The Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal document that outlines the terms and conditions for leasing equipment in the state of Oklahoma while also considering the investment tax implications. This lease agreement is designed to protect the interests of both the lessor (the equipment owner) and the lessee (the party leasing the equipment) and ensures compliance with Oklahoma state laws. This comprehensive lease agreement includes provisions that specifically address the investment tax aspects related to equipment leasing. It covers important details such as tax benefits, deductions, and other considerations that might arise during the lease term. By incorporating these provisions, both parties can understand and manage the tax implications associated with the leased equipment. In Oklahoma, there may be various types or variations of the Comprehensive Equipment Lease with Provision Regarding Investment Tax, depending on the specific needs and circumstances of the parties involved. Some common types of equipment leases under this agreement include: 1. Operating Leases: This type of lease allows the lessee to use the equipment for a specified period without assuming ownership. The investment tax provision in the lease addresses the relevant tax implications in cases where ownership is not transferred. 2. Financial Leases: Unlike operating leases, financial leases are structured in a way that allows the lessee to assume ownership of the equipment at the end of the lease term. The investment tax provision in this type of lease takes into account the tax implications of acquiring ownership at the conclusion of the lease. 3. Sale and Leaseback Agreements: This type of lease involves the sale of owned equipment to a lessor, who then leases it back to the original owner. The investment tax provision discusses the potential tax benefits and considerations associated with structured sale and leaseback arrangements. 4. Municipal and Government Leases: These leases are specifically tailored for municipal or government entities in Oklahoma. The investment tax provision in these leases is modified to reflect the unique tax regulations and exemptions applicable to such organizations. 5. Short-term Leases: Sometimes, equipment may only be needed for a short period. Short-term leases accommodate these requirements, and the investment tax provision outlines the relevant tax implications for such arrangements. It is essential for both lessors and lessees in Oklahoma to thoroughly understand the terms, conditions, and provisions of the Comprehensive Equipment Lease with Provision Regarding Investment Tax before entering into any leasing agreement. Seeking professional legal advice is recommended to ensure compliance with Oklahoma state laws and to optimize the investment tax benefits or deductions associated with equipment leasing.

Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

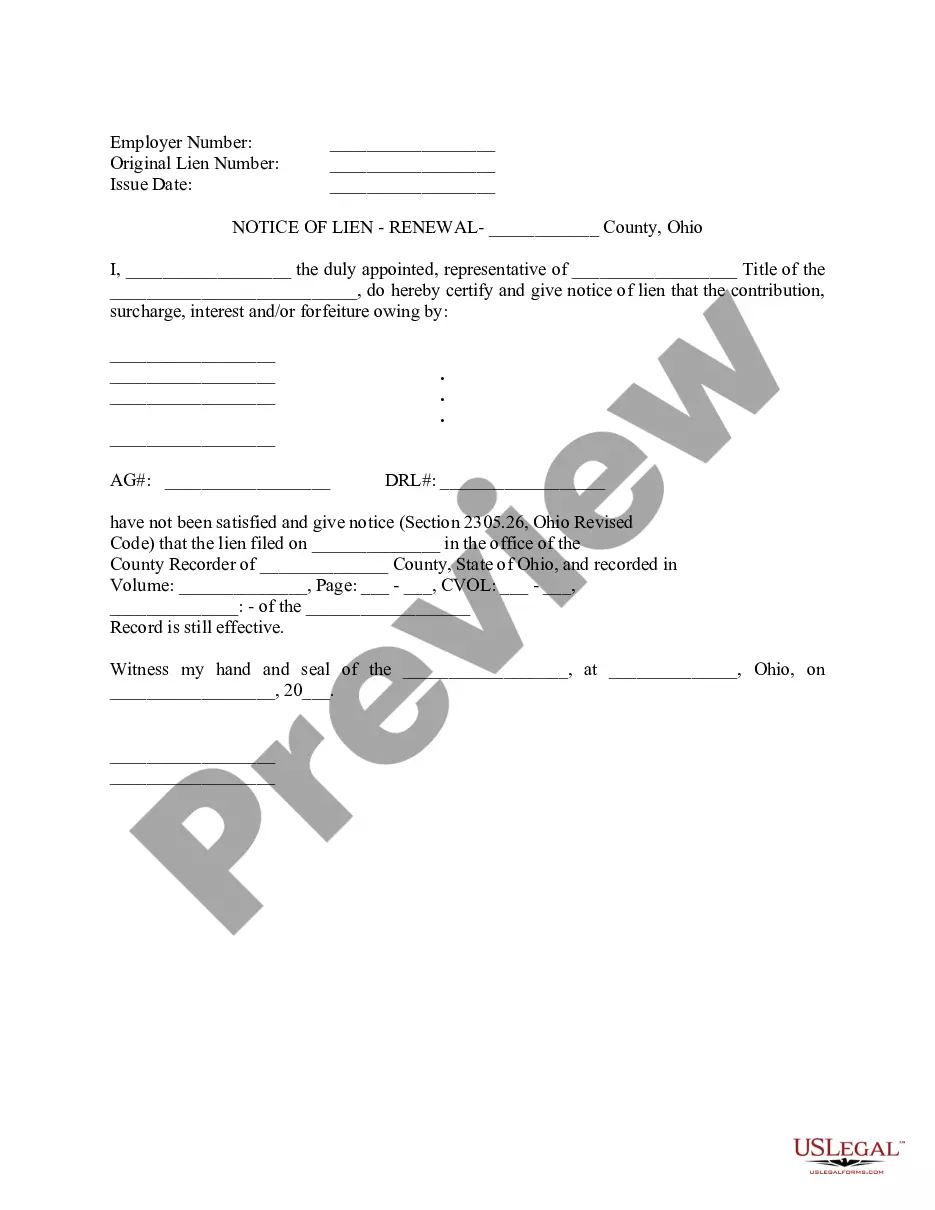

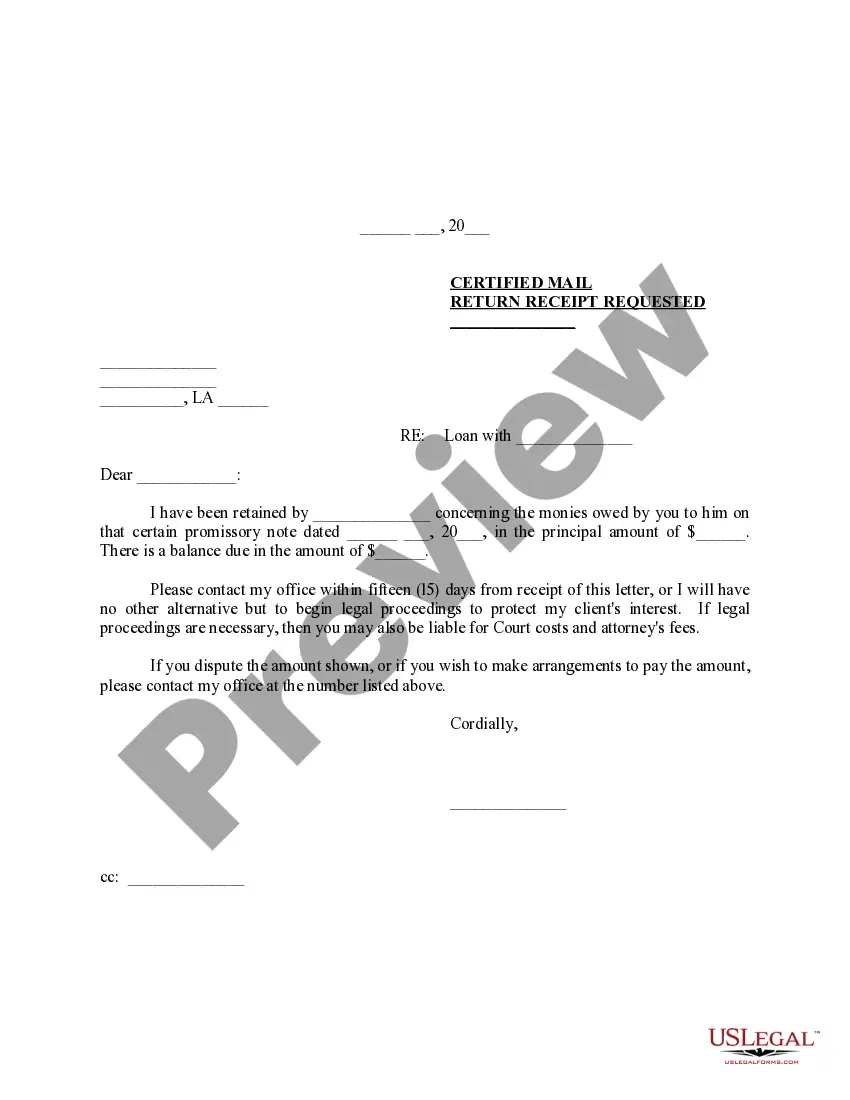

How to fill out Oklahoma Comprehensive Equipment Lease With Provision Regarding Investment Tax?

If you need to comprehensive, down load, or print out lawful record templates, use US Legal Forms, the biggest variety of lawful forms, that can be found on the web. Utilize the site`s basic and practical research to find the paperwork you require. Different templates for organization and specific purposes are sorted by categories and states, or keywords and phrases. Use US Legal Forms to find the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax within a couple of click throughs.

When you are previously a US Legal Forms buyer, log in to your bank account and click on the Download button to obtain the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax. You can even access forms you in the past acquired within the My Forms tab of your own bank account.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the shape for your correct city/region.

- Step 2. Make use of the Preview option to check out the form`s articles. Do not overlook to read through the description.

- Step 3. When you are unhappy with all the develop, take advantage of the Look for discipline near the top of the screen to get other models of your lawful develop design.

- Step 4. After you have located the shape you require, click the Get now button. Opt for the pricing program you choose and put your qualifications to sign up on an bank account.

- Step 5. Process the transaction. You can use your charge card or PayPal bank account to perform the transaction.

- Step 6. Choose the formatting of your lawful develop and down load it on the gadget.

- Step 7. Total, edit and print out or indication the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax.

Every lawful record design you buy is yours forever. You might have acces to every single develop you acquired with your acccount. Click on the My Forms area and decide on a develop to print out or down load once more.

Contend and down load, and print out the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax with US Legal Forms. There are millions of professional and state-particular forms you may use for your personal organization or specific demands.

Form popularity

FAQ

In Oklahoma, certain services may qualify for a sales tax exemption, including some educational services and specific medical services. However, when entering into an Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax, it is crucial to confirm whether your activities qualify for these exemptions. Consulting with a tax professional or using resources like uslegalforms can simplify this process and ensure compliance.

The sales tax rate on rental equipment in Oklahoma generally aligns with the standard sales tax rate, currently set at 4.5%. However, additional local taxes may apply, increasing the overall rate. It is essential to review your specific Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax to determine the total tax liability accurately. Being fully informed helps you budget more effectively.

Yes, Oklahoma does impose sales tax on rental equipment. However, specific conditions may apply depending on the type of equipment and its use. For your Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax, you should consult local guidelines to ensure compliance with tax obligations. Understanding these regulations will help you avoid unforeseen costs.

The statute of limitations on Oklahoma state income tax is typically three years from the date a return is filed. This timeframe gives the state the authority to assess taxes due or audit past returns. For those with an Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax, staying informed about this timeline can help in managing potential audits effectively.

Yes, rental equipment is generally taxable in Oklahoma, depending on the nature of the lease agreement. The Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax is designed to address specific tax provisions, aiding businesses in navigating these obligations. It’s important to consult legal resources or platforms like uslegalforms for detailed guidance on equipment rental tax policies.

Sales tax nexus in Oklahoma refers to the connection a business must have to establish tax obligations within the state. This can be determined by the location of your physical operations or other business activities. For those utilizing an Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding nexus is essential for accurate tax reporting and compliance.

Section 2355 of Title 68 pertains to the taxation of tangible personal property in Oklahoma. It specifies tax liability for certain assets, which is crucial for those entering into an Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax. Ensuring compliance with this section helps businesses avoid unexpected tax liabilities.

Section 3201 of Title 68 covers the definitions and regulations concerning sales tax within Oklahoma. This section is significant for businesses that engage in leasing, including those with an Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax. Understanding these terms helps in correctly calculating sales tax obligations on equipment rentals.

Pursuant to Title 68 Section 1358.1, the statutes provide guidelines for how equipment leases must be structured to qualify for tax credits. This section ensures proper compliance with investment tax provisions applicable to the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax. By adhering to these guidelines, businesses can protect their interests and maximize tax benefits.

In Oklahoma, a tax lien generally lasts for five years from the date it is filed. However, this period can be extended under specific circumstances, including extensions granted by the state. For those involved in leasing agreements, like the Oklahoma Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding tax liens is crucial for managing potential liabilities.

More info

Gage Rebuild Business Loans Borrowed ID.