Title: Understanding the Oklahoma Resolution of Directors of a Close Corporation Authorizing the Redemption of Stock Keywords: Oklahoma, resolution, directors, close corporation, redemption of stock, types, authorized shares, treasury shares, retired shares, shareholder value, corporate governance Introduction: The Oklahoma Resolution of Directors of a Close Corporation Authorizing the Redemption of Stock is a crucial legal document that outlines the process by which a director-led close corporation can redeem its own shares. This resolution ensures accountability, transparency, and adherence to corporate governance principles in determining the redemption of stock. In Oklahoma, different types of resolutions can be implemented based on the specific circumstances and objectives of the corporation. Types of Oklahoma Resolutions of Directors of a Close Corporation Authorizing Redemption of Stock: 1. Redemption of Authorized Shares: This resolution authorizes the redemption of shares that were previously issued and are part of the corporation's authorized share capital. Directors may decide to redeem these shares for various reasons, such as reducing the number of outstanding shares to increase per-share value or to repurchase shares from a departing shareholder. 2. Redemption of Treasury Shares: When a close corporation holds treasury shares, i.e., shares that were previously issued and subsequently repurchased by the corporation but not retired, a resolution for redemption of treasury shares may be required. These shares are often repurchased to enhance shareholder value, financial stability, or to adjust capital structure. 3. Redemption of Retired Shares: In some cases, a close corporation may decide to redeem shares that have been retired or repurchased and canceled. A resolution for the redemption of retired shares allows the corporation to permanently eliminate these shares from its equity structure. This decision may be driven by reasons such as simplifying the capital structure, adjusting ownership percentages, or restructuring the stockholder base. Benefits and Importance: a. Enhancing Corporate Governance: The resolution ensures that the redemption of stock is conducted in line with the corporation's governing documents and statutory requirements. It provides clarity on the decision-making process, protects shareholder rights, and promotes transparency within the corporation. b. Strategic Flexibility: By authorizing the redemption of stock, close corporations gain strategic flexibility to adjust their capital structure, optimize financing options, or modify ownership stakes. This can be crucial in adapting to changing market conditions, mergers and acquisitions, or other corporate actions. c. Maximizing Shareholder Value: Close corporations can utilize the redemption process to enhance shareholder value by reducing the number of outstanding shares, increasing earnings per share, or consolidating ownership. This flexibility can help create a more attractive investment proposition for existing and potential shareholders. Conclusion: In Oklahoma, the Resolution of Directors of a Close Corporation Authorizing Redemption of Stock plays a vital role in providing a framework for redeeming shares. It allows close corporations to strategically manage their capital structure and enhance shareholder value. Understanding the different types of resolutions, such as the redemption of authorized shares, treasury shares, or retired shares, empowers directors to make informed decisions that align with the corporation's objectives and legal requirements.

Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

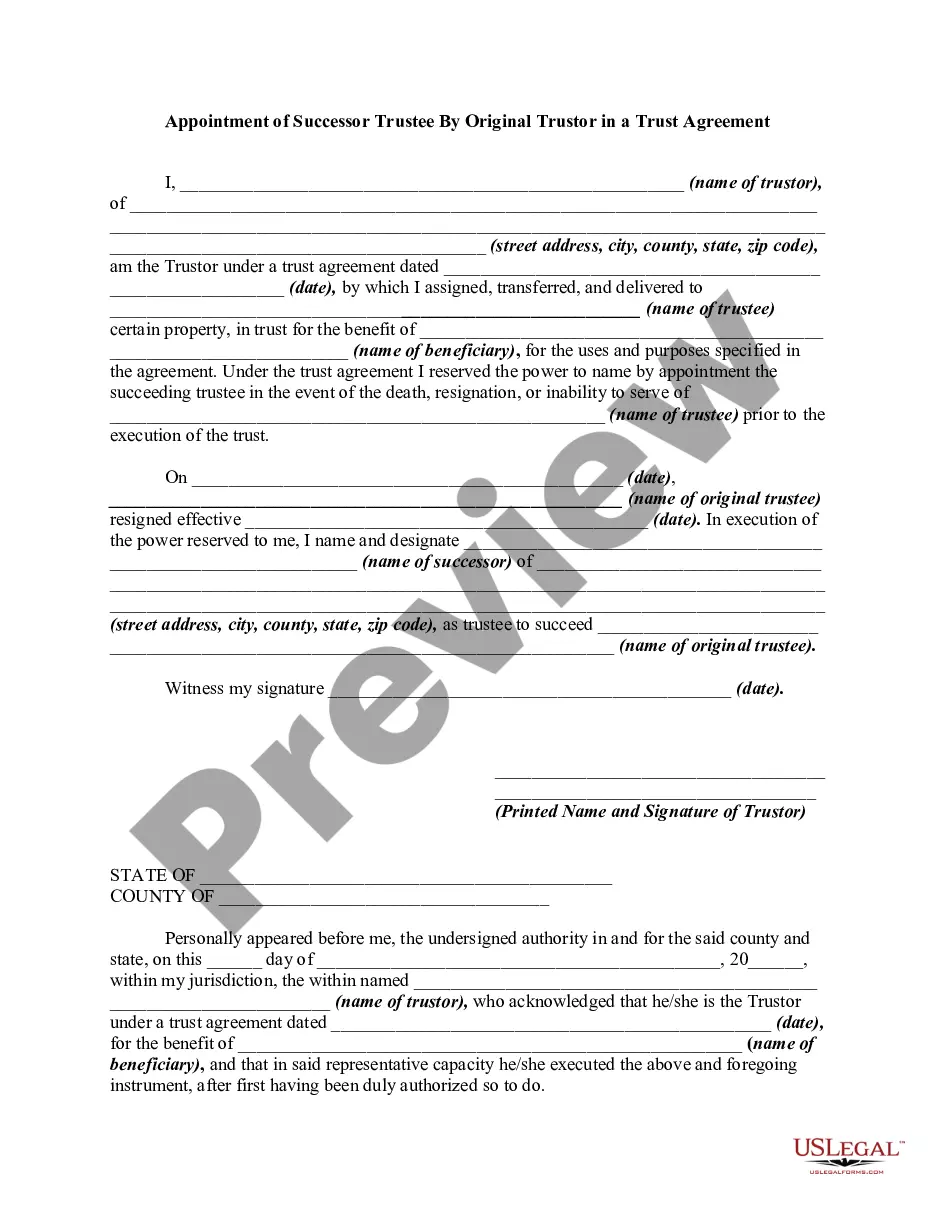

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

If you seek to be thorough, procure, or generate sanctioned documents topics, utilize US Legal Forms, the finest collection of legal templates accessible online.

Employ the site's straightforward and user-friendly search to acquire the paperwork you need.

Various themes for professional and personal uses are organized by categories and states, or keywords.

Step 3. If you are not content with the form, use the Search bar at the top of the screen to find alternative versions of the legal document template.

Step 4. After finding the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

- Use US Legal Forms to obtain the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Acquire button to obtain the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Be sure to read the summary.

Form popularity

FAQ

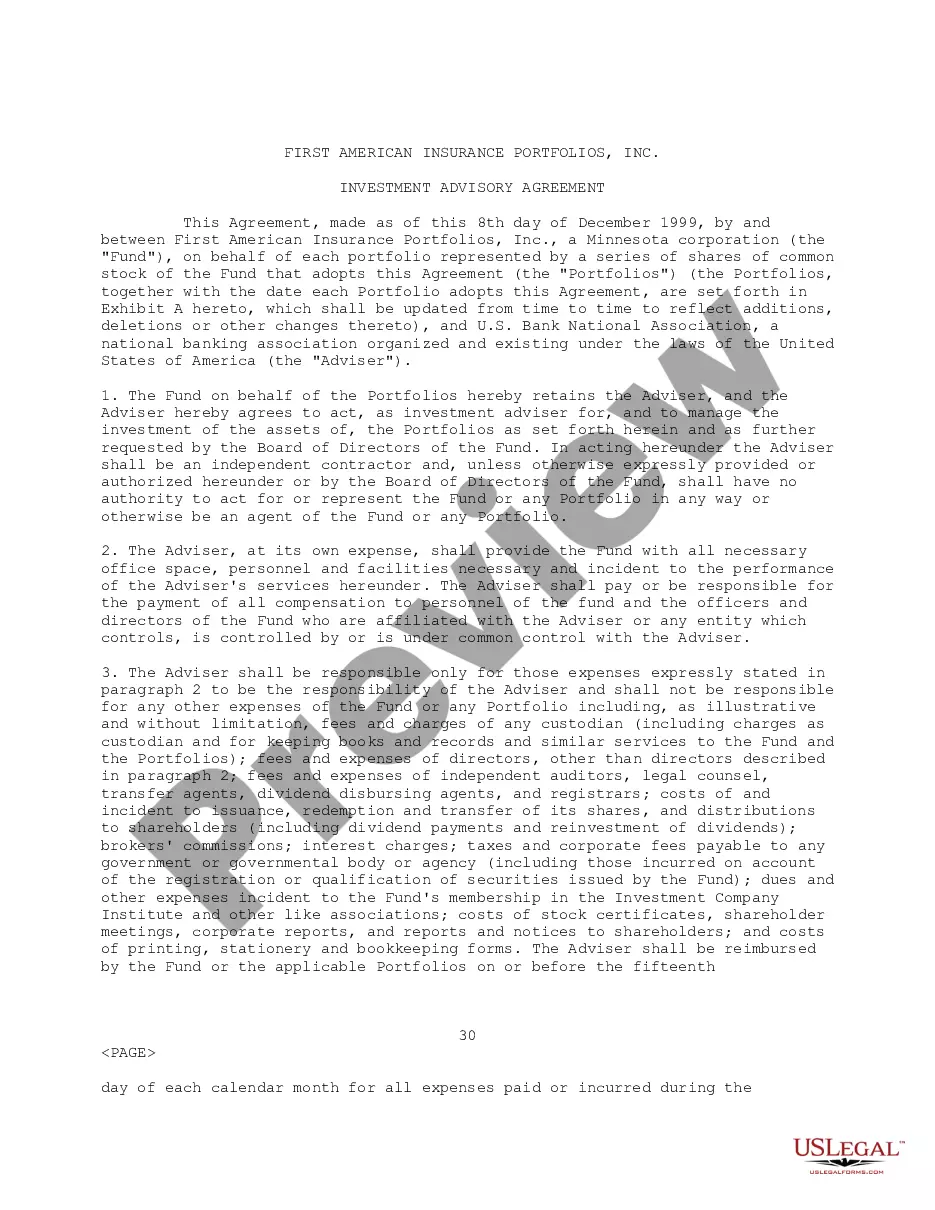

Title 18 Chapter 22 of the Oklahoma statutes pertains to regulations governing close corporations. This section outlines the legal framework for corporate governance, including provisions for Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Understanding this statute is essential for directors in close corporations to navigate stock redemption processes effectively and ensure compliance with Oklahoma law.

The resolution of share redemption is an official decision by a corporation's board to buy back its shares from shareholders. This process can enhance shareholder value and assist in managing the ownership structure of a close corporation. Establishing the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can ensure that this important action aligns with the corporation's financial strategy and regulatory requirements.

A director's written resolution is a document signed by directors indicating their agreement to a proposed action without the need for a physical meeting. This method enhances efficiency and ensures prompt decision-making. In the context of the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, such written resolutions can simplify the approval process for stock redemption activities.

An authorizing resolution is a formal declaration that permits specific actions within a corporation, such as entering contracts or approving major financial decisions. Such resolutions often require input from both the board of directors and shareholders. The Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock serves as a vital tool in confirming authority for financial redemption methods.

A director's resolution to issue shares is a documented decision that allows a corporation to create and distribute new shares to shareholders or investors. This procedure often requires assessment of the company’s capital structure and compliance with relevant laws. Utilizing the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can streamline this process and ensure adherence to legal standards.

A director's resolution is a formal document that reflects decisions made by a corporation's directors during a board meeting. This resolution typically outlines specific actions, such as approving budgets or issuing stock. For a close corporation, the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock highlights critical choices made by directors to navigate stock management effectively.

A directors resolution is a decision made by the board of directors concerning corporate management or operations. In contrast, a shareholder resolution is a proposal put forth by shareholders to be voted on at a meeting. Understanding these distinctions is vital when considering the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, as these resolutions impact corporate governance and financial decisions.

To issue shares, a close corporation must adopt a formal resolution by its board of directors. This resolution will specify the number of shares to be issued and the considerations for such a transaction. The Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can also play a crucial role in establishing guidelines for issuing additional shares while ensuring financial stability.

A written resolution for directors is a formal document that records decisions made without holding a physical meeting. It's essential for matters requiring immediate action, like the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. This document provides a clear record of the decisions and can be used for compliance and governance purposes.

To write a board resolution for an authorized signatory, clearly state the document's purpose and identify the individual being authorized. Ensure that you reference specific actions, such as those outlined in the Oklahoma Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Include a section for signatures to confirm approval from the board members.