Oklahoma Assignment of Rents by Lessor is a legal document that allows a lessor (property owner) to transfer or assign their right to collect rents from a leased property to another party. This assignment is often used as collateral for a loan, ensuring that the lender will receive rental income in case of default or non-payment by the lessee. The purpose of an Assignment of Rents by Lessor is to provide a secure and predictable income stream for the lender. By acquiring the right to collect rents, the lender can offset potential financial risks associated with the loan and ensure a steady source of revenue. This arrangement is commonly used in commercial real estate, where rental income plays a vital role in assuring the loan repayment. There are two main types of Oklahoma Assignment of Rents by Lessor: 1. Absolute Assignment of Rents: In this type, the lessor fully transfers their right to collect rents to the lender. The lender gains complete control over the rental income and can manage it as they see fit. They can actively collect rents and use the income to repay the loan or cover any other obligations. The lessor relinquishes their power to control or direct the rental income. 2. Conditional Assignment of Rents: This type of assignment grants the lender the right to collect rents on the condition that a default occurs. Until such a default event occurs, the lessor maintains their right to collect and manage the rental income. If the lessee fails to fulfill their lease obligations or defaults on the loan, the lender can step in and begin collecting rents to offset the financial loss. It is essential to note that an Assignment of Rents by Lessor does not transfer ownership of the property itself. The lessor retains ownership rights, while the lender obtains the right to collect future rents. This document serves as a valuable tool for lenders to protect their investment and ensure a stable income flow. In conclusion, an Oklahoma Assignment of Rents by Lessor is an important legal document used in commercial real estate financing. It allows property owners to transfer their right to collect rents to lenders as collateral for a loan. Whether it is an absolute or conditional assignment, the goal is to ensure the lender has a secure income source to offset potential loan risks.

Oklahoma Assignment of Rents by Lessor

Description

How to fill out Oklahoma Assignment Of Rents By Lessor?

You may spend several hours on the web trying to find the legitimate file format which fits the federal and state specifications you need. US Legal Forms provides thousands of legitimate types that happen to be examined by experts. It is simple to down load or print the Oklahoma Assignment of Rents by Lessor from your services.

If you already have a US Legal Forms account, it is possible to log in and click the Download option. Following that, it is possible to complete, change, print, or indication the Oklahoma Assignment of Rents by Lessor. Each legitimate file format you get is the one you have forever. To have an additional copy of the bought form, visit the My Forms tab and click the related option.

Should you use the US Legal Forms website initially, adhere to the simple guidelines beneath:

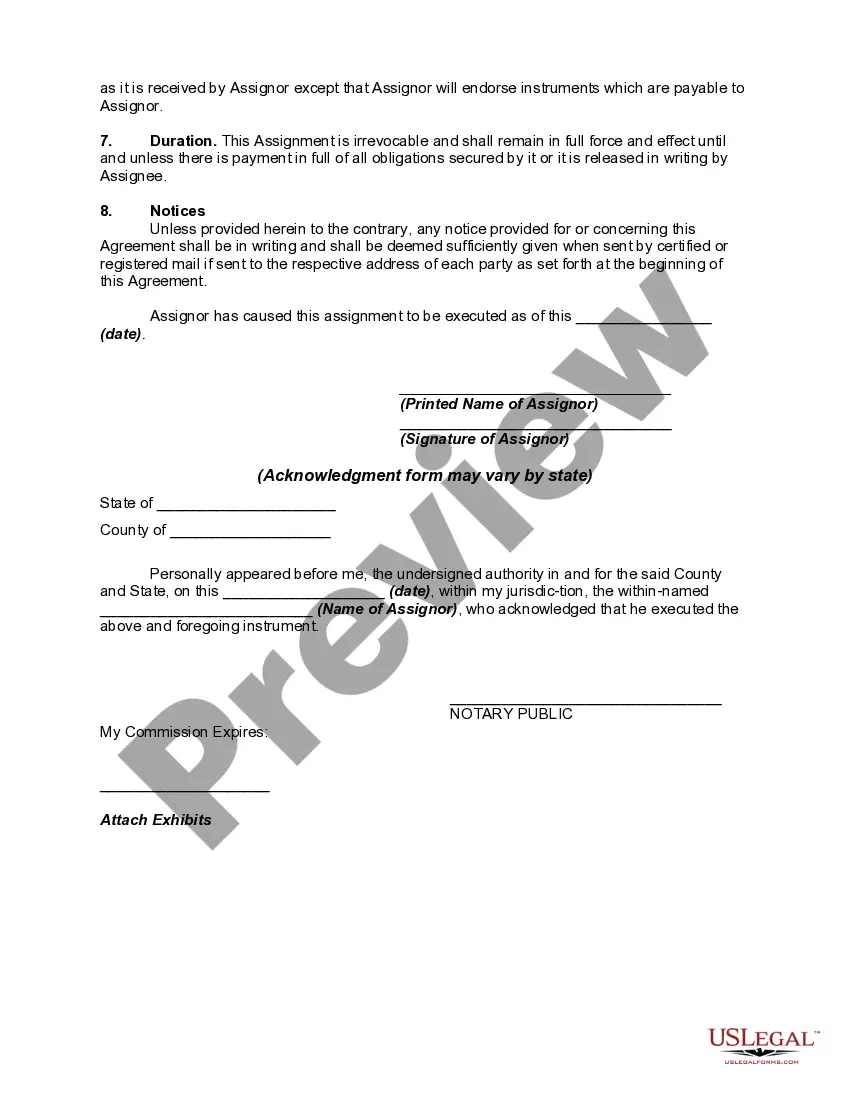

- Very first, make certain you have chosen the best file format for the area/area of your choosing. Browse the form explanation to ensure you have selected the right form. If available, utilize the Review option to search with the file format as well.

- If you wish to locate an additional model of the form, utilize the Look for discipline to get the format that fits your needs and specifications.

- When you have found the format you would like, simply click Purchase now to carry on.

- Select the costs strategy you would like, key in your accreditations, and register for your account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal account to pay for the legitimate form.

- Select the structure of the file and down load it in your system.

- Make alterations in your file if needed. You may complete, change and indication and print Oklahoma Assignment of Rents by Lessor.

Download and print thousands of file layouts while using US Legal Forms web site, which provides the greatest variety of legitimate types. Use skilled and status-specific layouts to take on your company or specific requires.