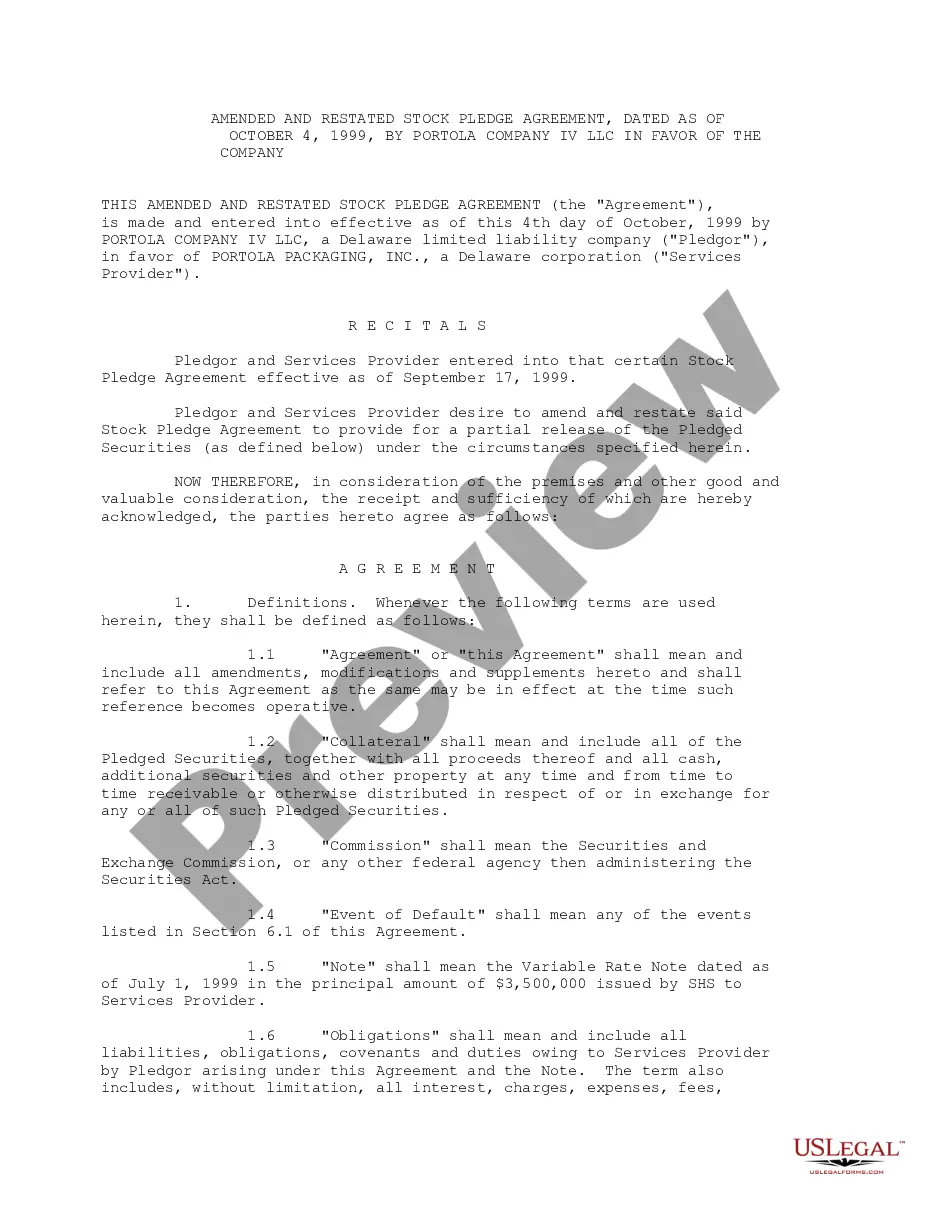

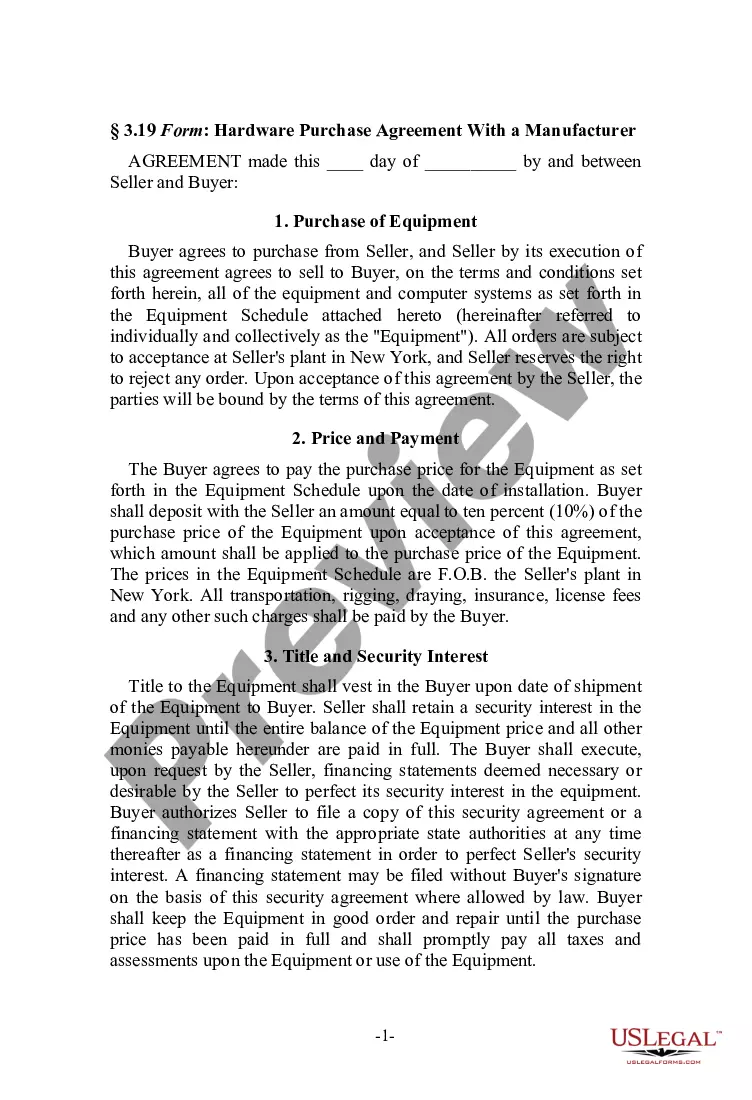

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Oklahoma Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

Are you presently in a location where you need documents for either professional or personal reasons frequently.

There are numerous legitimate document templates accessible online, but finding dependable versions is quite challenging.

US Legal Forms offers thousands of form templates, such as the Oklahoma Security Agreement with Farm Products as Collateral, that are designed to meet state and federal regulations.

Select a convenient document format and download your copy.

Explore all the document templates you have purchased in the My documents section. You can obtain another copy of the Oklahoma Security Agreement with Farm Products as Collateral whenever needed. Just select the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have your account, just Log In.

- Then, you can download the Oklahoma Security Agreement with Farm Products as Collateral template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and confirm it is for the correct area/state.

- Utilize the Review option to evaluate the form.

- Read the summary to ensure you have selected the correct template.

- If the form is not what you are looking for, use the Search field to find the template that suits you and your needs.

- If you find the appropriate template, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to set up your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

To file a UCC in Oklahoma, you must complete a UCC financing statement, which provides details about the parties involved and the collateral. This filing is submitted to the Oklahoma Secretary of State's office, where it becomes a public record. Utilizing platforms like uslegalforms can simplify this process, offering templates and guidance for your Oklahoma Security Agreement with Farm Products as Collateral. Following proper filing procedures ensures your interests are protected and easily identifiable.

Yes, Oklahoma adheres to the Uniform Commercial Code, which standardizes business laws across the United States. This code governs various transactions, including secured transactions that involve an Oklahoma Security Agreement with Farm Products as Collateral. By following the UCC, Oklahoma ensures consistency and predictability in commercial law, making it easier for businesses and lenders to engage. It also establishes clear guidelines for filing and enforcement.

Yes, Oklahoma has adopted the Uniform Commercial Code, which governs various aspects of commercial transactions, including security agreements. This adoption provides a legal framework for lenders and borrowers in Oklahoma. If you are engaging in an Oklahoma Security Agreement with Farm Products as Collateral, it is vital to comply with UCC regulations.

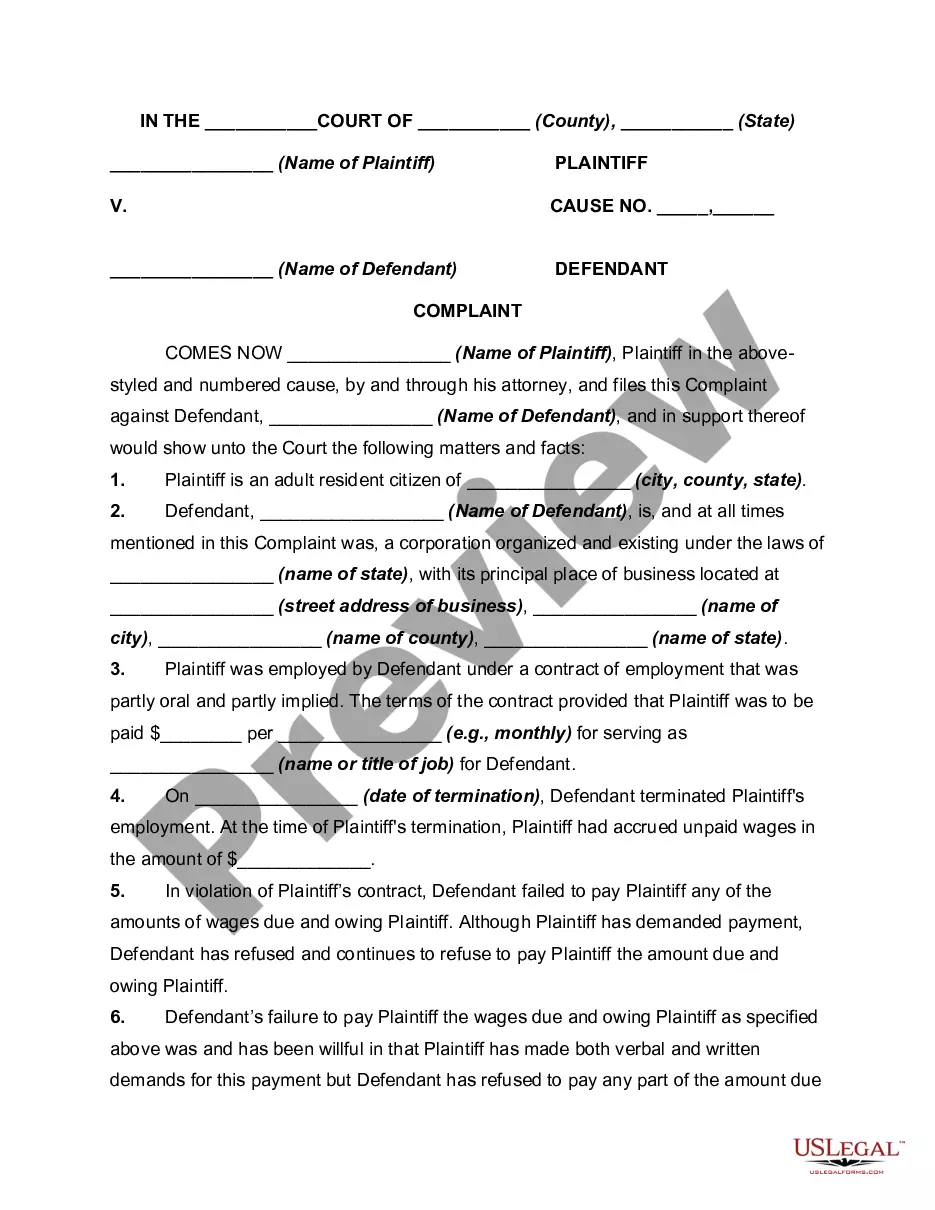

To perfect collateral, you generally need to file a UCC financing statement. This filing puts other creditors on notice about your security interest, ensuring that your rights to the collateral are protected. By properly perfecting your Oklahoma Security Agreement with Farm Products as Collateral, you enhance your security position in case of debtor default.

UCC stands for the Uniform Commercial Code, which is a set of laws that govern commercial transactions in the United States. This code provides a consistent framework for security interests, including those indicated in Oklahoma Security Agreements with Farm Products as Collateral. It's important to understand UCC regulations when entering into secured transactions.

UCC filings in Oklahoma are typically valid for five years from the date of filing. After this period, you will need to renew the filing to maintain your security interest. If your interests involve an Oklahoma Security Agreement with Farm Products as Collateral, keeping track of these timelines is essential for protecting your rights.

A UCC filing in Oklahoma is a notice that a lender or creditor has a legal interest in the personal property of a debtor. This filing is part of the Uniform Commercial Code process and serves to inform other parties about the security interest. Understanding this is key when you are dealing with an Oklahoma Security Agreement with Farm Products as Collateral.

Security agreement collateral is the asset or property that secures the payment or performance of an obligation. In the case of an Oklahoma Security Agreement with Farm Products as Collateral, the collateral typically includes crops, livestock, or any farm products. This collateral provides the lender with a guarantee of repayment.

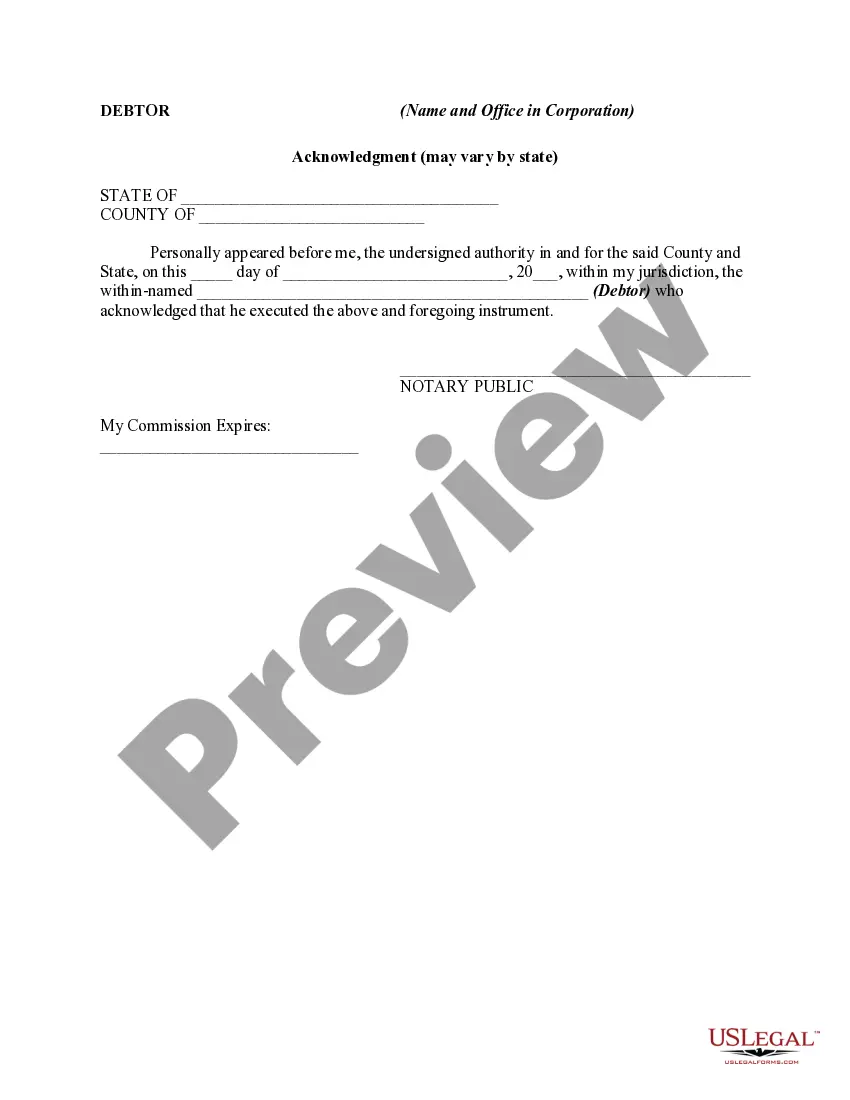

To create a security interest, you need a security agreement that identifies the collateral, such as farm products. The agreement must be signed by the debtor and the secured party. This process is crucial in establishing your Oklahoma Security Agreement with Farm Products as Collateral to protect your investment.

You can continue an expired UCC by filing a financing statement to renew the security interest. It is important to remember that the new filing must be submitted before the expiration date to maintain your rights. If your Oklahoma Security Agreement with Farm Products as Collateral has expired, consider consulting with a legal expert for guidance.