.

A common example of a leaseback transaction involves a company selling its office building to an investor and leasing it back to continue operating. This strategy frees up capital for the company while providing the investor a steady rental income. The Oklahoma Leaseback Provision in Sales Agreement details the terms of such arrangements to benefit both parties.

The leaseback condition refers to the specific terms detailing the obligations of each party after a sale has occurred. This condition often includes elements like rent payments, property maintenance, and duration of the lease. The Oklahoma Leaseback Provision in Sales Agreement outlines these conditions clearly to avoid misunderstandings.

Interesting Questions

More info

SIDE LEASE BACK AGREEMENT Sample LOI Agreement View Full Report Get the Report in Excel Export As CSV File More Reports in this topic Legal Forms Leaseback Agreements Sample Leaseback Agreements Other Forms Get report in another format Download .csv file Please be aware the data is for informational purposes only and is not legal advice. Do not act or act based on the data without first seeking the advice of a legal professional.