Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

Oklahoma Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

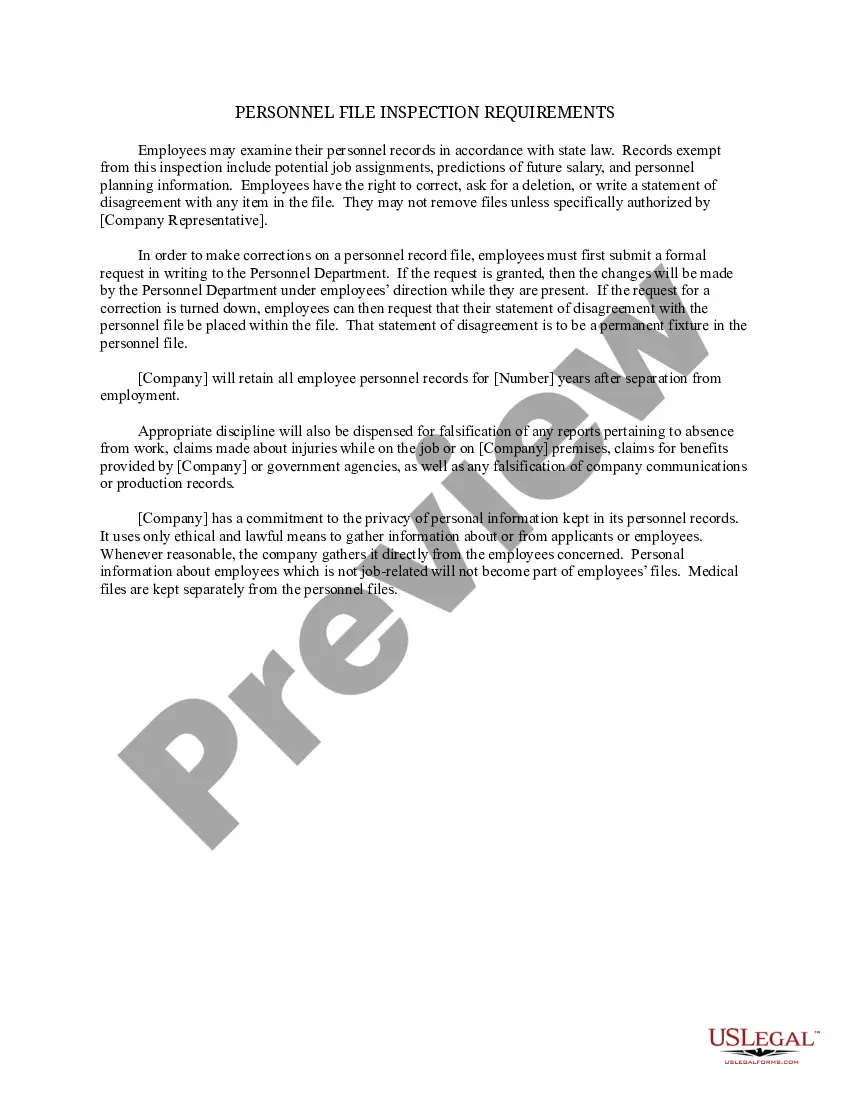

Choosing the right lawful record format could be a battle. Obviously, there are plenty of web templates available online, but how would you get the lawful kind you need? Utilize the US Legal Forms internet site. The service delivers a huge number of web templates, for example the Oklahoma Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency, which you can use for business and personal requirements. Each of the kinds are checked by pros and satisfy federal and state specifications.

If you are currently authorized, log in in your profile and click on the Down load option to have the Oklahoma Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency. Make use of profile to search with the lawful kinds you have acquired formerly. Check out the My Forms tab of your own profile and get another version of the record you need.

If you are a whole new consumer of US Legal Forms, here are easy guidelines so that you can adhere to:

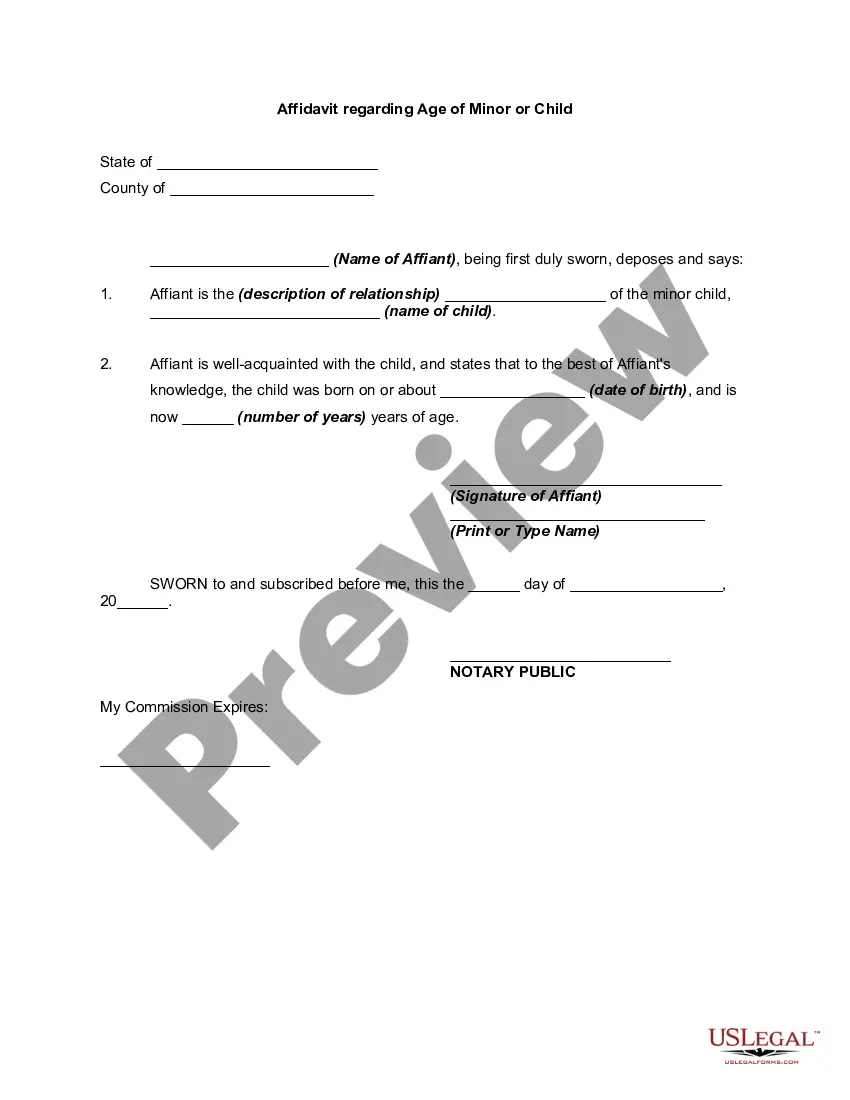

- Initial, ensure you have chosen the appropriate kind for your personal town/region. You are able to check out the form making use of the Preview option and look at the form description to guarantee it is the best for you.

- When the kind is not going to satisfy your expectations, take advantage of the Seach field to find the appropriate kind.

- When you are certain that the form would work, click on the Purchase now option to have the kind.

- Select the costs prepare you desire and enter in the required details. Design your profile and purchase the order utilizing your PayPal profile or credit card.

- Opt for the file file format and obtain the lawful record format in your device.

- Full, revise and print out and indication the attained Oklahoma Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency.

US Legal Forms is the biggest local library of lawful kinds that you can see various record web templates. Utilize the company to obtain professionally-manufactured files that adhere to state specifications.

Form popularity

FAQ

The minimum amount of Oklahoma auto insurance coverage is $25,000/$50,000/$25,000. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. It also covers up to $25,000 for damage to another person's property.

Surcharge for use of credit or debit card. A. No seller in any sales transaction may impose a surcharge on a cardholder who elects to use a credit card or debit card in lieu of payment by cash, check or similar means.

Oklahoma recognizes the doctrine of subrogation. Upon payment of the principal's debt, a surety or accommodation party has the right to be substituted to the position of the creditor who received payment.

Car insurance laws in Oklahoma Drivers are required to carry proof of insurance in their vehicles at all times. Oklahoma participates in an online insurance verification process. If you are stopped by law enforcement, the officer must verify insurance coverage through this.

No rate in a competitive market shall be considered unfairly discriminatory unless it classifies risk on the basis of race, color, creed, or national origin.

Uninsured Motorist coverage, unless otherwise provided in your policy, pays for bodily injury damages to you, members of your family who live with you, and other people riding in your car who are injured by: (1) an uninsured motorist, (2) a hit-and-run motorist, or (3) an insured motorist who does not have enough ...

If you're convicted of driving without insurance after an accident, you'll need to pay a $250 fine or serve jail time of up to 30 days ? on top of paying for costs related to the accident. The state will suspend your license and registration for a year and may impound your vehicle.

The Fair Credit Reporting Act in Oklahoma Oklahoma House Bill 2492 provides that prior to requesting a consumer report for work, you be notified and must be given an option of a copy free of charge. Oklahoma really adds nothing with what they attempted to add with a security freeze on your credit file.