An Oklahoma Employment Verification Letter for Mortgage is an official document that confirms an individual's employment status, income, and stability. Lenders often require this letter to verify the borrower's ability to repay the mortgage loan. The verification letter acts as evidence of the borrower's employment, serving as a crucial component of the mortgage approval process. The primary purpose of an Employment Verification Letter for Mortgage is to ensure that the borrower has a reliable and consistent source of income. This helps lenders assess the borrower's financial capacity to make timely mortgage payments. By confirming employment, lenders minimize the risk of lending to individuals who may experience difficulties in repaying their mortgage loans. This employment letter typically includes essential details such as the applicant's full name, job title, job description, employment start date, salary or hourly wage, the number of hours worked per week, and contact information of the employer. The letter should be prepared on official company or organization letterhead, signed by an authorized representative, and may require additional supporting documentation, such as recent pay stubs or tax returns, to verify the provided information. Different types of Employment Verification Letters for Mortgage may exist depending on the individual's employment situation: 1. Full-Time Employment Verification Letter: This is the most common type of verification letter, confirming that the borrower is employed on a full-time basis. It provides details about the borrower's job title, salary, employment duration, and any other relevant information pertaining to their employment. 2. Part-Time Employment Verification Letter: This letter is specifically issued for borrowers who work part-time or have multiple jobs. It confirms the borrower's part-time employment status, verifies the number of hours worked each week, and may include the respective income earned. 3. Self-Employed Verification Letter: In the case of self-employed individuals, a different format of verification letter is required. It should include details about the nature of the borrower's business, the length of self-employment, average monthly income, and any other pertinent information that validates the stability and profitability of the business. 4. Letter for Commission or Bonus-Based Income: Some borrowers receive a significant portion of their income through commissions or bonuses. In such cases, an Employment Verification Letter is tailored to highlight the consistency and predictability of this additional income source, supporting the borrower's overall creditworthiness. Obtaining a reliable Employment Verification Letter for Mortgage is vital for many individuals seeking home loans in Oklahoma. It assures lenders of the borrower's financial stability and provides them with the necessary information to make an informed lending decision.

Oklahoma Employment Verification Letter for Mortgage

Description

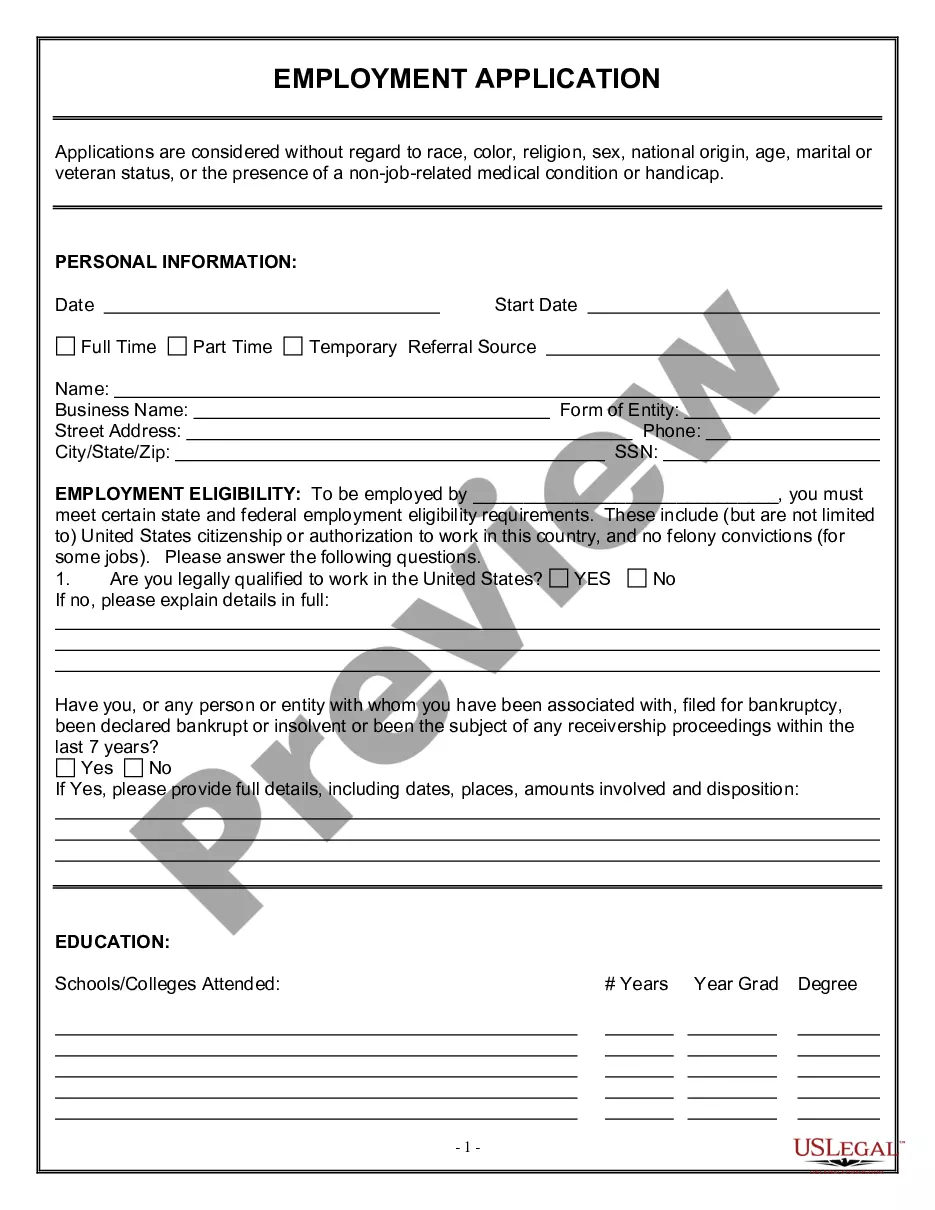

How to fill out Oklahoma Employment Verification Letter For Mortgage?

Choosing the right lawful record format can be a have difficulties. Of course, there are tons of templates available online, but how can you discover the lawful type you will need? Take advantage of the US Legal Forms web site. The assistance provides a large number of templates, for example the Oklahoma Employment Verification Letter for Mortgage, which can be used for company and personal demands. Each of the types are examined by professionals and meet up with federal and state specifications.

If you are presently registered, log in to your profile and click on the Acquire option to find the Oklahoma Employment Verification Letter for Mortgage. Make use of profile to appear from the lawful types you may have purchased previously. Visit the My Forms tab of the profile and have another backup from the record you will need.

If you are a whole new customer of US Legal Forms, allow me to share easy guidelines so that you can adhere to:

- Initial, make sure you have selected the proper type for your personal city/state. You are able to look over the form utilizing the Review option and look at the form outline to guarantee it is the best for you.

- In the event the type fails to meet up with your requirements, use the Seach area to obtain the correct type.

- When you are sure that the form would work, select the Get now option to find the type.

- Pick the rates plan you would like and enter in the needed info. Make your profile and buy the transaction making use of your PayPal profile or bank card.

- Choose the file formatting and obtain the lawful record format to your device.

- Comprehensive, modify and produce and indicator the attained Oklahoma Employment Verification Letter for Mortgage.

US Legal Forms is definitely the most significant local library of lawful types in which you can see various record templates. Take advantage of the company to obtain expertly-created paperwork that adhere to condition specifications.