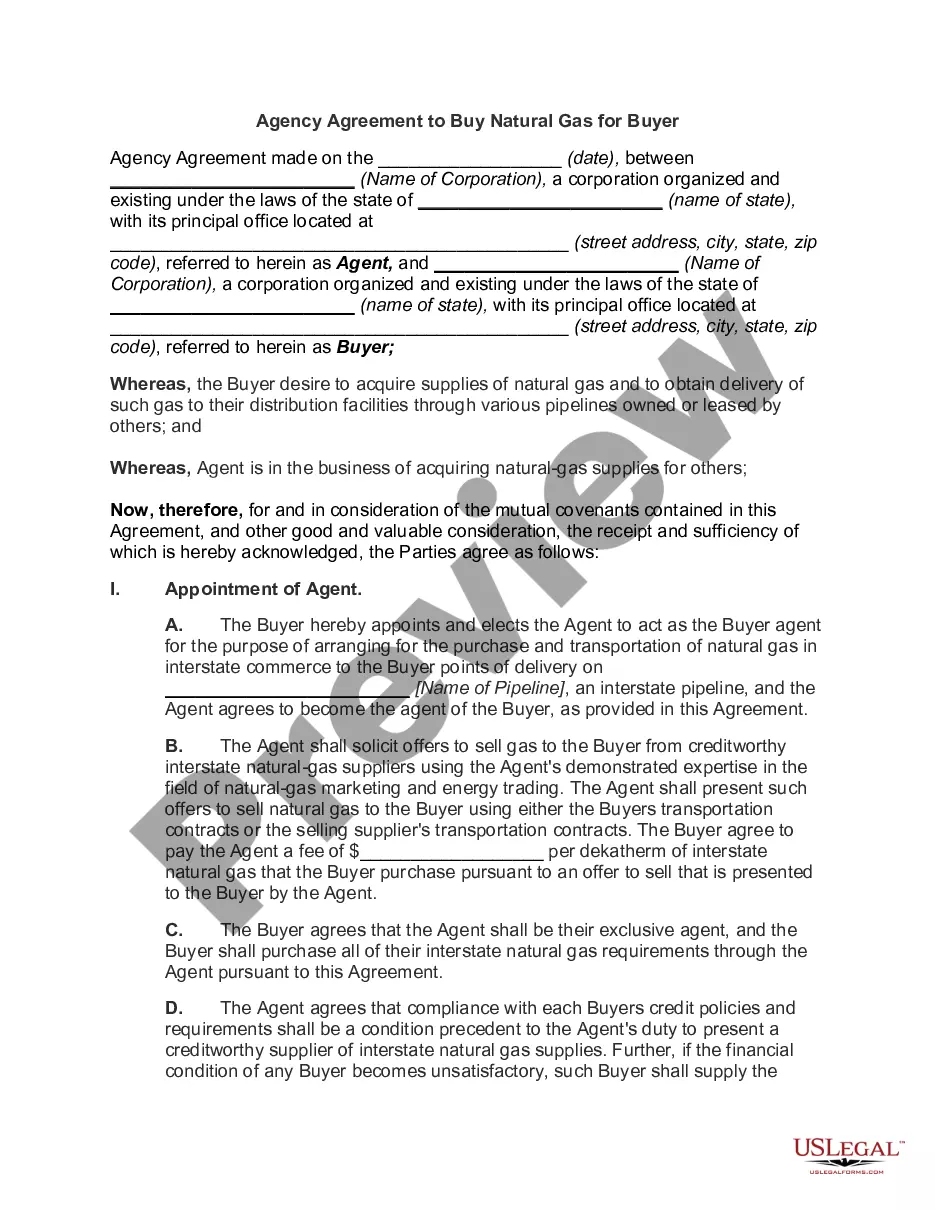

Oklahoma Assignment and Transfer of Stock refer to the legal processes involved in transferring ownership of stock shares from one party to another within the state of Oklahoma. Stock assignments and transfers are typically governed by the Oklahoma Uniform Commercial Code (UCC), which provides guidelines and regulations for these transactions. The process of transferring stock ownership involves assigning or transferring the rights, title, and interest in the shares from the current owner (assignor) to the new owner (assignee). This transfer can be done through a variety of methods, including written agreements, endorsement on stock certificates, or electronic transfers. There are different types of Oklahoma Assignment and Transfer of Stock, depending on the circumstances and requirements involved. Some common types include: 1. Intercompany Transfers: These transfers occur between affiliated companies or subsidiaries within the same corporate group. Such transfers may be necessary for business reorganizations, mergers, acquisitions, or other internal corporate restructuring. 2. Individual Transfers: These transfers involve the direct transfer of stock ownership from an individual or group of individuals to another individual or entity. These transfers can occur as part of an investment strategy, gifting shares, or transferring shares to heirs in an estate planning process. 3. Corporate Transfers: These transfers involve the transfer of shares from one corporation to another. This can happen during mergers or acquisitions when one company acquires the stock of another company. The transfer may be for cash, stock, or a combination of both. 4. Trustee Transfers: Trustee transfers occur when shares are transferred from a trust to an individual or vice versa. This type of transfer commonly occurs in situations where shareholders wish to establish or dissolve a trust arrangement, or when the trust's beneficiaries change. To initiate an Assignment and Transfer of Stock in Oklahoma, individuals or entities involved must follow specific procedures outlined by the UCC and the applicable provisions of the Oklahoma Business Corporation Act or Oklahoma Revised Uniform Limited Partnership Act, depending on the corporate structure. The parties must typically execute appropriate legal documents, such as stock assignment forms, stock transfer agreements, and update official records with the relevant stock transfer agent or registrar. Overall, understanding and adhering to the legal requirements involved in Oklahoma Assignment and Transfer of Stock is essential to ensure a smooth and legal transfer of ownership between parties.

Oklahoma Assignment and Transfer of Stock

Description

How to fill out Oklahoma Assignment And Transfer Of Stock?

Discovering the right legitimate papers design can be quite a have difficulties. Of course, there are tons of templates accessible on the Internet, but how can you find the legitimate kind you need? Utilize the US Legal Forms web site. The service offers a large number of templates, including the Oklahoma Assignment and Transfer of Stock, that can be used for enterprise and personal demands. Each of the forms are examined by experts and satisfy federal and state needs.

In case you are already registered, log in to the accounts and click the Down load key to find the Oklahoma Assignment and Transfer of Stock. Use your accounts to check through the legitimate forms you have ordered formerly. Proceed to the My Forms tab of your respective accounts and obtain yet another duplicate of your papers you need.

In case you are a whole new consumer of US Legal Forms, allow me to share straightforward guidelines that you should stick to:

- First, make sure you have selected the appropriate kind for the town/region. You can look through the form making use of the Preview key and read the form explanation to make sure it will be the right one for you.

- In the event the kind is not going to satisfy your expectations, use the Seach industry to get the proper kind.

- When you are positive that the form is suitable, go through the Purchase now key to find the kind.

- Pick the costs strategy you desire and enter the essential details. Make your accounts and buy an order making use of your PayPal accounts or charge card.

- Opt for the file formatting and down load the legitimate papers design to the gadget.

- Full, revise and print and sign the obtained Oklahoma Assignment and Transfer of Stock.

US Legal Forms is definitely the largest local library of legitimate forms where you can find various papers templates. Utilize the company to down load expertly-manufactured files that stick to status needs.