A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

If you need to summarize, obtain, or create official document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card, debit card, or PayPal account to process the transaction.

- Use US Legal Forms to obtain the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust.

- You can also access forms you have previously saved in the My documents section of your profile.

- If you’re using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

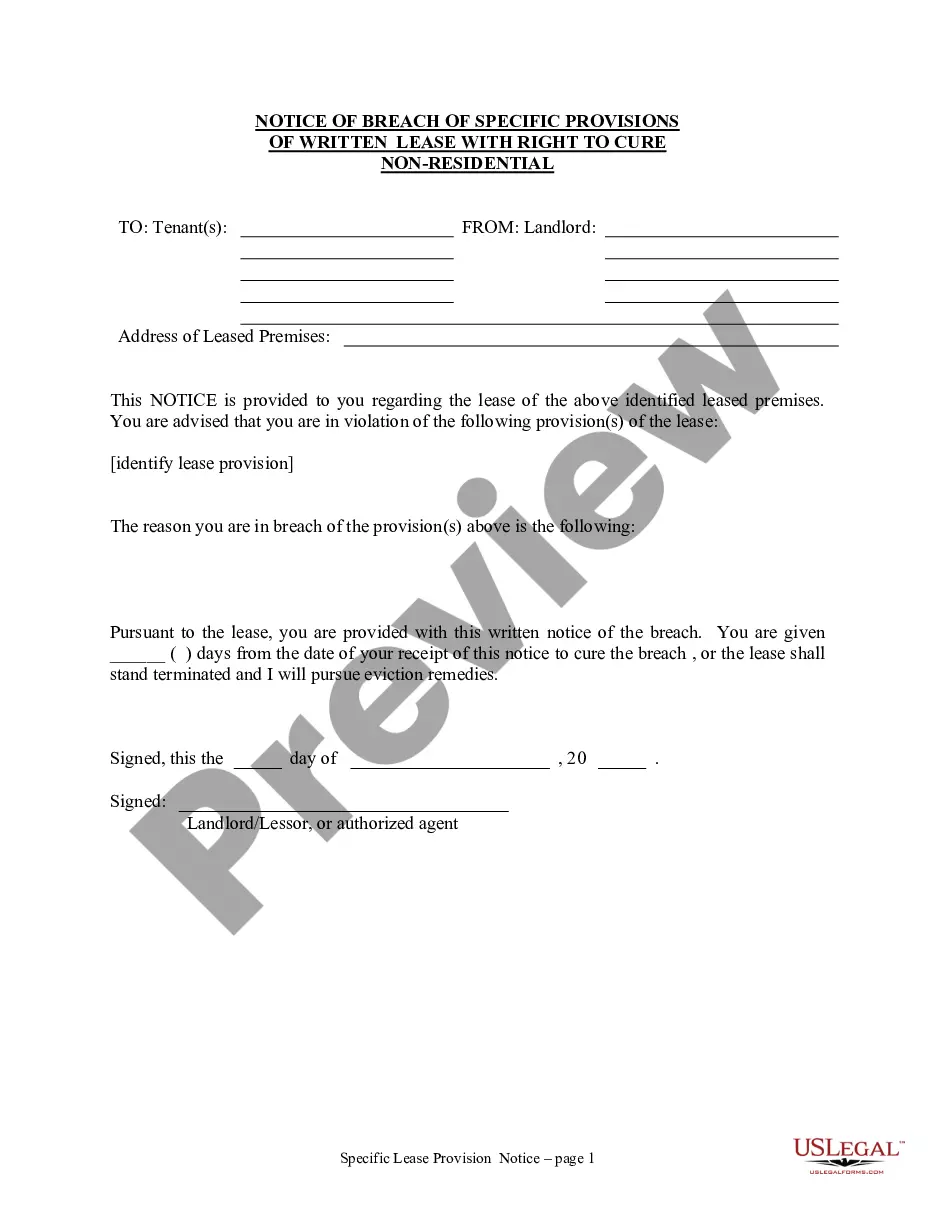

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form design.

Form popularity

FAQ

The Slayer statute in Oklahoma prevents an individual who unlawfully takes the life of another person from benefiting from that person's estate. This statute applies not only to inheritance but also to trust assets, ensuring that a person cannot profit from their wrongdoing. Understanding the implications of the Slayer statute is crucial, especially for trustors considering the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust to protect their interests.

Revocation of trust refers to the process where a trustor nullifies a trust agreement they established. This means that the trust is no longer effective, and the trustor regains control over the trust property. In the context of the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust, it is essential to properly execute documentation to ensure a smooth transition of assets back to the trustor.

One disadvantage of a family trust is that it may limit flexibility for beneficiaries, particularly when circumstances change. Moreover, family trusts can sometimes lead to strained relationships if family members disagree on asset management. To maintain clarity and prevent disputes, an Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust is critical in highlighting intentions.

There are several pitfalls when setting up a trust, such as selecting an unsuitable trustee or not funding the trust appropriately. These issues can lead to legal challenges and financial mismanagement. By ensuring clarity in the trust's specifics, including the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust, you can mitigate these risks effectively.

While trusts provide many benefits, they can also lead to complications if not managed properly. For instance, a trust can incur annual fees and require ongoing oversight, which might be burdensome for some families. Understanding these aspects helps in creating a solid plan that takes into consideration the Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust.

To revoke a trust in Oklahoma, the trustor must execute a written document indicating their intent to revoke the trust. This document should be signed and dated, and it is advisable to obtain legal assistance to ensure the revocation complies with state laws. Once revocation occurs, an Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust should be provided to detail the transfer of property back to the trustor.

When the trustor of a revocable trust passes away, the trust typically becomes irrevocable. At this point, the designated trustee must follow the terms outlined in the trust document, distributing assets as intended. An important part of this process includes issuing an Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust to formalize the changes after the trustor’s death.

A common error parents make is underestimating the complexity of their estate and not addressing potential tax implications. This oversight can result in unexpected costs and complications for beneficiaries. Ensuring proper management of the trust and including an Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust can significantly reduce these challenges.

One of the biggest mistakes parents often make when establishing a trust fund in the UK is failing to clearly define the terms of the trust. Without explicit guidelines, beneficiaries may not fully understand their rights, which can lead to disputes in the future. It's crucial to have a written record, including an Oklahoma Receipt by Trustor for Trust Property Upon Revocation of Trust, to clarify the intentions of the trustor.

A trust can become null and void due to several reasons, including lack of proper execution, impossibility of trust purposes, or changes in law that render it unenforceable. If the trust terms are unclear or violate public policy, it may also be deemed invalid. To avoid these issues, carefully creating and maintaining the trust documents is essential. Consulting with uslegalforms can help clarify these complexities and establish a valid trust.