When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

Oklahoma Disclaimer of Partnership

Description

How to fill out Disclaimer Of Partnership?

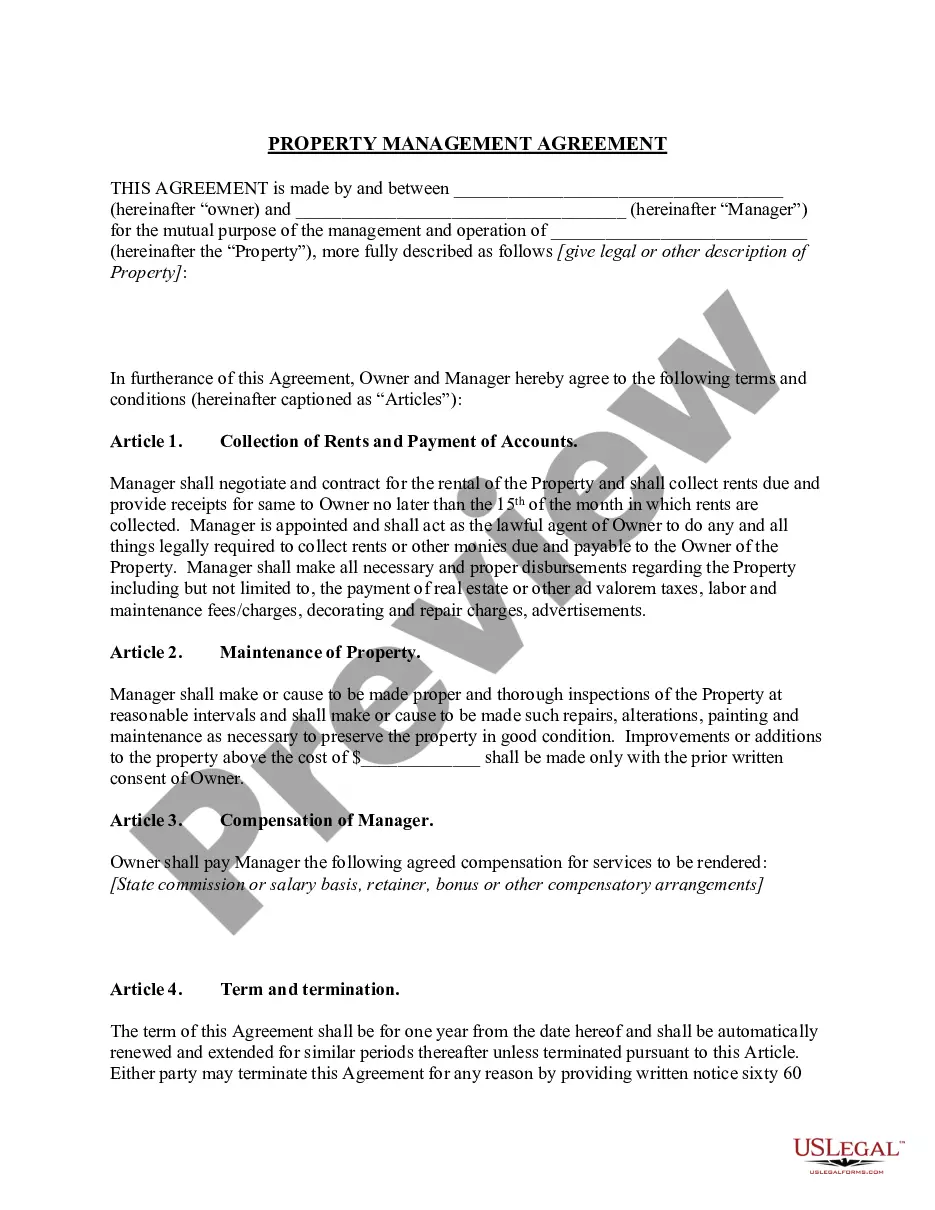

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you acquire the legal form you need? Utilize the US Legal Forms site. This service offers thousands of templates, including the Oklahoma Disclaimer of Partnership, which you can apply for business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to retrieve the Oklahoma Disclaimer of Partnership. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your region/territory. You can browse the form using the Preview button and read the form description to confirm this is suitable for you. If the form does not fit your requirements, use the Search area to find the correct form. Once you are certain the form is correct, choose the Get now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, and print, then sign the obtained Oklahoma Disclaimer of Partnership.

US Legal Forms is the largest repository of legal forms where you can discover various document templates. Take advantage of this service to download professionally crafted paperwork that adhere to state requirements.

- Ensure selection of the correct form.

- Browse using Preview button.

- Verify suitability through form description.

- Utilize Search for appropriate form.

- Press Get now to acquire form.

- Select pricing plan and provide information.

Form popularity

FAQ

In an Oklahoma Disclaimer of Partnership, partners generally do not have the unilateral right to sell property owned by the partnership. This is because partnership property is typically considered to be owned by the partnership as a whole. Therefore, any sale of partnership property requires the agreement of all partners unless a specific provision states otherwise. If you need clarity on these rights, using a legal form from UsLegalForms can help streamline the process and ensure that all partners are on the same page.

Form 1065 is the U.S. Return of Partnership Income, used to report income, deductions, gains, losses, and other pertinent details for partnerships. It serves as the foundation for producing Schedule K-1, where individual partners report their shares of the partnership's income on their tax returns. For Oklahoma partnerships, familiarity with the Oklahoma Disclaimer of Partnership ensures accurate reporting and compliance.

Schedule K-3 is used to report international information for partnerships, providing details necessary for partners who have foreign income or foreign assets. Partnerships including those governed by the Oklahoma Disclaimer of Partnership must file this form to ensure all partners are aware of their international tax implications.

Yes, you must file 1099 forms with the state of Oklahoma if you have made certain payments that require reporting. This includes payments made to individuals or entities that exceed specified amounts. For partnerships informed by the Oklahoma Disclaimer of Partnership, properly managing these filings helps maintain compliance.

Yes, partnerships operating in Oklahoma are subject to the state's franchise tax if they meet certain thresholds. This applies to partnerships that have formed in Oklahoma or that derive income from the state. Understanding tax responsibilities under the Oklahoma Disclaimer of Partnership can help mitigate potential liabilities.

Partnerships must file Form 1065 to report the profit or loss of their business activities. This form must reflect all income earned and losses incurred during the tax year. In Oklahoma, ensuring that this form is completed correctly is vital under the Oklahoma Disclaimer of Partnership, as it affects the partnership's tax status.

The IL 1065 form must be filed by partnerships doing business in Illinois, and it reports income, deductions, and other pertinent information. All partnerships, including those that align with the Oklahoma Disclaimer of Partnership, are required to disclose their financial activities accurately to ensure proper tax assessment.

In Oklahoma, partnerships that earn income are required to file an Oklahoma partnership tax return. This includes partnerships that are registered in the state, regardless of whether they operate there or simply receive income from Oklahoma sources. Understanding your obligations under the Oklahoma Disclaimer of Partnership is crucial for maintaining good standing.

Form 8949 is used by partnerships to report sales and other dispositions of capital assets. This form helps to reconcile amounts that have been reported on Schedule K-1. In areas like Oklahoma, this is essential for ensuring compliance with tax regulations, especially under the Oklahoma Disclaimer of Partnership.

When one partner withdraws from a partnership, it can significantly impact the business structure and operations. Typically, the remaining partners must decide how to handle the withdrawal and may need to execute an Oklahoma Disclaimer of Partnership to formalize the change. Consulting legal professionals can provide clarity on managing this transition efficiently.