The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

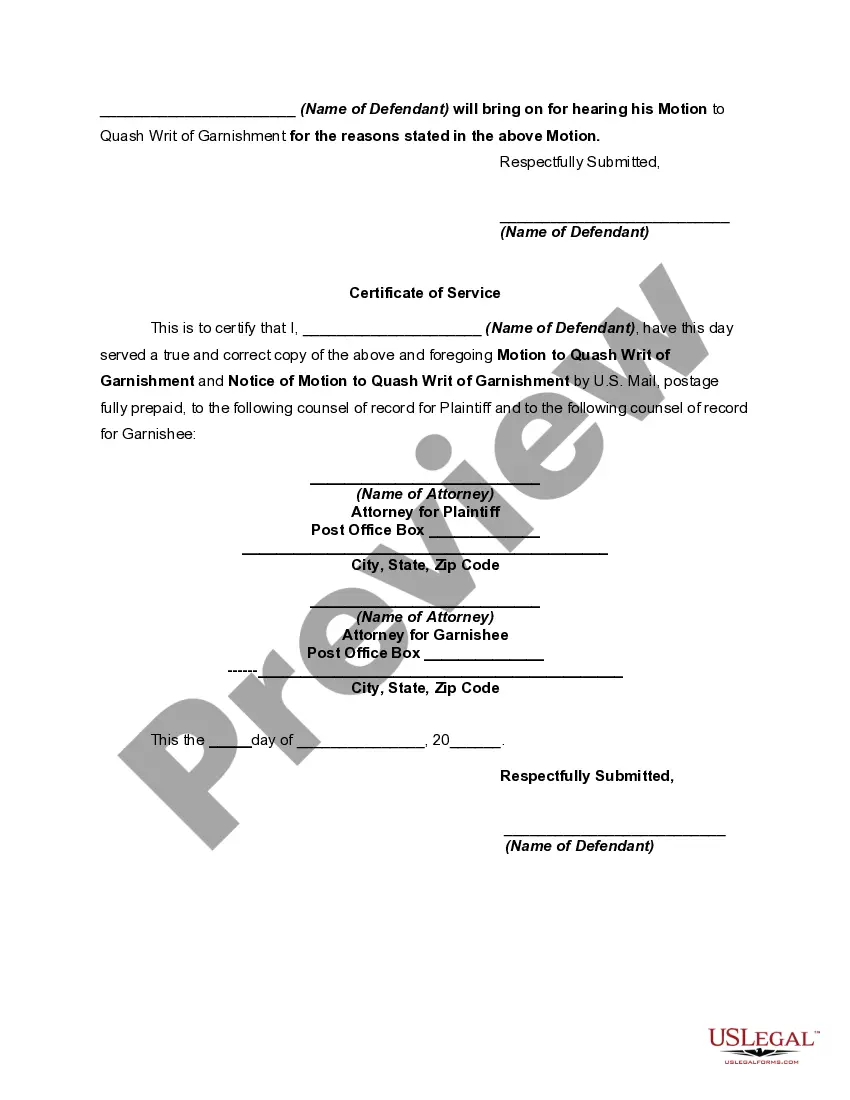

The Oklahoma Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is a legal document filed by a defendant in an Oklahoma court to request the dismissal or invalidation of a garnishment order. This motion is typically filed when the defendant believes that their funds are protected by certain exemptions under Oklahoma law, which make them exempt from garnishment. In Oklahoma, there are different types of exemptions that a defendant may rely on to claim that their funds are exempt from garnishment. Some common exemptions recognized under Oklahoma law include: 1. Exemption for Social Security and other public benefits: Oklahoma law exempts funds received as Social Security benefits, retirement benefits, disability benefits, and other public assistance benefits from garnishment. This exemption ensures that individuals relying on these benefits have sufficient means to support themselves. 2. Homestead exemption: The Oklahoma Constitution provides a homestead exemption, which protects a certain amount of equity in a primary residence from being garnished or seized. This exemption aims to safeguard the basic living needs of individuals and families. 3. Personal property exemption: Under Oklahoma law, certain types of personal property, such as household furniture, clothing, appliances, and tools of trade, may be exempt from garnishment to protect the individual's essential assets necessary for daily living and work. 4. Exemption for child support and spousal support: While wages can generally be garnished for child support or spousal support payments, Oklahoma law provides a limit on the percentage that can be garnished, ensuring that the defendant's income is not completely seized, and they can meet their own financial obligations. 5. Exemptions for specific funds: Oklahoma law also recognizes exemptions for specific funds, such as worker's compensation benefits, unemployment compensation, veterans' benefits, and retirement accounts like IRAs and 401(k)s. These exemptions aim to provide financial security for individuals who have experienced certain life circumstances or have contributed to specific funds. When filing a Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment, it is crucial to provide detailed evidence and documentation supporting the claim that the funds fall under one or more of the relevant exemptions. Consulting with an attorney experienced in Oklahoma garnishment laws is recommended to ensure proper legal representation and accurate submission of the motion.The Oklahoma Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is a legal document filed by a defendant in an Oklahoma court to request the dismissal or invalidation of a garnishment order. This motion is typically filed when the defendant believes that their funds are protected by certain exemptions under Oklahoma law, which make them exempt from garnishment. In Oklahoma, there are different types of exemptions that a defendant may rely on to claim that their funds are exempt from garnishment. Some common exemptions recognized under Oklahoma law include: 1. Exemption for Social Security and other public benefits: Oklahoma law exempts funds received as Social Security benefits, retirement benefits, disability benefits, and other public assistance benefits from garnishment. This exemption ensures that individuals relying on these benefits have sufficient means to support themselves. 2. Homestead exemption: The Oklahoma Constitution provides a homestead exemption, which protects a certain amount of equity in a primary residence from being garnished or seized. This exemption aims to safeguard the basic living needs of individuals and families. 3. Personal property exemption: Under Oklahoma law, certain types of personal property, such as household furniture, clothing, appliances, and tools of trade, may be exempt from garnishment to protect the individual's essential assets necessary for daily living and work. 4. Exemption for child support and spousal support: While wages can generally be garnished for child support or spousal support payments, Oklahoma law provides a limit on the percentage that can be garnished, ensuring that the defendant's income is not completely seized, and they can meet their own financial obligations. 5. Exemptions for specific funds: Oklahoma law also recognizes exemptions for specific funds, such as worker's compensation benefits, unemployment compensation, veterans' benefits, and retirement accounts like IRAs and 401(k)s. These exemptions aim to provide financial security for individuals who have experienced certain life circumstances or have contributed to specific funds. When filing a Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment, it is crucial to provide detailed evidence and documentation supporting the claim that the funds fall under one or more of the relevant exemptions. Consulting with an attorney experienced in Oklahoma garnishment laws is recommended to ensure proper legal representation and accurate submission of the motion.