A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

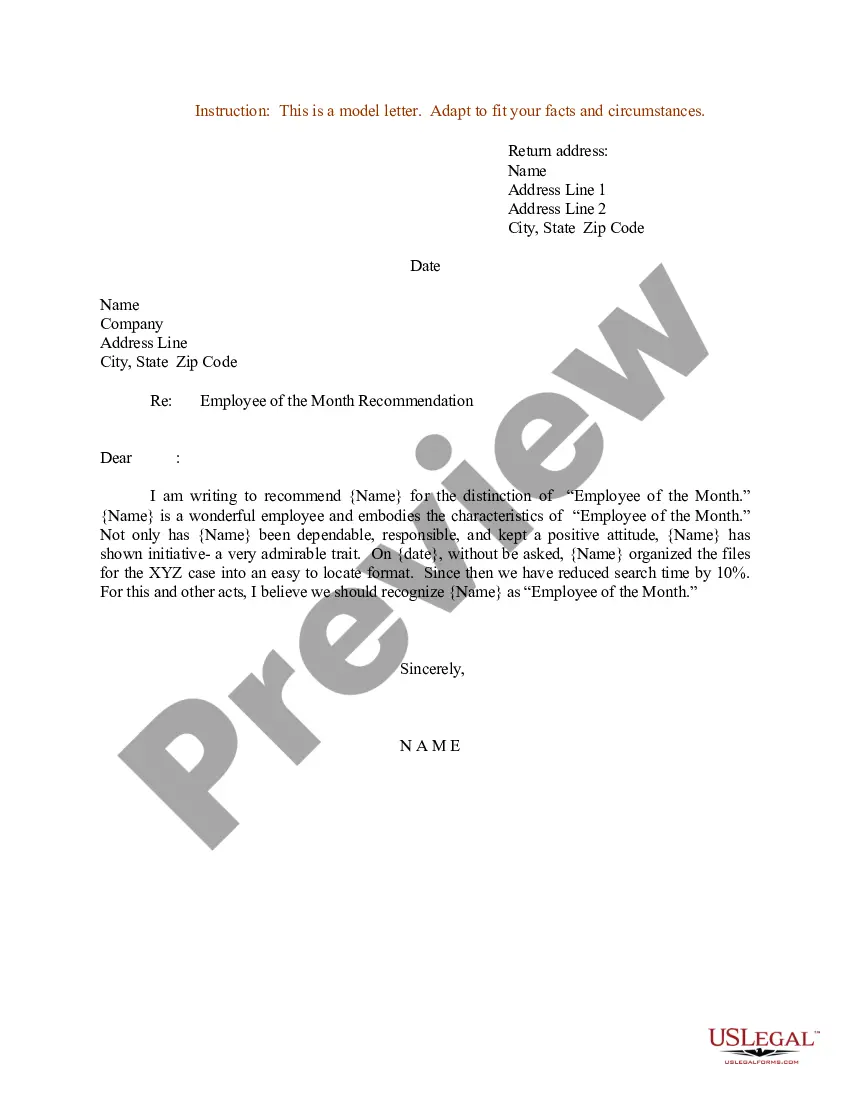

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders in just moments.

If the form does not meet your needs, use the Search bar at the top of the page to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred payment plan and provide your credentials to register for an account.

- If you already have a subscription, Log In and download the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders from your US Legal Forms library.

- The Download option will appear on every form you view.

- Access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure that you have chosen the correct form for your city/region.

- Select the Review option to examine the content of the form.

Form popularity

FAQ

The eleven-word phrase to stop debt collectors is: 'I request that you cease all communication with me.' This statement can halt communication from collectors while you review your debt situation. Understanding the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders is vital if you are a corporate stockholder dealing with persistent debt issues. You may also want to reach out to professionals who can guide you through this process.

In Oklahoma, a debt typically becomes uncollectible after five years, depending on the type of debt. This means creditors cannot sue you for recovery after this period. However, the situation could differ for stockholders under the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders due to potential personal liability. Understanding your circumstances is crucial for addressing your financial health.

After five years, unpaid debt may become uncollectible in Oklahoma due to the statute of limitations. This means that creditors can no longer take legal action to recover the amount owed. However, if the debt is related to the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders, there may be exceptions worth investigating. Staying informed about your debts can help you manage your financial obligations effectively.

Title 18 Chapter 22 of the Oklahoma statutes concerns the rights and obligations of corporations in the state. It outlines regulations regarding corporate governance, including how debts are handled. For stockholders, this chapter is critical because it relates to the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders, which plays a significant role in corporate finance. Understanding these laws can help prevent unexpected liabilities.

Yes, Oklahoma has a statute of limitations on debt collection, which varies depending on the type of debt. Generally, the statute is five years for most debts. However, if you face issues with unpaid business debts, understanding the implications of the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders is essential. It's critical to know your rights and obligations.

An example of a corporate guarantee occurs when a parent company guarantees the loans of its subsidiary. This arrangement enhances the subsidiary’s borrowing capacity and reassures lenders. The Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders serves as a framework where such guarantees can be legally enforced and beneficial for corporate operations.

The difference between a corporate guarantee and a personal guarantee lies in who assumes the risk. A corporate guarantee relieves an individual by making a corporation accountable for obligations. Conversely, a personal guarantee binds an individual to ensure the debts, highlighted by structures like the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

The three primary types of guarantees are personal guarantees, corporate guarantees, and bank guarantees. Each type serves different purposes and levels of liability. Understanding these guarantees, especially in relation to the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders, is vital for any business owner.

A corporate guarantee involves a corporation backing the obligations of another business, whereas a bank guarantee is an assurance from a financial institution to cover a borrower’s debts. Corporate guarantees often facilitate credit, while bank guarantees serve as a financial safety net. Both can be crucial in managing risks associated with the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

A corporate guarantee is a legally binding commitment made by a corporation to assume responsibility for another company’s financial obligations. This mechanism enhances creditworthiness and can facilitate smoother business transactions. Often, the Oklahoma Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a specific example of such arrangements.