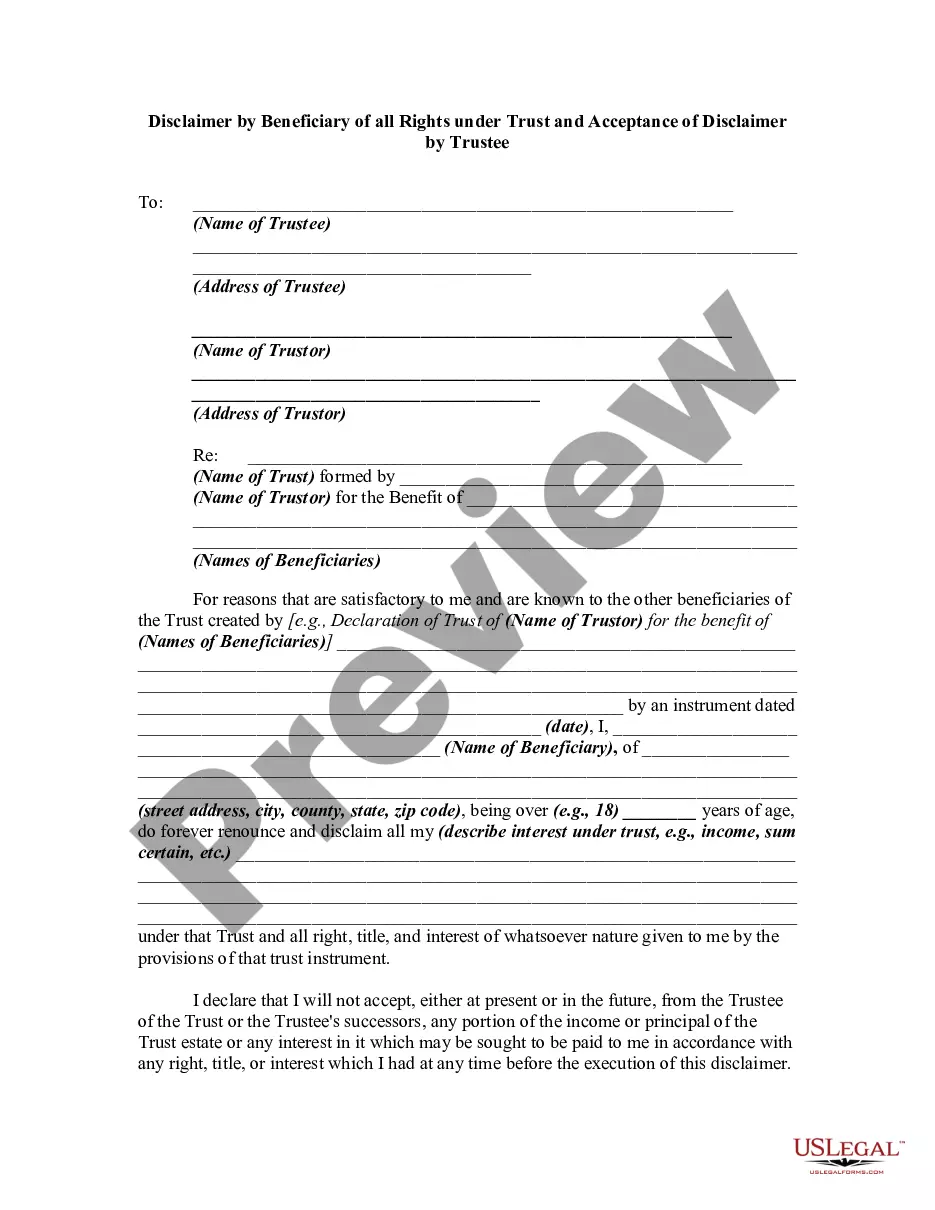

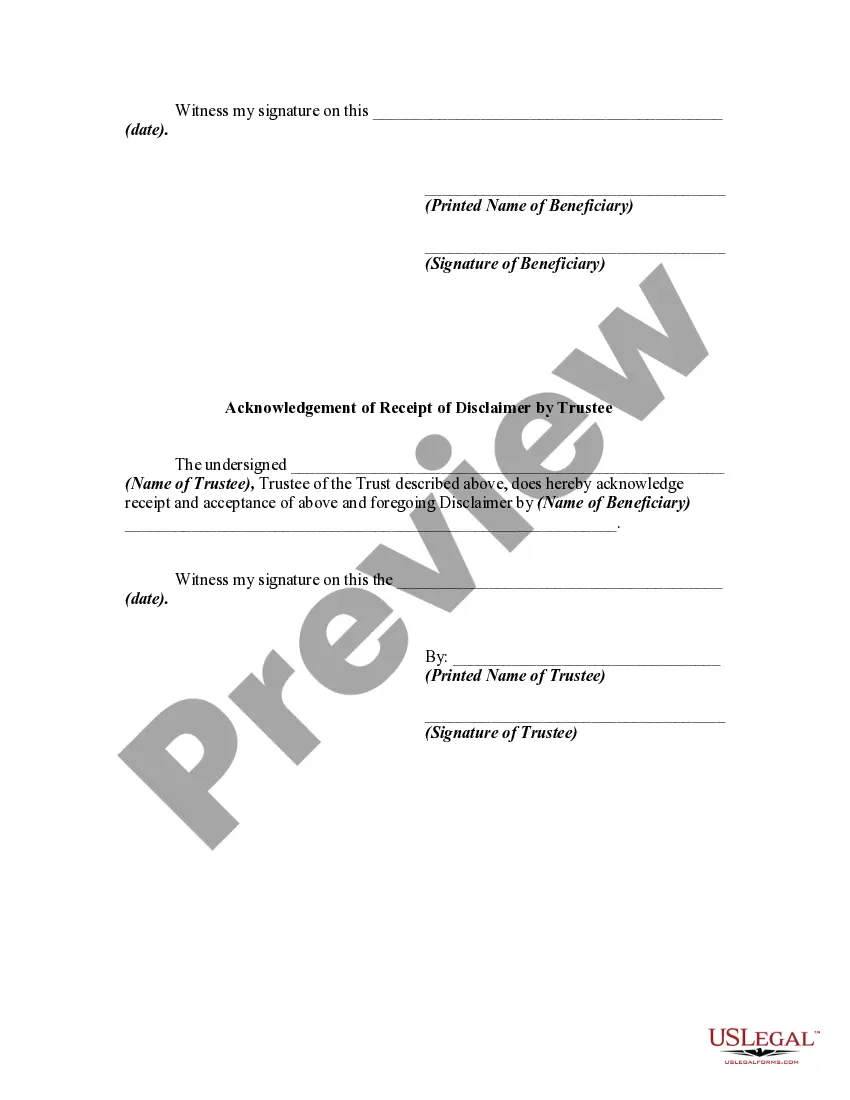

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal template formats that you can download or print. By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest forms, such as the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, in just a few minutes.

If you have an existing subscription, Log In and retrieve the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously obtained forms in the My documents section of your account.

Complete the purchase using your credit card or PayPal account.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Each format you have purchased does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure that you have selected the correct form for your area or county.

- Click the Review button to examine the content of the form.

- Read the form description to ensure you have selected the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A disclaimer trust is an estate planning tool that allows beneficiaries to refuse their share of an inheritance, redirecting it into a trust for future distribution. For instance, if a spouse receives an inheritance but prefers a trust to manage funds for children, they can utilize an Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This arrangement protects the assets and provides structured financial support for the intended beneficiaries.

A disclaimer of inheritance rights occurs when a beneficiary refuses their right to inherit property from a decedent’s estate. For example, if a family member is named as a beneficiary in a will but does not want to accept the inheritance due to tax implications or personal reasons, they can file an Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This legal act allows the property to pass to the next beneficiary, ensuring clarity and compliance with the law.

Anyone who meets legal qualifications can potentially be the trustee of a disclaimer trust. Typically, it's someone who understands financial management and trust obligations. A trusted family member or a financial institution is often suitable choices. Selecting a qualified trustee ensures proper execution of your wishes, especially surrounding the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

While disclaimer trusts offer benefits, they can also pose challenges. Some common issues include potential disputes among beneficiaries and complexities around asset division. Additionally, strict timelines must be followed for disclaiming assets, which can lead to confusion. Being aware of these pitfalls allows for smoother handling of an Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

The main difference lies in flexibility and control. A disclaimer trust allows a beneficiary to refuse inheritance, making it more adaptable in certain situations. In contrast, an irrevocable trust locks assets away, preventing any changes once established. Understanding these distinctions can help you determine which trust type best suits your estate planning needs, especially in light of Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

A disclaimer trust often has flexibility regarding who can act as the trustee. Generally, the beneficiary of the trust might also serve, provided they meet the legal requirements. However, it’s wise to choose a trustee who is impartial to ensure fair management of trust assets. Always ensure that whoever you select can act in the best interests of all parties involved in the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

In the context of an Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, a trustee can be an individual or a corporate entity. It's essential that the trustee is trustworthy and capable of managing the trust's assets responsibly. Typically, family members, friends, or financial institutions serve in this role. Always consider appointing someone knowledgeable about trust laws to navigate complexities effectively.

Section 60.1 of Title 22 refers to the statutes governing the validity of disclaimers in trusts and estates in Oklahoma. This section outlines the necessary criteria for a valid disclaimer to take place, ensuring that it meets the legal standards set forth by the state. If you are navigating this process, recognizing the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can be vital for effective compliance.

In Oklahoma, property may be considered abandoned after a specified period of inactivity, typically one to five years depending on the type of property. For real estate, the abandonment process generally requires the original owner to demonstrate a lack of intent to maintain ownership. When dealing with trust matters, including the Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, understanding these timelines is important.

To disclaim an inheritance in Oklahoma, you must file a written disclaimer with the trustee or the court within nine months of the inheritance's occurrence. Your disclaimer should clearly state your intent to refuse the benefits. Utilizing the right resources, like US Legal Forms, can help streamline the process of making an Oklahoma Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.