Oklahoma Owner Financing Contract for Car

Description

How to fill out Owner Financing Contract For Car?

Are you currently situated in a location where you require documentation for both corporate or personal reasons almost every day.

There are numerous legally approved document templates available online, but finding forms you can trust isn’t simple.

US Legal Forms provides a wide array of form templates, including the Oklahoma Owner Financing Contract for Car, that are created to fulfill both state and federal requirements.

Select a suitable paper format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Oklahoma Owner Financing Contract for Car at any time, if needed. Click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oklahoma Owner Financing Contract for Car template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

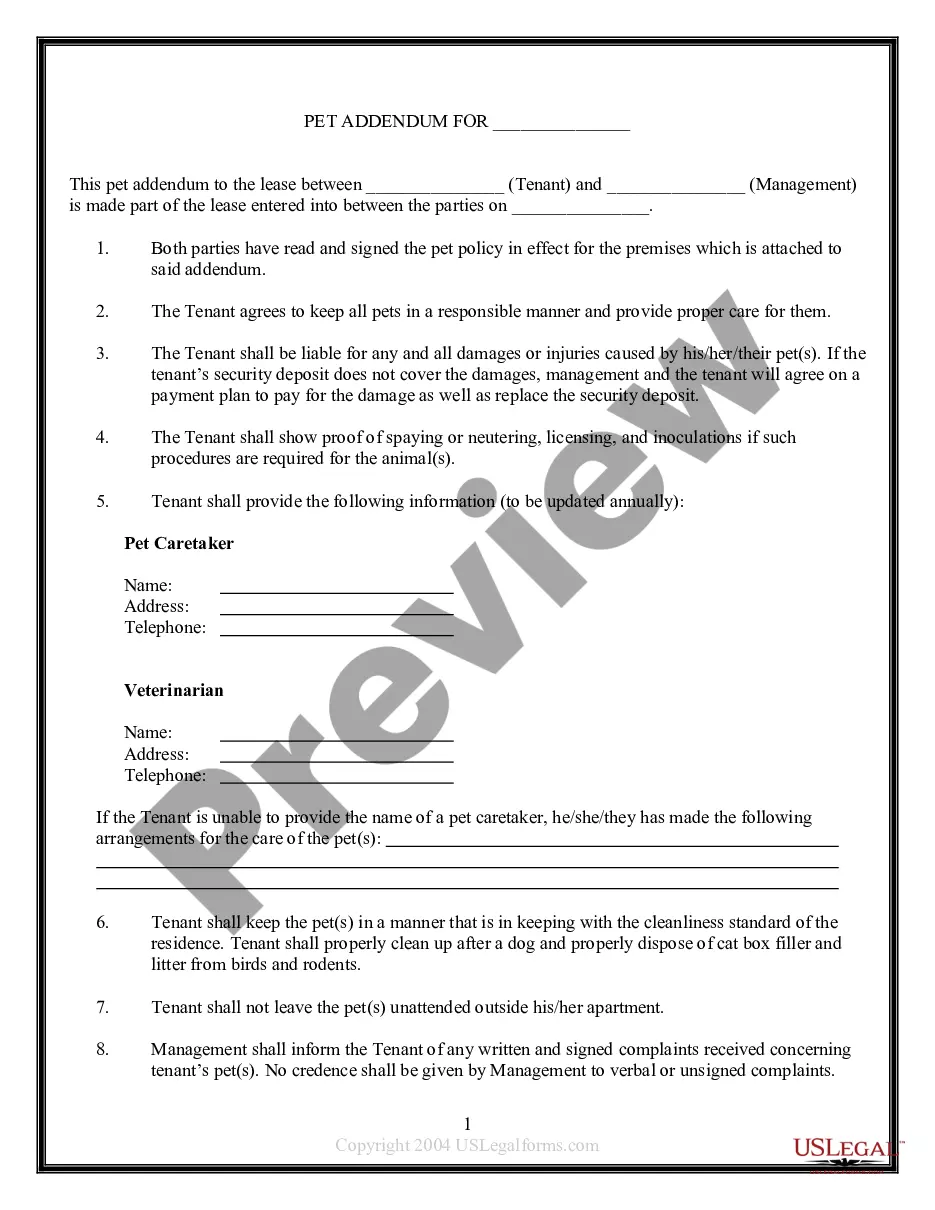

- Utilize the Review option to assess the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- If you locate the correct form, click Acquire now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Typically, the seller initiates the owner financing setup by proposing terms to the buyer. However, it’s advisable for both parties to consult legal professionals to ensure compliance with Oklahoma laws. Resources like USLegalForms can assist with creating a comprehensive Oklahoma Owner Financing Contract for Car.

Setting up an owner financing contract involves drafting a detailed agreement that outlines the payment terms, interest rates, and responsibilities of both parties. Using an Oklahoma Owner Financing Contract for Car template can simplify this process. Platforms like USLegalForms provide customizable templates to meet your specific needs.

If a buyer defaults on an owner financing agreement, the seller can initiate repossession of the vehicle. The specific procedures for this process are detailed in the Oklahoma Owner Financing Contract for Car. Sellers need to be prepared for these contingencies and to understand their rights during such situations.

In owner financing agreements, the seller holds the deed as security until the buyer completes their financial obligations. This arrangement is designed to provide both parties with a clear understanding of ownership and payment terms. Hence, understanding this aspect is crucial when entering into an Oklahoma Owner Financing Contract for Car.

The downside of owner financing involves the potential for higher interest rates and the responsibility placed on the seller for any defaults. Furthermore, if the buyer cannot keep up with payments, the seller may face legal challenges in reclaiming the vehicle. It’s essential to be fully informed about these risks when considering an Oklahoma Owner Financing Contract for Car.

In an Oklahoma Owner Financing Contract for Car, the lender does not typically hold the deed. Instead, the seller retains the deed until the buyer fulfills all terms of the financing agreement. This arrangement allows the seller to have a level of security while the buyer makes regular payments.

When considering an Oklahoma Owner Financing Contract for Car, it's important to know common terms. Typically, these contracts include a down payment, which can vary, followed by a series of monthly payments that cover both principal and interest. Interest rates are often flexible, allowing you to negotiate terms that suit your budget. Additionally, the contract duration generally ranges from a few months to several years, giving you the freedom to choose a plan that fits your financial situation.

An example of owner financing in the context of an Oklahoma Owner Financing Contract for Car could involve a seller who agrees to finance the car for the buyer directly. Imagine a seller offering a $15,000 car, where the buyer pays a $3,000 down payment and the remaining $12,000 financed over 36 months with a specified interest rate. This arrangement allows the buyer to make monthly payments directly to the seller, facilitating ownership without traditional financing methods. US Legal Forms provides the necessary tools to draft such agreements appropriately.

While owner financing offers flexibility, there are certain pitfalls to consider. The primary concern is the potential for non-payment, which can affect your financial standing when using an Oklahoma Owner Financing Contract for Car. Additionally, you may face difficulties if the buyer defaults, leading to legal complications. To navigate these challenges, consider the resources available on uslegalforms, which provide templates and guidelines to create comprehensive agreements.

Yes, owner financing is legal in Oklahoma. When utilizing an Oklahoma Owner Financing Contract for Car, the seller and buyer can agree on terms that suit both parties. It's important to follow state regulations and ensure the contract is properly written to protect your interests. Engaging with a platform like uslegalforms can help you create a legally binding agreement.