Oklahoma Non-Exclusive Online Affiliate Program Agreement

Description

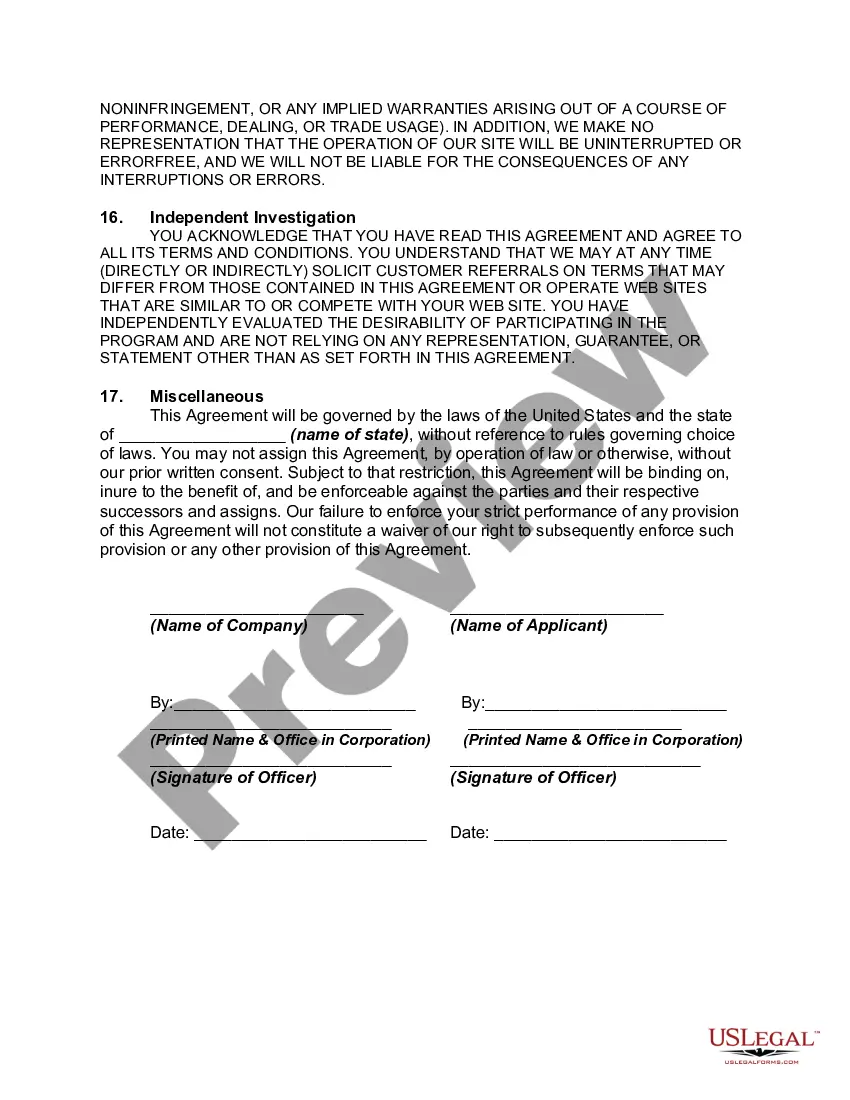

How to fill out Non-Exclusive Online Affiliate Program Agreement?

You can spend time online trying to locate the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can easily retrieve or create the Oklahoma Non-Exclusive Online Affiliate Program Agreement from the service.

If available, utilize the Preview feature to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Oklahoma Non-Exclusive Online Affiliate Program Agreement.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased document, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct document template for your state/city of preference.

- Review the form details to ensure you've selected the right one.

Form popularity

FAQ

Nonresidents who earn income in Oklahoma typically need to use Form 511NR to file their state tax returns. This form is specifically tailored for individuals who are not residents of Oklahoma but need to report their income sourced within the state, such as earnings from the Oklahoma Non-Exclusive Online Affiliate Program Agreement. Complete the 511NR carefully to ensure compliance and avoid potential penalties, and remember to check for any updates that might affect your filing requirements.

In Oklahoma, the nonresident filing threshold refers to the minimum amount of income that triggers a requirement to file a state tax return. For individuals earning income from sources within Oklahoma, knowing this threshold is crucial, especially when involved in programs like the Oklahoma Non-Exclusive Online Affiliate Program Agreement. Typically, if you have earned more than $1,000 from Oklahoma sources, you may need to file, but it's always wise to consult tax guidelines or a professional for specific advice tailored to your situation.

An affiliate is a person or business that promotes another company's products or services. In the context of the Oklahoma Non-Exclusive Online Affiliate Program Agreement, affiliates earn commissions by sharing links or advertisements. This mutually beneficial arrangement allows companies to reach a wider audience while affiliates gain income through referrals. Essentially, it creates a partnership where both parties can thrive.

An affiliate agreement is a formal contract that details the terms of engagement between a business and its affiliates. This includes compensation structures and promotional guidelines. With the Oklahoma Non-Exclusive Online Affiliate Program Agreement, you can ensure clarity and mutual understanding, fostering a collaborative environment for all parties involved.

An affiliate arrangement refers to the agreement and cooperation between a business and its affiliates. This outlines how affiliates will promote the business and what compensation they will receive. The Oklahoma Non-Exclusive Online Affiliate Program Agreement provides a comprehensive framework to ensure all parties remain aligned and benefit from successful marketing.

The purpose of an affiliation agreement is to establish clear terms for a relationship between a business and its affiliates. This document defines roles, payment terms, and promotional requirements. When you use an Oklahoma Non-Exclusive Online Affiliate Program Agreement, you create a solid foundation that promotes understanding and success in your marketing endeavors.

A participating affiliate arrangement describes the relationship and operational framework between an affiliate and a business. This setup clarifies how affiliates contribute to marketing efforts and what rewards they receive. With an Oklahoma Non-Exclusive Online Affiliate Program Agreement, these arrangements become more structured, leading to mutually beneficial outcomes.

A participating affiliate agreement is a specific type of contract that allows affiliates to take part in a marketing program. This agreement defines the affiliates' participation terms, including commission rates and promotional strategies. The Oklahoma Non-Exclusive Online Affiliate Program Agreement serves as a robust framework for such partnerships, facilitating success for both involved parties.

Yes, a contract is essential for affiliate marketing. It ensures both parties understand their roles, responsibilities, and payment structure. By using an Oklahoma Non-Exclusive Online Affiliate Program Agreement, you protect your interests and establish clear guidelines, which helps maintain a professional relationship.

An affiliation contract, commonly known as an affiliate agreement, outlines the terms between a business and its affiliates. This document specifies how the affiliate will promote the products or services of the business in exchange for compensation. In the context of the Oklahoma Non-Exclusive Online Affiliate Program Agreement, this means you can promote freely while benefiting from commissions.