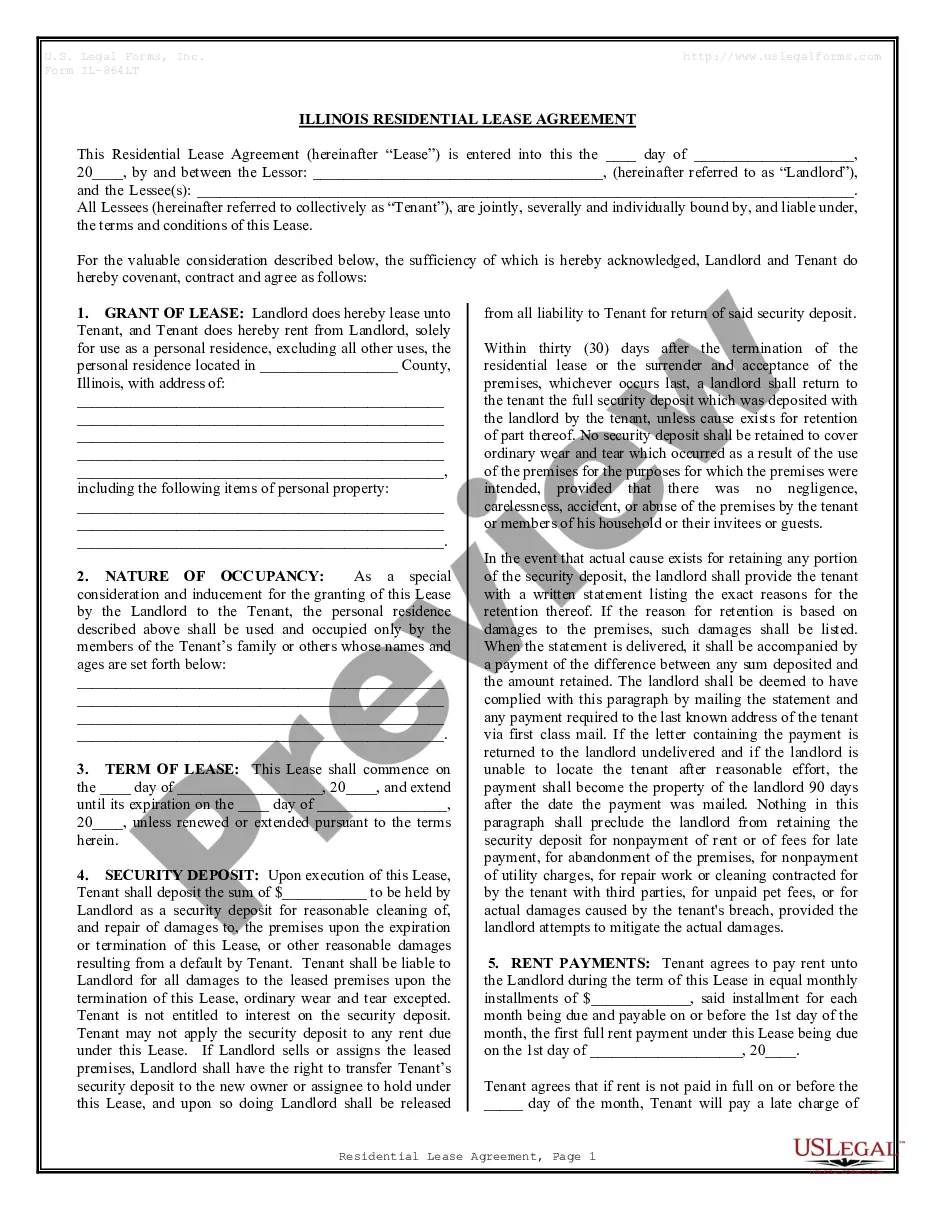

The Oklahoma Rental Lease Agreement for Business is a legally binding document that outlines the terms and conditions between a landlord and tenant for the rental of a commercial property in the state of Oklahoma. This agreement is specifically designed for business purposes, allowing both parties to establish clear expectations and obligations. Keywords: Oklahoma, rental lease agreement, business, landlord, tenant, commercial property, terms and conditions, expectations, obligations. There are different types of Oklahoma Rental Lease Agreements for Business based on various criteria: 1. Gross Lease Agreement: This type of lease agreement requires the tenant to pay a fixed amount of rent, while the landlord covers all additional expenses such as property taxes, insurance, and maintenance. 2. Net Lease Agreement: In this type of lease agreement, the tenant is responsible for paying a base rent amount along with a portion or all of the property's operating expenses, such as property taxes, insurance, and common area maintenance. 3. Triple Net Lease Agreement (NNN): A triple net lease agreement is quite similar to a net lease agreement. However, in an NNN lease, the tenant is responsible for paying all property-related expenses, including property taxes, insurance, common area maintenance, and utilities. 4. Percentage Lease Agreement: This lease agreement structure typically applies to retail businesses. In a percentage lease, the tenant pays a base rent amount plus a percentage of their sales as additional rent. 5. Short-term Lease Agreement: A short-term lease agreement is suitable for businesses looking for temporary or seasonal commercial space. These agreements typically have a duration of less than one year. 6. Long-term Lease Agreement: A long-term lease agreement is designed for businesses seeking a stable and extended rental commitment, often spanning multiple years. It provides security for both the landlord and tenant. It is important for both landlords and tenants to carefully review and understand the Oklahoma Rental Lease Agreement for Business before signing it. Consulting with a legal professional is advisable to ensure compliance with state laws and to protect the interests of both parties involved.

Oklahoma Rental Lease Agreement for Business

Description

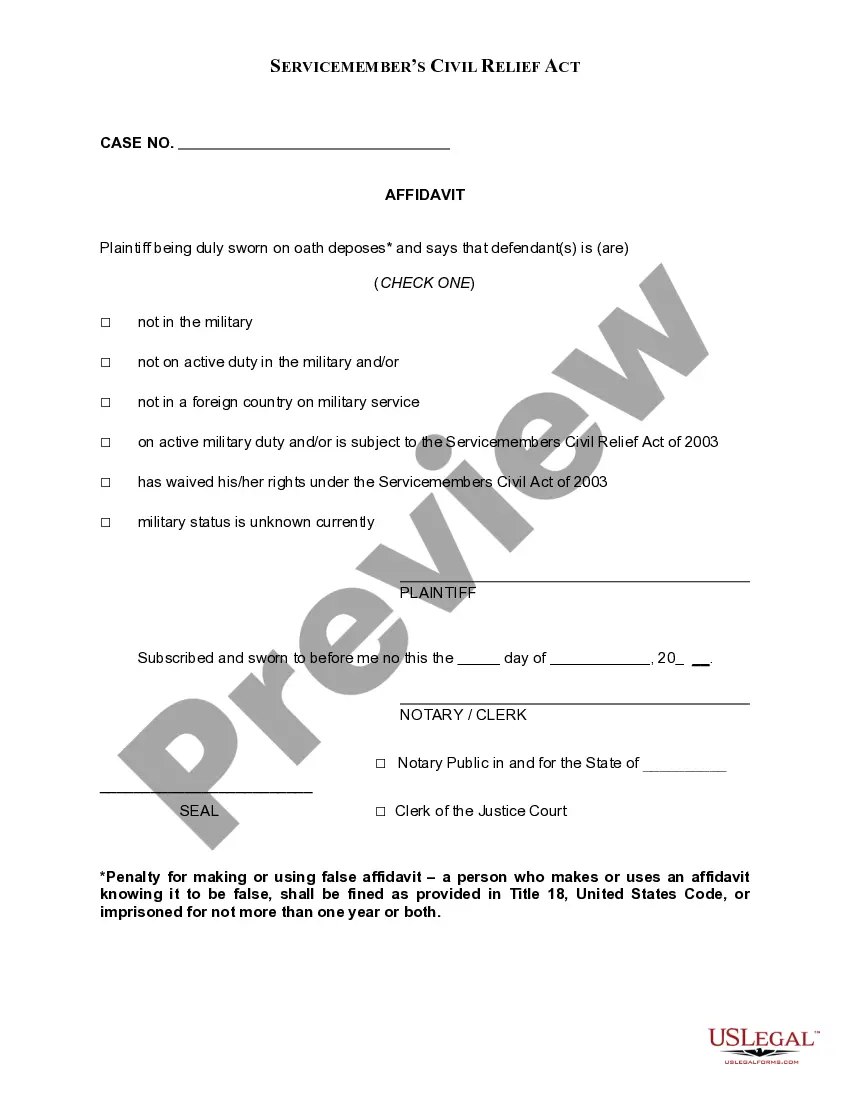

How to fill out Oklahoma Rental Lease Agreement For Business?

Are you situated in a location where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy versions is challenging.

US Legal Forms provides thousands of form templates, such as the Oklahoma Rental Lease Agreement for Business, designed to comply with federal and state regulations.

Once you find the appropriate form, click on Purchase now.

Choose the pricing plan you want, fill in the required details to set up your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oklahoma Rental Lease Agreement for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Use the Preview button to check the form.

- Review the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

In Oklahoma, a lease agreement does not typically need to be notarized to be valid. However, having a notary can enhance the document's credibility and provide greater legal protection. For the best practice, ensure you thoroughly review your Oklahoma Rental Lease Agreement for Business, as proper documentation is crucial.

Writing a business contract proposal involves defining the project's scope, timeline, and payment terms. Clearly articulate how the partnership will benefit both parties, and include standard legal language that may reference an Oklahoma Rental Lease Agreement for Business, ensuring all contractual obligations are specified.

A commercial real estate proposal should present a clear outline of the business opportunity, property information, and financial forecasts. Be sure to include detailed terms from the Oklahoma Rental Lease Agreement for Business to ensure all parties understand their responsibilities and expectations.

Exiting a commercial lease in Oklahoma typically involves checking the lease for break clauses or terms regarding early termination. Communication with your landlord can also lead to potential solutions. For a smoother transition, consult the terms in your Oklahoma Rental Lease Agreement for Business, and consider legal advice if necessary.

If a landlord does not sign the lease in Oklahoma, the lease may still be considered valid if both parties operate under its terms. However, it's always best to have a signed Oklahoma Rental Lease Agreement for Business to avoid any disputes. In such cases, consulting a legal expert can clarify any uncertainties.

A lease proposal outlines the terms and conditions a lessor offers to a prospective tenant. This document includes information on the rental rate, lease duration, property maintenance responsibilities, and other essential details. Having a clear and concise lease proposal is crucial when preparing an Oklahoma Rental Lease Agreement for Business.

The most common type of commercial lease is the gross lease, where the landlord covers property expenses, and the tenant pays a flat monthly rent. This arrangement simplifies budgeting for tenants since they do not have to worry about fluctuating costs. When formulating an Oklahoma Rental Lease Agreement for Business, understanding commercial lease types will help you negotiate favorable terms that align with your business strategy.

The most common commercial lease agreement is the triple net lease (NNN). In this arrangement, the tenant covers property taxes, insurance, and maintenance in addition to the base rent. This lease type is often preferred by landlords as it provides more predictable income while requiring tenants to manage operational costs. When considering an Oklahoma Rental Lease Agreement for Business, this structure may suit many business models.

An example of leasing in business would be a retailer leasing space in a shopping center. This arrangement allows the retailer to operate without purchasing real estate, preserving capital for operations. Using an Oklahoma Rental Lease Agreement for Business ensures that both the landlord and tenant understand their rights and obligations, creating a mutually beneficial relationship.

In Oklahoma, a lease does not need to be notarized to be legally binding; however, having it notarized can provide additional validation. This step can be particularly beneficial in creating an Oklahoma Rental Lease Agreement for Business, as it helps protect both parties by ensuring clarity in terms and conditions. Always ensure you have signed copies for both parties to avoid any disputes.

Interesting Questions

More info

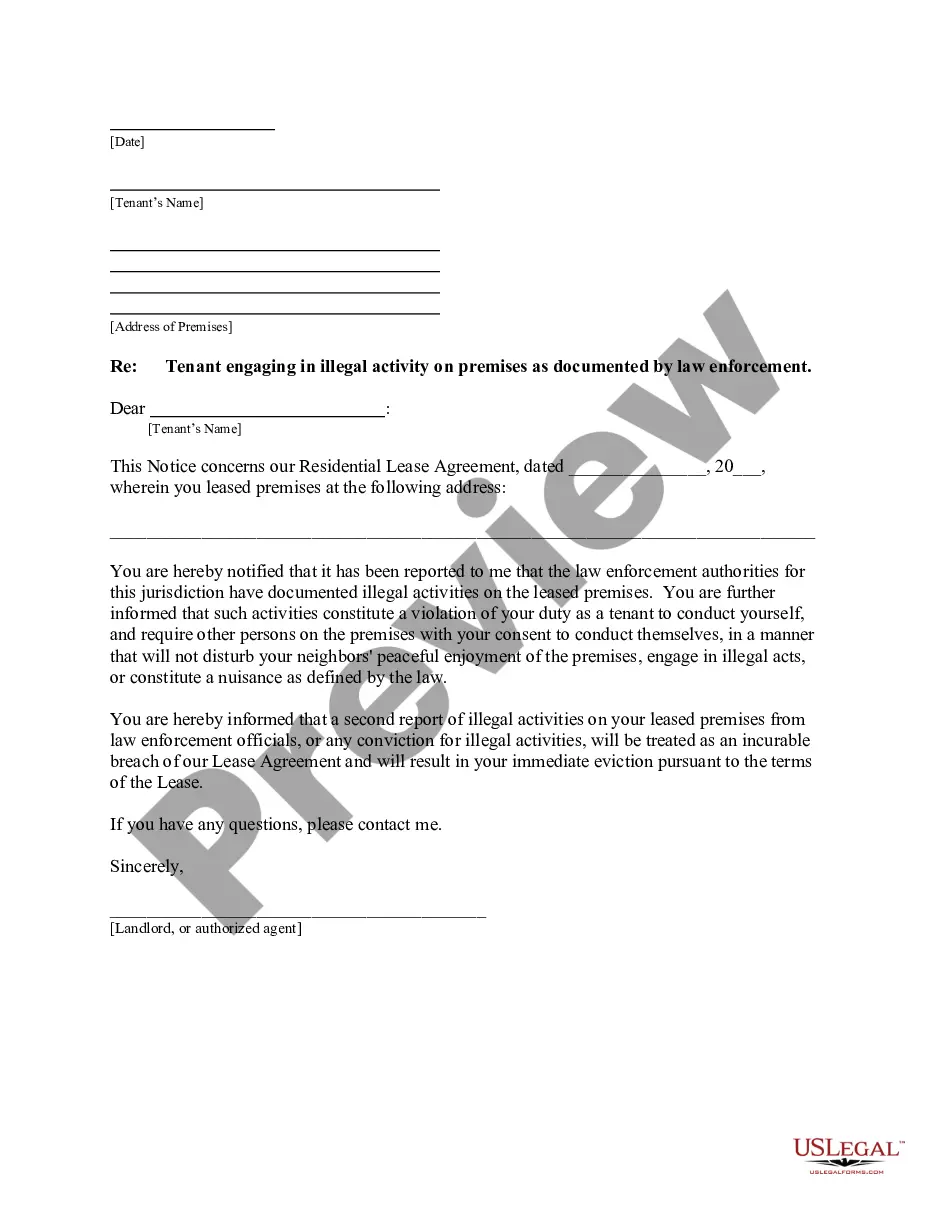

Ester agreement tenant rental lease with landlord and tenant's personal info tenant and landlord agreement.