Oklahoma Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

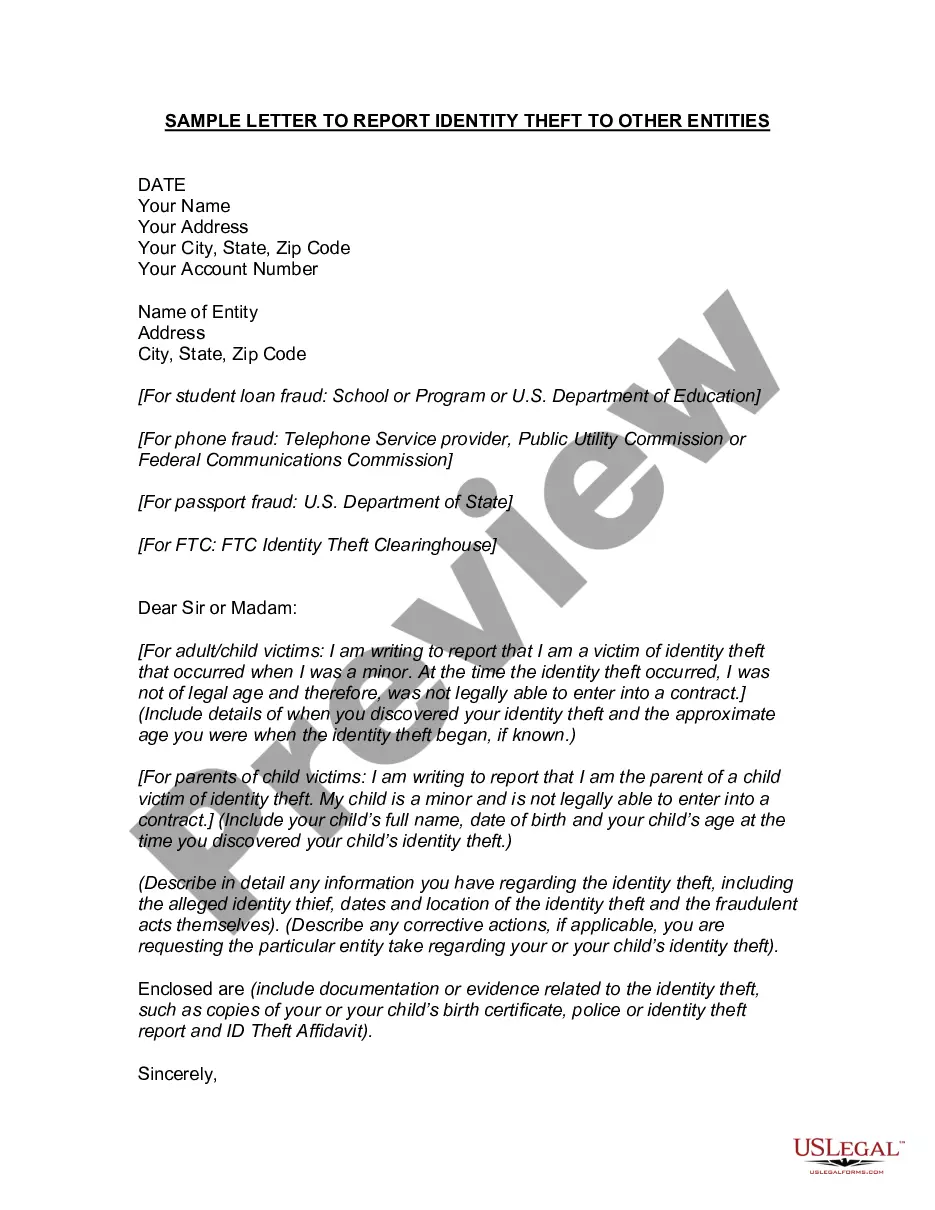

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

You are able to devote several hours on-line looking for the authorized document format which fits the federal and state requirements you need. US Legal Forms provides 1000s of authorized types which can be evaluated by experts. It is simple to download or printing the Oklahoma Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts from the assistance.

If you already possess a US Legal Forms profile, you may log in and click on the Acquire option. Afterward, you may total, edit, printing, or sign the Oklahoma Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. Each authorized document format you buy is the one you have for a long time. To acquire another version for any bought kind, visit the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms internet site for the first time, stick to the easy directions under:

- Initial, be sure that you have selected the proper document format for that area/metropolis of your choosing. Browse the kind outline to ensure you have picked out the appropriate kind. If offered, take advantage of the Review option to search from the document format at the same time.

- In order to get another edition from the kind, take advantage of the Search industry to find the format that meets your needs and requirements.

- Upon having located the format you want, click on Acquire now to continue.

- Choose the prices program you want, enter your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can use your charge card or PayPal profile to pay for the authorized kind.

- Choose the file format from the document and download it in your device.

- Make alterations in your document if possible. You are able to total, edit and sign and printing Oklahoma Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

Acquire and printing 1000s of document templates making use of the US Legal Forms site, which offers the largest variety of authorized types. Use specialist and express-particular templates to take on your organization or personal needs.

Form popularity

FAQ

You may receive a debt collection letter, to which you can respond by notifying the debt collector of the identity theft and providing it with proof of the theft, such as your Identity Theft Report. You should also contact the business that reported the debt to the collection agency and tell it to stop.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Many credit card companies and banks have customer protection plans in place to protect against identity theft or to recover funds from fraudulent purchases. Credit reporting companies and private insurers also offer fee-based identity theft protection plans, but their benefits have mixed reviews.

Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills. As debt accumulates and payments are missed, your scores may be negatively affected, because of the payment history associated with the accounts or the increase in your credit utilization.

Ing to the FTC, online fraud ? of which identity theft is a major component ? cost Americans $8.8 billion in 2022, with median losses of $650; some private estimates are much higher.

The bank/credit union will put your money back into your account after they receive a signed affidavit certifying that the charges in question were not made by you.

If you've been the victim of identity theft, you can take steps to reclaim your good name and restore your credit. To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt.

In most states, you're not liable for any debt that occurred as a result of fraudulent accounts being opened. Plus, under federal law, you are only liable for the first $50 in fraudulent charges on your credit card if someone uses your card to make a purchase.

All identity theft is a crime under California law, but "criminal identity theft" refers to one type of the crime. Criminal identity theft occurs when someone cited or arrested for a crime uses another person's name and identifying information, resulting in a criminal record being created in that person's name.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.