An Oklahoma Release of Lien for Contractor is a legal document that serves as proof of payment from a property owner to a contractor for services rendered. This document releases any claim or lien the contractor may have on the property as a result of the work performed. In Oklahoma, there are different types of Release of Lien forms that contractors may use depending on the stage or progress of the project: 1. Full Release of Lien: This document is typically used when the contractor has been fully paid for their services and has no further claim on the property. It releases any liens or encumbrances on the property related to the contractor's work. 2. Partial Release of Lien: If the contractor has been paid a partial amount but not the full contract price, a Partial Release of Lien may be used. This document acknowledges the partial payment and releases any claim on the property equal to the amount paid. 3. Progress Payment Release of Lien: During long-term projects, contractors often receive progress payments at different stages. In such cases, a Progress Payment Release of Lien is used to release any claim or lien on the property for the specific progress payment received. 4. Final Release of Lien: When a project is completed, and the contractor has been fully paid, a Final Release of Lien is used. This document signifies that the contractor has received the entire contract price and releases any lien on the property. It is crucial for contractors to use these Release of Lien forms to protect their rights and ensure they receive payment for their services. Likewise, property owners benefit from having these documents as proof of payment and to avoid potential legal issues in the future. The Oklahoma Release of Lien for Contractor is a vital legal document that safeguards the interests of both contractors and property owners. By understanding the different types of release forms and their purposes, contractors can manage their payment receivables effectively, while property owners can safeguard themselves from any potential property liens.

Oklahoma Release of Lien for Contractor

Description

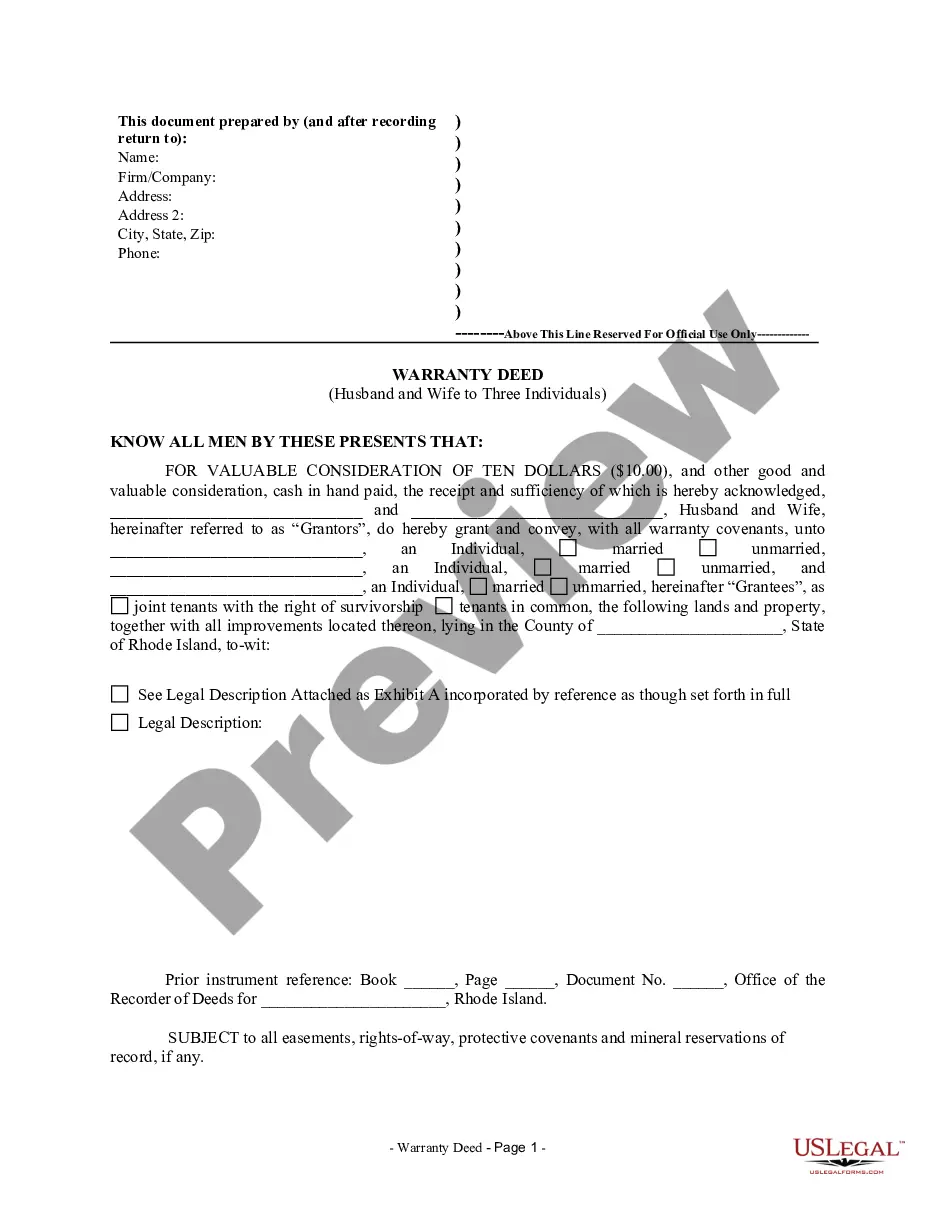

How to fill out Oklahoma Release Of Lien For Contractor?

You are able to invest hrs online looking for the legitimate record template that suits the state and federal specifications you need. US Legal Forms gives a huge number of legitimate varieties that are evaluated by experts. You can easily download or produce the Oklahoma Release of Lien for Contractor from the service.

If you currently have a US Legal Forms account, you can log in and then click the Obtain switch. After that, you can total, change, produce, or indication the Oklahoma Release of Lien for Contractor. Each and every legitimate record template you buy is the one you have for a long time. To have another version of any obtained type, proceed to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms website the very first time, stick to the simple recommendations beneath:

- Initially, make certain you have chosen the correct record template for the area/area that you pick. Read the type information to make sure you have chosen the correct type. If offered, take advantage of the Review switch to look with the record template at the same time.

- If you wish to locate another version in the type, take advantage of the Lookup field to obtain the template that meets your needs and specifications.

- When you have identified the template you want, simply click Buy now to move forward.

- Select the pricing prepare you want, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can use your charge card or PayPal account to fund the legitimate type.

- Select the file format in the record and download it for your device.

- Make modifications for your record if needed. You are able to total, change and indication and produce Oklahoma Release of Lien for Contractor.

Obtain and produce a huge number of record templates making use of the US Legal Forms Internet site, that offers the largest variety of legitimate varieties. Use expert and express-particular templates to handle your business or specific needs.

Form popularity

FAQ

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

What is the Deadline for Filing a Mechanic's Lien in Oklahoma? The deadline to file a mechanic's lien for a general contractor is within four (4) months after the date upon which material or equipment was last furnished or performed under the contract.

An action to enforce an Oklahoma mechanics lien must be initiated within 1 year of the date on which the lien was recorded. However, at least 90 days must have passed from the date on which the lien was recorded prior to initiating the enforcement action.

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

Here are the most common ways a lien may be removed: Direct Discharge of Lien. In most cases, after your lien has been filed your customer resolves their account and you need to remove a lien. ... Discharge in Trust. Sometimes liens can be removed "in trust". ... Consent Order/Court Order. ... Failure to prove lien. ... Expiry.

No. There is no statutory requirement in Oklahoma that a lien waiver be notarized.

A property owner can neutralize the Mechanics and Materialmen's Lien by depositing with the county clerk either an amount of money equal to 125% of the lien amount, or a surety bond (called a lien release bond) in an amount equal to 125% of the lien amount.

A property owner can neutralize the Mechanics and Materialmen's Lien by depositing with the county clerk either an amount of money equal to 125% of the lien amount, or a surety bond (called a lien release bond) in an amount equal to 125% of the lien amount.