The Oklahoma Agreement to Incorporate Close Corporation is a legally binding document that outlines the formation and incorporation of a close corporation in the state of Oklahoma. A close corporation, or closely-held corporation, is a type of corporation that is designed for small businesses, typically with a limited number of shareholders and a tightly controlled ownership structure. The agreement serves as a foundational document, setting forth the terms and conditions under which the close corporation will operate. It covers various aspects of the corporation, such as its purpose, structure, governance, and shareholder rights and responsibilities. By creating this agreement, the shareholders can establish clear guidelines for the management and operation of the close corporation, ensuring a well-structured and organized corporate environment. Some important keywords related to the Oklahoma Agreement to Incorporate Close Corporation include: 1. Oklahoma Corporation: The agreement is specific to the state of Oklahoma, indicating that it complies with the laws and regulations set forth by the state's corporate statutes. 2. Incorporation: The process of legally forming a corporation, with the close corporation being a specific type of corporation with a limited number of shareholders. 3. Close Corporation: Also known as closely-held corporation, it is a corporate structure that is often used by small businesses or family-owned enterprises, allowing for a more intimate and controlled ownership structure. 4. Shareholders: The individuals or entities who hold ownership shares in the close corporation and have a vested interest in its success. 5. Governance: The system and processes by which the close corporation is managed and controlled, including the roles and responsibilities of the shareholders, directors, and officers. 6. Purpose: The defined objectives and scope of activities that the close corporation will engage in, outlining its business focus and goals. 7. Shareholder Rights: The entitlements and privileges granted to the shareholders, including voting rights, distributions of profits, and participation in decision-making processes. In addition to the Oklahoma Agreement to Incorporate Close Corporation, there may be variations or supplemental agreements based on specific circumstances or shareholder preferences. For example, there could be variations that address specific industries or sectors, or agreements tailored for companies with different ownership arrangements, such as shareholder agreements for corporations owned by families or closely-knit groups. It is important to consult legal professionals or company advisors to ensure the relevance and accuracy of these alternative types of agreements within the state of Oklahoma.

Oklahoma Agreement to Incorporate Close Corporation

Description

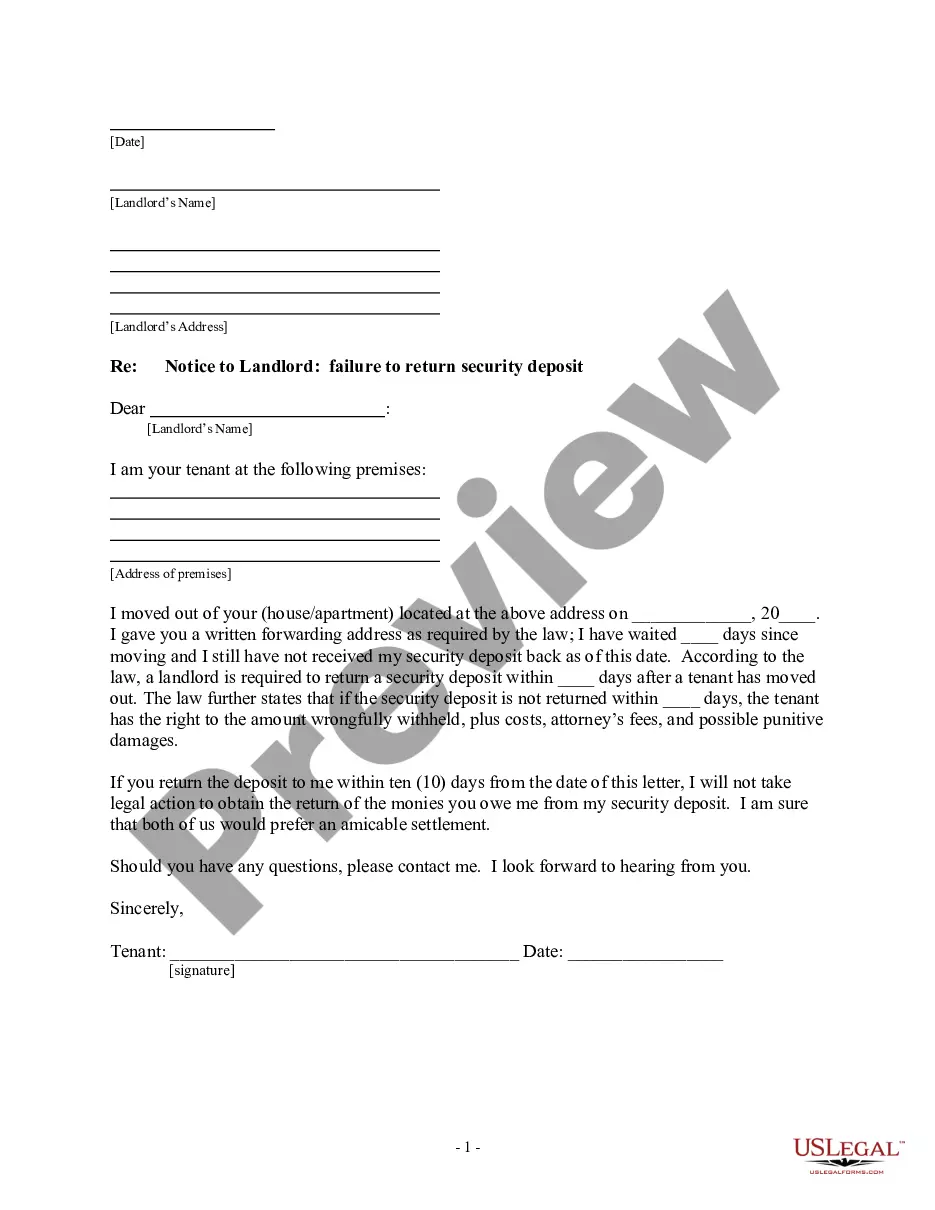

How to fill out Agreement To Incorporate Close Corporation?

Choosing the best legitimate document template could be a have a problem. Needless to say, there are a lot of web templates available on the net, but how can you get the legitimate develop you will need? Take advantage of the US Legal Forms site. The service delivers a huge number of web templates, such as the Oklahoma Agreement to Incorporate Close Corporation, that you can use for business and personal requirements. Every one of the kinds are checked by professionals and satisfy federal and state needs.

When you are currently authorized, log in for your profile and then click the Download option to have the Oklahoma Agreement to Incorporate Close Corporation. Make use of profile to appear with the legitimate kinds you may have bought formerly. Proceed to the My Forms tab of your profile and obtain an additional version from the document you will need.

When you are a brand new consumer of US Legal Forms, listed below are basic directions that you should follow:

- Very first, make certain you have selected the correct develop for your area/state. You are able to check out the shape making use of the Review option and browse the shape description to guarantee it is the right one for you.

- In the event the develop fails to satisfy your needs, utilize the Seach discipline to obtain the proper develop.

- When you are sure that the shape is proper, click on the Get now option to have the develop.

- Opt for the costs program you desire and enter the essential info. Make your profile and purchase an order with your PayPal profile or credit card.

- Pick the document structure and download the legitimate document template for your product.

- Total, change and produce and sign the obtained Oklahoma Agreement to Incorporate Close Corporation.

US Legal Forms may be the largest library of legitimate kinds in which you will find numerous document web templates. Take advantage of the company to download skillfully-manufactured documents that follow express needs.

Form popularity

FAQ

Statutory close corporations are limited to 50 or fewer shareholders. and affect voting and other rights, may be obtained without charge by a shareholder on written request to the corporation.? 3. Converting an Existing Corporation to a Statutory Close Corporation.

LLCs are considered pass-through entities for the purpose of US taxation; they don't file taxes in their own right, but have their income reported on the personal income tax returns of their owners. C corporations file their own tax returns.

How to Form a California Close Corporation Step 1: File the Articles of Incorporation with the California Secretary of State (required) ... Step 2: Prepare Corporate Bylaws. ... Step 3: Appoint the Corporation's Directors (required) ... Step 4: Hold a Board of Directors Meeting (required) ... Step 5: Issue Stock (required)

The difference lies primarily in the way that ownership, by way of shares, is distributed. In a close corporation, shares of the corporation are generally held by only a small number of people and are not available for sale or purchase in the public markets.

A Statutory Close Corporation is a corporation that has filed an election or supplement for special status in its Articles of Incorporation or through an amendment to its entity formation documents.

To start a corporation in Oklahoma, you'll need to do three things: appoint a registered agent, choose a name for your business, and file a Certificate of Incorporation with the Secretary of State. You can file this document online, by mail, or in person. The certificate costs a minimum of $50 to file.

Your Oklahoma Certificate of Incorporation can be submitted online, by mail, or in person. The filing fee is calculated at a rate of 1/10 of 1% ($1 per $1000) of total authorized capital. Minimum filing fees are included below. To file online, submit a Business Entity Filing on the Oklahoma Secretary of State website.

By structuring as a closed corporation when incorporating, a partnership can benefit from liability protection without dramatically changing the way that the business operates. It can also offer companies greater flexibility in operations, as they are free from most reporting requirements and shareholder pressure.