A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

Oklahoma Assignment of Business License as Security for a Loan

Description

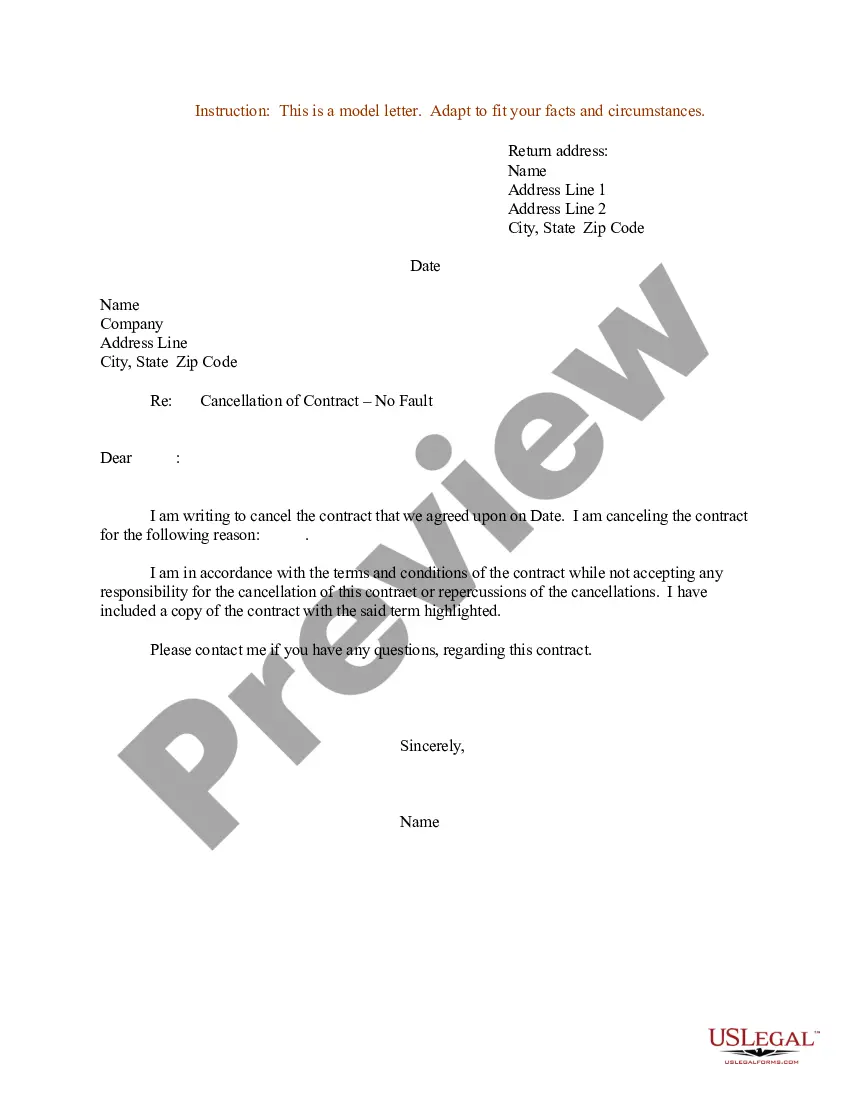

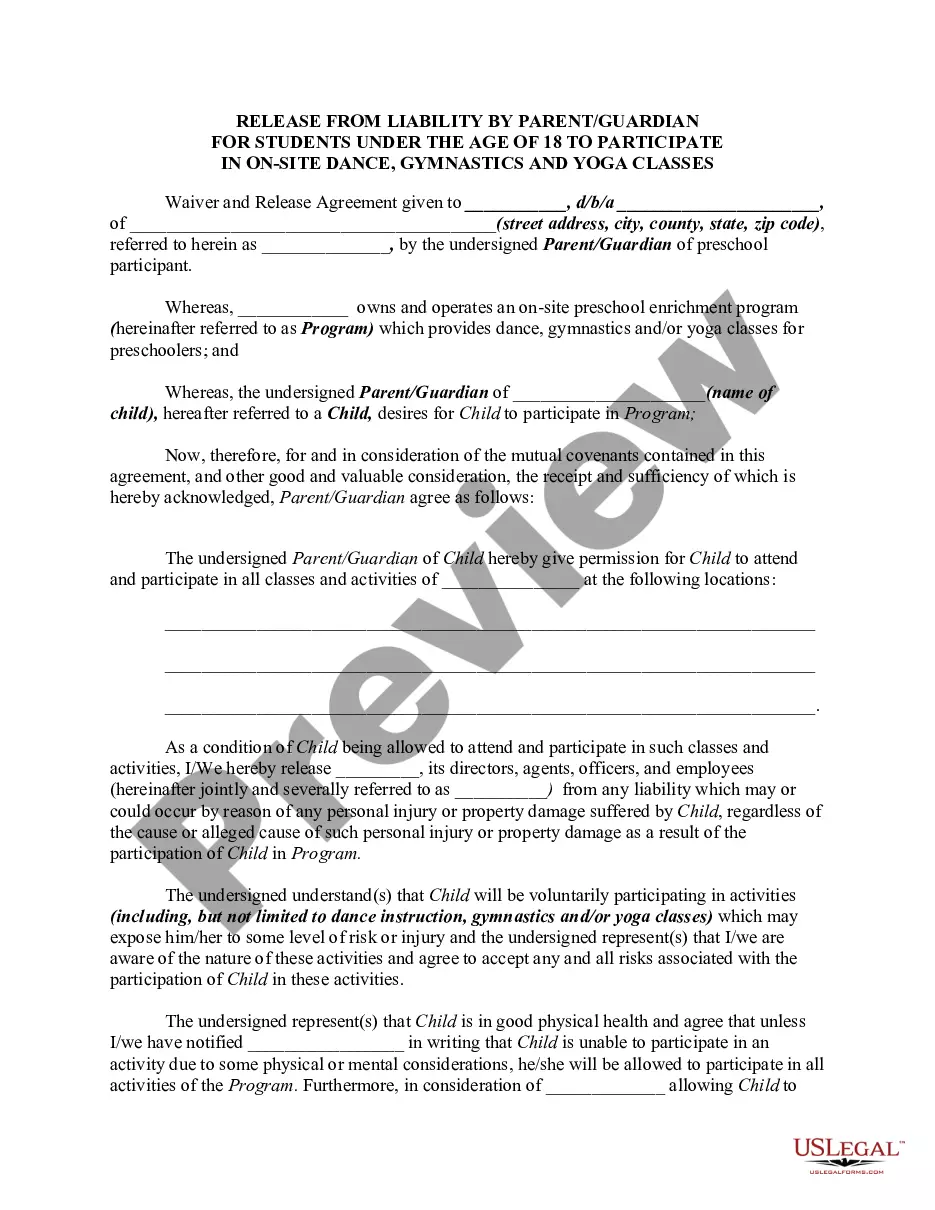

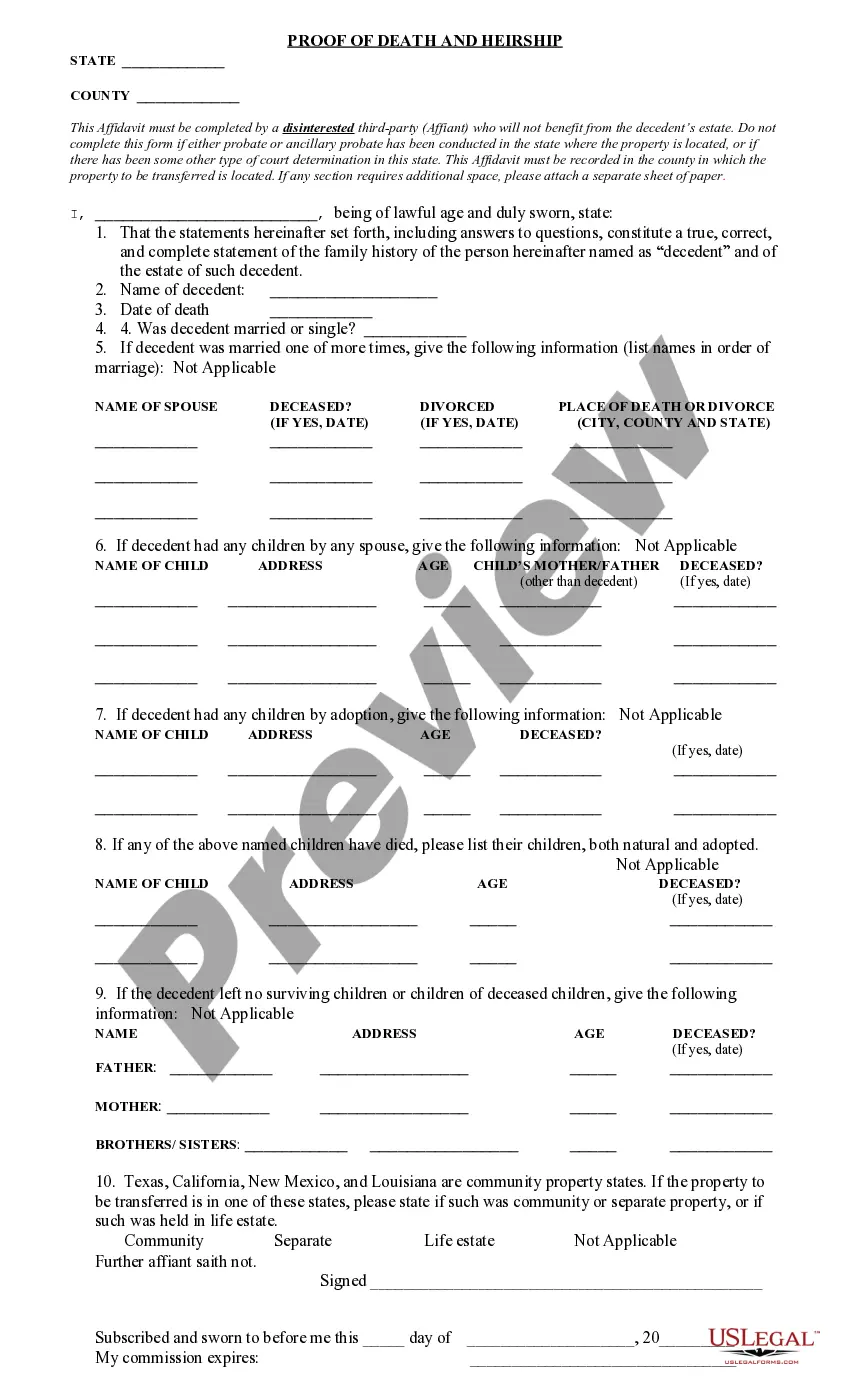

How to fill out Assignment Of Business License As Security For A Loan?

You may commit hrs on-line searching for the legal record template which fits the state and federal needs you want. US Legal Forms gives 1000s of legal forms which can be analyzed by experts. It is simple to download or print the Oklahoma Assignment of Business License as Security for a Loan from our service.

If you already possess a US Legal Forms profile, you may log in and click on the Obtain key. Next, you may complete, change, print, or signal the Oklahoma Assignment of Business License as Security for a Loan. Each and every legal record template you purchase is yours for a long time. To get another version associated with a acquired kind, go to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms site for the first time, stick to the easy instructions under:

- Initially, make certain you have selected the proper record template for your county/town of your choice. Read the kind outline to ensure you have chosen the appropriate kind. If available, make use of the Review key to check with the record template too.

- If you wish to find another model from the kind, make use of the Research area to find the template that meets your needs and needs.

- Once you have located the template you would like, click Purchase now to carry on.

- Choose the prices plan you would like, type your credentials, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You may use your credit card or PayPal profile to fund the legal kind.

- Choose the file format from the record and download it for your gadget.

- Make modifications for your record if necessary. You may complete, change and signal and print Oklahoma Assignment of Business License as Security for a Loan.

Obtain and print 1000s of record templates making use of the US Legal Forms web site, that provides the largest assortment of legal forms. Use skilled and express-particular templates to tackle your company or personal demands.

Form popularity

FAQ

If your business will sell a product, you will need a Sales or Use Tax Permit from the Oklahoma Tax Commission (OTC). Register for a sales or use tax permit through the OTC application portal ? this step costs $20 plus a handling fee.

In Oklahoma, there is no general license required to start or own a business. However, for specific types of businesses and occupations, licenses, permits, or special registrations and filings may be required before opening or operating.

Oklahoma State Business License Fee: $20 You'll need to create an account in order to apply for your permit. The permit costs $20 (plus any applicable credit card processing fees) and is good for three years, at which point it will need to be renewed.

If you are forming an LLC, partnership, non-profit, etc., you must file your business with the Oklahoma Secretary of State. As a registered business, you can legally sell goods or services in Oklahoma.

Your business needs to be licensed to legally operate. It is your responsibility, before engaging in any new business in the City of Oklahoma City, to obtain all necessary federal, state or local licenses or permits.