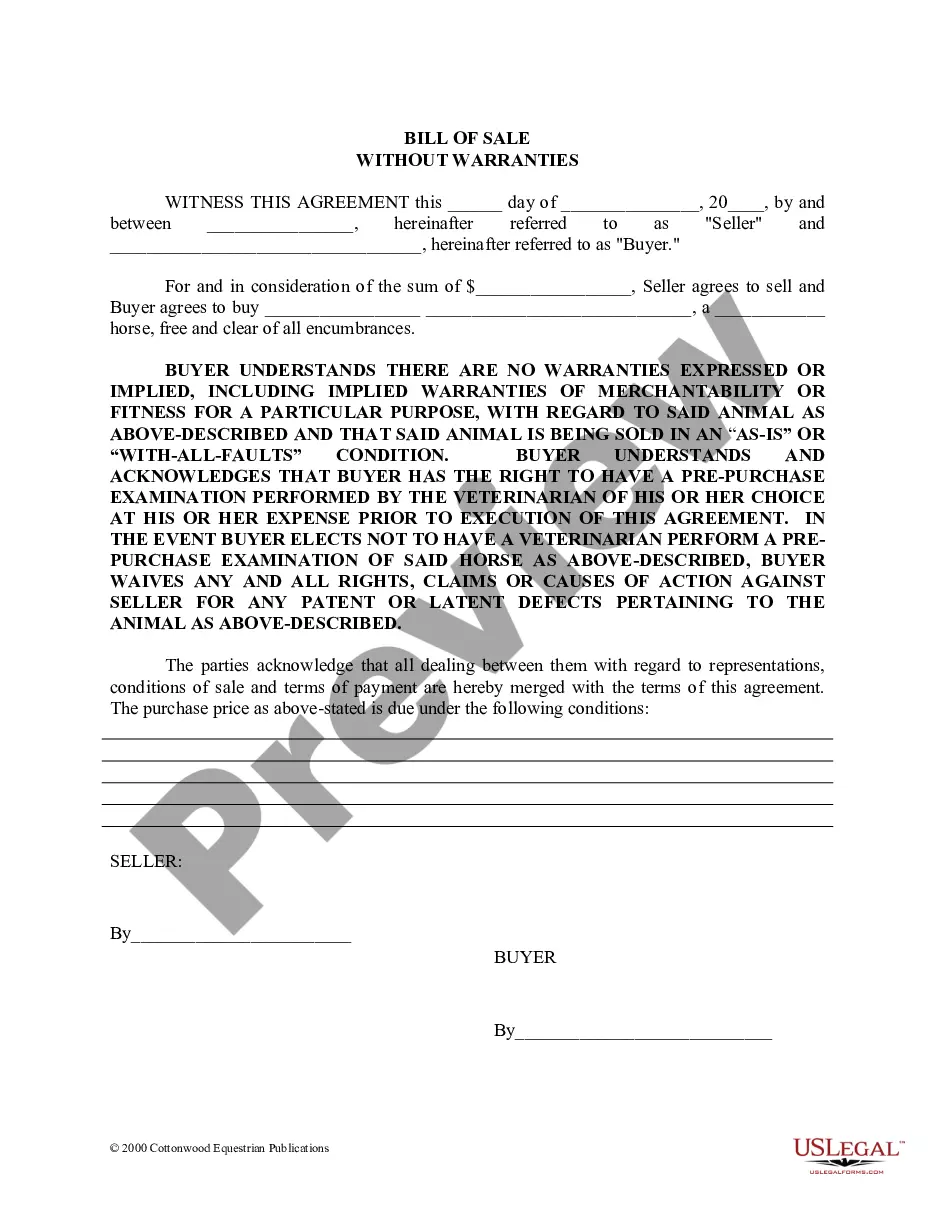

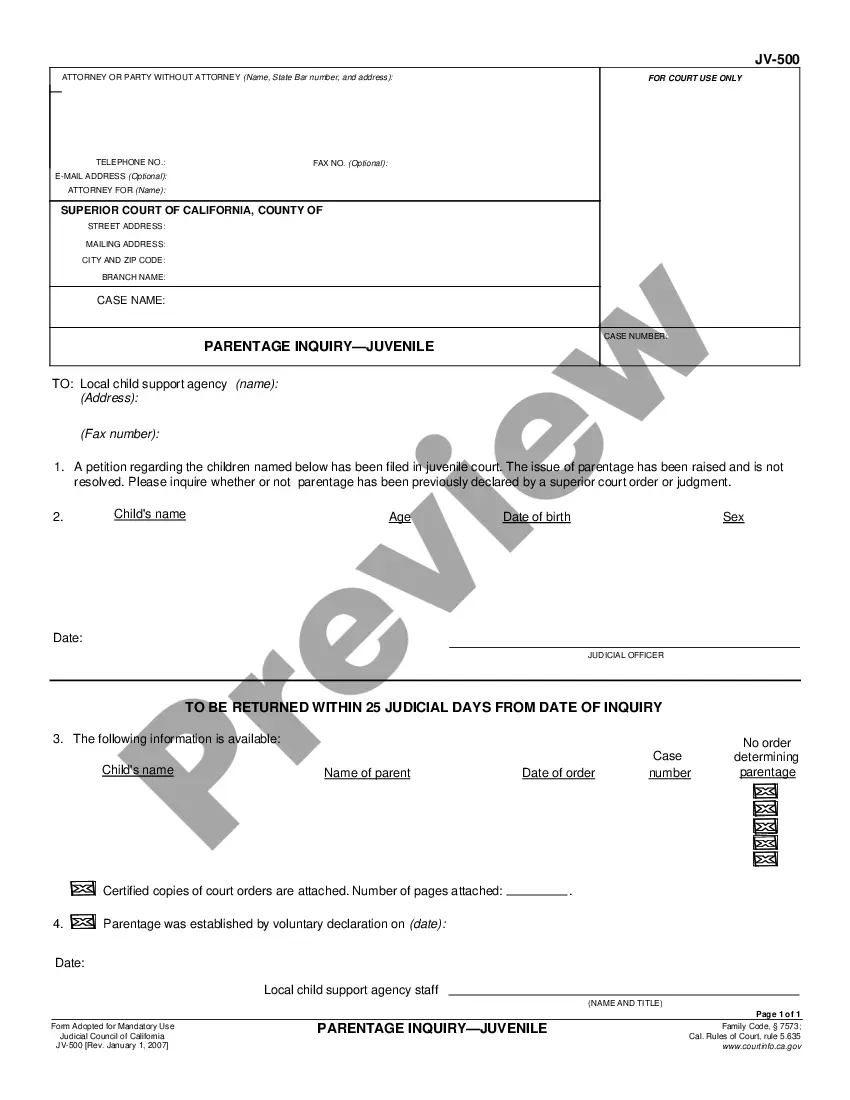

The Oklahoma Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser is a legal document that outlines the terms and conditions governing the sale and purchase of a corporation's stock in Oklahoma. This agreement serves as a contract between the seller (corporation) and the buyer (purchaser), establishing the rights, obligations, and responsibilities of both parties involved in the transaction of stock. In this agreement, the seller agrees to sell all the corporation's issued and outstanding stocks to the purchaser at an agreed-upon price. The purchaser, in turn, agrees to purchase the stocks and assume control over the corporation. This agreement is often used in mergers and acquisitions or when a corporation wishes to transfer ownership to a new party. Some key provisions typically included in an Oklahoma Stock Sale and Purchase Agreement are: 1. Sale and Purchase Terms: Details the specific terms of the stock sale, including the number of shares, purchase price, and payment terms. It also outlines any conditions precedent that must be met before the transaction can be completed. 2. Representations and Warranties: Sets forth the seller's representations and warranties regarding the corporation and its stocks. This section ensures that the seller guarantees the accuracy of information provided about the corporation, such as financial statements, legal compliance, and intellectual property ownership. 3. Closing Conditions: Specifies the conditions that must be fulfilled before the closing of the transaction, such as obtaining necessary regulatory approvals or consents. 4. Indemnification: States the obligations of each party regarding indemnification for any losses, costs, or damages arising from breaches of the agreement's terms or misrepresentations. 5. Governing Law and Dispute Resolution: Determines the jurisdiction of the agreement, usually Oklahoma, and outlines the process for resolving any disputes between the parties, such as through arbitration or litigation. Different types of Oklahoma Stock Sale and Purchase Agreements include: 1. Asset Purchase Agreement: In this type of agreement, the purchaser only acquires specific assets of the corporation, rather than the entire corporation itself. This can be advantageous in situations where the buyer wants to avoid assuming certain liabilities or obligations of the corporation. 2. Merger Agreement: A merger agreement is used when two or more corporations decide to merge into a single entity. This agreement establishes the terms of the merger, including the treatment of stocks, ownership structure, and role of shareholders in the new entity. 3. Stock Purchase Agreement — Minority Interest: This agreement is used when a purchaser intends to acquire a minority interest in a corporation, rather than full control. It outlines the specific rights and obligations of the minority shareholder and may include provisions for buyout or exit options. In conclusion, the Oklahoma Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser is a crucial legal document that facilitates the transfer of ownership of a corporation's stock. It outlines the terms of the transaction and provides protection for both parties involved. Understanding the different types of agreements related to stock sales is essential to choosing the most suitable agreement for specific circumstances.

Oklahoma Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Oklahoma Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

Locating the appropriate legal document template may prove difficult.

Naturally, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Oklahoma Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, which can cater to both business and personal purposes. All forms are verified by experts and comply with both federal and state regulations.

If the form does not meet your requirements, use the Search field to find the correct template. Once you are confident the template is appropriate, click the Purchase now button to acquire the form. Select the pricing plan you desire and fill in the necessary details. Create your account and pay for the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, and print and sign the acquired Oklahoma Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser. US Legal Forms is indeed the largest repository of legal forms where you can find numerous document templates. Utilize the service to obtain professionally-created paperwork that adhere to state requirements.

- If you are already registered, Log In to your account and click the Obtain button to download the Oklahoma Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

- Use your account to browse the legal forms you have acquired previously.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your specific city/state.

- You can view the template by using the Preview button and read the form details to confirm it is suitable for your needs.

Form popularity

FAQ

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

Buyers often prefer asset sales because they can avoid inheriting potential liability that they would inherit through a stock sale. They may want to avoid potential disputes such as contract claims, product warranty disputes, product liability claims, employment-related lawsuits and other potential claims.

Seller's perspective: Sellers often prefer selling the shares of the company as opposed to the assets for the following reasons: Taxes: Only half of the company's capital gains is considered taxable income. The other half of the gains can be included in income free of tax.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

As a result of the transaction, the buyer receives all of assets, including cash, of the selling company.

In addition, buyers prefer asset sales because they more easily avoid inheriting potential liabilities, especially contingent liabilities in the form of product liability, contract disputes, product warranty issues, or employee lawsuits. However, asset sales may also present problems for buyers.

An asset sale occurs when a business sells all or a portion of its assets. The seller, or target company, in this type of deal, is still legally the owner of the company, but no longer owns the assets sold. In a stock sale, the buyer acquires equity from the target company's shareholders.

Your company will also still exist after an asset sale, and administratively you will still need to take steps to dissolve the company and deal with any remaining liabilities and assets. Unlike a stock sale, 100% of the interests of a company can usually be transferred without the consent of all of the stockholders.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

More info

Shareholdings are represented by numbers. The Company is an electronic company which was incorporated as an S corporation on May 6, 1982, in Nevada. There were no outstanding warrants or options at date of incorporation, and the Company had only two shareholders- Kyle Bed and Daphne Corp. At the time of incorporation, the Company had no operations. The Company has since grown to serve its original shareholders, but has continued to expand throughout the years. In the Spring of 2004, the company was approached by several investors looking to purchase a significant portion of the Company's assets. The Company was receptive and immediately sent an offer package to these investors. There was some question of whether such a substantial increase in the Company's assets would make the Company subject to the requirements of APA's 2% reporting requirement.