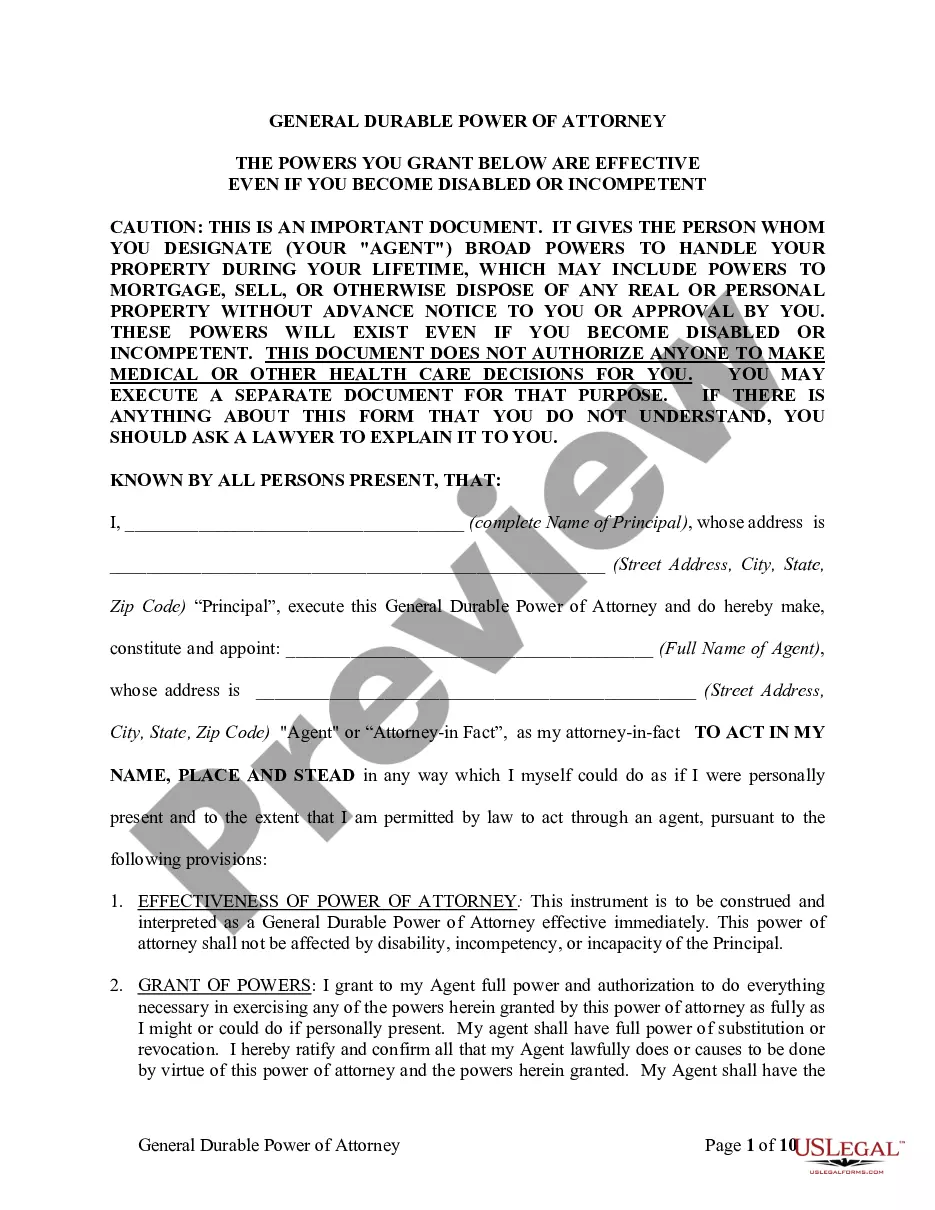

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Oklahoma Declaration of Gift Over Several Year periods is a legal document that allows individuals to make a series of gift transactions over a specified period. It ensures compliance with the Oklahoma Uniform Gifts to Minors Act (UGA) or the Oklahoma Uniform Transfers to Minors Act (TMA), depending on the type of gift involved. The purpose of the Oklahoma Declaration of Gift Over Several Year periods is to provide a framework for individuals to gift assets to minors without the need for establishing a trust or guardianship. This document enables a person, also known as the donor, to transfer property or funds to a minor beneficiary gradually over a few years instead of making a lump-sum gift. By spreading the gift over multiple years, the Oklahoma Declaration of Gift Over Several Year Period offers several advantages. Firstly, it allows the donor to manage the gift more strategically, potentially reducing the impact of gift taxes. Secondly, it allows the recipient to receive the benefits of the gift incrementally over time, instead of all at once. There are two types of Oklahoma Declarations of Gift Over Several years Period, each falling under a different inheritance law. The first type relates to gifts made under the Oklahoma Uniform Gifts to Minors Act (UGA). This act permits donors to gift assets such as cash, bonds, stocks, or real estate to a minor through a custodian. The custodian holds and manages the assets until the minor reaches the age of majority. The second type concerns gifts made under the Oklahoma Uniform Transfers to Minors Act (TMA). This act allows donors to gift a broader range of assets, including not only monetary funds and securities but also real estate, patents, royalties, and other valuable items. Similar to UGA, a custodian holds and manages the assets on behalf of the minor until they come of age. To initiate the Oklahoma Declaration of Gift Over Several years Period, the donor must draft a comprehensive document that outlines the specific terms and conditions of the gift. It is crucial to include details such as the donor's and minor's personal information, the nature and value of the gift, the intended time frame for making the gift, and any stipulations or restrictions related to the gift. Once this document is drafted, it must be executed according to the requirements of the Oklahoma state law, including proper notarization and obtaining the signatures of all parties involved. The declaration should be kept in a safe place, and copies should be provided to any custodian or relevant parties involved in managing the gifts. In summary, the Oklahoma Declaration of Gift Over Several Year periods is a beneficial tool for individuals looking to gift assets to minors incrementally over time. It helps ensure compliance with either UGA or TMA, depending on the nature of the gift. By consulting with legal professionals and properly preparing this document, individuals can effectively manage their gifts while benefiting the minors receiving them.