Title: Oklahoma Sale of Deceased Partner's Interest to Surviving Partner — Purchase Agreement and Bill of Sale Introduction: When a business partnership faces the unfortunate event of a partner's passing, it is necessary to navigate the legal process of transferring the deceased partner's interest to the surviving partner. In Oklahoma, this transaction can be accomplished through a well-drafted Purchase Agreement and Bill of Sale. This document outlines the terms, conditions, and specifics of the sale, ensuring a smooth transfer of ownership. Different types of such transactions may include voluntary sales, forced sales, and sales under partnership agreements. I. Voluntary Sale of Deceased Partner's Interest to Surviving Partner: In situations where the surviving partner voluntarily purchases the deceased partner's share, a Purchase Agreement and Bill of Sale must be prepared. This legally binding document protects the rights of both parties and ensures a fair transaction. The agreement covers aspects including purchase price, payment terms, transfer of ownership, and any other terms agreed upon by the parties involved. This type of sale typically occurs when the surviving partner has the financial means and willingness to assume full ownership of the partnership. II. Forced Sale of Deceased Partner's Interest: In some cases, the partnership agreement may include provisions for the forced sale of a deceased partner's interest. Such provisions are essential for protecting the interests of both the surviving partner and the business. A Purchase Agreement and Bill of Sale become necessary to facilitate the sale process in accordance with the partnership agreement terms. This forced sale ensures a smooth business transition while maintaining financial stability. III. Sale of Deceased Partner's Interest as per Partnership Agreement: Partnerships often establish pre-determined protocols for the sale of a deceased partner's interest. Such agreements specify the circumstances, valuation methods, and conditions for executing the sale. When a partner passes away, the surviving partner can rely on the existing partnership agreement to determine the sale process. In this case, the Purchase Agreement and Bill of Sale will outline the steps to be followed under the agreed-upon partnership agreement terms. This approach provides a clear framework for the transaction and assures all parties that the sale is aligned with the original intentions of the partnership. Conclusion: Navigating the sale of a deceased partner's interest to a surviving partner in Oklahoma necessitates a well-crafted Purchase Agreement and Bill of Sale. These documents protect the rights and interests of both parties involved, provide clarity on the sale process, and ensure a smooth transition of ownership. Whether the sale is voluntary, forced, or as per a partnership agreement, these legal documents play a vital role in maintaining the business's stability while honoring the deceased partner's legacy.

Oklahoma Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Oklahoma Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

If you wish to total, acquire, or print out legal file themes, use US Legal Forms, the greatest selection of legal forms, which can be found on-line. Utilize the site`s simple and easy hassle-free lookup to obtain the files you will need. A variety of themes for company and specific uses are sorted by classes and claims, or keywords. Use US Legal Forms to obtain the Oklahoma Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale in just a number of clicks.

In case you are previously a US Legal Forms customer, log in in your account and then click the Down load option to have the Oklahoma Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale. You can also access forms you in the past delivered electronically within the My Forms tab of the account.

Should you use US Legal Forms the very first time, follow the instructions under:

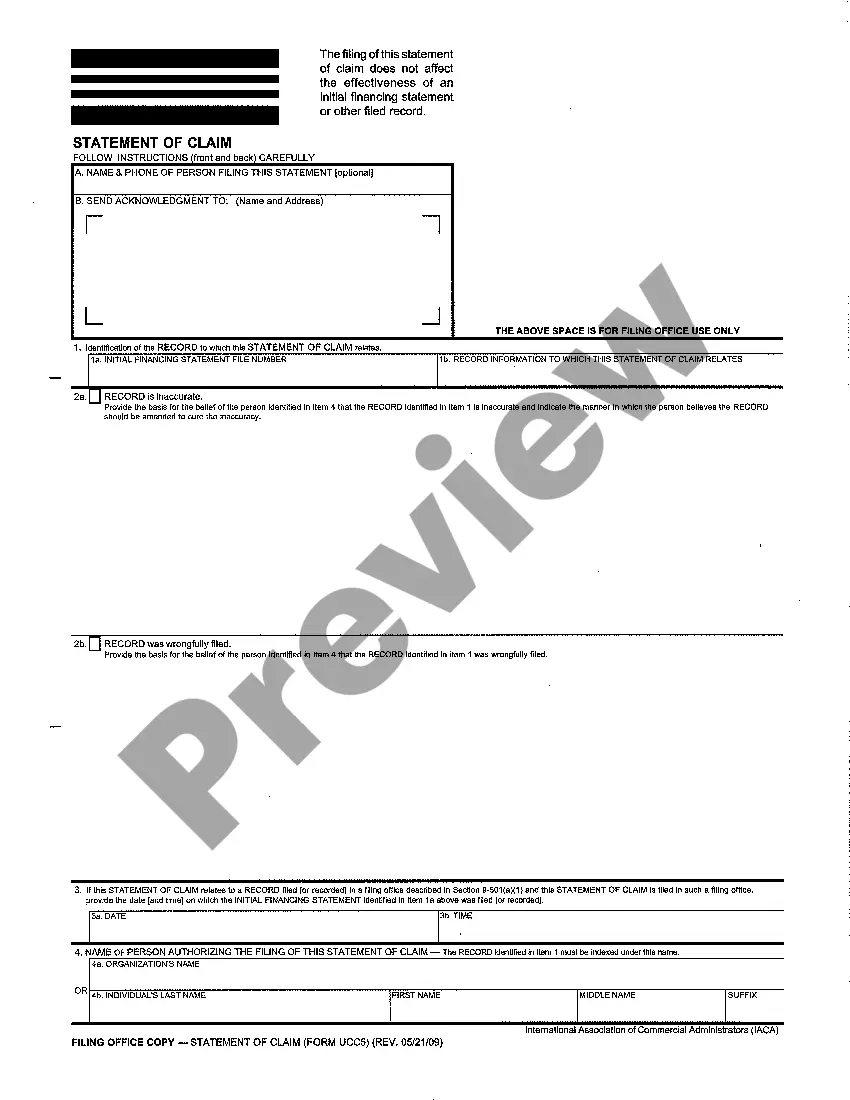

- Step 1. Be sure you have selected the form for that correct metropolis/nation.

- Step 2. Take advantage of the Review choice to look through the form`s articles. Never neglect to read the explanation.

- Step 3. In case you are not satisfied with all the type, utilize the Search discipline towards the top of the screen to discover other versions of the legal type web template.

- Step 4. Once you have discovered the form you will need, go through the Get now option. Select the pricing plan you favor and add your references to register for an account.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Select the format of the legal type and acquire it on the product.

- Step 7. Complete, change and print out or sign the Oklahoma Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

Every legal file web template you buy is your own property forever. You may have acces to every single type you delivered electronically in your acccount. Go through the My Forms section and select a type to print out or acquire once more.

Be competitive and acquire, and print out the Oklahoma Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with US Legal Forms. There are thousands of skilled and condition-distinct forms you may use for your personal company or specific requires.