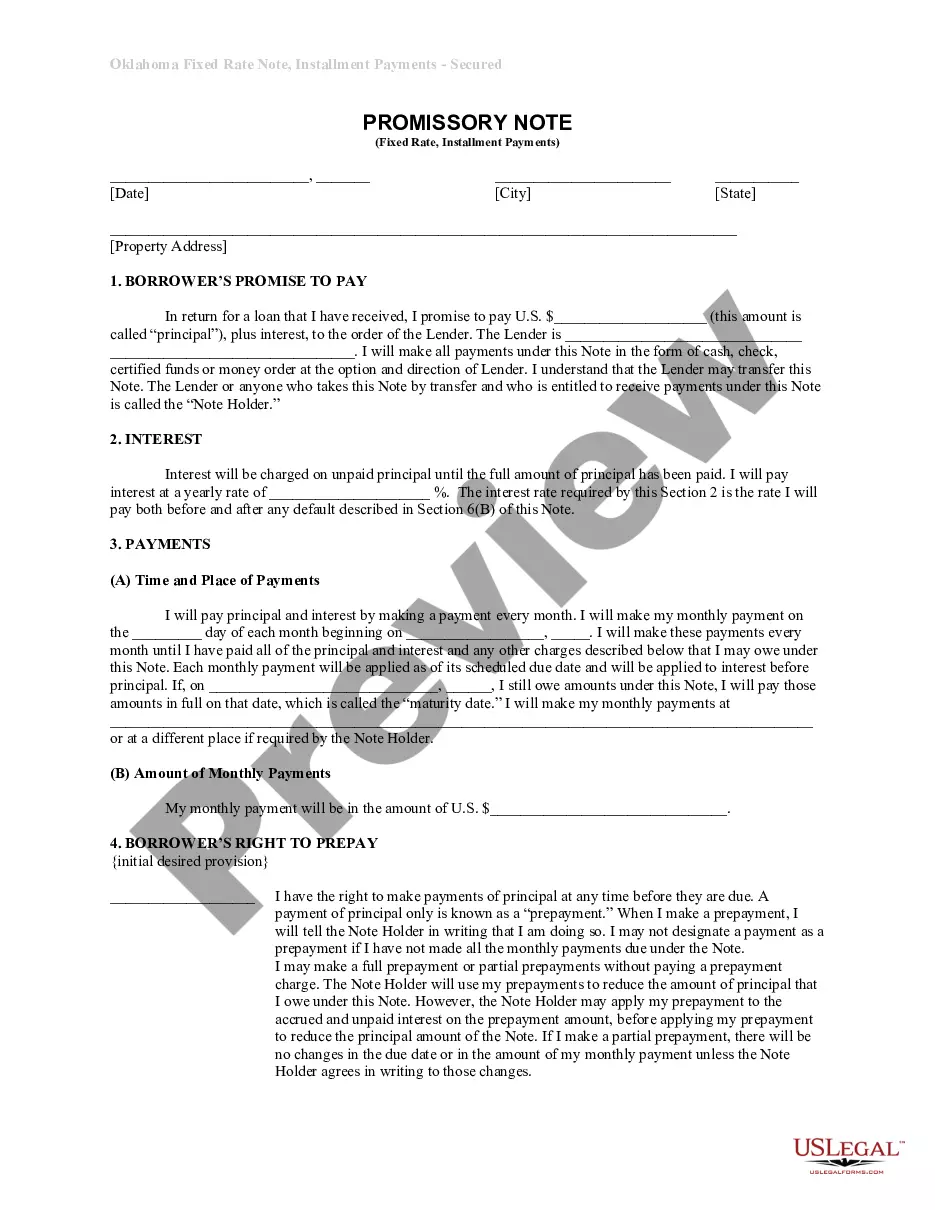

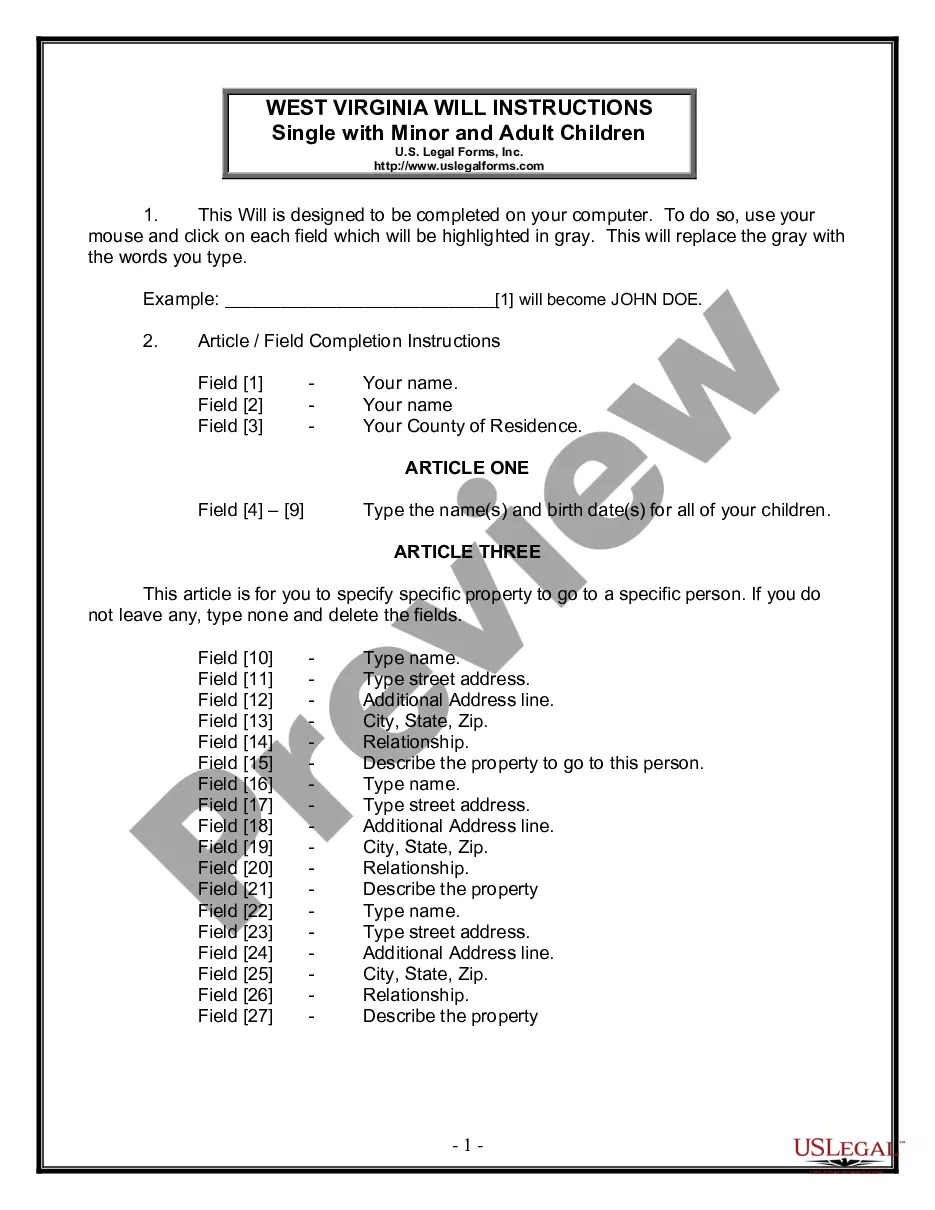

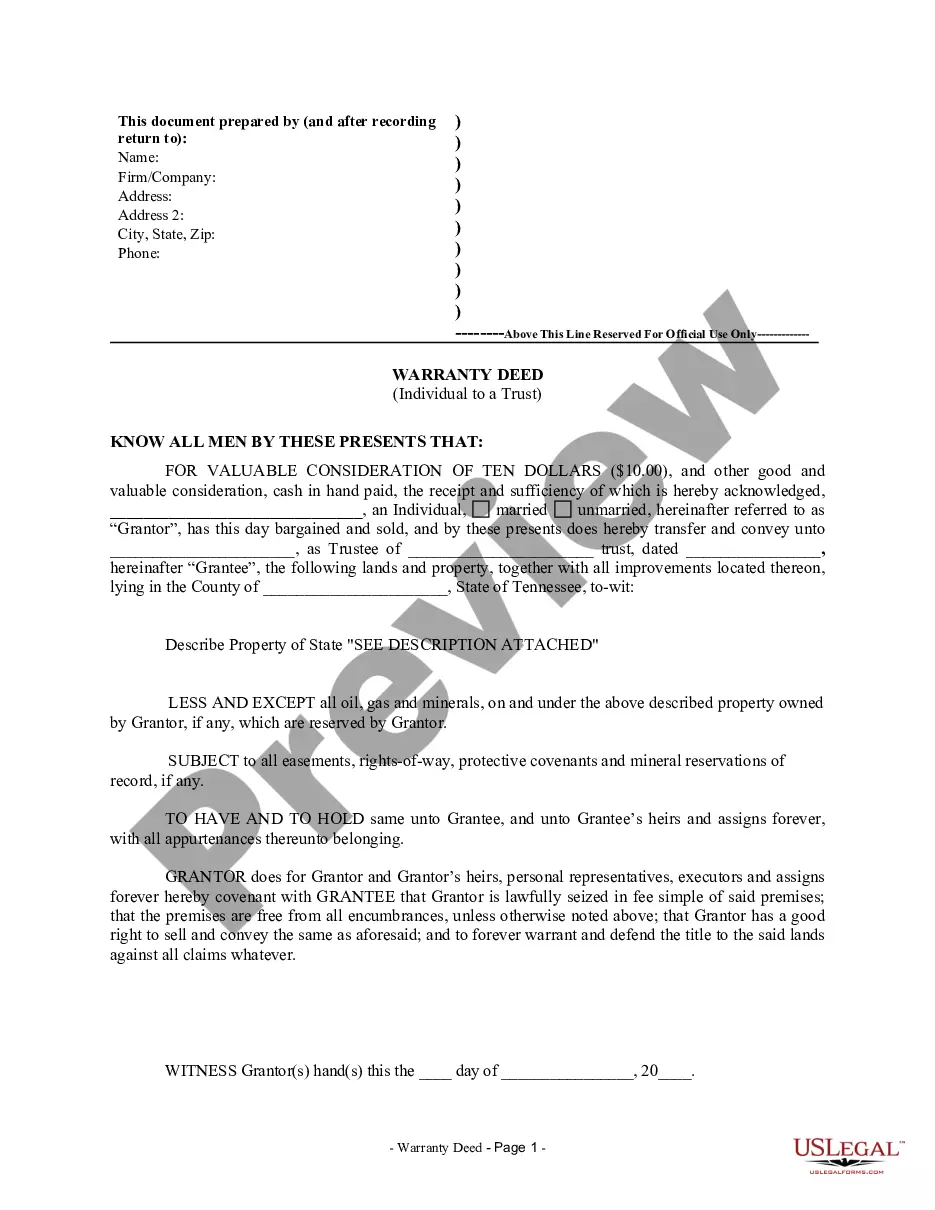

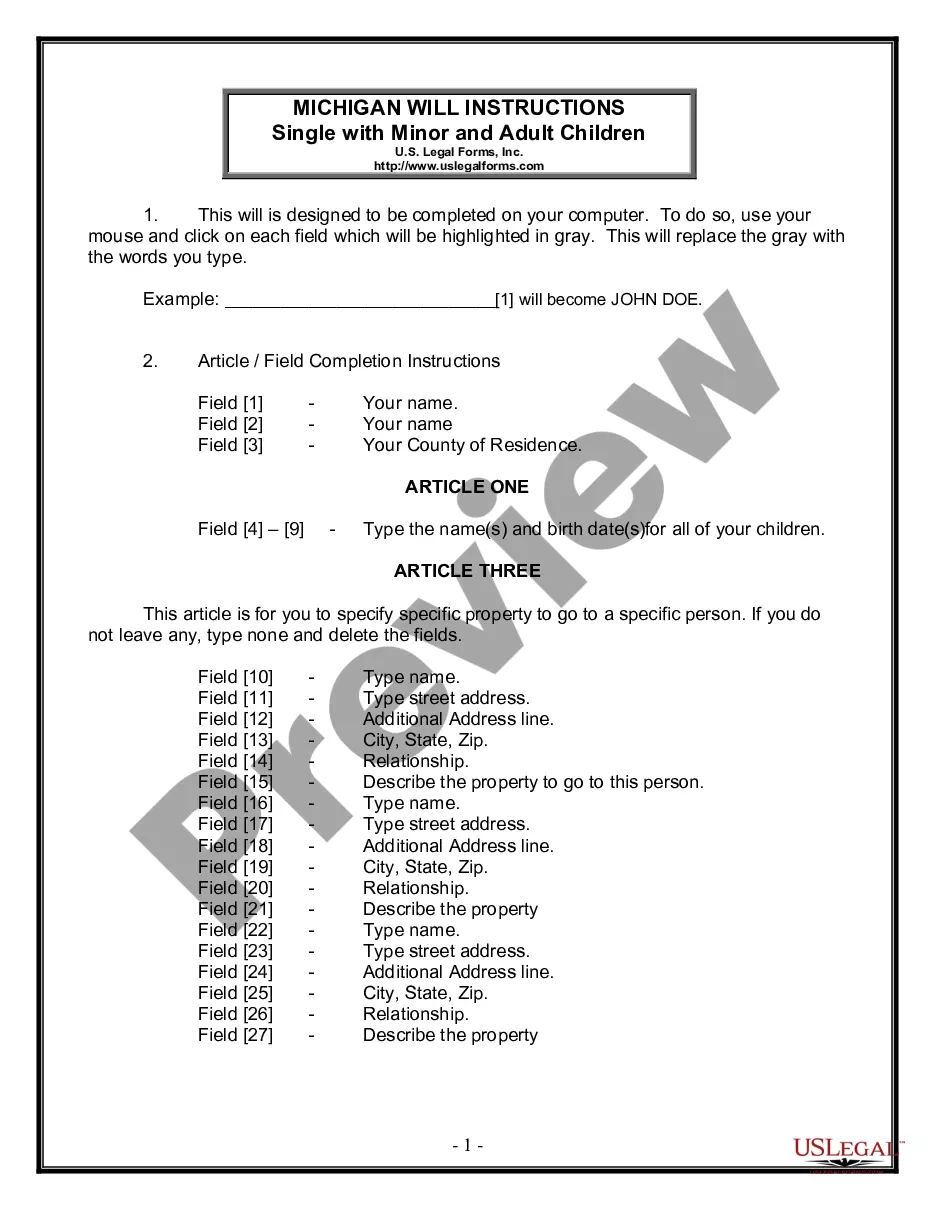

Oklahoma Owner Financing Contract for Home: A Comprehensive Guide to Understanding the Various Types In Oklahoma, an Owner Financing Contract for Home refers to a legally binding agreement between a homeowner (seller) and a potential buyer, where the seller acts as the lender and finances the purchase of the property. This alternative form of financing allows buyers who may have difficulties obtaining traditional mortgages to fulfill their homeownership dreams. The agreement typically outlines the terms and conditions of the loan, the repayment schedule, and any other relevant details. There are several types of Owner Financing Contracts for Homes available in Oklahoma, each designed to suit different situations and needs. Let's delve further into the most common types: 1. Contract for Deed: Also known as a Land Contract, this type of owner financing allows the buyer to take possession of the property while making installment payments to the seller. The seller retains the title until the buyer completes all the payment obligations outlined in the contract, after which the title is transferred to the buyer. 2. Lease Purchase Agreement: In this arrangement, the buyer leases the property for a specified period with the option to purchase it at the end of the lease term. A portion of the monthly lease payments may be applied towards the purchase price, providing the buyer with an opportunity to build equity over time. 3. Wraparound Mortgage: This type of financing involves the buyer acquiring the property from the seller, who still has an existing mortgage on the home. The buyer makes mortgage payments to the seller, who, in turn, pays the original mortgage. The buyer assumes the first mortgage while the seller holds the second mortgage, also known as a wraparound mortgage. 4. All-Inclusive Trust Deed (AID): AID financing combines the existing mortgage and a new financing arrangement into a single loan. The seller becomes the lender for the full amount owed on the property, with the buyer making payments directly to the seller. This method can be suitable when the existing mortgage has favorable terms that the buyer wants to retain. When entering into an Oklahoma Owner Financing Contract for Home, it is crucial to carefully review and understand the terms and conditions outlined in the agreement. Seek legal advice if needed to ensure compliance with Oklahoma laws and regulations. Both parties should negotiate and agree upon essential aspects such as the purchase price, interest rates, repayment periods, and any contingencies before finalizing the contract. Remember, entering into an Owner Financing Contract provides an opportunity for buyers who may encounter difficulties with conventional financing. However, it is important to conduct due diligence, such as obtaining a title search, home inspection, and appraisal, to safeguard both parties' interests and ensure a smooth transaction. Note: It is essential to consult with a real estate attorney or a professional familiar with Oklahoma housing laws to obtain accurate and up-to-date information regarding Owner Financing Contracts for Homes in the state.

Oklahoma Owner Financing Contract for Home: A Comprehensive Guide to Understanding the Various Types In Oklahoma, an Owner Financing Contract for Home refers to a legally binding agreement between a homeowner (seller) and a potential buyer, where the seller acts as the lender and finances the purchase of the property. This alternative form of financing allows buyers who may have difficulties obtaining traditional mortgages to fulfill their homeownership dreams. The agreement typically outlines the terms and conditions of the loan, the repayment schedule, and any other relevant details. There are several types of Owner Financing Contracts for Homes available in Oklahoma, each designed to suit different situations and needs. Let's delve further into the most common types: 1. Contract for Deed: Also known as a Land Contract, this type of owner financing allows the buyer to take possession of the property while making installment payments to the seller. The seller retains the title until the buyer completes all the payment obligations outlined in the contract, after which the title is transferred to the buyer. 2. Lease Purchase Agreement: In this arrangement, the buyer leases the property for a specified period with the option to purchase it at the end of the lease term. A portion of the monthly lease payments may be applied towards the purchase price, providing the buyer with an opportunity to build equity over time. 3. Wraparound Mortgage: This type of financing involves the buyer acquiring the property from the seller, who still has an existing mortgage on the home. The buyer makes mortgage payments to the seller, who, in turn, pays the original mortgage. The buyer assumes the first mortgage while the seller holds the second mortgage, also known as a wraparound mortgage. 4. All-Inclusive Trust Deed (AID): AID financing combines the existing mortgage and a new financing arrangement into a single loan. The seller becomes the lender for the full amount owed on the property, with the buyer making payments directly to the seller. This method can be suitable when the existing mortgage has favorable terms that the buyer wants to retain. When entering into an Oklahoma Owner Financing Contract for Home, it is crucial to carefully review and understand the terms and conditions outlined in the agreement. Seek legal advice if needed to ensure compliance with Oklahoma laws and regulations. Both parties should negotiate and agree upon essential aspects such as the purchase price, interest rates, repayment periods, and any contingencies before finalizing the contract. Remember, entering into an Owner Financing Contract provides an opportunity for buyers who may encounter difficulties with conventional financing. However, it is important to conduct due diligence, such as obtaining a title search, home inspection, and appraisal, to safeguard both parties' interests and ensure a smooth transaction. Note: It is essential to consult with a real estate attorney or a professional familiar with Oklahoma housing laws to obtain accurate and up-to-date information regarding Owner Financing Contracts for Homes in the state.