Oklahoma Retirement Cash Flow is a crucial financial tool that enables individuals to plan for a secure and comfortable retirement in the state of Oklahoma. It primarily refers to the income streams received during retirement, which consist of various sources such as pensions, Social Security benefits, annuities, investments, and other forms of passive income. Planning for retirement cash flow is essential to ensure financial stability and meet one's desired lifestyle during the retirement years. By carefully considering the adequacy of retirement savings, the potential growth of investments, and estimating expenses, individuals can devise a strategic plan to generate a steady income flow post-retirement. There are several types of Oklahoma Retirement Cash Flow to consider, including: 1. Employer Pensions: Many Oklahoman's have access to employer-sponsored pension plans that provide a predictable income stream during retirement. These pensions are often based on the employee's years of service and salary history. 2. Social Security Benefits: Every retiree in Oklahoma is eligible for Social Security benefits. These benefits are based on an individual's earnings history and can provide a reliable income source. Optimizing Social Security benefits is crucial to ensure maximum cash flow during retirement. 3. Individual Retirement Accounts (IRAs): IRAs are personal retirement accounts that allow individuals to save for retirement through pre-tax or post-tax contributions. This type of account can include traditional IRAs, Roth IRAs, and SEP-IRAs. It is important to choose the right IRA type to optimize cash flow in retirement while considering tax implications. 4. Annuities: Annuities are financial products designed to provide a steady income stream during retirement. Oklahoma's retirees often consider immediate annuities, which involve a lump-sum payment in exchange for regular payouts. Fixed or indexed annuities are also popular options for securing a guaranteed cash flow. 5. Retirement Investments: Investing in stocks, bonds, mutual funds, or real estate can generate additional retirement cash flow. Carefully managing and diversifying investments can contribute significantly to one's financial well-being during retirement. It's important to evaluate risk tolerance and seek professional advice while choosing suitable investment options. 6. Rental Income: Owning rental properties can provide a consistent cash flow throughout retirement. Oklahoma's retirees often opt to invest in real estate to generate rental income, utilizing property investments as an additional source of retirement cash flow. Oklahoma Retirement Cash Flow planning involves considering all these types of income sources and creating a comprehensive strategy that ensures financial stability and meets retirees' desired lifestyle goals. Consulting with financial advisors and professionals specializing in retirement planning can help individuals make informed decisions and enhance their cash flow during retirement in Oklahoma.

Oklahoma Retirement Cash Flow

Description

How to fill out Oklahoma Retirement Cash Flow?

Are you presently inside a position in which you need to have paperwork for possibly company or specific reasons just about every day? There are plenty of lawful document themes accessible on the Internet, but discovering types you can trust isn`t easy. US Legal Forms provides a large number of type themes, just like the Oklahoma Retirement Cash Flow, which are written to satisfy federal and state requirements.

When you are already acquainted with US Legal Forms website and also have an account, simply log in. After that, you are able to down load the Oklahoma Retirement Cash Flow template.

Unless you provide an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is to the proper town/state.

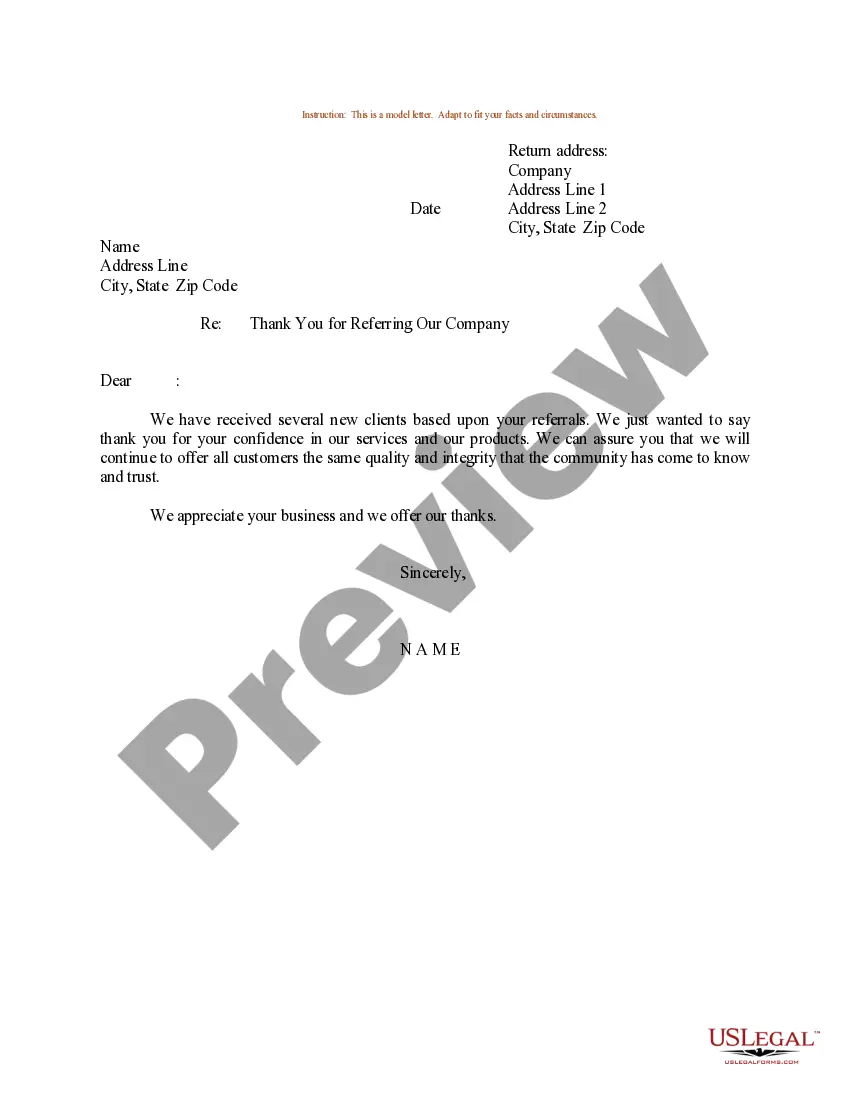

- Make use of the Preview key to analyze the form.

- Look at the description to ensure that you have selected the correct type.

- In case the type isn`t what you`re looking for, take advantage of the Lookup industry to obtain the type that suits you and requirements.

- Whenever you obtain the proper type, just click Buy now.

- Select the rates plan you want, fill in the specified information and facts to generate your money, and purchase an order utilizing your PayPal or credit card.

- Decide on a practical paper structure and down load your copy.

Find every one of the document themes you might have bought in the My Forms menu. You can get a more copy of Oklahoma Retirement Cash Flow at any time, if necessary. Just click on the essential type to down load or print out the document template.

Use US Legal Forms, one of the most comprehensive assortment of lawful types, to save time as well as avoid blunders. The services provides professionally created lawful document themes which you can use for a selection of reasons. Produce an account on US Legal Forms and begin creating your way of life a little easier.