Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

How to fill out Investment Letter Promising Not To Violate Exemption Of Intrastate Offering?

If you need to thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal use are categorized by type and state or keywords.

Every legal document template you obtain is yours indefinitely. You have access to all forms you downloaded within your account.

Stay competitive and acquire and print the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal requirements.

- Employ US Legal Forms to acquire the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

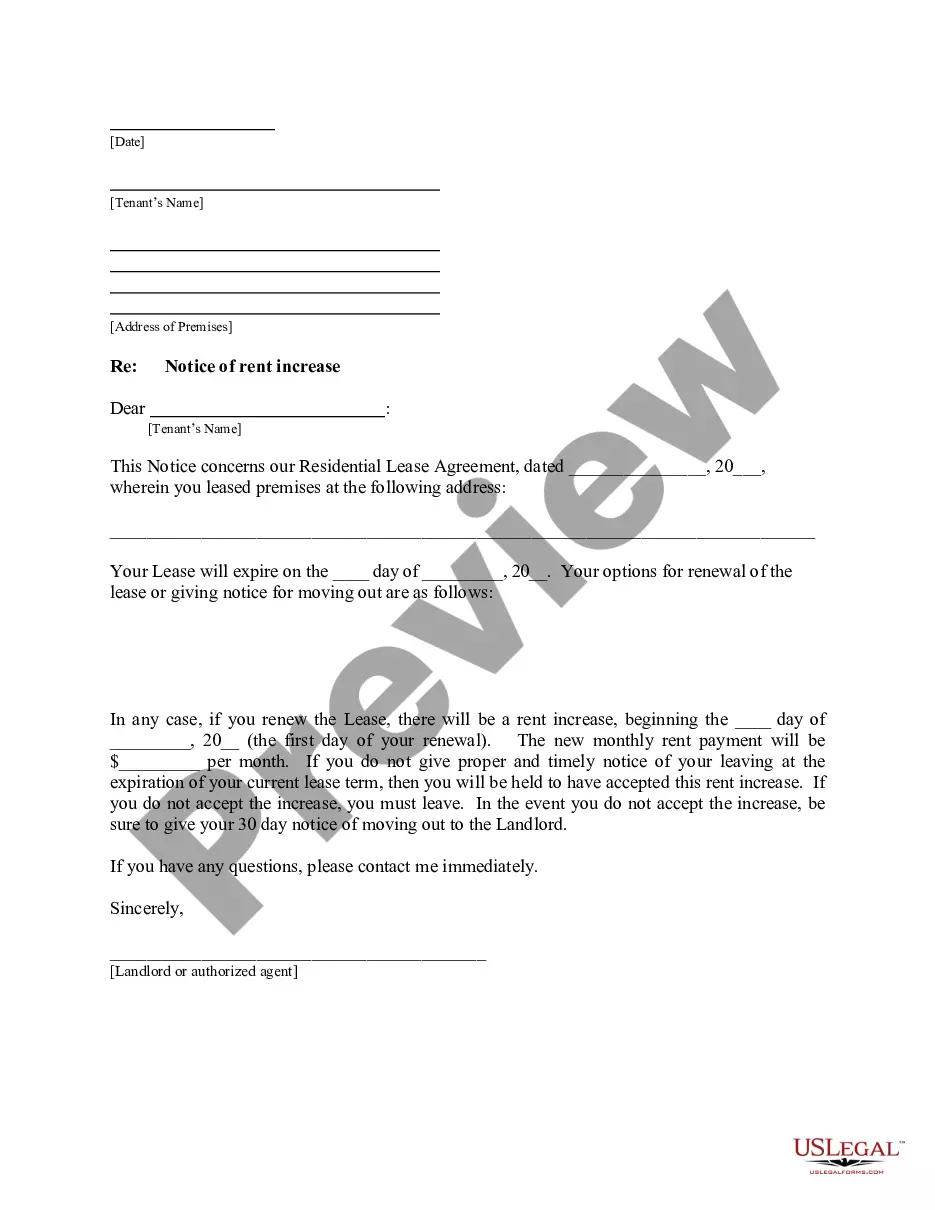

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format.

- Step 4. Once you have located the form you need, click the Get now button. Select the payment plan you prefer and enter your credentials to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering.

Form popularity

FAQ

Rule 147 for intrastate offerings stipulates that companies can offer securities to residents of their home state without SEC registration, provided they meet specific requirements. This rule aims to encourage local investment and support economic growth within states. Therefore, businesses must prepare an Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering to ensure compliance with these regulatory obligations.

Regulation 147 outlines the legal framework for intrastate offerings, allowing small businesses to raise capital without federal registration requirements. This regulation is particularly beneficial for local businesses aiming to attract investors within their own states. If you are in Oklahoma, it is vital to create an Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering to adhere to these rules effectively.

One common misconception about rule 147 is that it allows companies to sell securities outside their home state. In reality, rule 147 restricts intrastate offerings solely to residents of that state. Thus, for businesses in Oklahoma, crafting an Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering is crucial to comply with this regulation.

The 147 rule is a guideline that helps businesses raise capital without registering their offerings with the SEC. This rule allows companies to sell securities to residents of the same state, provided they meet specific conditions. For entrepreneurs in Oklahoma, understanding the 147 rule is essential, especially when creating an Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering.

An exempt transaction typically involves securities sales that comply with regulatory exemptions, allowing for simplified fundraising processes. Examples include private placements under Regulation D or intrastate offerings that restrict sales to state residents. Understanding what qualifies as an exempt transaction is vital for businesses seeking to raise capital efficiently. Utilizing the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering can help clarify these distinctions.

Yes, intrastate offerings can be exempt transactions if they meet the established criteria. These offerings primarily allow companies to raise funds from in-state investors without federal registration. However, issuers must be careful to comply with state regulations and the specifics of the exemption. The Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering can help to ensure that your offering remains compliant.

An exempt transaction could include a private placement to accredited investors under Regulation D or a local offering under state law. These transactions often do not require extensive regulatory oversight, making them less burdensome for small businesses. However, it’s essential to confirm that all requirements are met to maintain the exempt status. The Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering can provide guidance in evaluating exempt transactions.

Regulation D offerings can be exempt, but they come with their own regulations and guidelines. Specifically, these offerings allow companies to raise capital by selling securities to accredited investors without registering with the SEC. It is crucial for businesses to ensure they adhere to the conditions set forth in Regulation D to maintain this exemption. Consider the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering as a helpful tool to navigate these complexities.

Rule 147 intrastate offerings are exclusive to investors within the same state as the issuer. This makes it vital to understand the residency requirements before proceeding with investments. Additionally, issuers must hold onto the securities for a specific period, further ensuring that the offerings remain local. By using the Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering, you can clarify these important details for potential investors.

Rule 147A provides a set of guidelines for intrastate offerings that allow companies to raise capital without federal registration. This rule is designed to support smaller businesses by simplifying the process for local investors. Under this rule, issuers can offer securities to residents of their home state while enjoying the benefits of an exemption. The Oklahoma Investment Letter Promising not to Violate Exemption of Intrastate Offering can assist in adhering to these guidelines.