Oklahoma Subcontractor Agreement for Insurance

Description

How to fill out Subcontractor Agreement For Insurance?

Are you in a location where you need documents for either business or personal purposes nearly every day.

There are numerous reputable document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of template forms, including the Oklahoma Subcontractor Agreement for Insurance, which are designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oklahoma Subcontractor Agreement for Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct area/county.

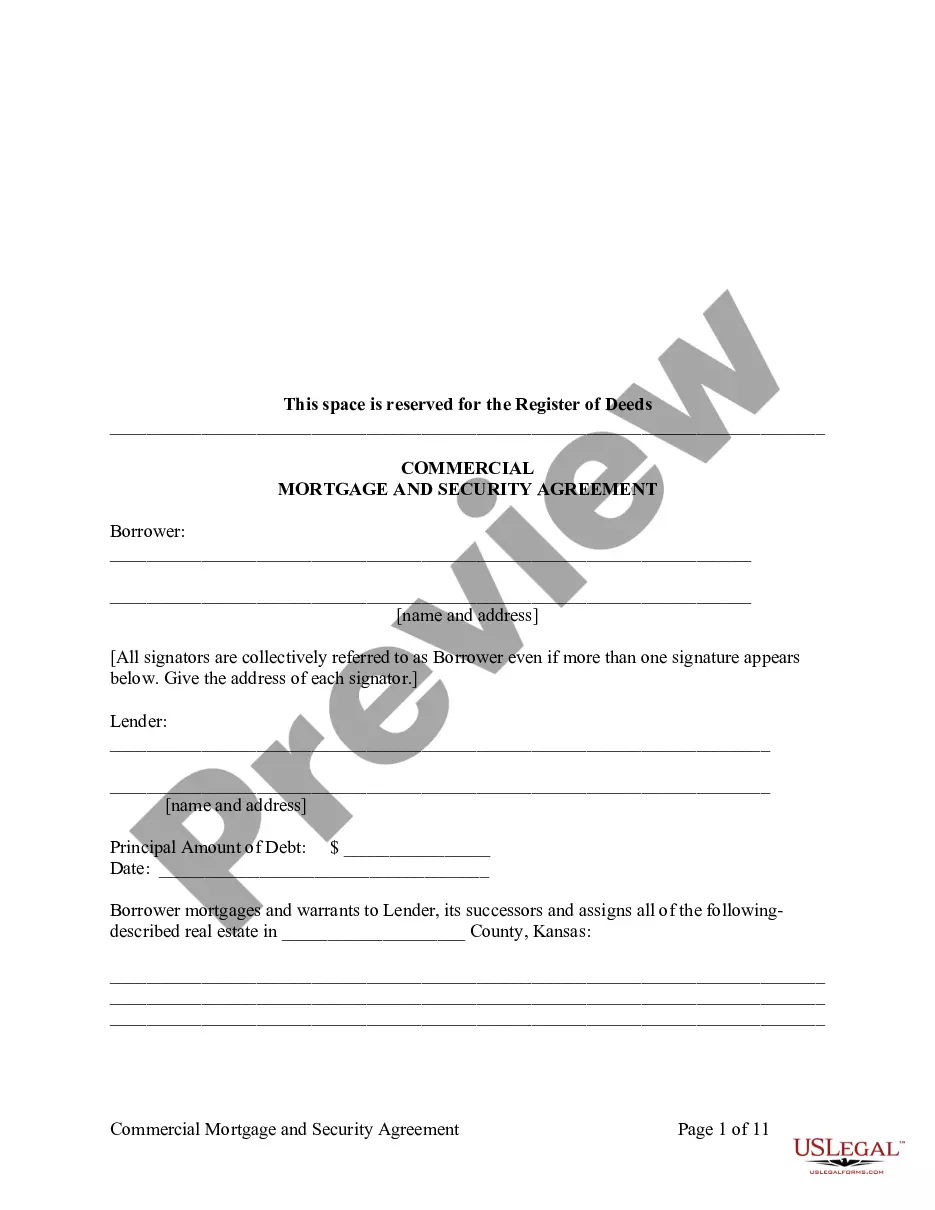

- Use the Preview option to review the document.

- Check the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Search section to find the form that fits your requirements.

Form popularity

FAQ

Yes, a subcontractor agreement is crucial to clearly define the expectations and responsibilities of both parties involved. It establishes legal protections, especially related to insurance and liability. Using an Oklahoma Subcontractor Agreement for Insurance template can help you navigate through essential terms, ensuring mutual understanding and compliance with regulations. This step ultimately protects your interests and promotes a positive working relationship.

Yes, subcontractors generally need to carry insurance to shield themselves and the businesses operating with them from various risks. An Oklahoma Subcontractor Agreement for Insurance lays out the specific requirements and ensures that appropriate coverage is maintained throughout the project. This practice enhances trust and accountability between the parties involved, contributing to a successful partnership. Make sure to verify their insurance status regularly.

Subcontractors should have their own insurance to cover potential liabilities arising from their work. It not only protects them from lawsuits but also provides peace of mind to the hiring business. With an Oklahoma Subcontractor Agreement for Insurance, both parties can establish clear expectations for coverage, fostering a secure work environment. Therefore, the right insurance helps safeguard your project and enhance collaboration.

Yes, subcontractors are typically required to carry insurance to protect both themselves and the businesses hiring them. An Oklahoma Subcontractor Agreement for Insurance can specify these requirements clearly, making it a vital part of the hiring process. By ensuring that subcontractors have adequate coverage, you reduce your risk of financial exposure during a project. Always verify their insurance before commencing any work.

A subcontractor's default insurance refers to the standard insurance coverage they are expected to carry during the project. This often includes general liability and workers' compensation insurance. To safeguard your project, having an Oklahoma Subcontractor Agreement for Insurance stipulates the required coverage amount and types. This ensures that subcontractors carry adequate protection for themselves and your business.

For hiring a subcontractor, you will need several documents including a subcontractor agreement and proof of insurance. An Oklahoma Subcontractor Agreement for Insurance effectively addresses the insurance requirements and outlines the project scope. Additionally, request any necessary permits, tax identification numbers, and any relevant licenses. Having proper documentation ensures smooth operations and lowers potential disputes.

To create subcontractor agreements, start by defining the scope of work and payment terms. You can utilize an Oklahoma Subcontractor Agreement for Insurance template to ensure all essential clauses are included, such as insurance requirements and liability coverage. Clearly outline the responsibilities of both parties and ensure that the agreement complies with state laws. This structured approach helps protect your interests.

If your subcontractor does not have insurance, you may face liabilities in case of accidents or damages arising from their work. It is essential to include an Oklahoma Subcontractor Agreement for Insurance that mandates subcontractors to possess valid insurance. This broadens your protection and minimizes financial risks if an issue arises. Ensure you review and understand the ramifications before hiring an uninsured subcontractor.

Having a subcontractor agreement is highly advisable to protect both parties in a work arrangement. An Oklahoma Subcontractor Agreement for Insurance clearly outlines expectations and responsibilities, minimizing potential disputes. Using such an agreement also helps ensure that both you and the subcontractor understand your rights and obligations.

Yes, obtaining consent to subcontract is crucial in many agreements. This consent safeguards relationships between contractors and clients, ensuring that all parties are on the same page. Review your main contract for any specific provisions regarding subcontracting, and consider using an Oklahoma Subcontractor Agreement for Insurance to formalize the process.